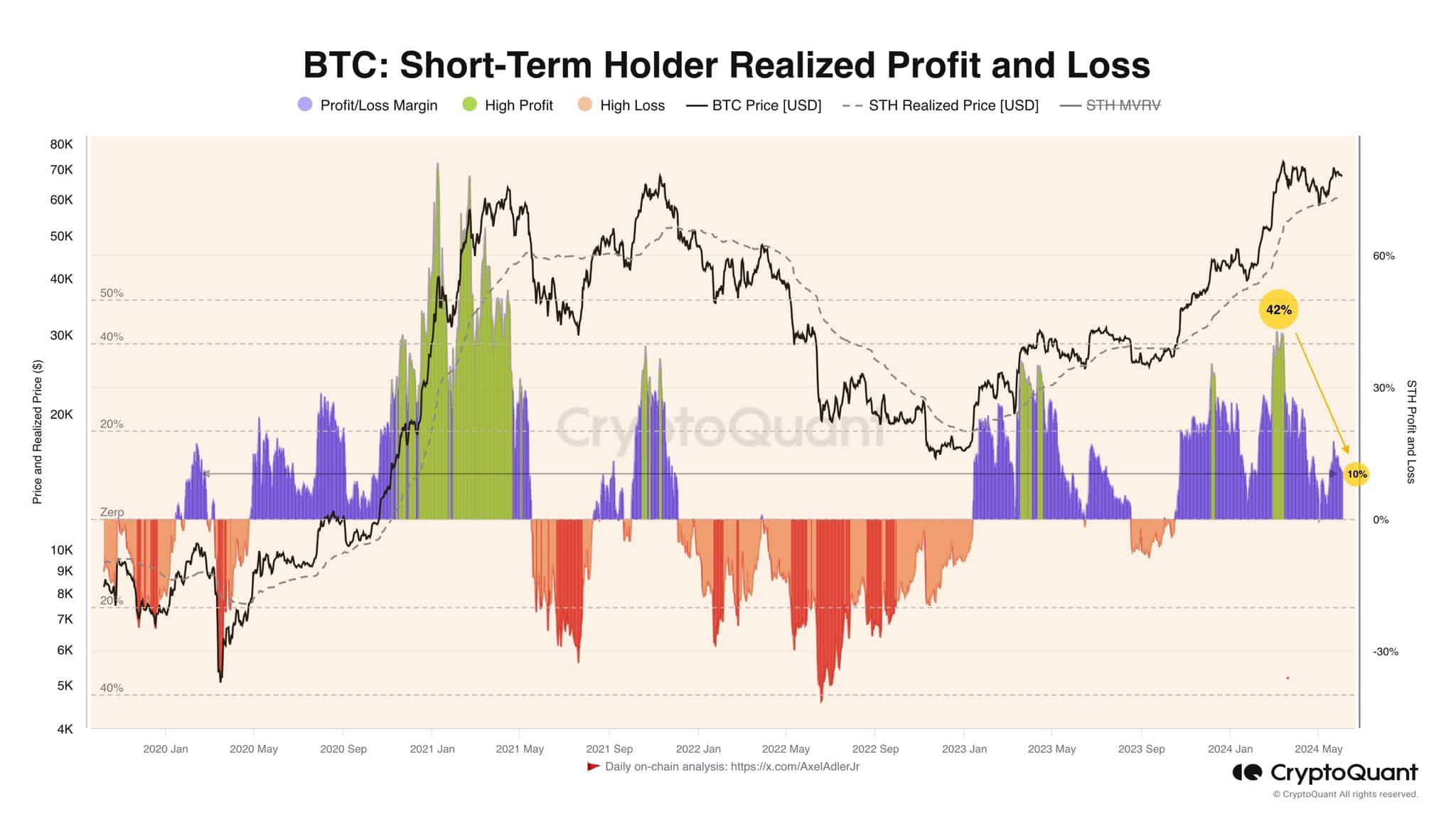

- Bitcoin’s short-term holder metric showed the recent consolidation has eroded their profits.

