- Activity on the Litecoin network hit a mind-blowing number, suggesting that LTC could rally.

- Targets from analysis showed that the price could reach $85.

Litecoin [LTC] has formed a bullish divergence that could lead the price to a higher level, AMBCrypto discovered. A bullish divergence marks the end of a downtrend.

It occurs when the price of a coin falls, the oscillator drops but activity on the network increases. This was the case with Litecoin.

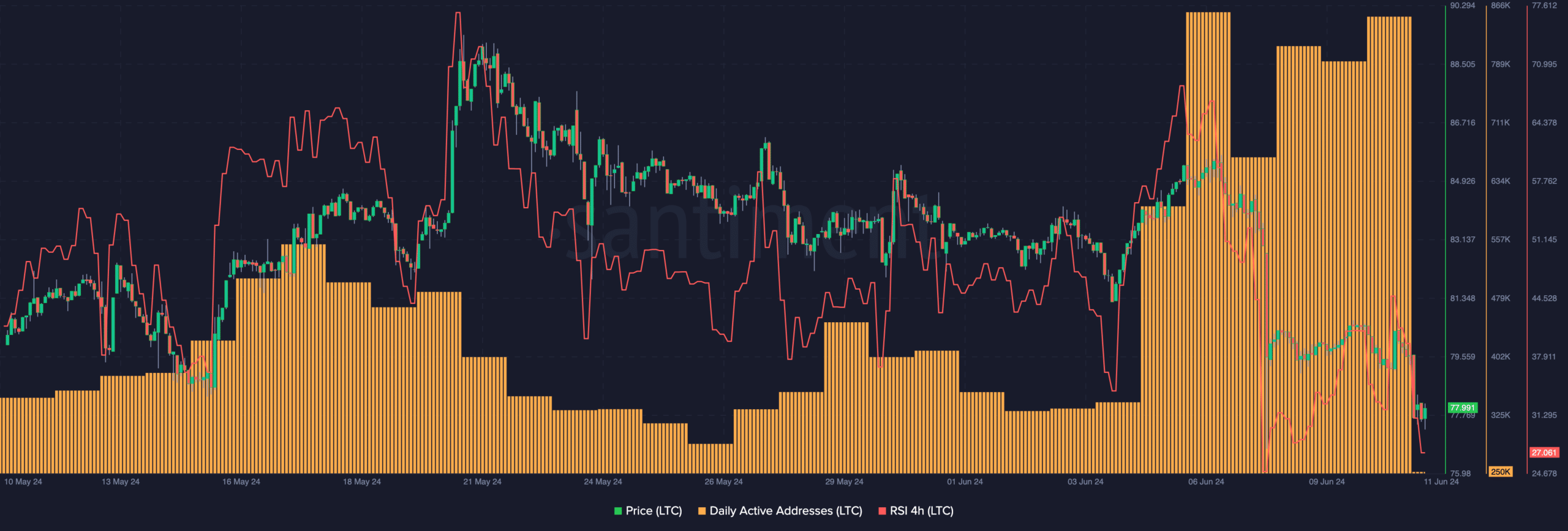

According to data from Santiment, the number of unique addresses interacting with LTC hit 704,000 in the last seven days.

In May, the total number of active addresses was 345,000. An active address refers to a market participant engaged in a successful transaction.

Therefore, the increase meant that interaction on Litecoin in the first few days of June was much more than the entire May.

Are LTC sellers exhausted?

The last time such an event occurred, LTC moved from $78.60 to $84.63 within a few days. However, the rise in network activity was not the only metric supporting a potential bounce.

AMBCrypto also looked at the Relative Strength Index (RSI) and found that it aligned with the prediction. The RSI measures momentum and help participants identify overbought or oversold levels.

Reading at 70 and above suggests that an asset is overbought. On the other hand, a reading at 30 or below indicate that a cryptocurrency was oversold.

At press time, the RSI on Litecoin’s 4-hour chart was close to the oversold region, indicating that the coin was close to being oversold. From a price point, this position could lead LTC toward $75.

However, with increasing network activity, the price of the coin may bounce. If this is the case, a target of $85 might be plausible.

