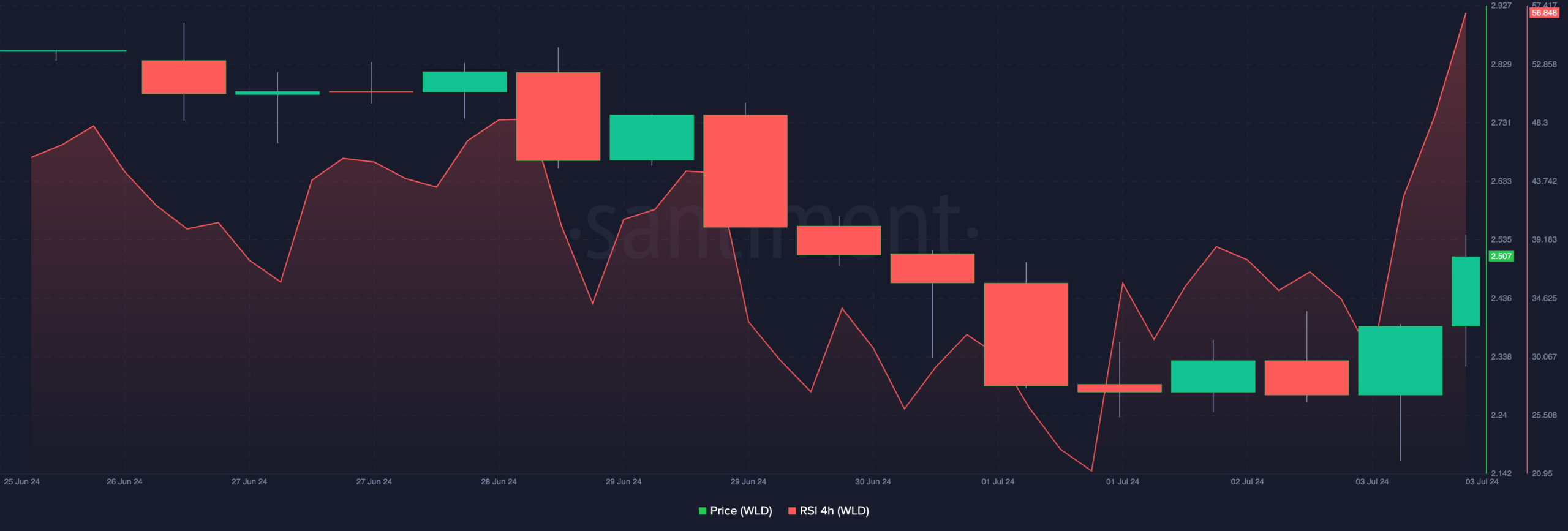

- Worldcoin was oversold up until 1 July and then, the price began to move higher

- Sentiment around the token improved, suggesting that demand could be better

The last 90 days have been turbulent for Worldcoin [WLD], the token linked to the digital identity application. At press time, WLD was valued at $2.52.

This price pointed to a 64.90% decrease within the last three months. It also represented the lowest value the token had hit since November 2023. Worldcoin’s depreciation could be linked to different events, ranging from regulatory problems to profit-taking.

Down, but not out

For example, in March, the price of the token hit an all-time high of $11.82. However, since that time, the cryptocurrency has struggled to keep up the momentum. During the intervening period, Worldcoin hit oversold levels, with the same highlighted by the Relative Strength Index (RSI).

The RSI reveals the momentum around a cryptocurrency. A reading above 70 indicates that a token is overbought. If it is below 30, the token is oversold.

According to Santiment, the RSI on Worldcoin’s 4-hour chart was 21.04 on 1 July. This meant the the token was oversold. However, at press time, the reading had improved somewhat.

This was a sign that sellers were exhausted, and buyers had taken advantage of the discount. Here, it is also important to mention that at press time, the price had risen by 6.13% in just 24 hours.

Should the momentum remain bullish, WLD’s price could close in on $3 in the short term. However, traders might need to watch out. If the RSI reading, which was 56.84 at press time, hits 70.00 or above, the token will be overbought.

If this happens before the price hit $3, WLD’s price might retrace. However, that might not be the case according to signals from the Bulls and Bears Indicator.

