- Terra Classic Foundation delegated 30M LUNC to hexxagon.io.

- Despite the impressive amount delegated, LUNC remained bearish.

Terra Classic Foundation announced the continued support for Galaxy Finder and station. In a recent announcement, the foundation announced a massive delegation of 30 million LUNC tokens to hexxagon.io.

On their official X (formerly Twitter) page, Terra Classic Foundation stated,

“We have delegated another 30M $LUNC to @hexxagon_io for running and maintaining Galaxy Station (https://station.hexxagon.io) and Galaxy Finder (https://finder.terra-classic.hexxagon.io)”

This delegation is crucial because it boots Hexxagon in managing its ecosystem.

Since the collaboration between the joint L1 Taskforce and Hexxagon last year, it has been critical and vital in developing and maintaining finder and galaxy stations.

Galaxy Station is the center for interaction and governance within the Terra classic ecosystem. It helps users navigate the Terra Classic network, including transactions, addresses, and other activities.

With recent delegation, the amount delegated to the platform totals 930M LUNC. The delegation indicated the team’s full commitment to continued security and development within the Terra classic ecosystem.

Therefore, developing a solid, user-centered infrastructure for a better experience will be crucial.

Impact on LUNC?

Notably, massive delegation can impact price charts in both the short and long term.

Although the delegation shows trust and confidence in the network, which can attract investors, AMBCypto’s analysis indicated that LUNC’s market sentiment remained at press time.

As of this writing, LUNC was trading at $0.0000801 after a 0.70 decline in 24 hrs. Also, it has declined by 1.47% in the last seven days.

However, the trading volume has increased by 8.02% to $15M over the previous 24 hrs.

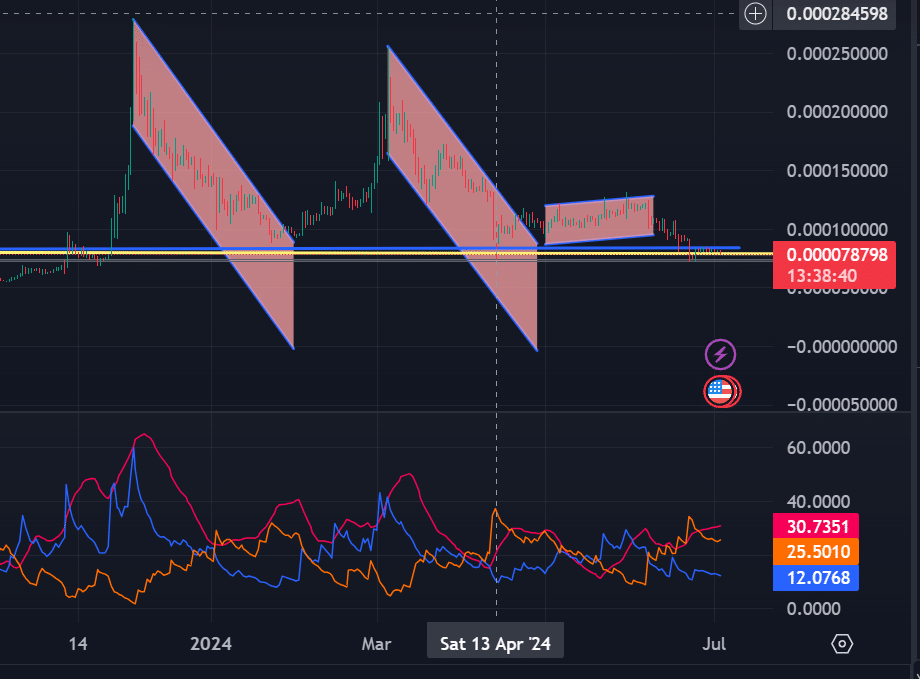

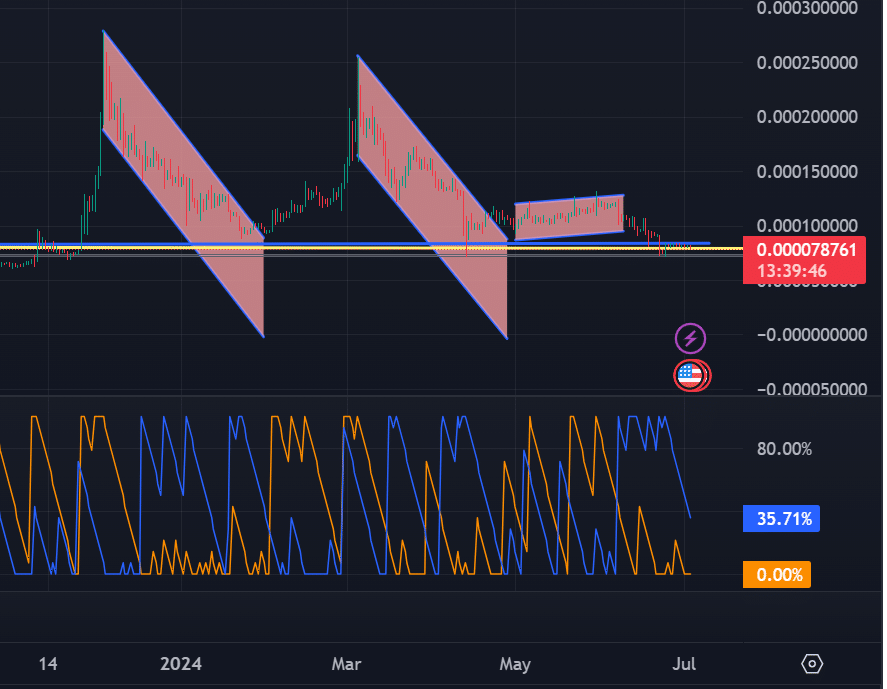

Our analysis showed a strong bearish trend as well. Looking at LUNC’s Directional Movement Index, the negative index (red) at 30 sat above the positive index at 12, which showed that the downtrend was strong.

