AFP

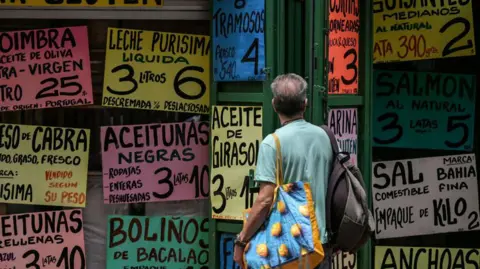

AFPVenezuela’s battered economy is one of the key battlegrounds in Sunday’s presidential election, with President Nicolás Maduro hoping to convince voters that the country has turned the corner after years of strife.

Thanks to his recent efforts to push down the cost of living, the outlook is slightly rosier. In February, Venezuela finally said goodbye to the rampant hyperinflation that had seen price rises peak at more than 400,000% a year in 2019.

Now annual inflation is more manageable, but still high at about 50%.

Mr Maduro has been keen to take credit for the fall, saying it shows that he has “the correct policies”.

Unfortunately, however, those policies have done little or nothing to tackle the economy’s underlying structural problems – chiefly, its historic dependence on oil, to the detriment of other sectors.

“Since it was discovered in the country in the 1920s, oil has taken Venezuela on an exhilarating but dangerous boom-and-bust ride,” as the US Council on Foreign Relations think tank puts it.

Now opponents of President Maduro are pinning their hopes of economic revival on a change of leader, and a new beginning under his electoral rival, Edmundo González.

“An opposition victory would lead to a renewed opening of Venezuela’s trade and financial ties with the rest of the world,” says Jason Tuvey, deputy chief emerging markets economist at Capital Economics.

That would also mean the end of US economic sanctions imposed after Mr Maduro’s victory in the 2018 presidential election, which was widely dismissed as neither free nor fair.

These have made it difficult for state-run oil company PDVSA to sell its crude oil internationally, forcing it to resort to black market deals at big discounts.

But Mr Tuvey cautions that reversing the economic collapse of the past decade will be a tall order, given the enormous investment needed to raise oil production and with peak oil demand approaching.

“Venezuela’s economy can never get back to where it was 15 to 20 years ago,” he tells the BBC. “It will be starting by and large from square one.”

AFP

AFPVenezuela’s 25-year-old Bolivarian Revolution – the name that the late President Hugo Chávez gave to his political movement – promised many things, but has failed to deliver what the country arguably most needed: a broad-based economy.

Instead of diversifying away from the oil industry, the governments of Chávez and Mr Maduro doubled down on Venezuela’s mineral wealth.

Paying little heed to the future, they treated PDVSA as a cash cow, milking its funds to finance social spending on housing, healthcare and transport.

But at the same time, they neglected to invest in maintaining the level of oil production, which has plummeted in recent years – partly, but not solely, as a result of US sanctions.

These problems were already evident when President Chávez died in 2013, but have grown worse on his successor’s watch.

“Under Chávez, Venezuela was able to ride on the coat-tails of an oil boom, up until the global financial crisis,” Mr Tuvey says.

“Fifteen to 20 years ago, Venezuela was a major oil producer. It used to produce three-and-a-half million barrels a day, along the lines of some of the smaller Gulf states.

“Now the oil sector has been completely hollowed out, and it produces less than a million barrels a day.”

GDP declined rapidly, down by 70% since 2013. But Mr Maduro resorted to compensating for lower oil prices by printing money to fund spending, resulting in the runaway inflation which the country has only recently curbed.

Economic hardship has taken its toll on the Venezuelan population, with more than 7.7 million people fleeing in search of a better life – about a quarter of the population.

But for those left behind, there have been signs of improvement. While the bolívar is still the official currency, an informal dollarisation has taken place, with US greenbacks increasingly the payment method of choice in retail transactions – at least, for those who have access to them.

That has stabilised the economy – but it has brought with it a social cost.

Getty Images

Getty ImagesResidents in the capital, Caracas, now find themselves subject to a two-tier economy. While US dollars are fuelling a consumption boom in high-end shops and restaurants, those paid in bolívars feel increasingly excluded.

One symbolic event that highlighted these changes was Colombian reggaeton superstar Karol G’s recent appearance in Caracas as part of her current world tour.

Few major artists perform in Venezuela these days, but she had no trouble selling out two nights in March at the 50,000-capacity Estadio Monumental, despite ticket prices ranging from $30 to $500 (£23 to £390).

At the same time, according to Caracas-based consultancy Ecoanalítica, about 65% of Venezuelans earn less than $100 a month, while only eight or nine million of the country’s 28 million people can be seen as consumers with actual purchasing power.

“Those with a very close connection to the regime or to PDVSA have been barely affected by all this,” says Mr Tuvey.

AFP

AFPAs well as the need to raise living standards and reduce inequality, another big economic challenge for Venezuela is what to do about its massive foreign debt.

The country owes an estimated $150bn to bondholders and other foreign creditors. It has been in partial default since 2017, and although Mr Maduro has repeatedly promised talks on a restructuring, none have yet taken place.

The issue has been complicated by the fact that some of the bonds were issued by PDVSA using the company’s US refiner, Citgo, as collateral. As a result, bondholders have been able to pursue the issue through the New York courts.

Bruno Gennari, emerging markets strategist at investment bank KNG Securities, tells the BBC that because the US does not recognise Mr Maduro as president after the 2018 election, this leaves Venezuela with a “legitimacy crisis”.

This means that whoever wins Sunday’s election would have to be acceptable to Washington if a US-approved debt restructuring is to take place.

Mr Gennari does not rule out that the US “could turn a blind eye” if Mr Maduro wins the election under dubious conditions, but he believes that is rather unlikely.

“This election will have a sizeable impact on Venezuela’s future. If restructuring can go ahead, we could see the beginning of a very complex recovery process,” says Mr Gennari.

Once the richest country in South America, Venezuela now has a possible path back to stability – but whatever happens, its economic glory days are firmly behind it.