- Solana’s price increased by over 5% in the last 24 hours.

- Several metrics and indicators hinted at a price correction.

Like most other cryptos, Solana [SOL] bulls have also managed to maintain their control over the market for quite a few days now.

Though this hinted at a continued price uptick, SOL might soon face a roadblock ahead, even if the bulls dominate. Let’s find out what’s happening.

Solana remains bullish, but…

CoinMarketCap’s data revealed that SOL’s price increased by over 12% last week. In the last 24 hours alone, the token’s value surged by more than 5%.

At the time of writing, SOL was trading at $161.26 with a market capitalization of over $74.8 billion, making it the 5th largest crypto.

In fact, AMBCrypto reported earlier that Captain Faibik, a popular crypto analyst, posted a tweet revealing that he expects SOL to touch $1,000 in this bull cycle.

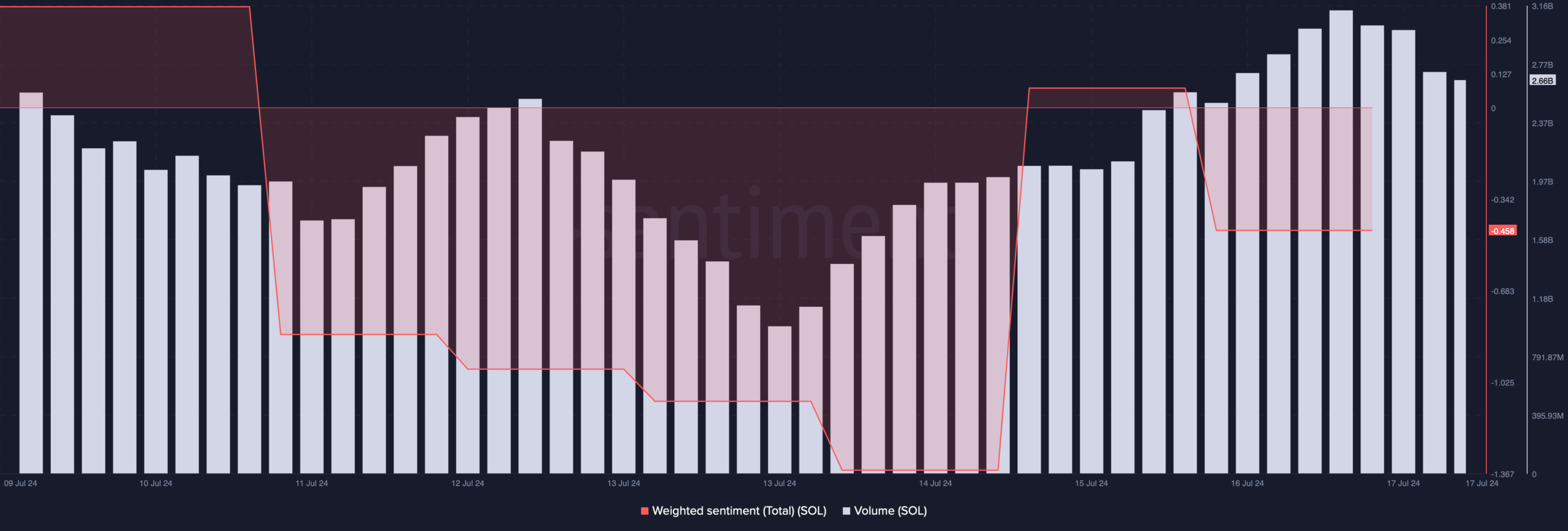

As per our analysis of Santiment’s data, SOL’s trading volume increased along with its price last week. This can be interpreted as a bullish signal, as rising volume acts as a foundation for an ongoing price hike.

However, its Weighted Sentiment dropped, meaning that bearish sentiment around the token was increasing in the market.

There was more trouble for SOL ahead. Ali, a popular crypto analyst, posted a tweet highlighting an interesting development. Notably, $2.98 billion in short positions will be liquidated if SOL surges to $176.

Generally, when liquidation rises during a bull rally, it results in a short- to midterm price correction. Solana must successfully go above that mark in order to sustain its bull rally and possibly reach $1k in the long-term.

SOL’s road ahead

AMBCrypto then planned to take a look at other datasets to better understand what to expect from the token. We found that SOL’s Funding Rate increased sharply in the last few days.

Generally, prices tend to move the other way than the Funding Rate. This indicated that SOL might witness a price correction before it reaches $176, where over $2 billion will be liquidated.