Another move may be in the works

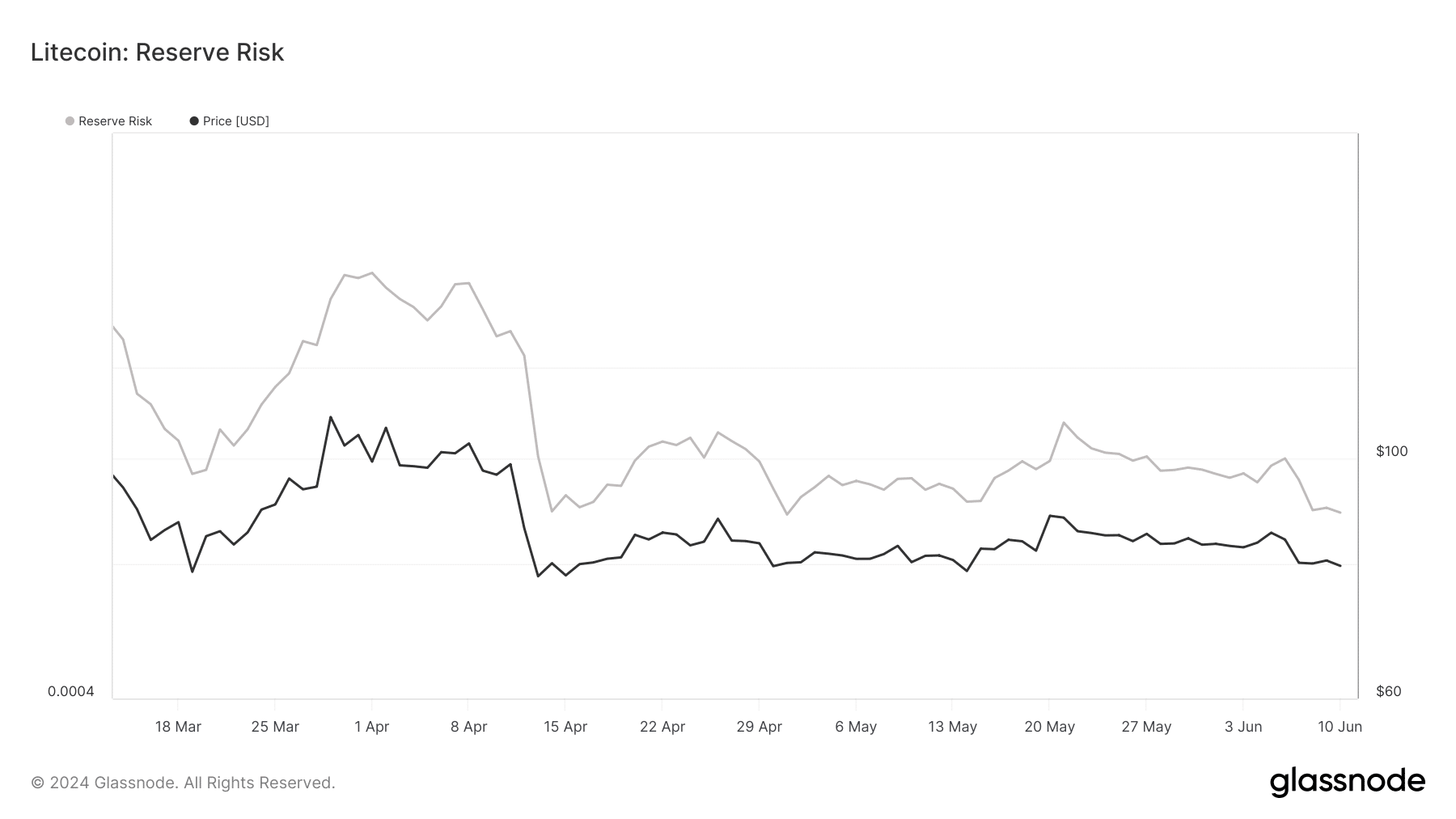

Looking down the rabbit hole to assess if the LTC could soon trend higher, AMBCrypto considered looking at the Reserve Risk. Reserve Risk measures the confidence in the market, and risk-to-reward ratio of an asset.

When the metric is high, it means that confidence is low, and the risk is not worth the reward. On the other hand, a low Reserve Risk breeds high confidence, and an attractive risk-to-reward ratio.

As of this writing, the metric for Litecoin was at a low reading of $0.00050, suggesting that it could be a good time to buy LTC. But what are the possible targets for LTC in the short term?

