Skift Take

— Pranavi Agarwal

Skift Research’s latest report explores the state of venture capital investment in the travel industry. Below we present 5 key insights and takeaways.

Insight 1: Venture capital investment in the travel industry has dropped to its lowest level in a decade.

Travel had only $2.9 billion of venture capital (VC) investment in 2023, compared to $5 billion in 2022 and nearly $9 billion in 2019. It was the lowest level in 10 years.

The number of deals has also dropped considerably, from 1,021 deals in 2019 to only 587 in 2023. The number of deals in 2023 dropped more than 20% vs 2022 – the second steepest decline since the 2020 lockdowns.

The declines in travel investment track the overall declines in VC, which continues to struggle in a tough macroeconomic environment marked by higher rates and declining valuations.

In 2020 and 2021, travel VC underperformed the total VC market. However, in 2022 and 2023, both saw similar declines, with each down about 40%.

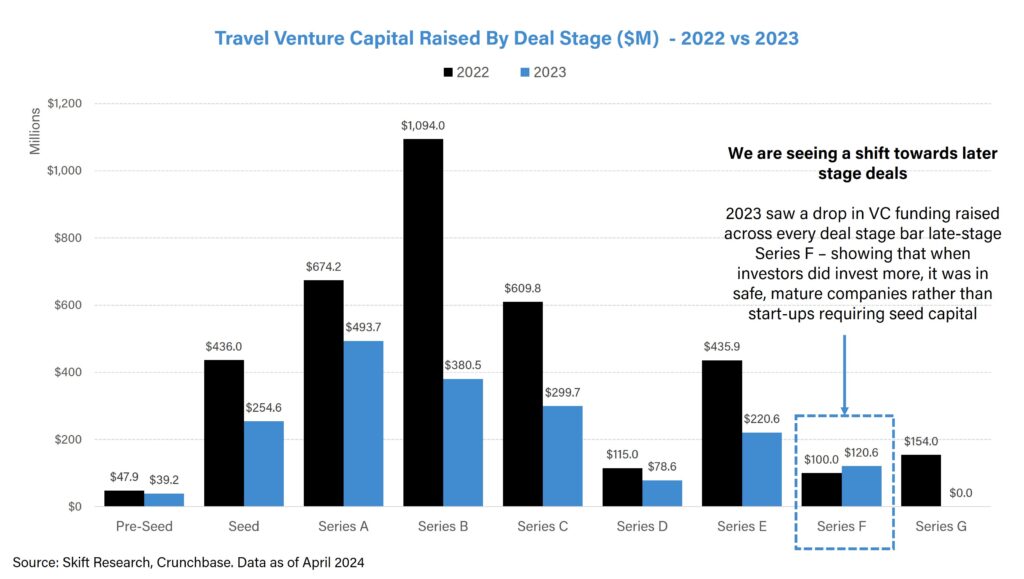

Insight 2. There is an on-going shift towards investment into later-stage, mature companies.

Though 2020 and 2021 saw a surge in early stage (pre-seed or seed capital) VC raised by start-ups, there was a move toward late-stage funding in 2023.

For example, there was a drop last year in VC funding across every deal stage – except late-stage Series F. That shows that when investors did invest, it was in safe, mature companies.

