- SEC-Ripple settlement sends XRP soaring to a three-month high of $0.61.

- XRP’s spot market sell pressure dropped in the past 7seven days amid the upswing.

Ripple [XRP] reclaimed a $0.6 level, a three-month high, amid speculations of a settlement between the US Securities and Exchange Commission (SEC) and Ripple.

According to some market observers, a secret meeting between SEC and Ripple scheduled for 18th July could end the long-running legal battle between the two parties.

‘XRP VS SEC settlement. Keep your eyes on July 18th, 2024.’

No Ripple settlement, says former SEC laywer

However, a former SEC lawyer, Marc Fagel, downplayed the SEC-Ripple settlement rumors. He noted that the agency has held several such meetings with Ripple, none of which resulted in a conclusive endgame for the ongoing lawsuit.

‘I mean, they’ve had about 150 of these nearly-weekly meetings since the case was filed and Crypto Twitter was convinced a settlement was being discussed at every one of those meetings, but this is DEFINITELY the one!.. It’s not the one.’

However, some market participants were convinced the massive XRP pump was linked to insider news of a potential settlement or positive news.

The upswing to $0.61 on the price chart marked a +7% daily gain and effectively reversed all losses made in Q2.

On a monthly adjusted basis, XRP was up 30% in July after rallying from $0.38 to above $0.6. This performance eclipsed the rest of the market, including Bitcoin [BTC], which was up only 3% in the first half of July.