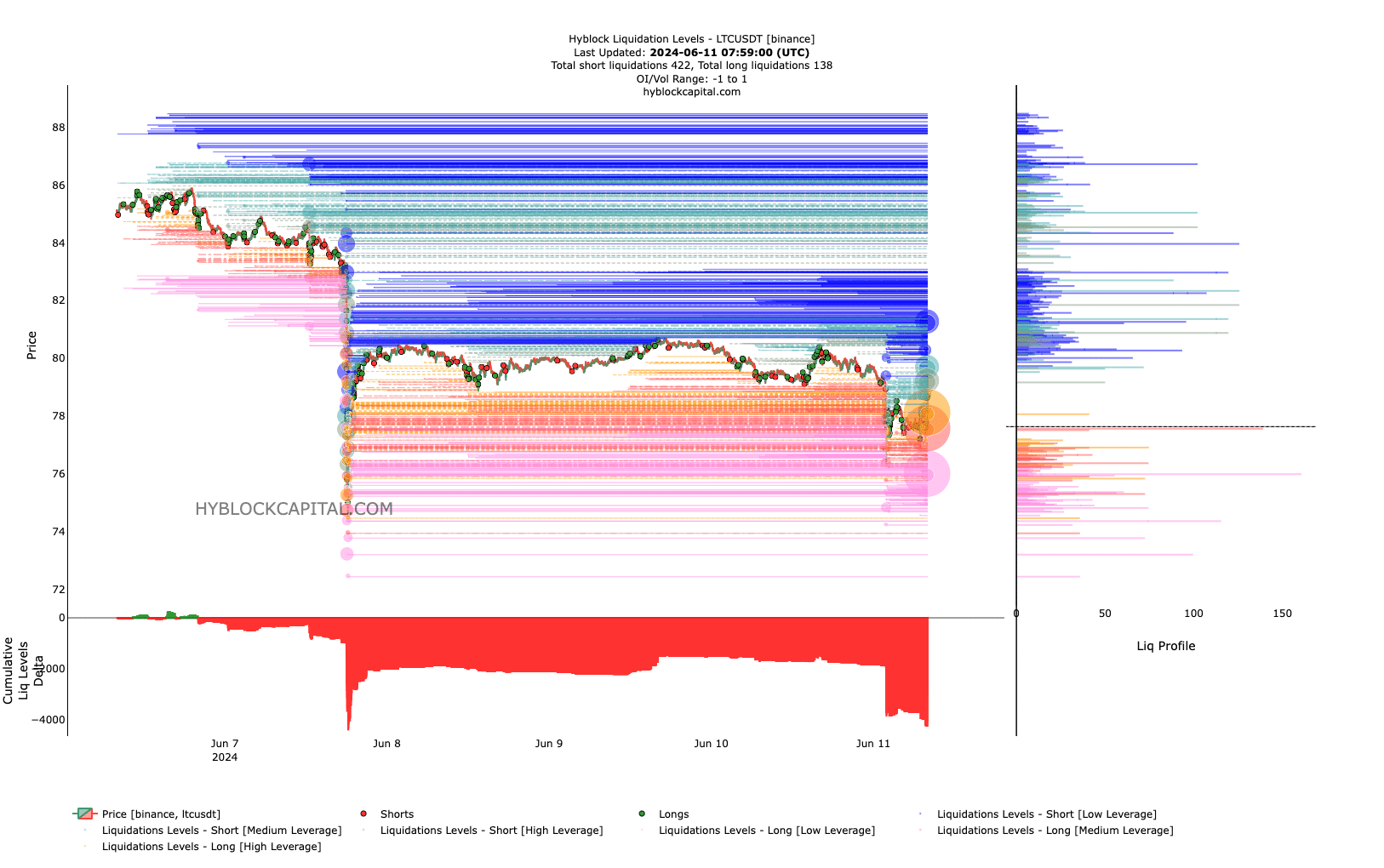

To get a hang of this, we analyzed the liquidations levels. These levels are price points where liquidation events might occur. At press time, a cluster of liquidity appeared from $80.20 up to $87.65.

Read Litecoin’s [LTC] Price Prediction 2024-2025

These high areas of liquidity suggest that the price can move toward such levels. In addition, the Cumulative Liquidation Levels Delta (CLLD) was negative.

This implies that Litecoin’s price might retrace as recovery was close. Should this be the case, the price of the token might head above $85 within the next few weeks.