Introduction: UK house prices rise for third month running, close to record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

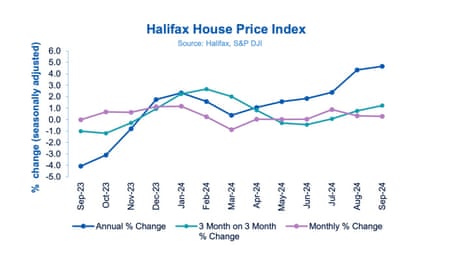

UK house prices have risen for the third straight month, lender Halifax reports this morning, helped by lower borrowing costs.

According to Halifax, the average house price rose by 0.3% in September to £293,399, up from £292,540 in August, which pushed the annual growth rate up to 4.7%.

This left the average price only a little short of the record high of £293,507 set in June 2022, on Halifax’s index, before the market started to slide in autumn 2022 after the mini-budget pushed up mortgage rates.

Amanda Bryden, Head of Mortgages at Halifax, says improved mortgage affordability is stimulating the market.

But, she adds, it’s “essential” to view these recent gains in context.

Bryden explains:

While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months. Looking back two years, prices have increased by just +0.4% (£1,202).

Market conditions have steadily improved over the summer and into early autumn. Mortgage affordability has been easing thanks to strong wage growth and falling interest rates. This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest.”

The agenda

-

7am BST: Halifax house price index for September

-

7am BST: German factory orders for August

-

9.30am BST: Sentix survey of eurozone investor confidence

-

10am BST: Eurozone retail sales for August

Key events

German factory orders tumble in August

Dark economic clouds are flocking over Germany this morning, with the news that manufacturing orders fell more sharply than expected in August.

New orders at German factories fell by 3.8% month-on-month, statistics body Destatis reports this morning, rather worse than the 2% fall forecast by economists.

On an annual basis, orders were 3.9% lower than in August 2023.

Destatis reports that the large monthly drop was partly because “extensive large orders” had been placed in July, for vehicles such as aircraft, ships, trains, and military transport.

The decline in factory orders will make it harder for Germany’s economy to return to growth, after it shrank slightly in April-June.

Last month, the country’s leading economic institutes downgraded their forecasts and predicted Germany’s economy would shrink by 0.1% in 2024.

Reuters: BP drops oil output target in strategy reset

Reuters are reporting that BP has abandoned a target to cut its oil and gas output by 2030.

The apparent u-turn come as CEO Murray Auchincloss scales back the firm’s energy transition strategy to regain the confidence of investors who have questioned its current strategy.

Instead of cutting fossil fuel output, the focus has moved to several new possible investments in the Middle East and the Gulf of Mexico to boost its oil and gas output, Reuters reports.

BIG OIL STRATEGY: BP as abandoned a target to cut oil and gas output by 2030 as CEO Murray Auchincloss scales back the firm’s energy transition strategy to regain investor confidence, Reuters reports | #OOTT $BP https://t.co/LjarLEJECe

— Javier Blas (@JavierBlas) October 7, 2024

BT has already trimmed this target once. It had initially planned to cut oil and gas production by 40% by 2030, but in February 2023 it cut this target to 25% and scaled back its climate ambitions.

Auchincloss was appointed BP’s CEO in January. So far this year its shares have fallen 10%, while rival Shell’s are flat.

A BP spokesperson has said:

“As Murray said at the start of year… the direction is the same – but we are going to deliver as a simpler, more focused, and higher value company.”

🇬🇧🛢 BP $BP lowers its oil output target and shifts strategy

It is fascinating to see how major oil companies are taking different paths. 🇫🇷 Total $TTE, for instance, is heavily focusing on renewables

Which strategy is better? It all depends on your investment horizon https://t.co/TCEH44XYF4

— Quality Stocks (@Quality_stocksA) October 7, 2024

Hamptons: Millennials’ mortgage misfortune

Rising house prices will make it harder for first-time buyers to get onto the housing ladder, unless lenders do continue to cut mortgage rates.

And new data from estate agents Hamptons shows that younger home buyers are already facing a tougher squeeze from mortgage payments than older generations.

Hamptons has calculated that millennials will be the first generation of homeowners to see mortgage repayments rise in the second half of their loan.

Higher interest rates today, compared to a few years ago, mean that the average Millennial still has over half (61%) of their projected total mortgage repayments to make, they say. By the same point, the average Baby Boomer had 41% left to pay and Generation X had 40%.

Hamptons reports that in 2024 prices, the average millennial (someone born between 1981 and 1995) will have paid £863 per month during the first five years of their mortgage loan. This compares to Generation X (those born from 1966 to 1980) who on average paid the equivalent of £923 a month (at today’s prices), and Baby Boomers (1946-1965) who paid an average of £775 a month on their new mortgage.

