|

Commercial lunar infrastructure could benefit startups like Interlune, which proposes to harvest helium-3 on the Moon. (credit: Interlune) |

by Jeff Foust

Monday, May 20, 2024

You may have heard in recent weeks a two-word phrase whose individual words were very familiar but which, until now, had been rarely combined: lunar railroad. Earlier this month, NASA Innovative Advanced Concepts (NIAC), the agency program that funds work on early-stage technologies, awarded a Phase 2 grant for a project called Flexible Levitation on a Track (FLOAT) to create a maglev railroad of sorts on the Moon and other planetary bodies. “We want to build the first lunar railway system, which will provide reliable, autonomous, and efficient payload transport on the Moon,” explained Ethan Schaler of JPL, who is leading work on FLOAT.

| Nayak said the goal of LunA-10 was to bring together companies that offered different lunar services, from transportation to communications to power, “and form sort of a consortium” that could combine those services into a commercial ecosystem. |

The announcement of the FLOAT grant came about a month and a half after Northrop Grumman announced its own lunar railroad project. The company said it won a DARPA grant to study a “lunar railroad network could transport humans, supplies and resources for commercial ventures across the lunar surface.” Unlike the NIAC announcement, Northrop did not go into technical details about its railroad concept, other than to describe how the study will examine issues ranging from interfaces to costs.

The Northrop lunar railroad award is part of a project called the 10-Year Lunar Architecture Capability Study, or LunA-10, at DARPA. When the agency announced plans for LunA-10 last August, it surprised many people: why was DARPA looking at lunar architecture when NASA had already developed its Moon to Mars Architecture and outlined plans to refine and update it annually?

Michael “Orbit” Nayak, the DARPA manager for LunA-10, said last summer that DARPA had coordinated its plans for the project with NASA. “We set out to talk with NASA, figure out what they’re doing, figure out what their roadmap is, and then see if there are other complementary investments that we can make to significantly advance the state of the art that are sort of in line with your typical DARPA mission,” he said then.

The goal of the effort, he said, was to bring together companies that offered different lunar services, from transportation to communications to power, “and form sort of a consortium” that could combine those services into a commercial ecosystem. The project started with a “commercial end state” that, in ten years, there would be a self-sufficient lunar economy, working backwards from there to identify key technical and economic issues.

At a meeting last month of the Lunar Surface Innovation Consortium, DARPA discussed the initial results of the LunaA-10 study. Phil Root, director of DARPA’s Strategic Technology Office, described the agency’s hypothesis that “investments in technology maturation for lunar infrastructure might make a significant difference in catalyzing the lunar economy” that LunA-10 would test. “We believe that LunA-10 has supported that hypothesis.”

Later in the consortium meeting, Nayak discussed the work that 13 companies selected for LunA-10 awards last December had performed. (DARPA had selected 14 companies, and it wasn’t clear what happened to the 14th, Nokia.) Those companies had explored various concepts for providing services at the Moon, many of which were summarized in a slide deck released by the consortium.

The companies proposed a wide range of capabilities. Fibertek offered a concept called the Lunar Infrastructure Optical Node (LION), a base station that could provide navigation and communications services as well as power beaming. Icon, a company that uses 3D-printing technology to produce structures, offered an approach to develop landing pads, roads, and roads out of lunar regolith. Sierra Space outlined a system to generate oxygen from regolith.

The two companies building lunar landers for NASA’s Human Landing System program also took part in LunA-10. Blue Origin described how its Blue Moon lander, starting with the smaller Mark 1 cargo version, could be used to build up lunar infrastructure, with the company also proposing how it could be used for a power and communications system.

| “We don’t have a commercial lunar economy until we can not just survive the night but operate through the night,” Nayak said. |

SpaceX, unsurprisingly, explained how Starship could support a lunar base, starting with three Starship landings: one serving as a hub for power, communications and other services, a second delivering heavy equipment, and a third that services as a crew habitat. Those Starships would remain on the Moon, their propellant tanks repurposed for storing other fluids and gases and other unneeded components, like Raptor engines, “harvested and processed into raw feedstock material,” the company explained on one slide. (Nayak later called that “re-ISRU” or recyclable in situ resource utilization.)

“They’re a huge enabler for the lunar economy,” he said of SpaceX and Starship. “It’s an unprecedented amount of mass that can be delivered in one shot.”