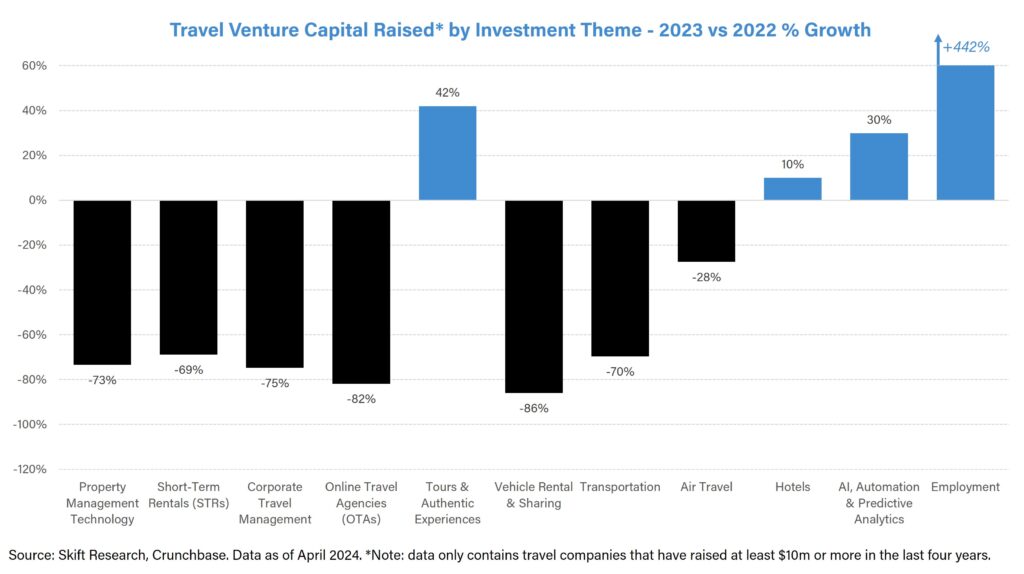

Insight 3. Where the growth is: Tours & experiences, AI & automation and hospitality employment.

There has been significant investment into the tours and experiences sector. This has been led by large funding rounds in OTAs Klook and GetYourGuide. Investors see opportunity and untapped prospects for the tours and experiences sector: It is highly fragmented with a long tail of small suppliers and is rapidly shifting online. Read our deep dive on the Experiences sector here: The Last Outpost of Travel: A Deep Dive into Tours, Activities and Experiences 2023.

Hospitality employment has also seen significant growth in VC investment, predominantly led by funding rounds in Instawork, which offers on-demand staffing apps and recruitment services. Funding into Instawork grew from $8 million in 2022 to $60 million in 2023 with its latest series-D round focussed specifically on implementing AI and machine learning into its operations.

AI, automation & predictive analytics in 2023 is another key area of investor interest. At Skift’s 2024 Data & AI Summit, Chris Hemmeter, Managing Director of Thayer Ventures, said there remains a large opportunity for technological advancement in the travel industry – a gap which could be potentially filled by AI.

“We find ourselves now with this incredible technical debt and in a real problem, because at the same time that our [hospitality] industry has been playing catch up and just layering technology on top of itself, the traveler has changed,” Hemmeter said.

However, investors aren’t just investing “for the sake of AI,” said Kurien Jacob of Highgate Technology Ventures:

“We don’t look for an AI company in travel, you don’t have that approach”, but rather “you look for companies that can use the best of AI”.

According to Hemmeter of Thayer Ventures, “Every quality company is going to have some sort of AI tool integrated into their value proposition”.

Investors are increasingly seeking companies that can efficiently implement AI into their tech stacks and strategies rather than investing in AI companies on their own. Read our deep dive into AI in travel: Generative AI’s Impact on Travel for further reading.

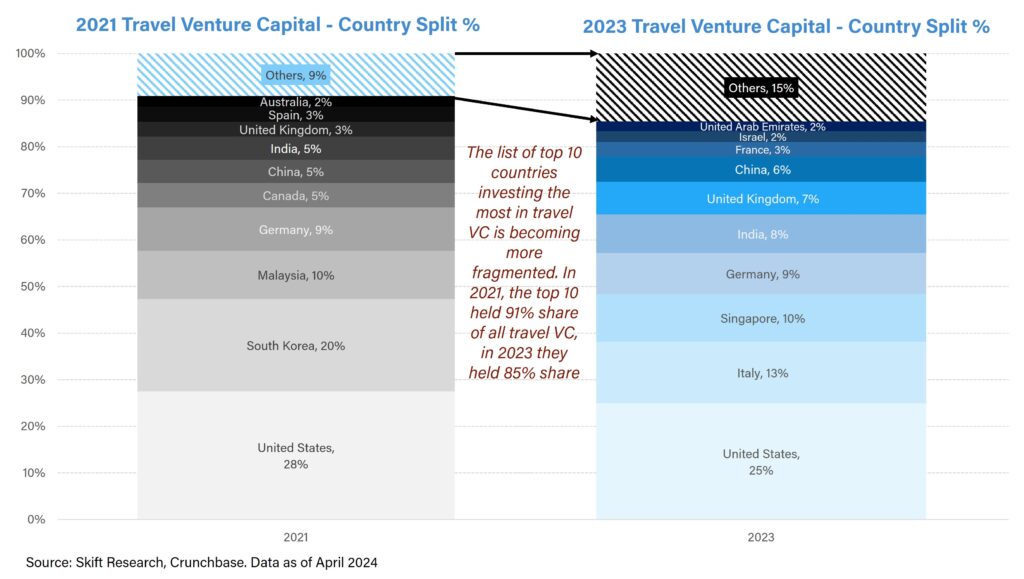

Insight 4. There is an increased fragmentation and shift eastward in the list of top-10 countries investing in travel venture capital.

