- Solana recorded a massive surge in stablecoin inflows.

- A 10% potential gain was at stake as SOL consolidated around 50-day SMA.

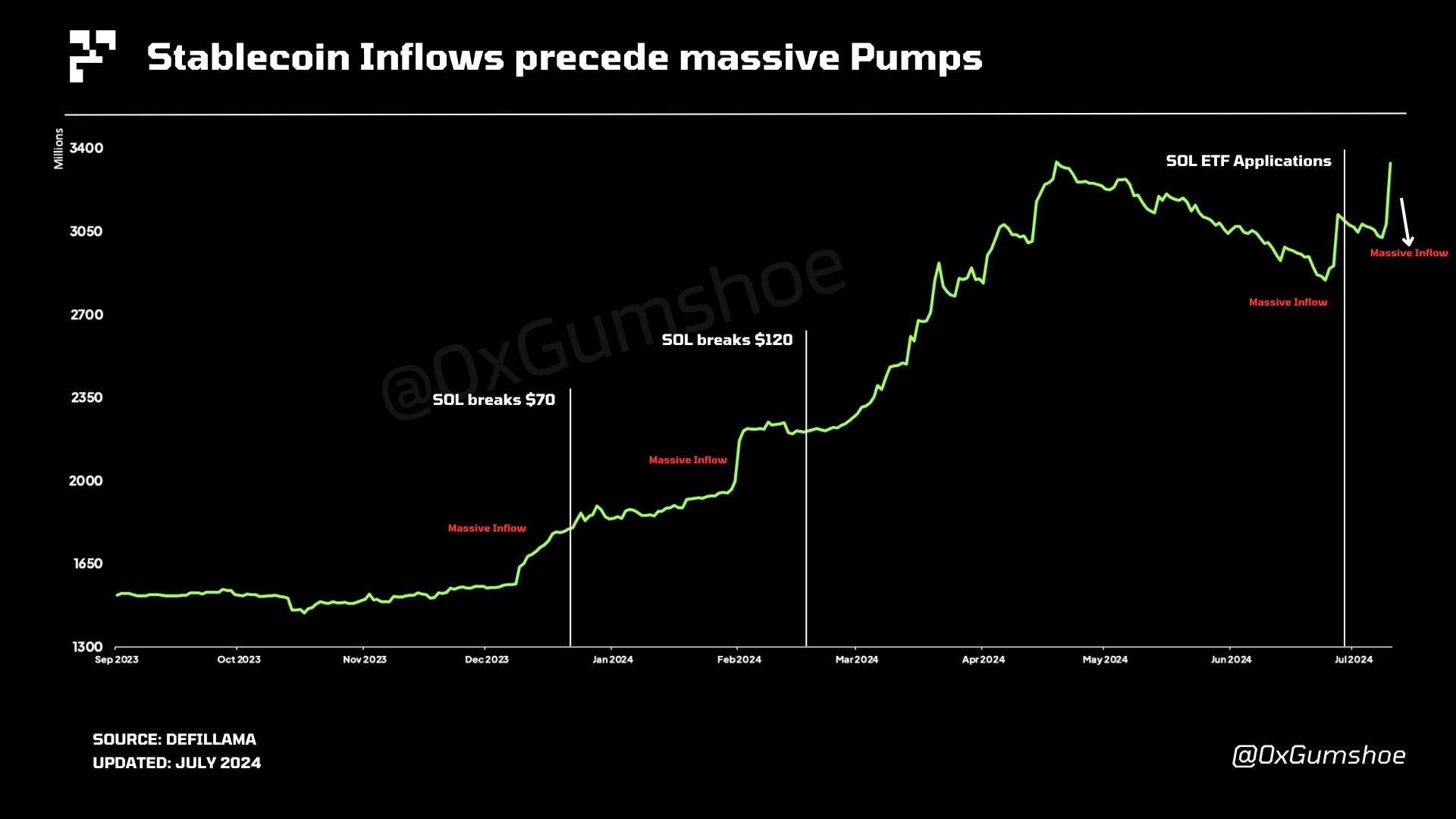

Solana [SOL] has recorded a massive stablecoin inflow, tipping market observers to suggest that SOL could moon soon based on historical data.