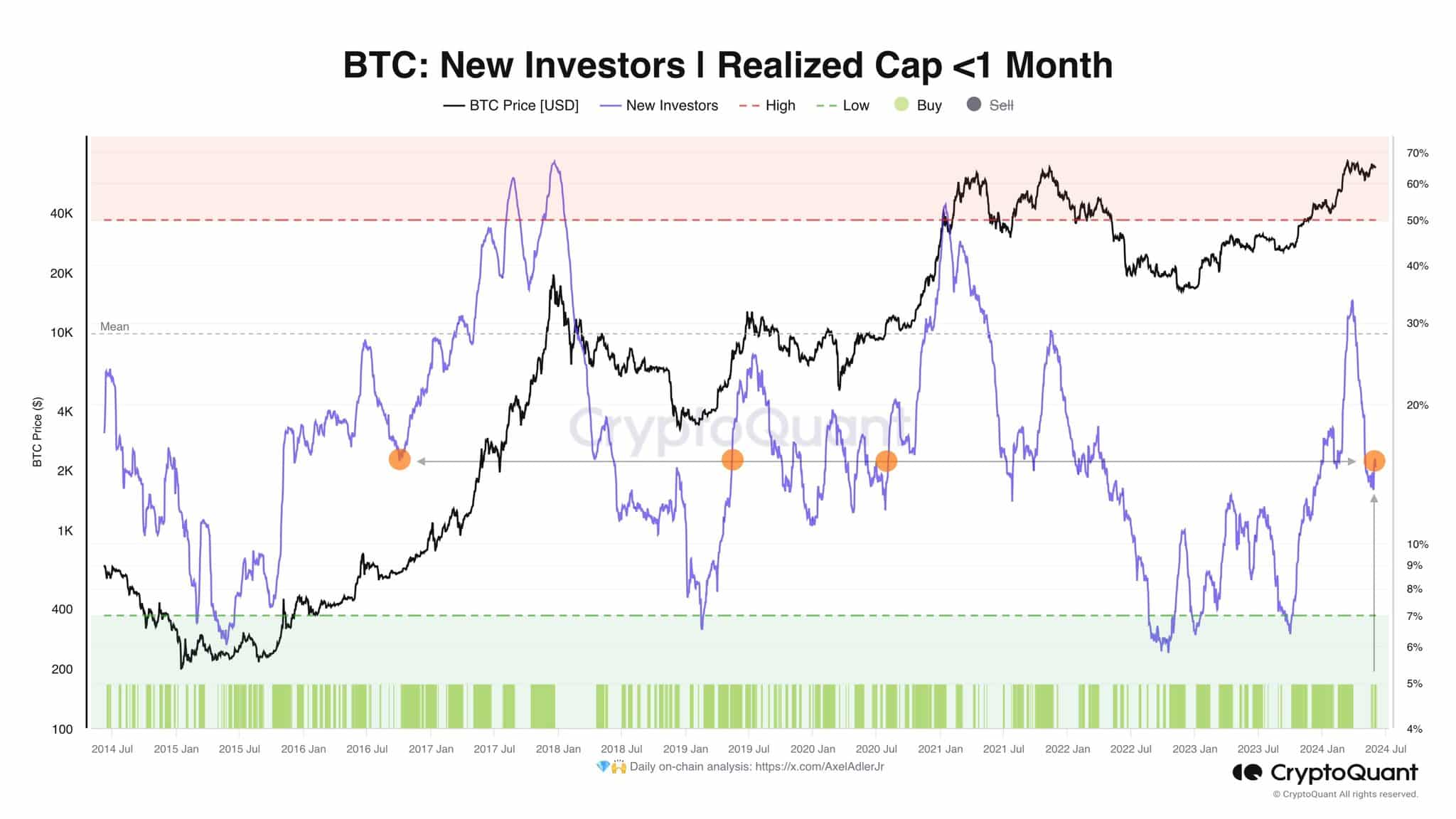

- An influx of new investors could arrive, which might lead to a price breakout.

Bitcoin [BTC] short-term holder (STH) profits were down 32%, crypto analyst Axel Adler observed. On the 13th of March, the profit of STHs was 42%.

At press time, even though the price of Bitcoin is not much lower, the profit is at 10%.

Source: Axel Adler on X

This is a positive development. The consolidation of the past two months has done its job and shaken out the impatient market participants. The high-profit levels have also been reset, giving Bitcoin bulls renewed energy to drive prices higher.

AMBCrypto took a closer look at on-chain metrics to understand the behavior of short-term and long-term holders, and what insights that could have for the future price trends.