In 2021, the top 10 countries held a 91% share of the travel venture capital market; in 2023 they held 85%.

The U.S. continues to be the single largest country for travel VC investment, accounting for $722 million in 2023 – 25% of the global total. But we are increasingly seeing a shift east, with Singapore and India taking the number 3 and number 5 spots, respectively. India has moved up from 7th place in 2021.

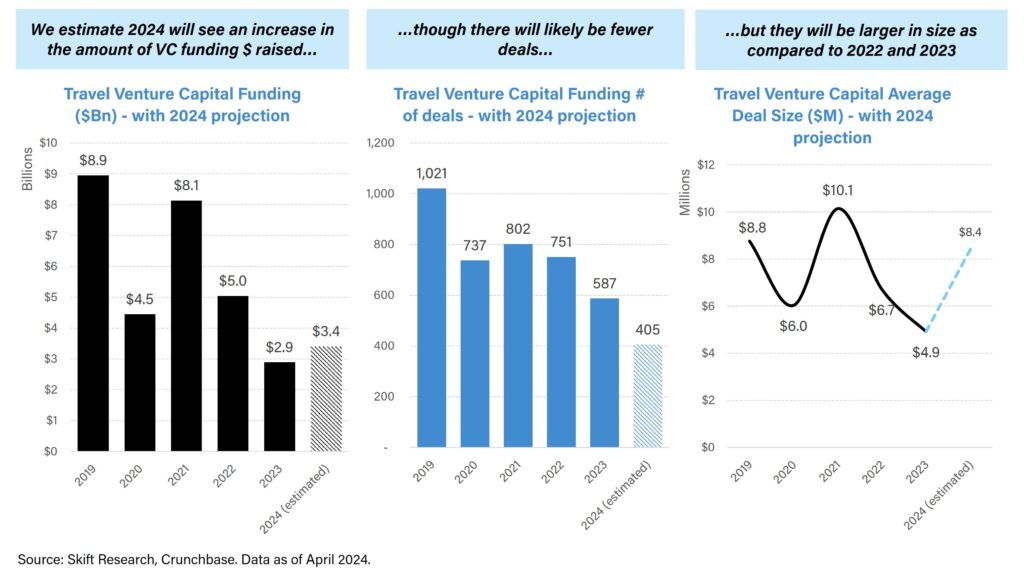

Insight 5. We expect that 2024 will see an increase in VC funding in travel.

Based on preliminary data from the first quarter of 2024 and in line with the on-going shift towards investment into larger, late-stage mature companies, we expect that investors will continue being highly selective.

We think the trend is for fewer deals, but for them to be of a larger average size versus 2023.

This should culminate into an overall increase in travel VC funding in 2024. For example, year-to-date there have already been at least 10 companies (such as Travelperk, Mews and Guesty) that have raised more than $100 million of venture capital funding.

Additionally, as the interest rate environment improves into 2025 and 2026, we should expect VC deal flow to further improve. We have found a strong inverse correlation between U.S. interest rates and the amount of VC funding in the U.S. travel industry. Our analysis shows that every 0.1% decrease in the U.S. interest rate could mean an increase of around $50 million in VC investment in U.S. travel companies.

Read the full report for methodology and further analysis of the travel venture capital market by region, company and sector.

What You’ll Learn From This Report

Read the full report for methodology and further analysis of the travel venture capital market by region, company and sector.

- The size of the travel startup financing market from 2009 – 2023, with projections for 2024

- 2023 funding by deal stage, region, company and sector

- Key 2023 funding trends in travel startups: tours & experiences, corporate travel and expense management, property management technology, short-term rentals, OTAs and AI automation & predictive analytics, amongst other thematic buckets

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Photo Credit: Unsplash/ Image is of a unicorn money box and it represents the tours & experiences operators Klook and GetYourGuide which are each private companies with valuations above $1 Billion, thus granting them unicorn status. Klook and GetYourGuide were the top two most funded travel companies in 2023.