- WIF, one of the best-performing memecoins this cycle, lost a chunk of its value and left the top 50.

- Data from showed that million of short position would face liquidation if WIF bounces.

dogwifhat [WIF], the Solana [SOL]-based token that kept other memecoins trailing, is now at a spot no one would have imagined a few months back. In the last 30 days, the WIF crypto price has decreased by 45.83%.

Not only that, the cryptocurrency has also dropped out of the top highly-regarded 50 per market cap. At press time, WIF’s price was $1.53. Its market cap was $1.56 billion, with Fantom [FTM] taking its place.

Though dogwifhat launched in mid-December 2023, its rise to stardom was in Q1 2024. During that time, the price jumped by more than 1500%.

WIF’s volume is no more at the top

This helped the WIF crypto price hit an all-time high of $4.84. While there were predictions that WIF would rally to $10, none of that has come to pass since it began this steep correction.

At some point, some analysts mentioned that the memecoin would flip the likes of Pepe [PEPE] and Shiba Inu [SHIB]. But that has not happened.

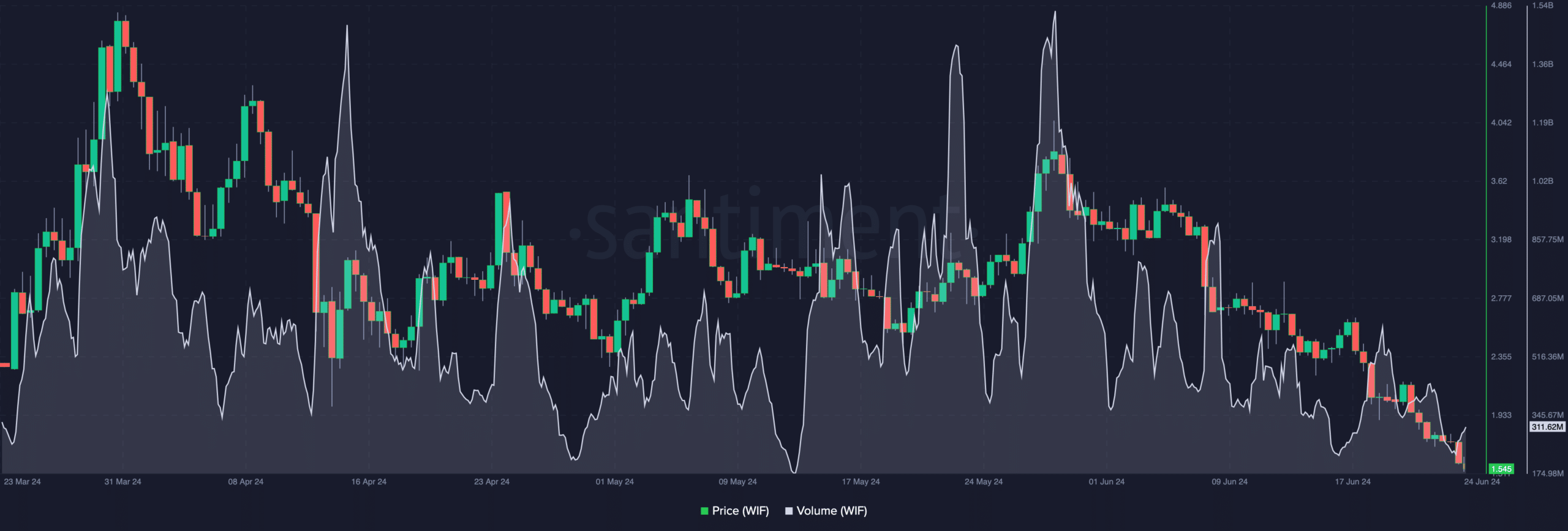

For this piece, AMBCrypto examined Dogwifhat’s on-chain status, and its potential for the future. The first metric we looked at was WIF’s crypto volume.

