Looking back on leisure facilities stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Planet Fitness (NYSE:PLNT) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from “things” to “experiences”. Leisure facilities seek to benefit but must innovate to do so because of the industry’s high competition and capital intensity.

The 13 leisure facilities stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter’s revenue guidance was 5.2% below consensus. Stocks–especially those trading at higher multiples–had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but leisure facilities stocks have shown resilience, with share prices up 9.9% on average since the previous earnings results.

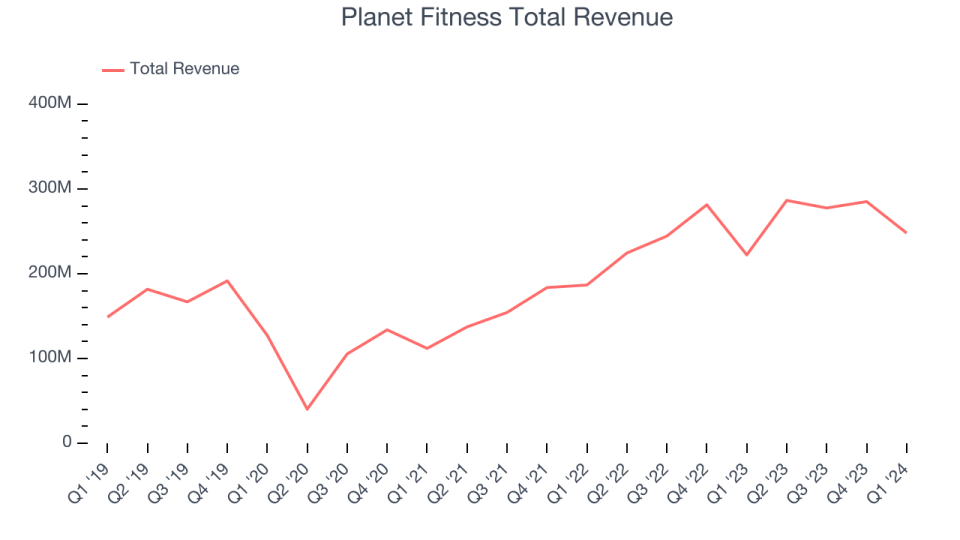

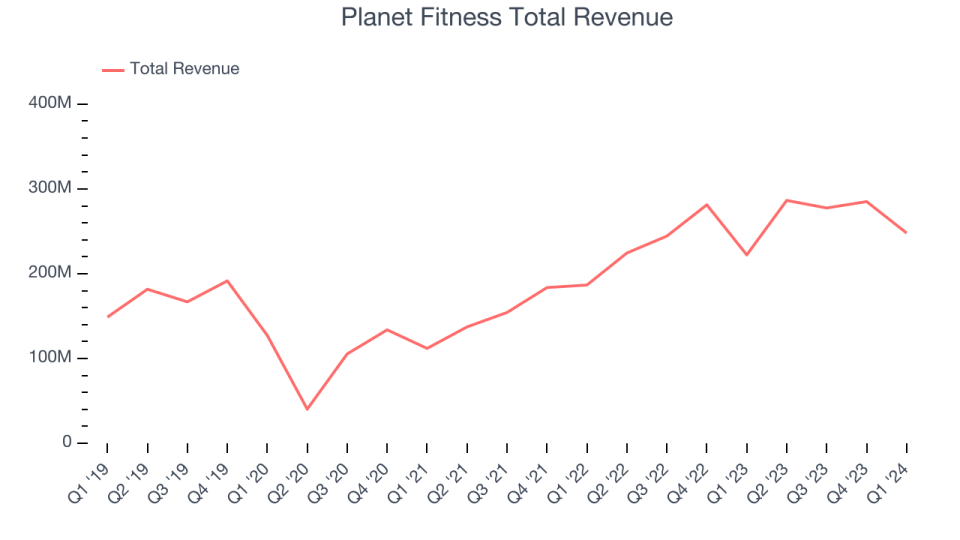

Planet Fitness (NYSE:PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise which caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $248 million, up 11.6% year on year, falling short of analysts’ expectations by 0.2%. It was a weak quarter for the company, with a miss of analysts’ earnings estimates.

“Planet Fitness ended the first quarter with approximately 19.6 million members and system-wide same store sales growth of 6.2 percent primarily driven by new member growth. During the quarter, we faced several headwinds which impacted our results including a shift in consumer focus in the New Year to savings and concern over the increase in COVID infections and other illnesses, as well as a national advertising campaign that we believe may not have resonated as broadly as we had anticipated. As a result of these and other factors, we are lowering our outlook for the full year,” said Craig Benson, Interim Chief Executive Officer.

The stock is up 20.3% since the results and currently trades at $74.4.

Read our full report on Planet Fitness here, it’s free.