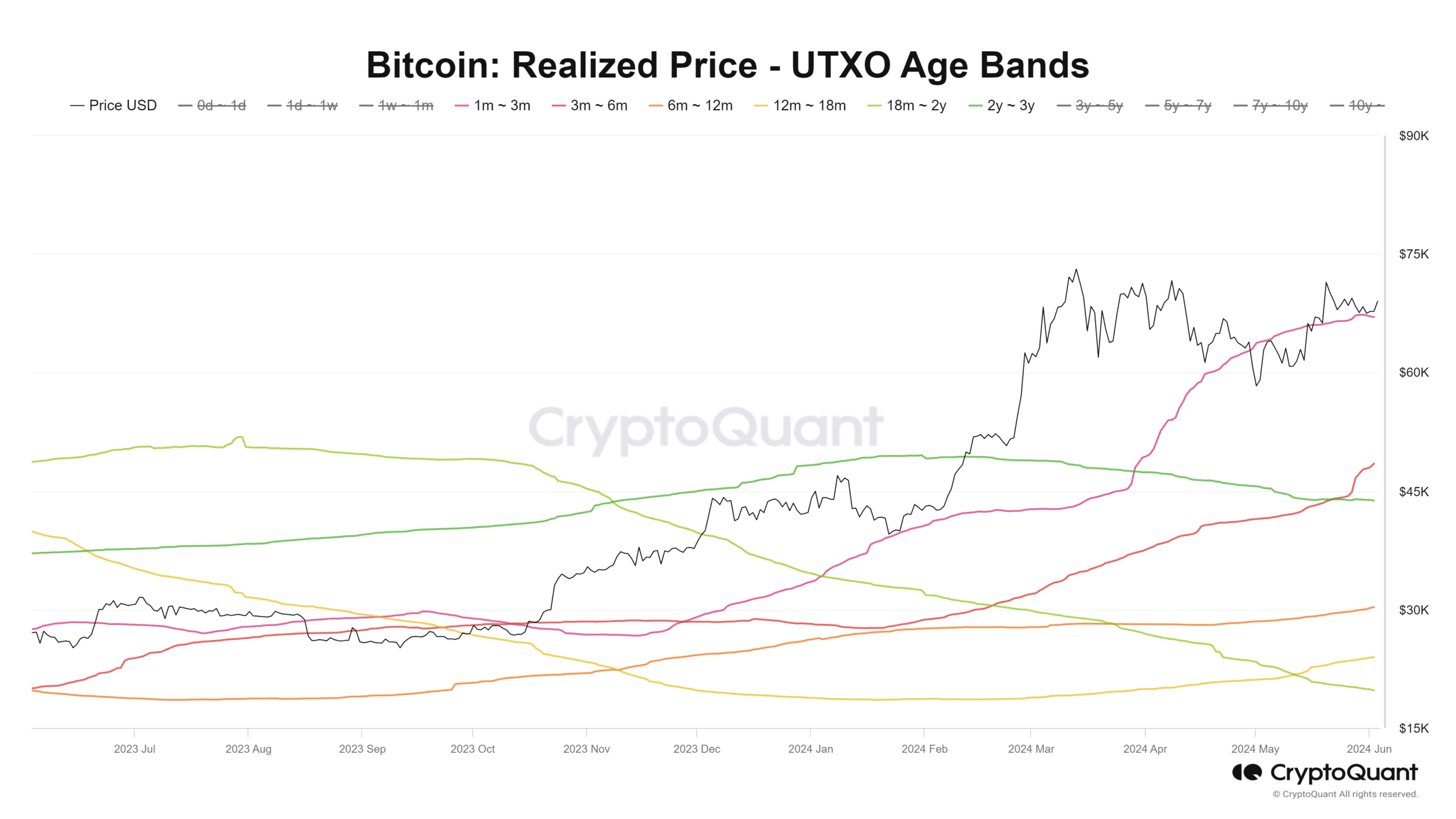

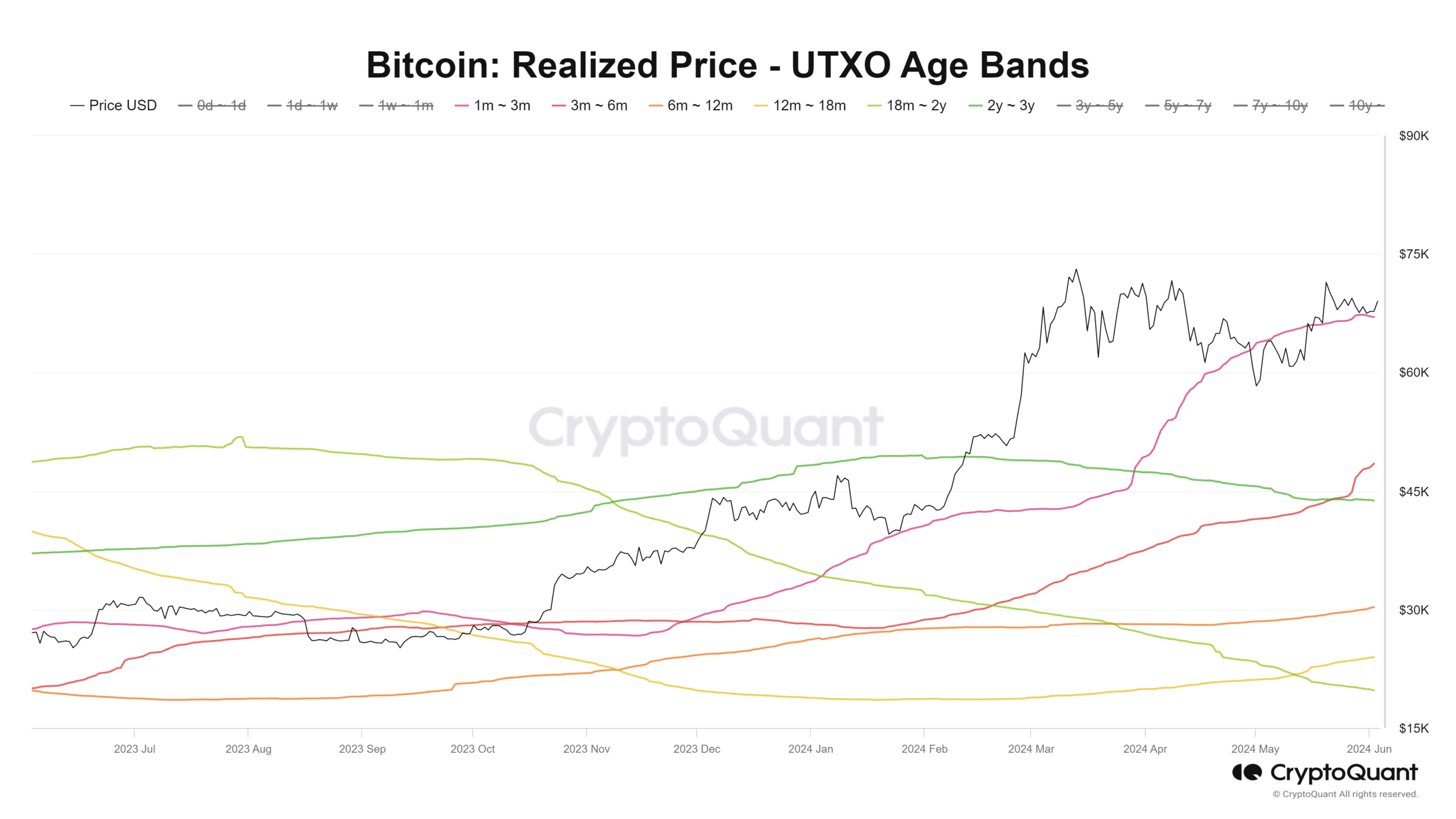

Using the realized price age bands to understand holders’ sentiment

Source: CryptoQuant

The UTXO realized price age distribution metric showed that holders whose Bitcoin is aged 1 month to 18 months saw increased activity since March. The degree of this increase varied, with the shorter-term holders being more active in the markets.

On the other hand, the 18-month to 3-year-old Bitcoin saw a decline in activity. This was a sign of reduced coin movement from these holders, which further outlined strong bullish expectations from the long-term investors.

