- SOL rallied 9% and hit $150 following VanEck’s SOL ETF application

- A market maker has since gone long on SOL, projecting its price could appreciate 8.9x.

The first US spot Solana [SOL] ETF application on 27th June by asset manager VanEck boosted crowd optimism on the SOL token. It rallied 9.4% during the intraday trading session on the same day.

However, unlike Bitcoin [BTC] and Ethereum [ETH], SOL doesn’t have a product based on future ETFs, which could affect the SEC’s approval.

But Bloomberg senior ETF analyst Eric Balchunas noted that things could change with a new administration.

‘If change at POTUS, I think anything possible…I see this filing as a call option on the POTUS election. Because the election happens but the 240 days the SEC has to ponder.’

SOL ETF to drive price 8.9x?

Balchunas’s sentiment was echoed by another policy watcher, Scott Johnsson, a finance lawyer at Van Burien Capital. Johnsson added that Solana ETF could be approved without having the futures ETF like BTC and ETH did.

‘This SEC (and any led by another chair) is going to change the rules again when it’s politically expedient.”

Given the conviction that Solana ETF could be a matter of ‘when’ not ‘if’, crypto market maker GSR has gone ‘long on SOL.’ In a recent update, GSR noted,

‘And with the others having or on the cusp of a spot ETF, not only is it likely just a matter of time before Solana gets one too, but also the impact on SOL just might be the largest yet…GSR is long SOL.’

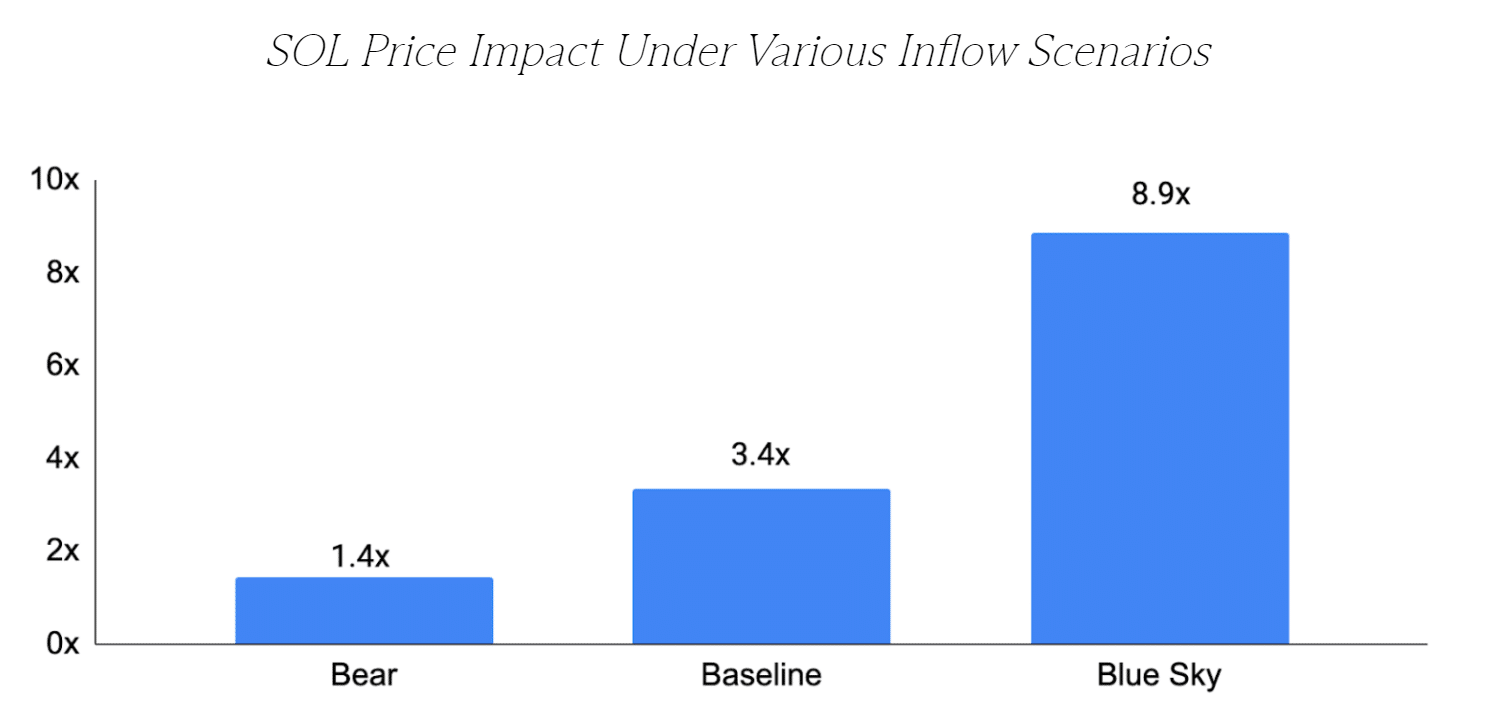

GSR estimated that the ETF could attract 2%- 14% of BTC ETF flows. Per the market maker, if SOL ETF attracts 14% of BTC flows, SOL’s price could rally 8.9X in a bullish case scenario (Blue Sky).

