| Updated:

Fintech ‘unicorn’ the Bank of London has announced a £42m injection of funding today after a tumultuous week in which it was hit with a winding-up order and revealed its chief executive was stepping down.

In a statement, the specialist clearing bank, one of only two to be created in the UK in the past 250 years, said the new capital was raised in August and would fund its “next phase of growth”.

Luxembourg-based investor Mangrove Capital Partners led the round, the company said.

It comes after the bank surprised the City on Tuesday with the announcement its founder and chief executive, Anthony Watson, would be stepping down from his role. City A.M. then revealed on Saturday that it had been hit with a winding-up order from His Majesty’s Revenue & Customs (HMRC), the UK’s tax authority.

A winding-up petition is a formal legal process used against a company that has not paid its debts. It is commonly used by HMRC against companies that have failed to pay tax bills more than 21 days after a statutory demand and can result in their assets being forcibly sold.

The firm claimed HMRC’s petition was down to a “simple administrative handling delay due to an internal miscommunication” and denied the departure of Watson was connected to the winding-up petition.

In a statement today, Watson’s replacement, Stephen Bell, said the fresh cash injection “underscores investor belief and confidence in our vision”.

Watson is remaining with the bank in a new “founder & senior adviser” role and is still a non-executive director of its holding company. Bell was formerly chief risk and compliance officer.

Declining to comment on specific cases, an HMRC spokesperson said over the weekend: “We take a supportive approach to dealing with customers who have tax debts and only file winding-up petitions once we’ve exhausted all other options, in order to protect taxpayers’ money.”

Dan Neidle, former UK head of tax at law firm Clifford Chance and founder of think tank Tax Policy Associates, told City A.M. that the situation “suggests major governance and administrative failings”.

In its latest annual report, HMRC named The Bank of London as one of 11 UK banks that had chosen not to adopt its voluntary code of practice on taxation for the sector as of March 2023.

The code, introduced after the financial crisis and adopted by 316 banks, is designed to clamp down on their potential use, promotion and funding of tax avoidance.

The group, valued at $1.1bn in February 2023, previously tapped investors for £25m last November.

Its most recent annual report, filed last December after a three-month delay, showed the group paid £7.9m in corporation tax in the year ending on 30 December 2022.

The same report showed its pretax loss widened to £41.8m, from £15.7m in 2021 – driven by technology spending and a hiring spree that saw the bank add more than 100 staff. It made no revenue over the period because the bank had yet to start trading, recruiting its first client last April.

The Bank of London’s auditor, Sedulo, highlighted tax legislation as one of four areas of law and regulation that would most likely have a “material effect” on the business if it were found non-compliant.

Sedulo resigned as The Bank of London’s auditor after signing off on its latest accounts and was replaced by EY. Sedulo did not respond to a request for comment on Saturday.

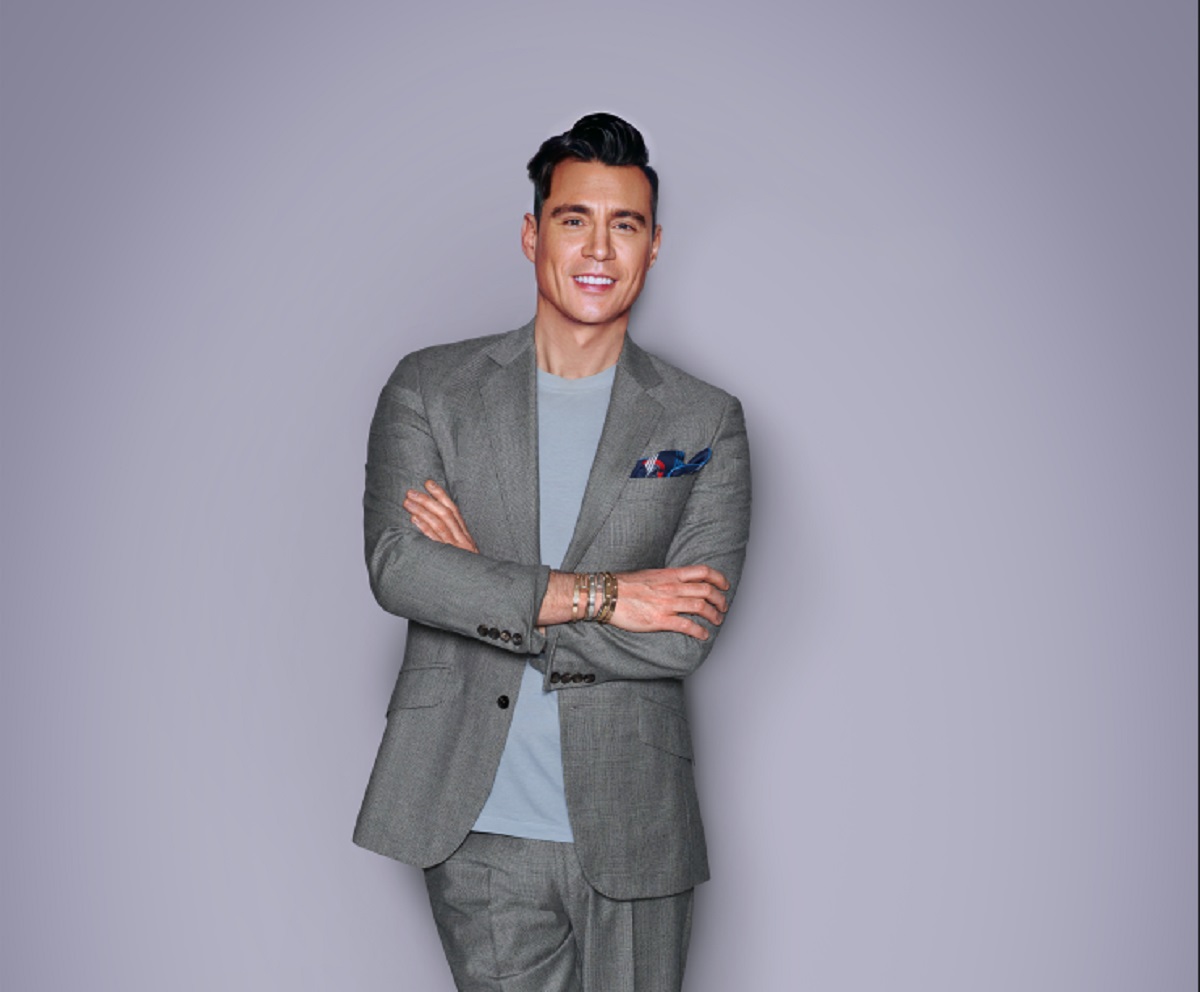

Watson, a former Barclays executive and LGBT campaigner, launched The Bank of London in 2021 as a global clearing, agency and transaction bank for business customers.

It was only the second such firm to launch in the UK in 250 years, after fellow start-up ClearBank in 2017.

The Bank of London does not lend and holds all of its deposits with the Bank of England. The firm claims more than 4,500 businesses use its banking products and services.

It boasts former business secretary and New Labour architecht Peter Mandelson as its deputy chairman. The bank’s chair is Harvey Schwartz, an ex-Goldman Sachs and Citi executive who is CEO of the world’s fifth-largest private equity firm, The Carlyle Group.