The Aroon line further proved this, as the Aroon down (blue) at 35 sat above the Aroon up line, which is zero — a bearish signal.

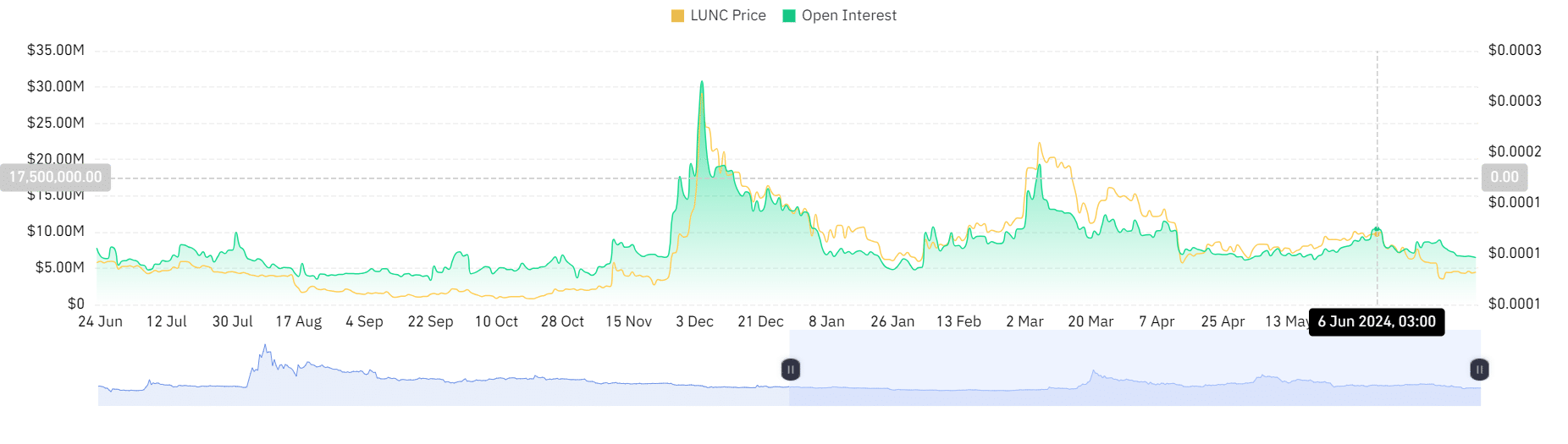

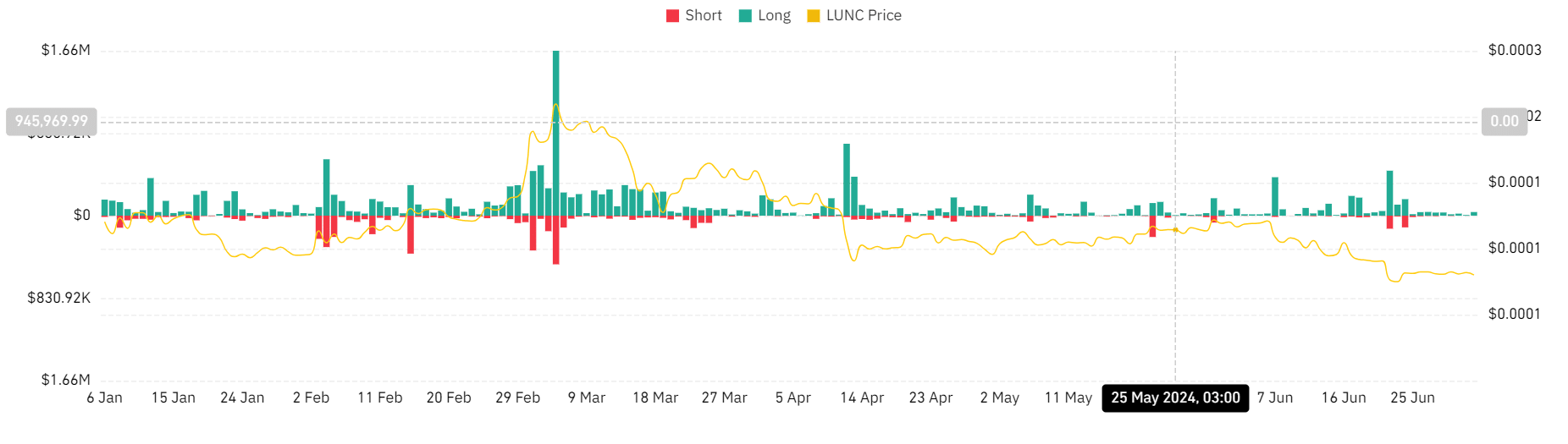

Looking further, Coinglass data shows that LUNC’s Open Interest has continually declined in the last seven days from a high of $8.89M to $6.4M at press time.

Reduced Open Interest shows that holders are closing their positions without opening new ones.

Finally, in the last 24 hrs, LUNC has reported higher liquidation at long positions with $36k while short at zero.

The same liquidation trend has occurred during the previous seven days, showing the market sentiment was largely bearish.

Can prices rise after the delegation?

While the 30M delegation has potential economic impacts on the price charts, LUNC’s remained in a downtrend.

Is your portfolio green? Check the LUNC Profit Calculator

If the bearish trend persists, LUNC will break down the critical support at $0.0000793 and a further decline to LSL around $0.0000747.

However, if the market experiences correction following the delegation, LUNC will rise to the next significant resistance level around $0.0000837.