All products and promotions are independently selected by our experts. To help us provide free impartial advice, we will earn an affiliate commission if you buy something. Click here to learn more

Thousands of mobile phones are stolen every year in the UK.

In London alone, one phone is stolen every four minutes. While we’re waiting for Google’s clever AI solution to block phone thieves to launch, digital bank Monzo has announced a raft of new app-based features to stop criminals from raiding your savings even if they manage to steal your mobile phone.

If your iPhone or Android device is unlocked when it’s stolen, thieves can access a slew of important features, including checking email (allowing them to access password reset emails), text messages (helpful for any accounts with two-factor authentication), making purchases on shopping apps, and even access some banking or payment apps to raid your savings.

Monzo wants to prevent criminalsfrom transferring or withdrawing money from your account — even if they have access to an unlocked phone. The new protections, the first of their kind for mobile banking, should block thieves behind impersonation scams, as well as those who steal personal information.

First up, a new “known locations” feature will let you choose a spot — like a home address or workplace — where you’ll need to be located in order to transfer money or withdraw savings over a certain limit. Using GPS data, the digital bank will verify whether the device is in one of these locations.

If not, it will block any attempted transactions.

Monzo will also let you pick a trusted friend or family member (who also has a Monzo account) to be notified before they send or withdraw money over a chosen limit. That person will be able to review whether they believe a payment looks safe or is suspicious.

Phone theft has spiralled in select cities in the UK, with one mobile phone snatched by thieves every four minutes in the UK capital city

PROTECT YOUR BUBBLE PRESS OFFICE

All of these tools will be optional, so if you want to continue to be able to transfer and withdraw any amount of money in any location, then you can choose to disable the new safeguards.

Speaking about the security innovations, Monzo Senior Engineer, Priyesh Patel said the bank was trying to “outpace” the tactics of fraudsters by rolling out new in-app tools.

“Whether it’s choosing your safety radius with known locations or having a trusted contact sense-check your payments before you make them, these features offer customers peace of mind and force a much-needed moment of pause in a high-stakes situation,” he said.

British bank Monzo, one of a slate of new digital banks, also unveiled a third new feature whereby you’ll be able to authenticate any payment by getting a “secret” QR code sent to a different device. You will need to scan the code within the Monzo app for the transaction to go through.

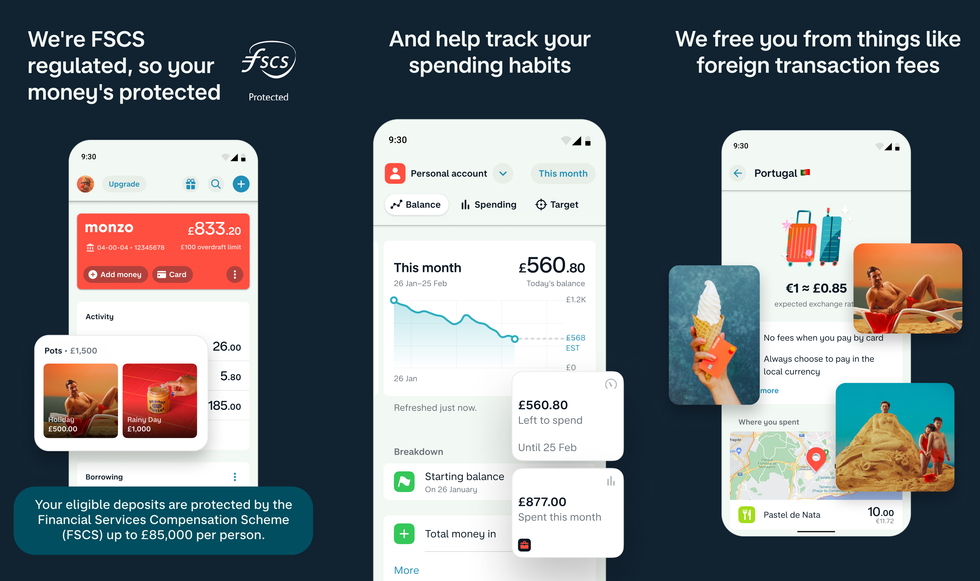

Monoz doesn’t have a presence on the high street, with an iPhone or Android app used to manage your savings, Direct Debits, and other tasks

MONZO PRESS OFFICE

That means if a thief has access to your phone, they won’t be able to make any payments without access to a second gadget, like a laptop or tablet. Mr Patel added there was “much more to come” after launching the three new security controls. Monzo has nine million customers in the UK.

About 90,000 mobile phones, or 250 a day, were stolen in London in 2022, according to the latest statistics from the Met Police.

LATEST DEVELOPMENTS

A separate survey, last month, from money insights provider Intuit Credit Karma found that around a 10th of people in the UK say they have been targeted by thieves for their phones in the past five years.

Meanwhile, the level of fraud has been spiralling across the country, with banks taking steps to try and prevent people losing their savings to scammers. Trade body UK Finance found that more than £1 billion was stolen by criminals through unauthorised and authorised fraud last year.