There’s even an intergenerational divide between older Millennials who bought early at rock bottom pre-Covid mortgage rates, and younger ones who bought later at higher prices, and higher mortgage rates.

And it’s worse for those born in the late 1990s. Higher rates today mean that Generation Z face average mortgage payments of £1,739 per month, roughly double what Millennials are paying.

House prices: What the experts say

House prices could be spurred higher if the Bank of England cuts interest rates (as expected) next month, says Matt Thompson, head of sales at estate agent Chestertons:

“Lower interest rates and sub-4% mortgage products saw more house hunters start their property search in September. The uplift in buyer activity, and looming changes to Capital Gains Tax in the upcoming Autumn Budget, also motivated sellers to put their property up for sale. We expect this level of market activity to continue and could see an additional boost in buyer motivation if the Bank of England decides to cut interest rates in November.”

Coinciding with wage growth and rate trims, UK house prices, tiptoed up +0.3% in September 2024.

Annually, growth edged up to +4.7% making the avg property price £108 short of the record high of £293,507 set in June 2022.The regional picture showed that on an annual basis,… pic.twitter.com/lQ0YzFtR1i

— Emma Fildes (@emmafildes) October 7, 2024

Mark Harris, chief executive of mortgage broker SPF Private Clients, says:

“Lenders continue to reduce their mortgage rates, which is encouraging buyers to make their move. The Bank of England Governor’s comments about a more aggressive approach to rate setting should feed through to even lower mortgage pricing.

“Several lenders repriced downwards last week, including HSBC, NatWest, Barclays and Santander. Two-year fixes are now available from 3.84 per cent while the cheapest five-year fix is pegged at 3.68 per cent, which will prove to be more palatable for borrowers than some of the higher rates they have been paying recently.

“This ongoing rate war among lenders is great news for borrowers as there are some really compelling deals being launched, which will go some way to helping affordability.”

Tom Bill, head of UK residential research, Knight Frank, suggests there might be a “relief bounce” after this month’s budget:

“The last two years have underlined the close relationship between mortgage rates and house prices – as one goes up the other goes down. We expect low single-digit price growth this year as rates continue to drift lower, with the Budget the main cause of uncertainty on the horizon.

If it better than feared, there is likely to be a relief bounce in activity before Christmas that lasts into next spring.”

On an annual basis, UK house price inflation was nearly a two-year high last month.

The 4.7% increase in house prices on an annual basis in September is the fastest annual rate since November 2022, according to data from Halifax.

Unsurprisingly, London continues to have the most expensive property prices in the UK.

Halifax reports that the average house price in the capital rose by 2.6% in the year to September, to £539,238.

That’s still below the capital’s peak property price of £552,592 set in August 2022.

Halifax’s data also shows that first time buyers are paying less for a home than in 2022.

Todays report explains:

The average amount paid by first-time buyers has increased by +4.2% over the past year, which equates to an extra £9,409 in cash terms. This brings the typical first-time buyer property price up to £232,769, its highest level since May 2024.

However that’s still about £1,000 less than the average amount paid by a first-time buyer two years ago (£233,760), a decrease of around -0.4%.

Northern Ireland continues to record the strongest annual house price growth in the UK

Halifax reports that Northern Ireland continues to record the strongest property price growth of any nation or region in the UK.

The average price of a property in Northern Ireland is now £203,593, after prices rose by. 9.7% on an annual basis in September.

House prices in Wales rose by 4.4% to an average of £224,119.

Scotland saw a more modest rise in house prices, up 2.1%, meaning a typical property now costs £205,718.

Across England, the North West recorded the strongest house price growth of any region in England, up by +5.1% over the last year, to sit at £234,355.

Introduction: UK house prices rise for third month running, close to record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have risen for the third straight month, lender Halifax reports this morning, helped by lower borrowing costs.

According to Halifax, the average house price rose by 0.3% in September to £293,399, up from £292,540 in August, which pushed the annual growth rate up to 4.7%.

This left the average price only a little short of the record high of £293,507 set in June 2022, on Halifax’s index, before the market started to slide in autumn 2022 after the mini-budget pushed up mortgage rates.

Amanda Bryden, Head of Mortgages at Halifax, says improved mortgage affordability is stimulating the market.

But, she adds, it’s “essential” to view these recent gains in context.

Bryden explains:

While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months. Looking back two years, prices have increased by just +0.4% (£1,202).

Market conditions have steadily improved over the summer and into early autumn. Mortgage affordability has been easing thanks to strong wage growth and falling interest rates. This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest.”

The agenda

-

7am BST: Halifax house price index for September

-

7am BST: German factory orders for August

-

9.30am BST: Sentix survey of eurozone investor confidence

-

10am BST: Eurozone retail sales for August