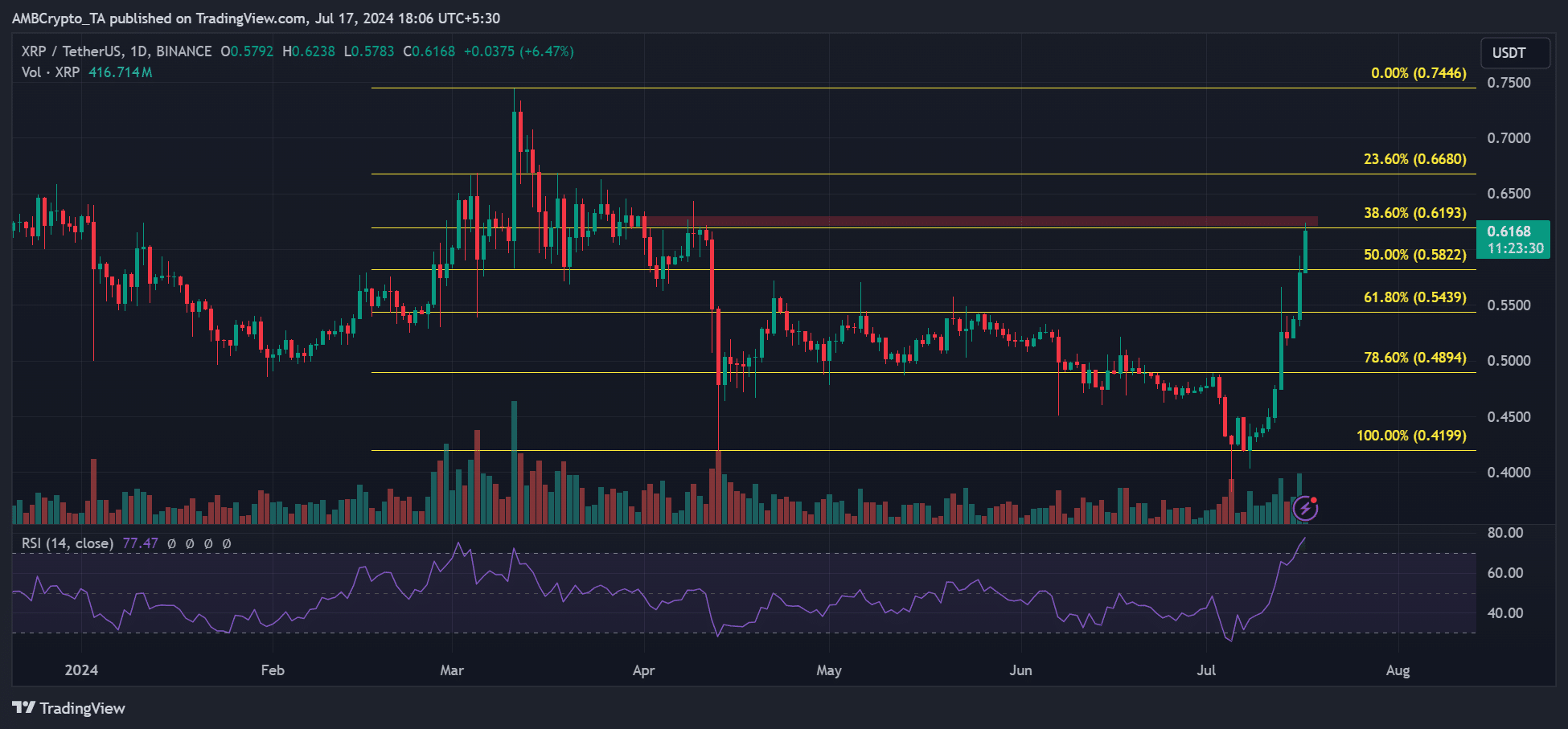

If XRP convincingly reclaimed the 38.6% Fib level ($0.61) and eyes the next bullish target at 23.6% Fib ($0.66), an extra 7% gain would be likely.

However, XRP hit a key in a bearish order block, marked in red, which aligned with the 38.6% Fib level. Additionally, the RSI (Relative Strength Index) was in the overheated territory. This meant that buying was strong, but buyer exhaustion couldn’t be ruled out.

If so, a retracement to the 50% Fib level could offer side-lined speculators another market re-entry point to ride the rally to the 23.6% Fib level.