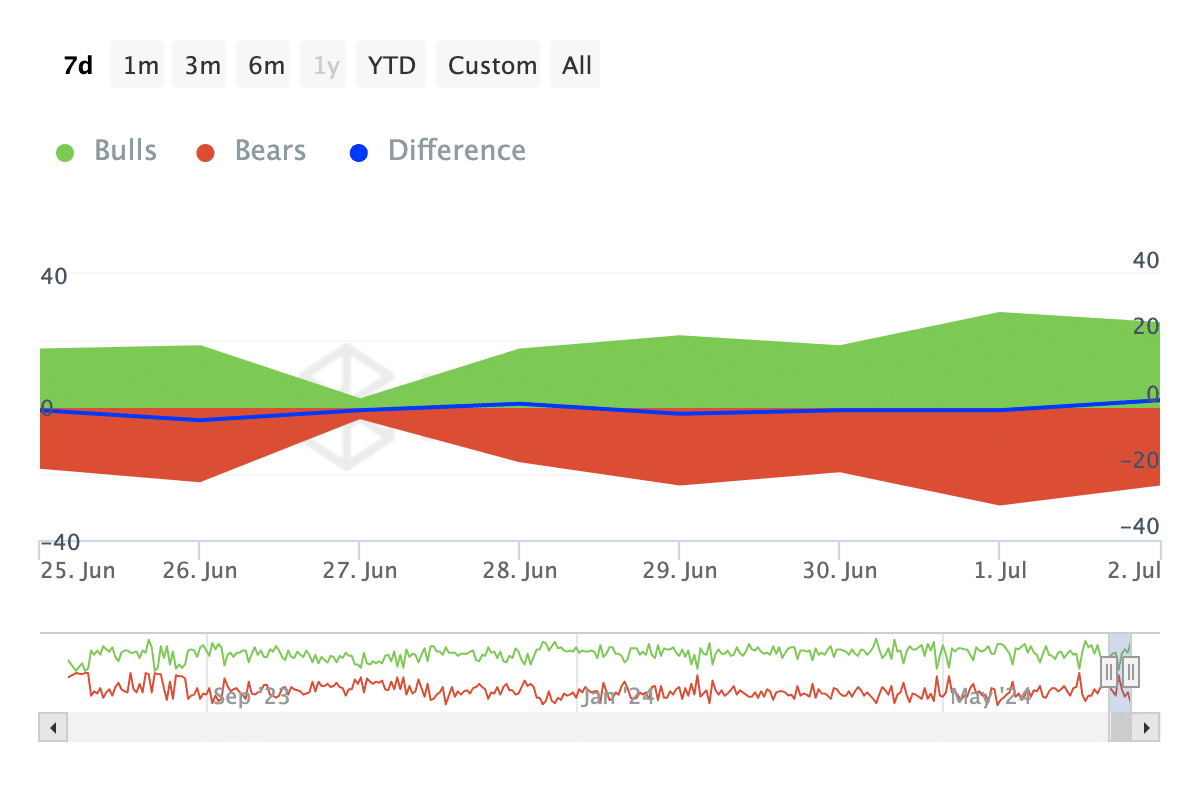

Bulls are at the forefront

This indicator looks at the activity of buyers (bulls) who have purchased more than 1% of the total trading volume. It also considers the sellers (bears) who have sold more than 1% of the trading volume.

If the bulls are more than bears, then a token’s price will potentially hike. But if bears are more than bulls, a decline could happen. For Worldcoin, there were more bulls than bears.

If sustained, the price of the cryptocurrency would tilt closer to $3 as initially stated.

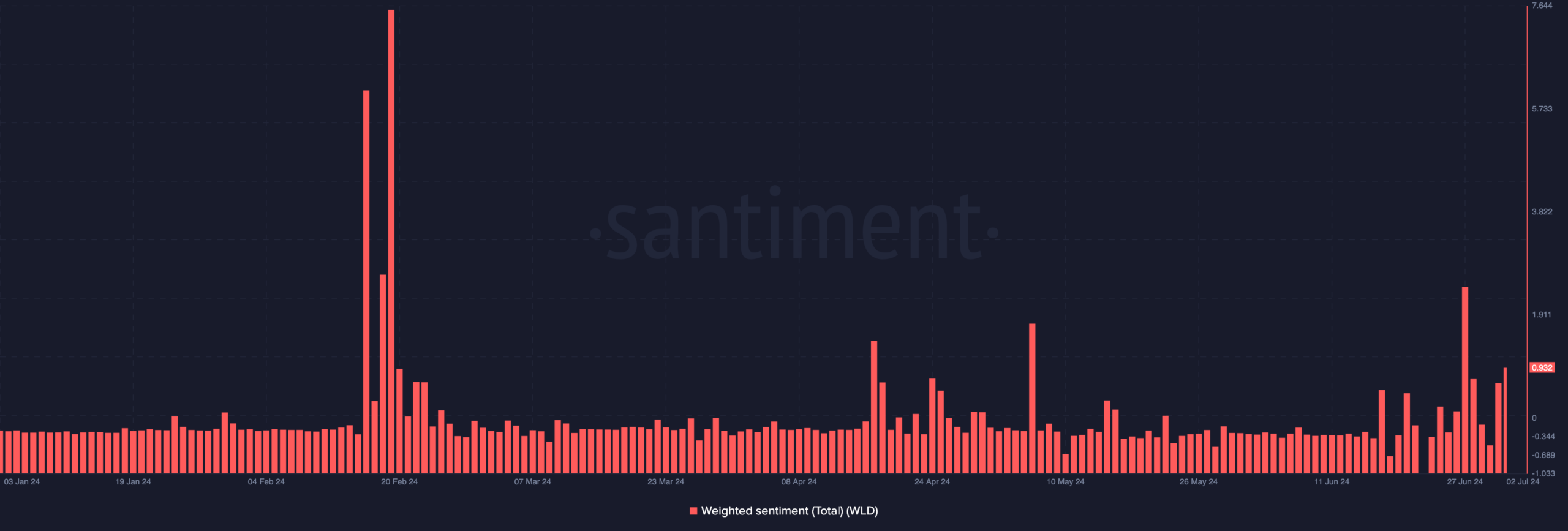

Additionally, the sentiment around Worldcoin has changed too. Previously, the Weighted Sentiment was negative, indicating that most comments about the project online were gloomy. However, at press time, the metric had risen to 0.932.

If the sentiment stays positive, demand for WLD might increase. Also, as long as holders of the cryptocurrency decide not to sell, the token would most likely not drop below $2.

Is your portfolio green? Check the Worldcoin Profit Calculator

Considering the analysis above, WLD might continue to jump on the charts. However, if bulls struggle to sustain their momentum, the upswing could be neutralized.