As is typical, the first Friday of the month brings market participants their latest read on the state of the US labour market, with the June employment report set to be released, wrapping up the first trading week of H2 24.

After the mixed signals of May’s report – a surprisingly strong headline NFP print in May, coupled with an unexpected rise in unemployment – participants will likely be seeking additional clarity on the health of the jobs market, as the spectre of a September Fed cut continues to loom.

Headline nonfarm payrolls are seen rising +200k in June, a relatively sharp slowdown from the +272k pace seen in May, while also being below both the 3-month average of job gains, and the breakeven payrolls pace, both of which reside around +250k.

Nevertheless, the range of forecasts for the headline payrolls print is unusually tight, between +140k and +237k, the tightest absolute range since the tail end of 2018.

Said range is also just 4.4 standard deviations wide, considerably tighter than the 12-month average of 5.5 deviations, somewhat raising the prospect of the ever-volatile NFP print falling outside expectations.

Leading indicators for the headline payrolls print point marginally to the downside.

Both initial and continuing jobless claims have risen notably over the past month, rising +23k and +49k respectively between the May and June survey weeks, with the latter metric having also risen to its highest level since November 2022. Meanwhile, the June ISM manufacturing survey pointed to an unexpected decline in employment, with the appropriate sub-index slipping to 49.3, from a prior 51.1. The services gauge is due on Wednesday, as is the latest ADP employment figure, though this latter point is best ignored, and has borne little-to-no resemblance to the BLS jobs data for some time now.

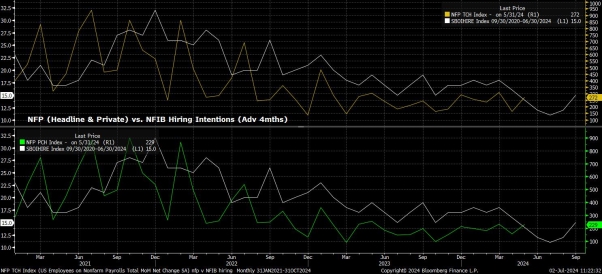

Meanwhile, the NFIB’s hiring intentions gauge, which has tracked both headline, but particularly private, payrolls growth this cycle, albeit with a 3/4-month lag, closely this cycle, points to a further moderation in jobs growth in June, and an NFP print of around 170k, though said indicator sees this slowdown bottoming out towards the end of summer.

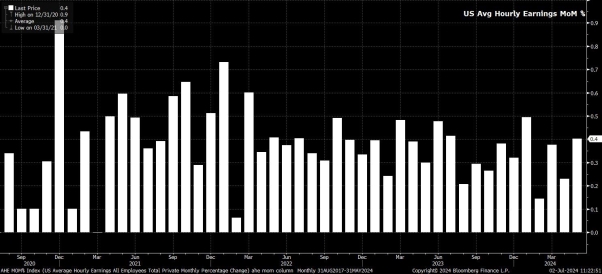

Sticking with the establishment survey, the June employment report is set to show a modest cooling in earnings pressures, after the May data showed average hourly earnings rising at the fastest monthly rate since January.

This time around, earnings are set to have risen by 0.3% MoM, 0.1pp slower than the pace seen a month prior, which should in turn drag the annual pace of earnings growth down to 3.9% YoY, from a prior 4.1%. Data of this ilk would be consistent with a slow, albeit bumpy, decline back towards 2% inflation, while also signifying a very gradual loosening of the labour market.

Further evidence of this slow, albeit steady, labour market loosening is likely to be found in the establishment survey, where unemployment is set to remain at 4.0%, after an unexpected rise to its highest since January 2022 in the prior jobs report. That said, expectations are for labour force participation to tick 0.1pp higher to 62.6%, after a surprising drop in the prior month.

Of course, it must again be stated that the household survey metrics are substantially more volatile than usual at present, owing to the impact of increased immigration to the US somewhat skewing the figures. This also goes a long way to explaining the continued divergence between employment metrics in the household, and establishment, surveys, with the latter being both substantially more reliable, and accurate.

Overall, the June jobs report is again likely to point to a continued normalisation, and gradual loosening, in labour market conditions – one that is, it must be said, broadly in line with that foreseen in the FOMC’s latest Summary of Economic Projections (SEP).

With this in mind, the policy implications of the jobs report are likely to be relatively limited, with the inflation side of the dual mandate continuing to take precedence in the minds of policymakers, and Chair Powell having previously noted that only “unexpected” labour market weakness would elicit a policy response, before adequate “confidence” in inflation returning towards target had been obtained.

Consequently, market reaction to the jobs report is likely to be relatively muted, with said muted reaction compounded by the timing of the data release. While, as usual, coming on the first Friday of the month, the June jobs report will drop on 5th July, a day after Independence Day.

Naturally, many US-based traders and market participants will take the Friday of ‘Jobs Day’ away from their desks, enjoying a long holiday weekend.

As such, volumes are likely to be substantially lighter than usual, and liquidity rather thin, over the print. This has two consequences – a print in line with expectations should be expected to cause little by way of significant market reaction, however a big miss – in either direction – outside of the narrow forecast range outlined above, could be expected to cause an outsized reaction, as markets react to the surprise in thin conditions. As always, risk management remains the priority.