Source: GSR Markets

What’s next for SOL?

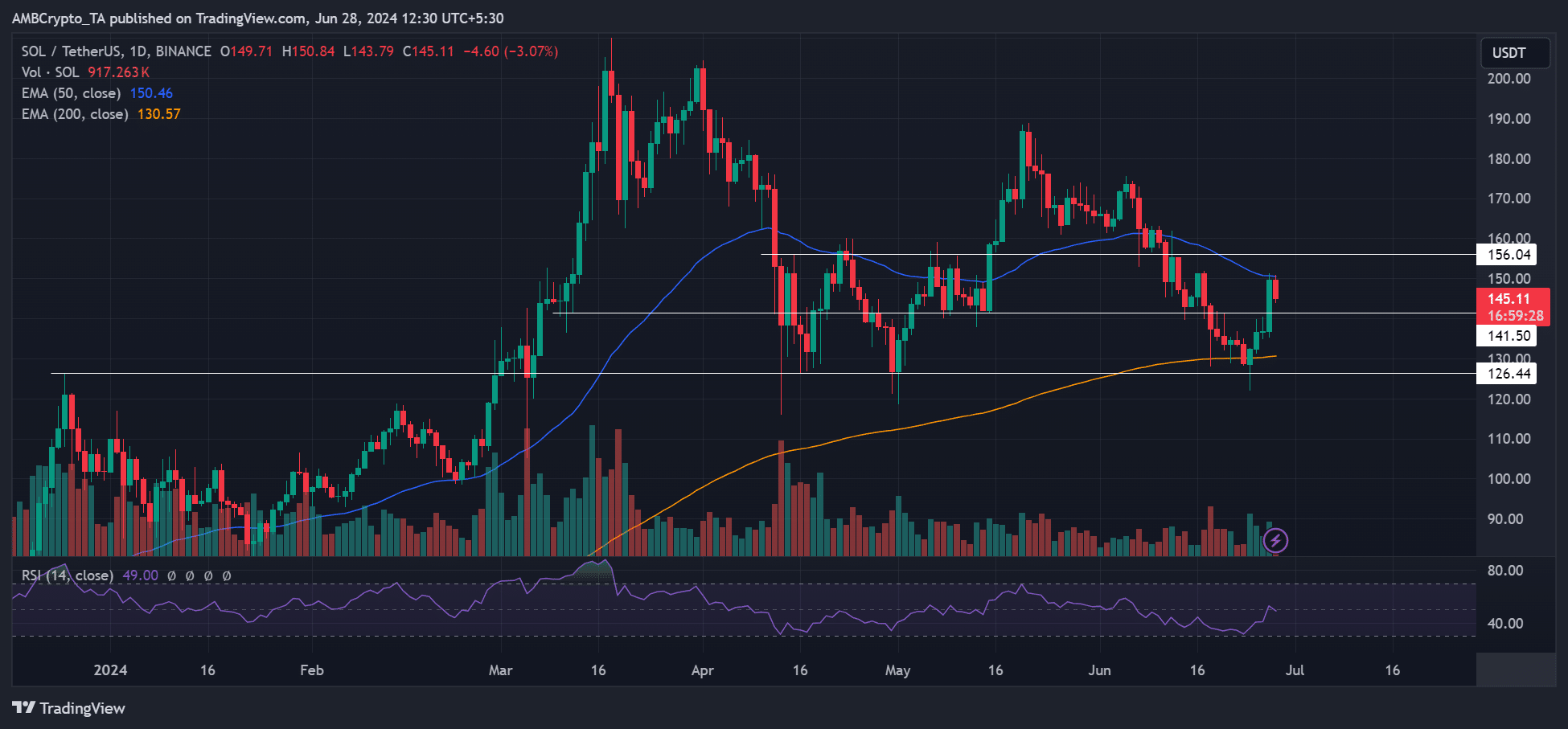

In the meantime, the Thursday upswing saw SOL hit $150. However, it also reached the 50-day EMA (Exponential Moving Average), which could be a key resistance level if the crowd optimism wanes.

As of press time, SOL had erased part of Thursday’s gains and traded at $145. Santiment, a blockchain intelligence data platform, had previously noted that SOL’s correction was likely after the SOL ETF news.

‘SOL’s rally is being accompanied by traders FOMO’ing in, meaning the rally is less likely to continue.’