Our look at Coinglass’ data revealed that Solana’s Long/Short Ratio dropped. This suggests that bearish sentiment is rising as more short positions get opened in the market.

Apart from that, SOL’s fear and greed index at press time showed that the market was in an “extreme greed” phase. Usually, when the metric hits this level, it pointed at a possible price correction soon.

Is your portfolio green? Check out the SOL Profit Calculator

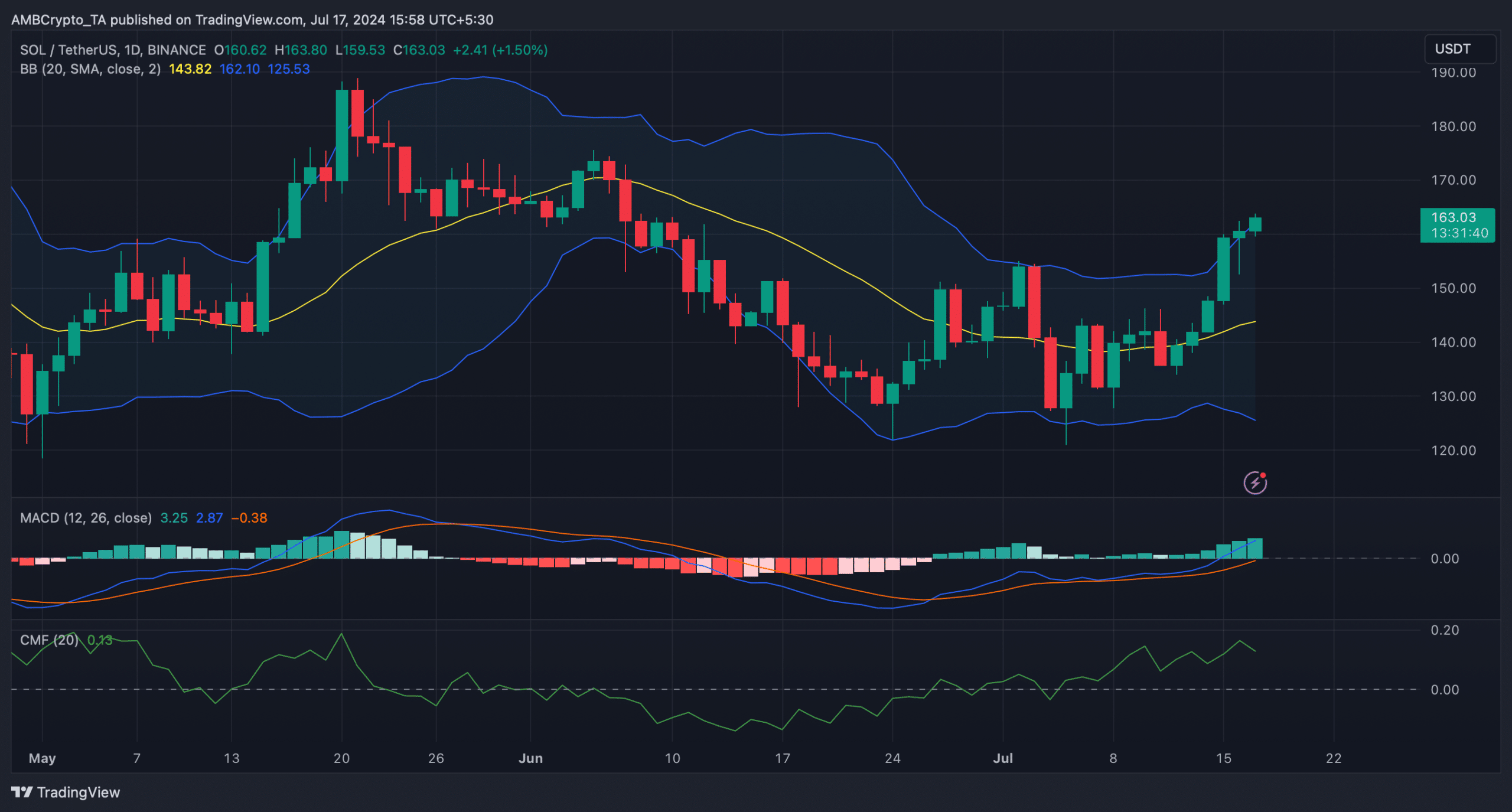

We then analyzed SOL’s daily chart to see what indicators had to say regarding SOL reaching $176.

SOL’s price had already retouched the upper limit of the Bollinger Bands. The Chaikin Money Flow (CMF) also registered a downtick, hinting at a price decline. Nonetheless, the MACD continued to support the bulls.