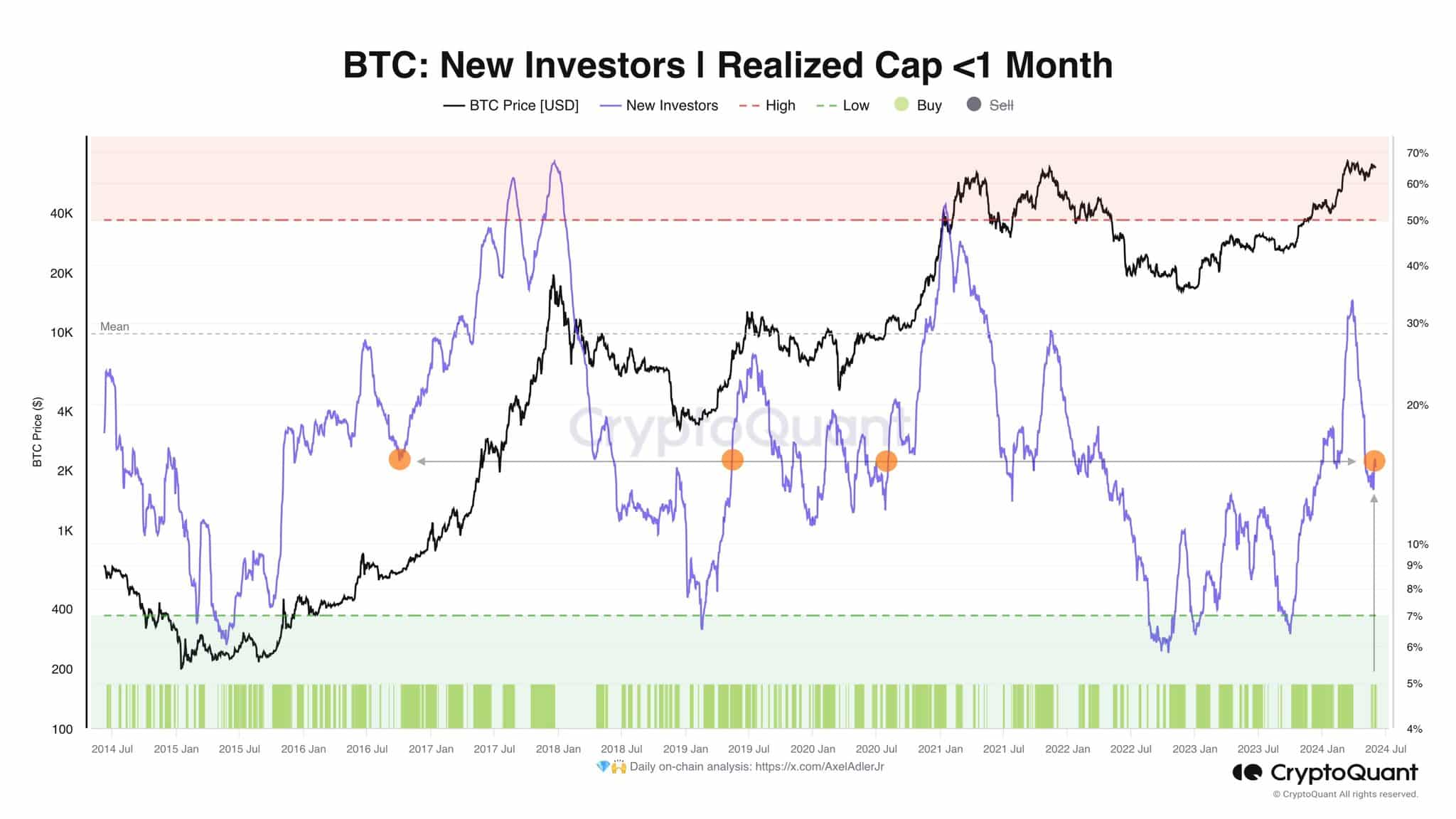

New investors could be poised to enter the market soon

Historically, the first two months after the halving have seen BTC consolidate. The reduced activity among the older cohorts reflects this expectation as they did not see a dramatic shift in activity in the past two months.

Source: Axel Adler on X

Another post from Axel Adler highlighted this. The realized market capitalization from investors holding BTC for less than a month had fallen dramatically in recent weeks but was beginning to climb higher again.

Is your portfolio green? Check the Bitcoin Profit Calculator

If this uptrend continues, it could mark a new phase of price expansion for Bitcoin. Investors and traders could keep a close eye on this metric.

With STH profits down, we will likely see a move northward, but the demand was not yet in place to drive this price move.