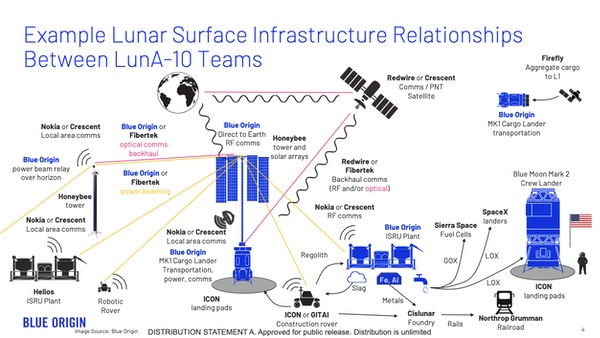

The study, though, sought to not just have individual companies expound on their technologies and systems but also explore how those capabilities would interact with one another. Blue Origin, for example, included in its slides a complex diagram of how its capabilities would serve, and be served by, those being developed by other companies in the LunA-10 study. Other companies outlined who they might sell to and buy from.

A chart from Blue Origin’s LunA-10 slides showing how the companies involved would use each others’ products and services. (credit: Blue Origin) |

It also identified potential new services needed for this lunar architecture. “Under LunA-10 we’ve come to realize this idea of ‘thermal as a service,’” Nayak said. That is thermal management that rejects excess heat during the lunar day and generates heat at night. He said studies showed 40–50% of the mass of spacecraft being sent to the lunar surface involved their thermal management systems. If that could instead be offered as a service, “then you either have reduced your cost to the Moon by half or you have doubled the capability that you can bring.”

“We don’t have a commercial lunar economy until we can not just survive the night but operate through the night,” he added.

The presentations described in detail how the various infrastructure providers would work with one another, providing products and services among each other. There was far less discussion, though, about who else would use that infrastructure: who will need that power, communications, thermal management, transportation, and other services?

“The lunar economy is going to be diverse. All kinds of users, going all kinds of places,” Nayak said in a discussion of power needs on the Moon, but didn’t elaborate on the users or places.

One potential user of that infrastructure is a startup called Interlune, founded by former Blue Origin executives Rob Meyerson and Gary Lai. The company formally exited stealth mode earlier this year to reveal its plans to prospect for eventually harvest helium-3—not for fusion reactors that don’t yet exist but for other applications, like medical imaging and quantum computing.

“We’re focused on increasing the supply of helium-3,” Meyerson, the CEO of Interlune, said in an on-stage interview at the 39th Space Symposium last month. “We have customers lined up and interested.”

He said Interlune focused on helium-3 because of its high price: $20 million per kilogram. “It is the only resource that is priced high enough to warrant going to the Moon and bringing it back. We needed something like that to anchor the business case.”

Interlune is planning three missions, starting with one in late 2026 or early 2027 that would do initial prospecting. Two more, in 2028 to 2030, would set up first a pilot plant to harvest helium-3 from lunar regolith and then an operating plant that would return helium-3 for sale to customers.

| “I think this is inevitable. I think that going to the Moon to stay is inevitable,” Meyerson said. |

Meyerson said the company will make use of commercial lunar landers, like those flying Commercial Lunar Payload Services missions for NASA. In terms of other infrastructure, he said he saw gaps in power and Earth return capabilities. He didn’t specifically mention if something like the architecture proposed by LunA-10—whose interim results had not been published yet—would be helpful.

The panel discussion at the consortium meeting didn’t elaborate on other users of this infrastructure, or their willingness to pay. “We are now at a phase of looking at what is the return on investment,” Root said. “We are now looking at what is the return on investment: what is the size of investment and how large that return is, both in dollars and in terms of national priorities.”

Nayak envisioned turning LunaA-10 into a book that would serve as a “field guide to the lunar economy,” offering a snapshot in time of technologies and services. It would also include what he described as “external perspectives” on topics ranging from insurance to space law.

At Space Symposium, Meyerson sounded optimistic about the long-term prospects for lunar commercialization and, with it, necessary infrastructure. “I think this is inevitable. I think that going to the Moon to stay is inevitable and we have an opportunity right now to invest alongside the investment being made by NASA and its partner countries to go do something really good.”

That said, there’s probably no rush to buy a ticket to ride the Shackleton Express just yet.

Note: we are now moderating comments. There will be a delay in posting comments and no guarantee that all submitted comments will be posted.