According to pseudonymous market observer Gumshoe, the recent pump in stablecoin inflows was a set-up for a possible SOL rally.

‘SOL pumped hard in the last three times we had a SUDDEN increase in stablecoins. Last time this happened, we had an SOL ETF application hours later’

Additionally, the analyst suggested this could be insider information for an upcoming update that could sway SOL’s price.

Per Gumshoe, SOL’s move above the $70 and $120 levels happened after a massive stablecoin inflow. The latest surge happened on 9th July, worth over $260 million per DeFiLlama data.

It’s worth noting that the day coincided with CBOE’s (Chicago Board of Options Exchange) confirmation of the VanEck and 21Shares SOL ETF plans on the exchange.

Apart from the Solana ETF speculation, the network recently hit a testnet milestone for its third validator client, Firedancer, which has been touted as a game changer for the ecosystem.

So, the SOL ETF confirmation by CBOE and Firedancer update could be key catalysts for SOL’s FOMO and might explain the stablecoin surge.

However, was there any change in SOL’s market structure on the price chart?

SOL’s price action

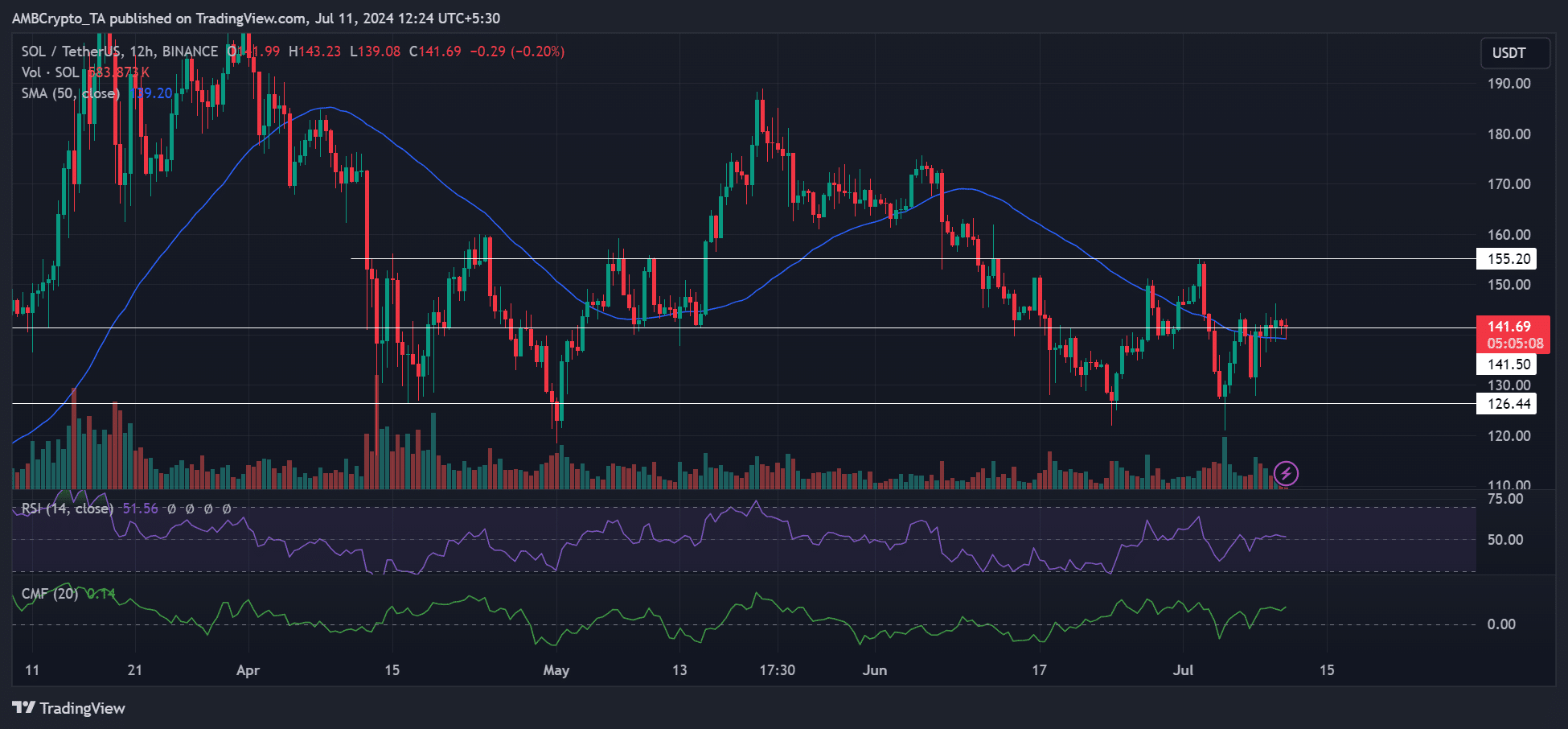

On 9th July, SOL posted limited gains of about 1% as it consolidated around $141, a key resistance level. Interestingly, the 50-day SMA (Simple Moving Average) was also at the resistance level.

A surge in CMF (Chaikin Money Flow) confirmed the massive inflows, which could be read as investors’ risk-off approach to SOL. This meant that SOL could consolidate around the 50-day SMA and eye $155, which would be a 10% potential gain.

However, the RSI (Relative Strength Index) was flat at the neutral level, which meant there was no strong buying pressure to push SOL forward.

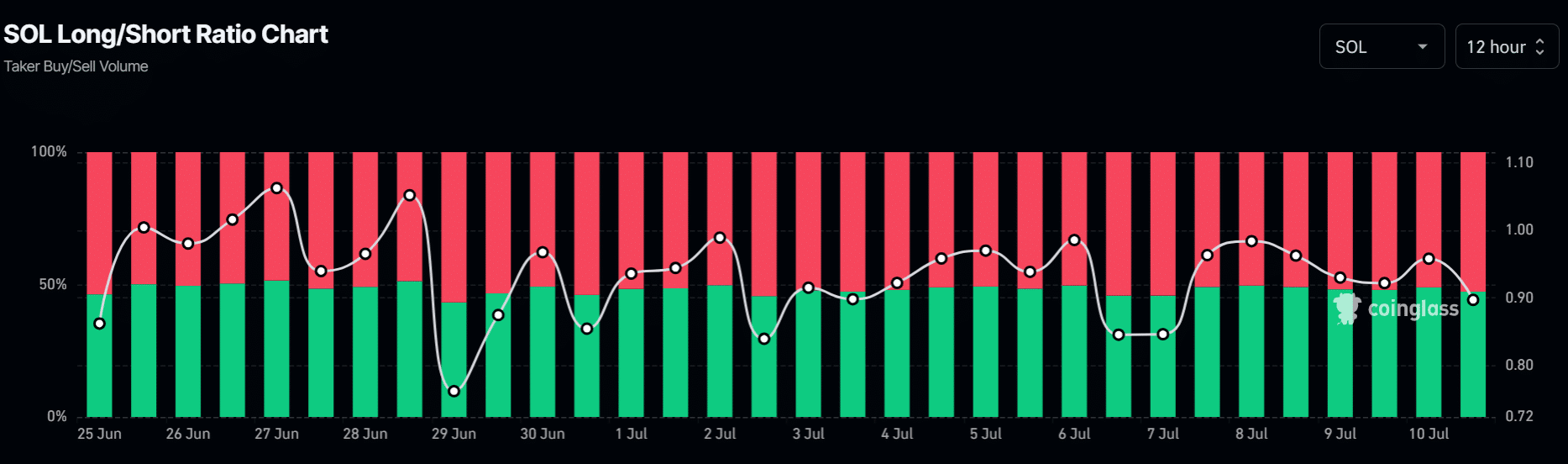

Additionally, since 8th July, the percentage of traders going long on SOL has dropped from 49.6% to 47% as of press time. This meant that SOL’s recovery could be delayed unless Bitcoin [BTC] reversed recent losses.

However, another market observer, based on historical patterns, projected that SOL could hit $2800 in the long term.