The average share of electric cars in new registrations rose from 14% to 20%, but some major markets saw a decline in this metric

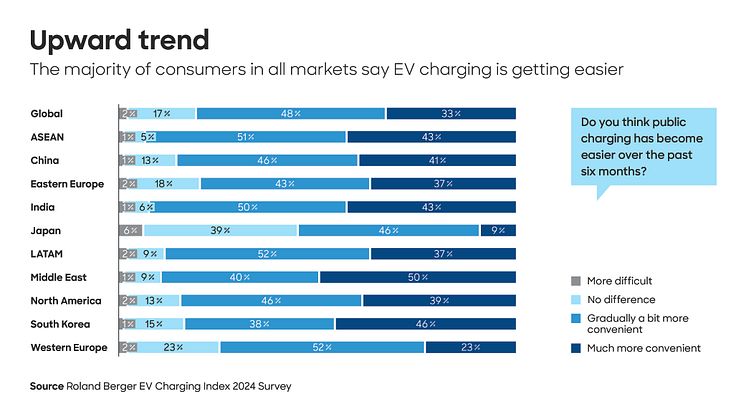

After a period of rapid expansion, 2023 saw a slowdown in EV sales growth. Global EV sales rose by 33% in 2023, having grown by more than 100% in 2022. The average share of EVs in new vehicle registrations continues to rise – up 20% from 14% in 2022 – but some established markets, including South Korea and Germany, saw a decline in this metric. The sector currently faces numerous headwinds, including high electricity costs, inflation, and reduced subsidies as governments shift their funding focus from vehicles to charging facilities. Growth in the number of charge points was strong in 2023, rising by 65%, with most regions seeing a slight decline in their overall vehicle-to-charger ratios. As a consequence, 81% of consumers say EV charging has become easier in the past six months. A strong increase in the ratio of fast chargers has helped. These are the key findings of the Roland Berger EV Charging Index 2024, which is based on extensive industry interviews and a survey of 16,000 respondents in markets from Europe, Asia, North and South America, and the Middle East – and assesses their charging facility readiness and customer satisfaction amid general EV trends

“The global e-mobility landscape paints a varied picture. Mature markets are reducing or removing incentives for EVs, but less mature markets, for example in southern Europe, are now pushing infrastructure expansion and EV sales,” says Adam Healy, Principal at Roland Berger. “Mixed OEM strategies also play a part – some auto manufacturers are recommitting to new fully electric platforms, while others shift to plug-in-hybrids. Slow progress towards cost parity between internal combustion engine vehicles and EVs is a further factor.”

China leads the way for e-mobility once more

China’s overall score in the Index may not have increased in 2023, but its lead at the top of the rankings has not suffered as it maintained strong growth in EV sales and charging infrastructure. Its closest competitors – Germany, the United States, and the Netherlands – have all seen their scores either stall or decrease, a trend seen across most established markets in 2023. Meanwhile, developing markets in the Middle East and Southeast Asia are showing rapid growth in EV sales, and closing the gap to the leading nations.

The United States ranked joint second in the latest edition of the EV Charging Index, driven by continued EV sales growth in 2023, including the increasingly popular plug-in-hybrids. Growth in the public charging network did not keep pace, although the very high percentage of US EV owners with home charging reduces dependency on the public network. Meanwhile, ongoing federal support for e-mobility rests heavily on the outcome of the US election in November 2024

OEMs increase charging involvement to help drive EV sales

The EV charging market is vibrant, with a variety of new companies entering the fray in both mature and developing regions. Across the globe, OEMs are increasing their involvement in charging, either through their own branded networks or collaborating with others in consortiums. This is especially true in less mature markets, where they can drive EV sales by expanding infrastructure.

“Charging-related investment has become increasingly popular across all regions and market participants are continuing to test new business models and technologies,” says Jack Zhuang, Principal at Roland Berger. “Ultimately, a wide range of solutions are likely to be appropriate for different use cases.

SOURCE: Roland Berger