Millions of savers are set to be hit with stealth tax bills with many, according to new research.

Some six million savings accounts risk being impacted by fiscal drag, analysis by lender Shawbrook suggests.

Fiscal drag is the term used to describe when tax allowances are frozen at a time when incomes are on the rise.

This results in taxpayers being dragged into higher tax brackets, often unexpectedly.

As it stands, basic rate taxpayers are able to earn £1,000 in interest annually on savings earned held in a bank account before they have to pay money to HMRC.

Shawbrook is sounding the alarm that more than six million savers were liable to earn enough interest to pay tax from April 6, 2024.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are losing more of their money to the tax man when attempting to save their money

GETTY

This is significantly greater than the three million savers who were at risk of losing money to the tax last year.

Since 2020-21, income tax thresholds have been frozen and are line to remain at their current level until 2027-28, under rules laid out by former Chancellor Jeremy Hunt.

Figures from HMRC in July 2023 indicate that an additional one million taxpayers will pay tax on savings interest this year.

Currently, the Government estimates 1.4 million basic rate taxpayers will lose money to HMRC on their savings interest in 2024.

Furthermore, 842,000 higher rate taxpayers and 452,000 additional rate taxpayers are line to pay more tax, according to a Freedom of Information (FoI) request.

Under the personal savings allowance, basic rate taxpayers are able to save £1,000 in interest on their savings tax-free.

In comparison, higher rate taxpayers get an allowance of £500 and additional rate taxpayers do not get any allowance.

Research conducted by the Centre for Economics and Business Research found that this tax cost Britons £7.2billion in 2022.

Laura Suter, the director of personal finance at AJ Bell, warned that thousands of savers should prepare for shock tax bills to come their way.

She explained: “The impact of the Tories’ freeze on income tax bands means that more people will be pushed into the higher rate tax bracket, meaning their tax-free limit for savings interest will be cut in half from £1,000 to £500.

LATEST DEVELOPMENTS:

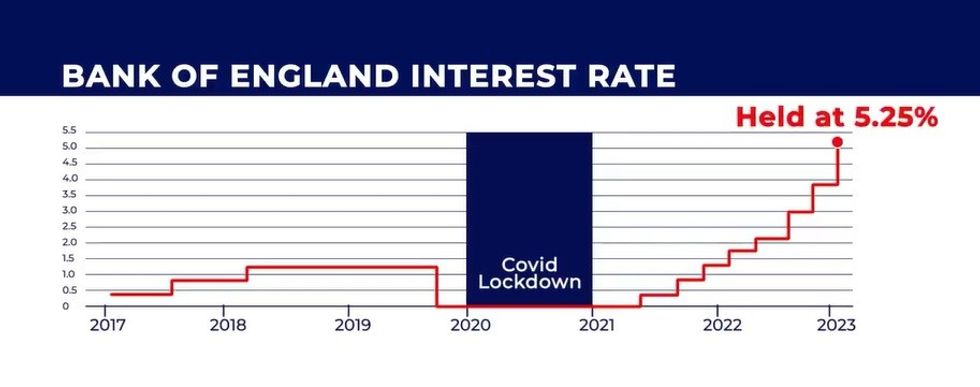

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

“As a kicker, those who have crept into the higher rate tax bracket will also pay 40 per cent tax on that savings interest, rather than the basic rate of 20 per cent.

“At the top easy-access savings account interest rate of around five per cent you’d only need around £20,000 in savings to reach the £1,000 personal savings allowance, while a higher-rate taxpayer would only need £10,000 in savings to hit their tax-free limit.

“In some cases the interest people receive is itself pushing them into the higher tax band – meaning they pay the tax at a higher rate and on more of their money.”

GB News has contacted the Treasury for comment.