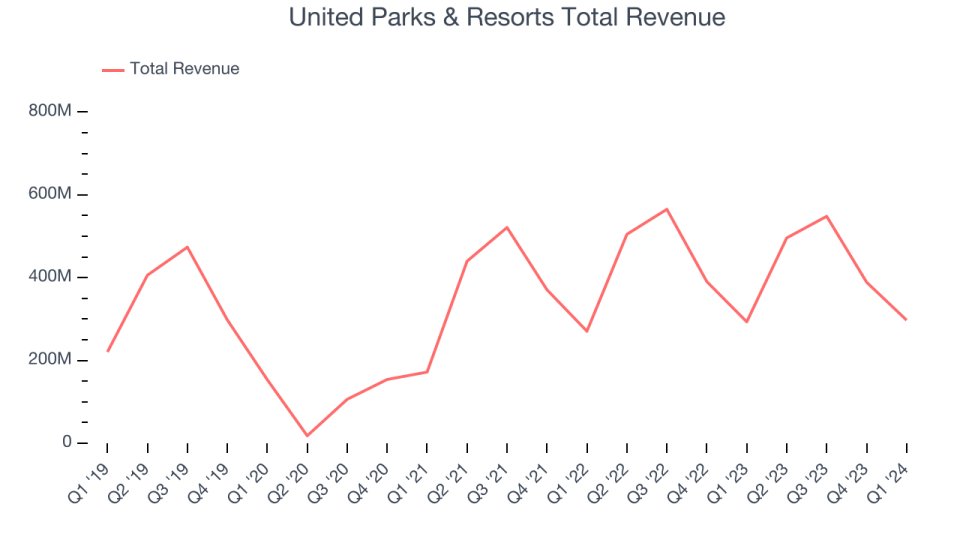

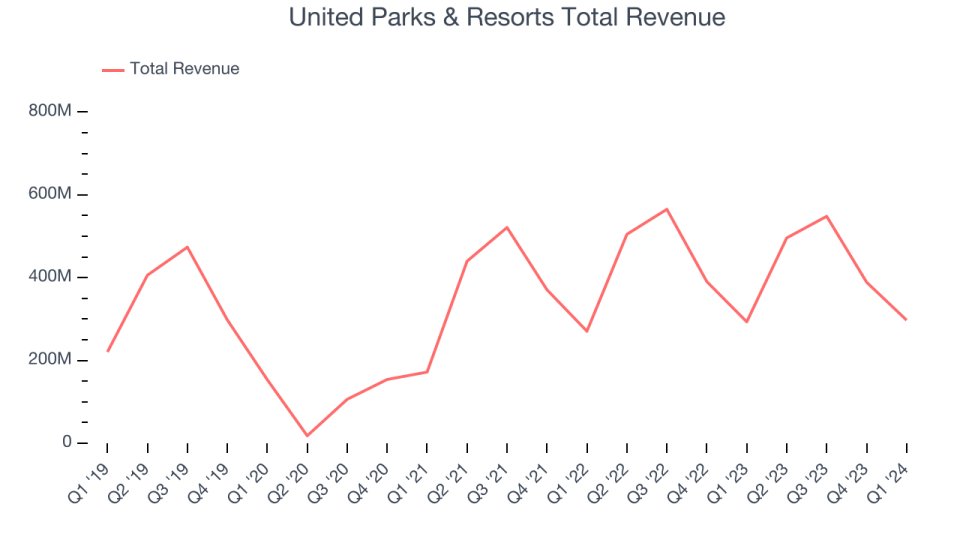

Best Q1: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $297.4 million, up 1.4% year on year, outperforming analysts’ expectations by 4.5%. It was a very good quarter for the company, with an impressive beat of analysts’ earnings estimates and a narrow beat of analysts’ visitors estimates.

The stock is up 7.9% since the results and currently trades at $52.99.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dave & Buster’s (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster’s reported revenues of $588.1 million, down 1.5% year on year, falling short of analysts’ expectations by 4.5%. It was a weak quarter for the company, with a miss of analysts’ earnings estimates.

Dave & Buster’s had the weakest performance against analyst estimates in the group. The stock is down 24.2% since the results and currently trades at $38.18.

Read our full analysis of Dave & Buster’s results here.

Sphere Entertainment (NYSE:SPHR)

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

Sphere Entertainment reported revenues of $321.3 million, up 98.3% year on year, falling short of analysts’ expectations by 1%. It was a weak quarter for the company, with a miss of analysts’ earnings and revenue estimates.

Sphere Entertainment scored the fastest revenue growth among its peers. The stock is down 7.4% since the results and currently trades at $38.25.

Read our full, actionable report on Sphere Entertainment here, it’s free.

Six Flags (NYSE:SIX)

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Six Flags reported revenues of $133.3 million, down 6.3% year on year, falling short of analysts’ expectations by 2.5%. It was a weak quarter for the company, with a miss of analysts’ earnings estimates.

Six Flags had the slowest revenue growth among its peers. The stock is up 30.3% since the results and currently trades at $32.66.

Read our full, actionable report on Six Flags here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.