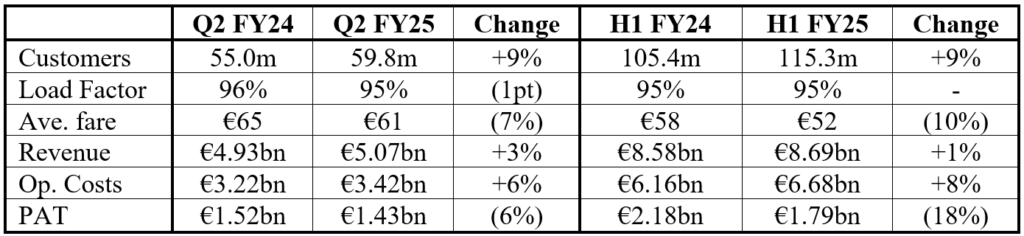

Ryanair Holdings plc today (4 Nov) reported a H1 after tax profit of €1.79bn, which is 18% lower than the prior-year H1 PAT of €2.18bn, as strong traffic growth (up 9%) to 115m customers was offset by lower air fares, which declined 7% in the second quarter.

H1 highlights include:

- Traffic grew 9% to a record 115m, despite repeated Boeing delays.

- Ave. fare fell 10% (-15% in Q1 & -7% in Q2).

- 170x B737 “Gamechangers” in 608 fleet at 30 Sept.

- 5 new bases & 200 new routes opened for S.24.

- “Approved OTA” partnerships now protect over 90% of OTA consumers.

- Fuel hedges extended: 85% of H2 FY25 covered at $79bbl & 75% of FY26 at $77bbl.

- €700m share buyback completed in Aug. & over 30% of €800m follow-on now done.

- €0.223 interim div. per share declared (payable in Feb. 2025).

H1 FY25 BUSINESS REVIEW

Ryanair Group CEO Michael O’Leary, said:

Revenue & Costs:

“Total H1 revenue rose 1% to €8.69bn. Scheduled revenue fell 2% to €5.95bn. The move of half Easter into PYQ4 and out of Q1, consumer spending pressure (driven by higher-for-longer interest rates and inflation reduction measures) and a drop in OTA bookings ahead of S.24 necessitated more price stimulation than originally expected (with Q1 fares down 15% & Q2 down 7%) as Ryanair maintained its ‘load active/yield passive’ pricing policy. Many customers are switching to Ryanair for our lower air fares. As a result, we are capturing record share gains across most markets. Traffic, despite repeated Boeing delivery delays, grew 9% to 115m while ancillary revenues were resilient, rising 10% to €2.74bn. Operating costs performed well, rising 8% (lagging behind 9% traffic growth) to €6.68bn, as fuel hedge savings offset higher staff and other costs due, in part, to Boeing delivery delays. While modest delay compensation was received in H1 (mainly maintenance credits) this does not offset the substantial impact of a 5m+ passenger shortfall in FY25 due to these delivery delays.

H2 FY25 fuel is 85% hedged at $79bbl, derisking the Group during the recent period of significant fuel price volatility. FY26 hedge cover has also been increased to 75% at $77bbl, securing modest year-on-year price savings.

Balance Sheet, Liquidity & Shareholder Returns:

Ryanair’s balance sheet is one of the strongest in the industry with a BBB+ credit rating (both S&P and Fitch). Gross cash was over €3.3bn and net cash was €0.6bn at 30 Sept., despite €0.9bn capex, €0.9bn share buybacks and a €0.2bn final dividend in H1. Our owned B737 fleet (580 aircraft) is fully unencumbered, which widens Ryanair’s cost advantage over competitor airlines, many of whom are exposed long term to expensive finance and lease costs.

The Group restarted share buybacks in May, with €700m completed in Aug. We expect the €800m follow-on programme to be completed by mid 2025. When complete, Ryanair will have returned almost €9bn (incl. dividends) to shareholders since 2008, with approx. 36% of the issued share capital repurchased. A final dividend of €0.178 per share was paid in Sept. and today the Board (in line with Ryanair’s dividend policy) has declared an interim dividend of €0.223 per share, to be paid in late Feb. 2025.

FLEET & GROWTH

Ryanair had 172x B737 Gamechangers in our fleet at 31 Oct. We now expect our remaining 9 Q3 deliveries to slip into Q4 due to recent Boeing strikes. While we continue to work with Boeing leadership to accelerate aircraft deliveries ahead of peak S.25, the risk of further delivery delays remains high. We believe it is therefore sensible to moderate Ryanair’s FY26 traffic growth target to 210m passengers (previously 215m) to reflect these delivery delays, as we wish to avoid being over-scheduled, over-crewed and over costed as we were in S.24.

During S.24 we operated our largest ever schedule, carrying a new record of 20.5m passengers in one calendar month (Aug.). Our S.24 network included 5 new bases and over 200 new routes. As we move into W.24 and plan for S.25, we’ll continue to reallocate capacity, and growth, to regions and airports who are investing in growth by cutting/scrapping aviation taxes (as Sweden, Hungary and various Italian regions have) or who are incentivising traffic growth. To date, over 90% of S.25 capacity is on sale, incl. 165 new routes.

We expect European short-haul capacity to remain constrained for some years as many of Europe’s Airbus operators work through the Pratt & Whitney engine repairs, both major OEMs struggle with delivery backlogs, and airline consolidation continues, including Lufthansa’s takeover of ITA (Italy) and the impending sale of TAP (Portugal). These capacity constraints, combined with our widening cost advantage, strong balance sheet, low-cost aircraft orders and industry leading operational resilience will, we believe, facilitate Ryanair’s low-fare profitable growth to 300m passengers over the next decade.