XRP traders’ position and sentiment

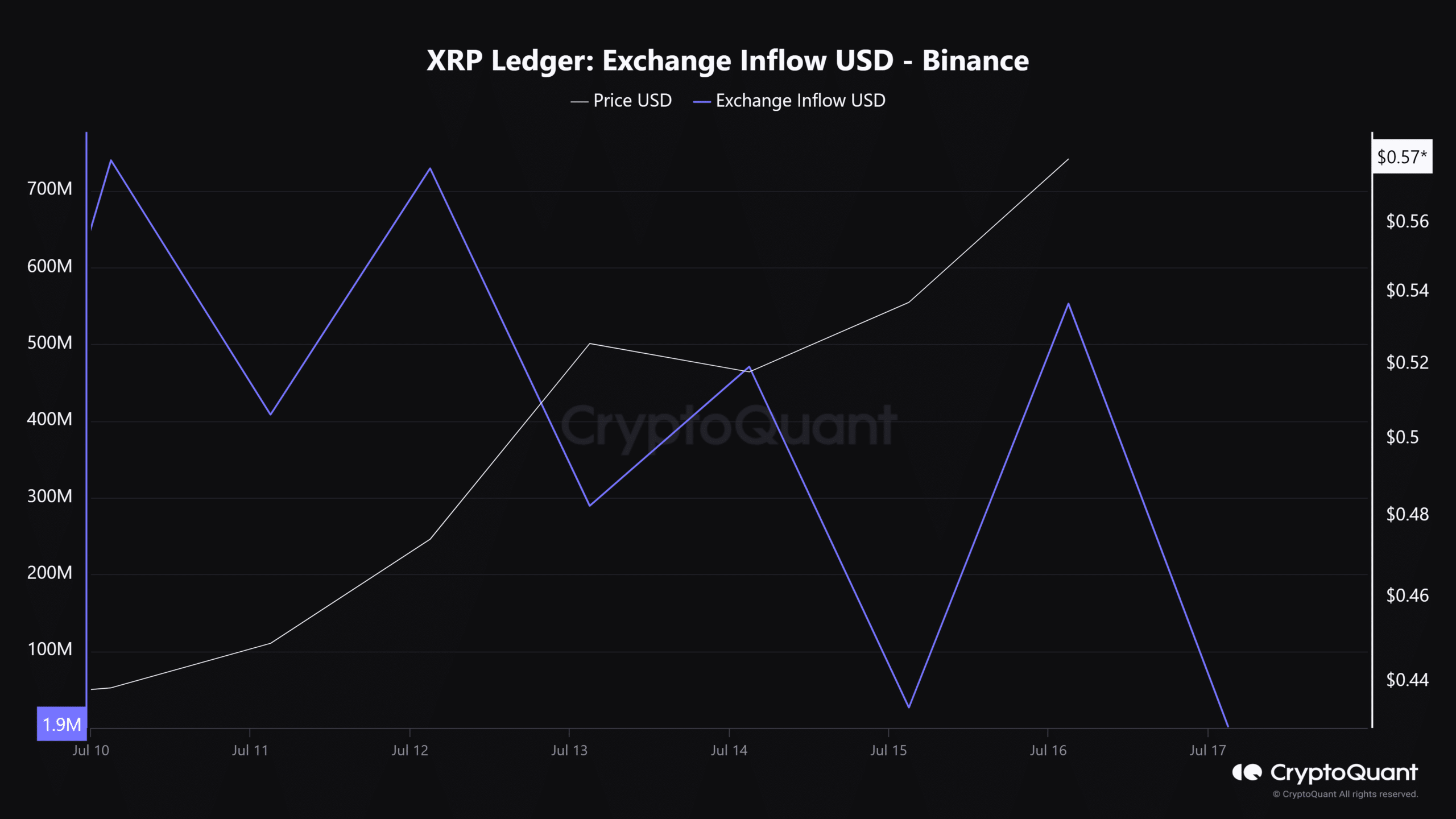

The overall spot market, especially in Binance, indicated significantly reduced selling pressure. This was clear from a drop in Exchange Inflow in the past seven trading days.

The metric has dropped from $739 million on 10th July to $1.9 million as of press time.

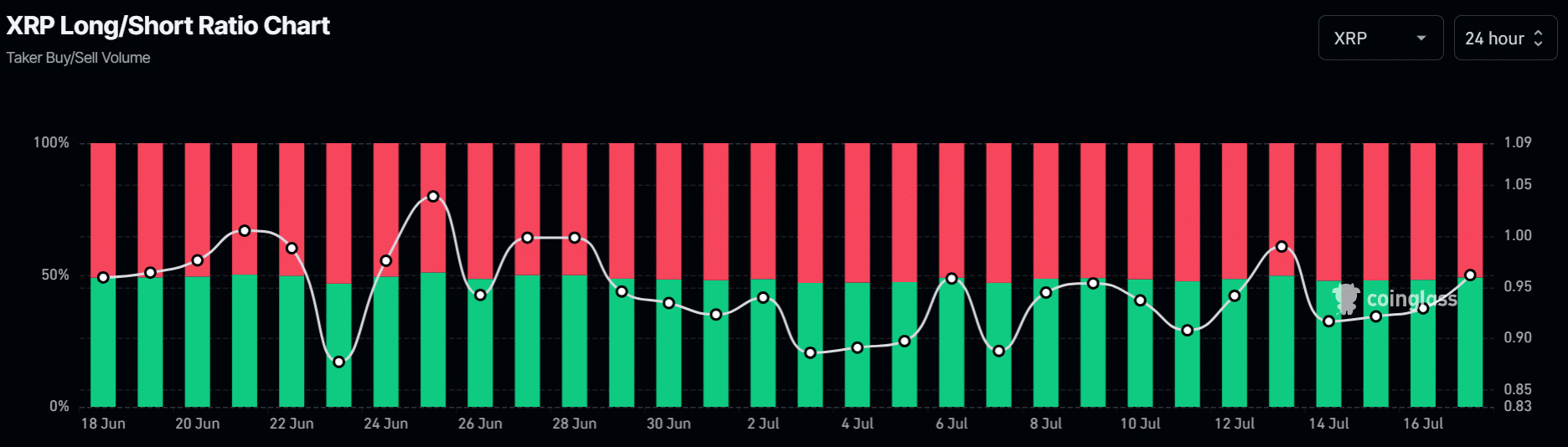

Meanwhile, traders went long on XRP since Monday, with the futures long positions increasing from 47% to 49%. The outcome of the July 18th meeting could determine whether the rally will be sustained or not.