According to data from Santiment, the token’s volume was $211.62 million. This was close to the lowest it has reached since the 13th of May.

When WIF experienced its quarter-long upswing, the volume got close to $2 billion on several occasions.

Bears risk liquidation

Therefore, the value at press time implies that interest in the token was nearing an all-time low. As such, it might be challenging for the price to recover some of its losses.

However, if market participants in their numbers take advantage of the discount offered, WIF’s price might rebound. But not a lot of traders are confident in WIF’s comeback.

For example, blockgraze, a pseudonymous trader, posted on X (formerly Twitter). According to him, he does not believe that the memecoin has provided another buying opportunity. He wrote that,

“Many people are talking about how WIF is in their accumulation zone, but I just checked the chart and it doesn’t seems like anyone is accumulating.”

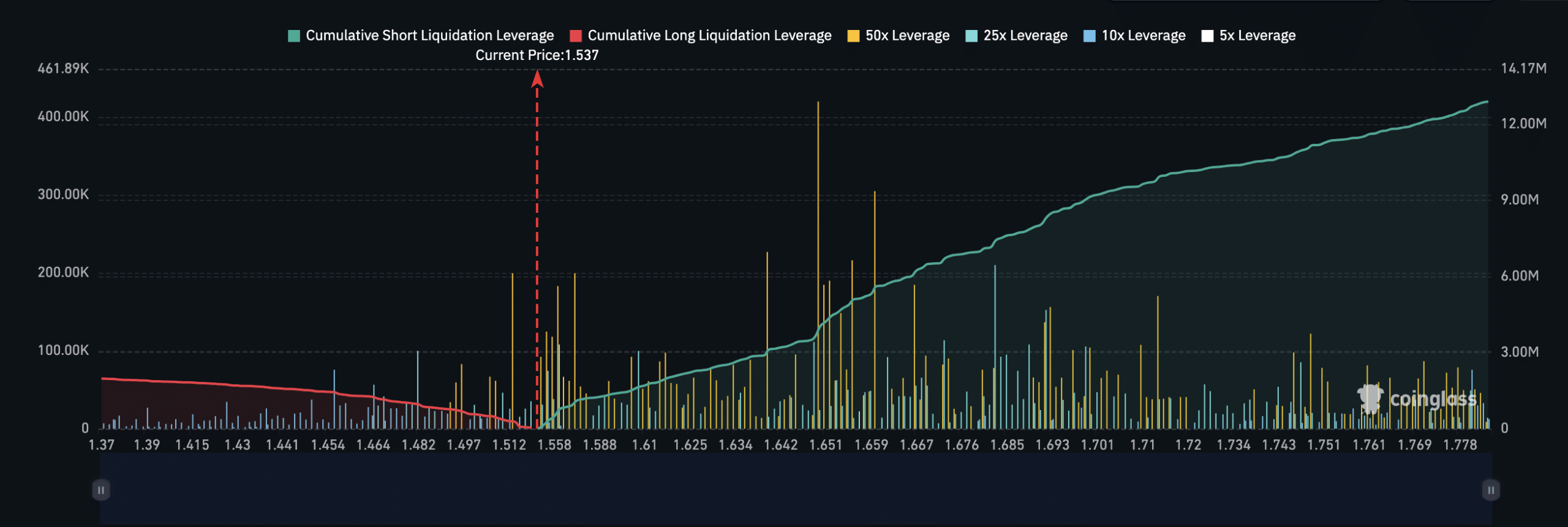

Furthermore, traders risk losing million if WIF price rebounds, according to Coinglass data. AMBCrypto observed this after looking at the liquidation map.

Liquidation occurs when an exchange forcefully closes an open position to reduce the risk of further losses.

This is usually due to insufficient margin balance or high volatility when the market is treading in the opposite direction of a trader’s position.

For the liquidation map, it identifies prices where traders are exposed to liquidation risks. At press time, we observed that a total of 12.89 million short positions could be liquidated if WIF rebounds to $1.78.