ESG

Ryanair is Europe’s No. 1 rated ESG airline with industry leading ratings from Sustainalytics, MSCI (A) and CDP (A-). Our new aircraft, increasing use of winglets and SAF positions Ryanair as one of the EU’s most efficient major airlines. We welcome SBTi’s (Science Based Targets initiative) recent validation of the Ryanair Groups environmental targets (to reduce CO2 per pax/km to c.50grams by 2031 – a 27% reduction), making us the first major airline with a target validated to the latest SBTi guidelines. During H1 we took delivery of 24x B737-8200 “Gamechangers” (4% more seats, 16% less fuel & CO2) and this winter we’ll extend the retro-fit of winglets to our B737NG fleet (target 409 by 2026), reducing fuel burn by 1.5% and noise by 6%. Next summer, Ryanair plans to migrate the last 25% of customers who don’t already check-in via the Ryanair App to paperless boarding. Apart from removing 300 tonnes of paper annually, this initiative ensures that all customers have access to Day of Travel updates, live flight information, the convenience of Order to Seat for onboard purchases and the many other features contained in the Ryanair App (the ideal travel companion).

During 2024 European airlines suffered a summer of record ATC delays due to daily ATC staff shortages and repeated equipment failures, which caused repeated flight delays and cancellations (especially to the first wave morning departures). We renew our call on the new EU Commission to urgently deliver long delayed reform of Europe’s hopelessly inefficient ATC service. This can be achieved by properly staffing Europe’s ATC providers, especially for the morning/first wave departures and protecting overflights (during national strikes) which would deliver dramatic punctuality and environmental benefits for EU air travel and our citizens.

EU Airline Ownership & Control:

In Sept. the Board confirmed that over 49% of Ryanair’s issued share capital is held by EU nationals and, based on current trends, they expect this figure to exceed 50% within the next 6-12 months. In anticipation of this threshold being reached, the Board deemed it appropriate to review the potential variation of (1) the purchase prohibition on non-EU nationals acquiring Ryanair ordinary shares (in place since 2002) or (2) the voting restrictions (in effect since Jan. 2021, following Brexit) in a manner that best ensures compliance with EU Reg. 1008/2008. As part of this review, an engagement process with shareholders and regulators is ongoing. Current restrictions on share purchases and voting by non-EU nationals will remain in place during the review, and there can be no certainty as to the duration of this review or that any variation in approach will result from the review.

OUTLOOK

We continue to target between 198m and 200m passengers in FY25 (+8%), subject to no worsening of current Boeing delivery delays. Unit costs performed well in H1 as the cost gap between Ryanair and EU competitor airlines continues to widen. We expect full-year unit costs to be broadly flat, as our fuel hedge savings, strong interest income and some modest aircraft delay compensation will largely offset ex-fuel cost inflation (particularly crew pay & productivity increases, higher handling & ATC fees and the cost inefficiency of repeated B737 delivery delays). Forward bookings suggest that Q3 demand is strong and the decline in pricing appears to be moderating. We remain cautious on Q3’s ave. fare outlook, expecting them to be modestly lower than Q3 prior year (subject to close-in Christmas and New Year bookings). As is normal at this time of year, we have almost zero Q4 visibility, although this quarter will not benefit from last year’s early Easter, which will make the prior year Q4 comps challenging. It therefore remains too early to provide meaningful FY25 PAT guidance. The final FY25 outcome will be subject to avoiding adverse developments during the remaining 5 months of FY25, especially given the risk of conflicts in Ukraine and the Middle East, repeated ATC short-staffing and capacity restrictions, and/or further Boeing delivery delays.”

Ryanair Holdings plc, Europe’s largest airline group, is the parent company of Buzz, Lauda, Malta Air, Ryanair & Ryanair UK. Carrying c.200m guests p.a. on approx. 3,600 daily flights from 95 bases, the Group connects 234 airports in 37 countries on a fleet of over 600 aircraft, and almost 340 new Boeing 737s on order, which will enable the Ryanair Group to grow traffic to 300m p.a. by FY34. Ryanair has a team of over 27,000 highly skilled aviation professionals delivering Europe’s No.1 operational performance, and an industry leading 39-year safety record. Ryanair is one of the most efficient major EU airlines. With a young fleet and high load factors, Ryanair targets 50grams of CO₂ per pax/km by 2031 (a 27% reduction).

Certain of the information included in this release is forward looking and is subject to important risks and uncertainties that could cause actual results to differ materially and that could impact the price of Ryanair’s securities. It is not reasonably possible to itemise all of the many factors and specific events that could affect the outlook and results of an airline operating in the European economy and the price of its securities. Among the factors that are subject to change and could significantly impact Ryanair’s expected results and the price of its securities are the airline pricing environment, fuel costs, competition from new and existing carriers, market prices for the replacement of aircraft, costs associated with environmental, safety and security measures, actions of the Irish, U.K., European Union (“EU”) and other governments and their respective regulatory agencies, post-Brexit uncertainties, any change in the restrictions on the ownership of Ryanair’s ordinary shares and the voting rights of its shareholders and ADR holders, including as a result of regulatory changes or the actions of Ryanair itself, weather related disruptions, ATC strikes and staffing related disruptions, delays in the delivery of contracted aircraft, fluctuations in currency exchange rates and interest rates, airport access and charges, labour relations, the economic environment of the airline industry, the general economic environment in Ireland, the U.K. and Continental Europe, the general willingness of passengers to travel and other economics, social and political factors, global pandemics such as Covid-19 and unforeseen security events.