However, if the WIF crypto price falls to $1.37, a little under 2 million long liquidations will occur. On the broader outlook, the perception around WIF was in a discouraging position.

Is it over for WIF?

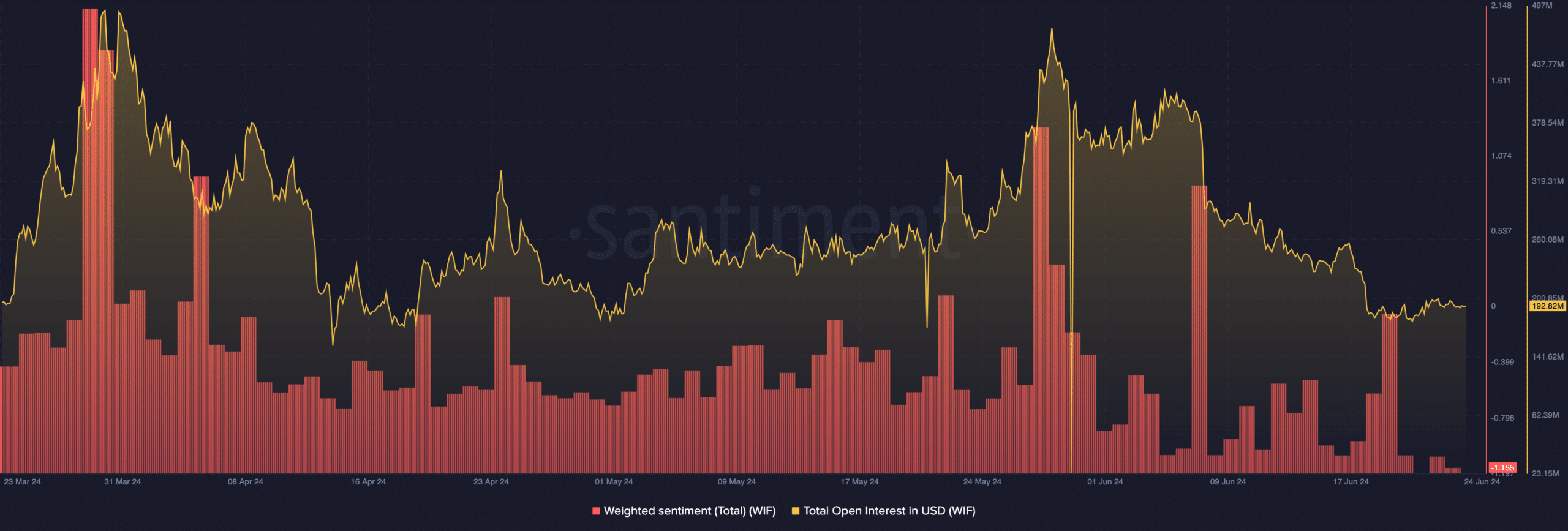

At press time, WIF’s Weighted Sentiment, based on on-chain data, was -1.15. This was the lowest WIF had reached in the last six months.

Weighted Sentiment shows the comments made online about a project. Therefore, the decline implied that for every positive comment about the memecoin, there was 1.15 more titled toward the bearish outlook.

If this continues, WIF’s price may continue to decline. If this happens, the price could drop to $1.35.

At the same time, extreme negative sentiment sometimes act as fuel for recovery. Should this happen in WIF’s case, the value of the token could head in the $2 direction.

Meanwhile, Open Interest (OI) in WIF has dropped below the $200 million mark. OI is the sum of outstanding futures contracts in the market.

Realistic or not, here’s WIF’s market cap in PEPE terms

When it increases, it means that net positioning is moving up. However, a decline, like in WIF’s situation, implies that traders are closing existing positions.

Should this position linger, then WIF’s price might decrease, and the market cap might slide below the 51st position.