- Polygon noted a bearish market structure and was poised for more losses

- The uptick in dormant circulation warned of a wave of selling pressure

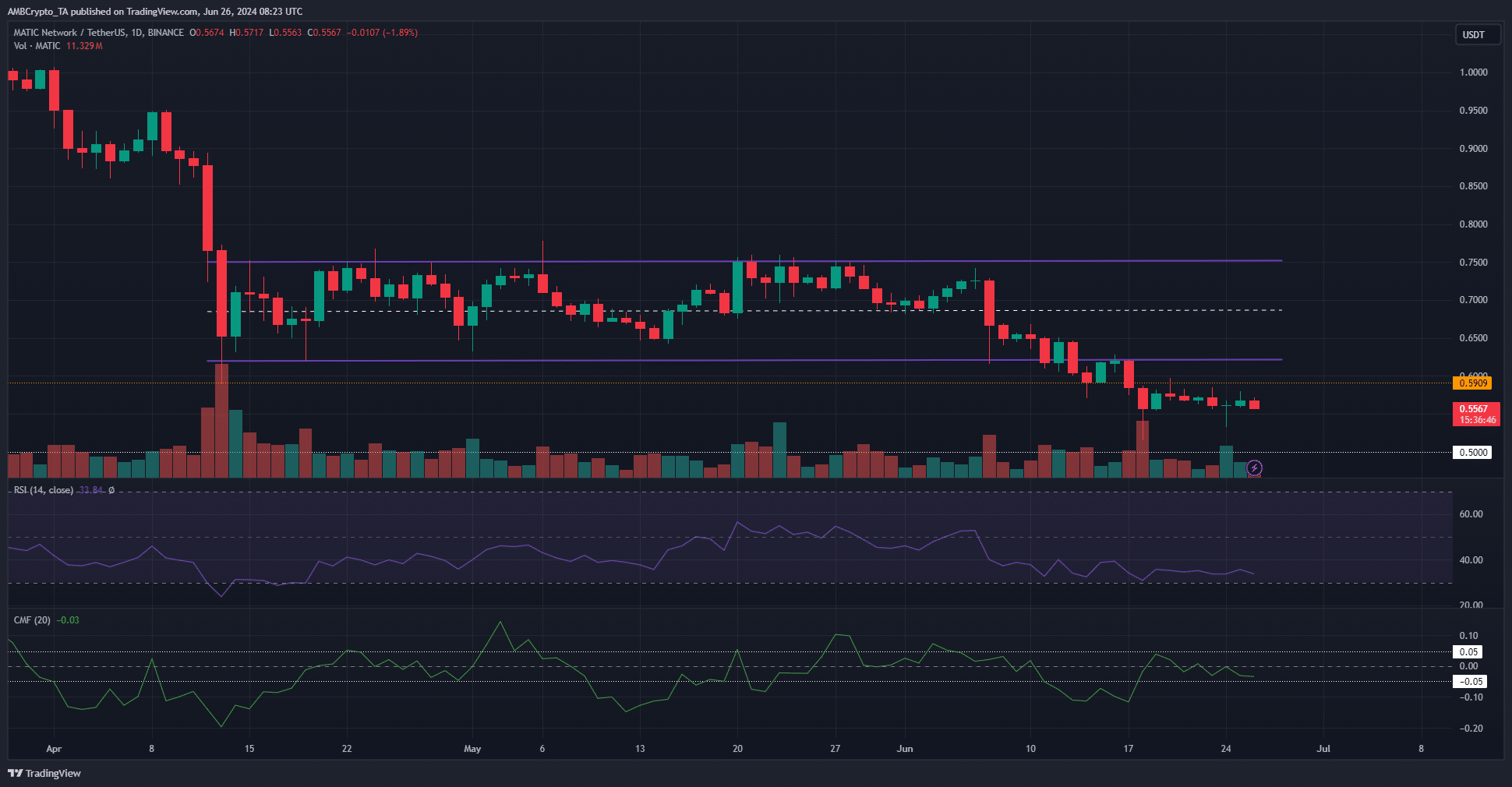

Polygon [MATIC] crypto saw the downtrend intensify in June. It began with the price slipping below the 2-month range on the 11th of June. On the 16th of June, the lows at $0.621 were retested as resistance.

This solidified the bears’ holdings and paved the way for a new move southward. At press time, the $0.59 level was the next key resistance. Should the bulls anticipate more losses and remain sidelined in the market?

The next HTF support level was also a psychologically important one

With the $0.59 level flipped to resistance, the $0.5 is the next psychological and technical support level. It was important in September and October 2023 and launched the massive rally that saw Polygon crypto reach $1.29 highs in May 2024.

Therefore, a move to this support in search of liquidity is expected. The market structure on the daily timeframe is severely bearish.

Hence, the $0.5 level might not immediately reverse the downtrend, but perhaps it might temporarily halt it.

The CMF was at -0.03, and traders can wait for it to drop below -0.05 to indicate heavy capital flow out of the markets. The RSI was at 33 and indicated a firm downtrend in progress.

If the indicators continue to fall, it will negatively impact the chances of a bullish defense of the $0.5 support.

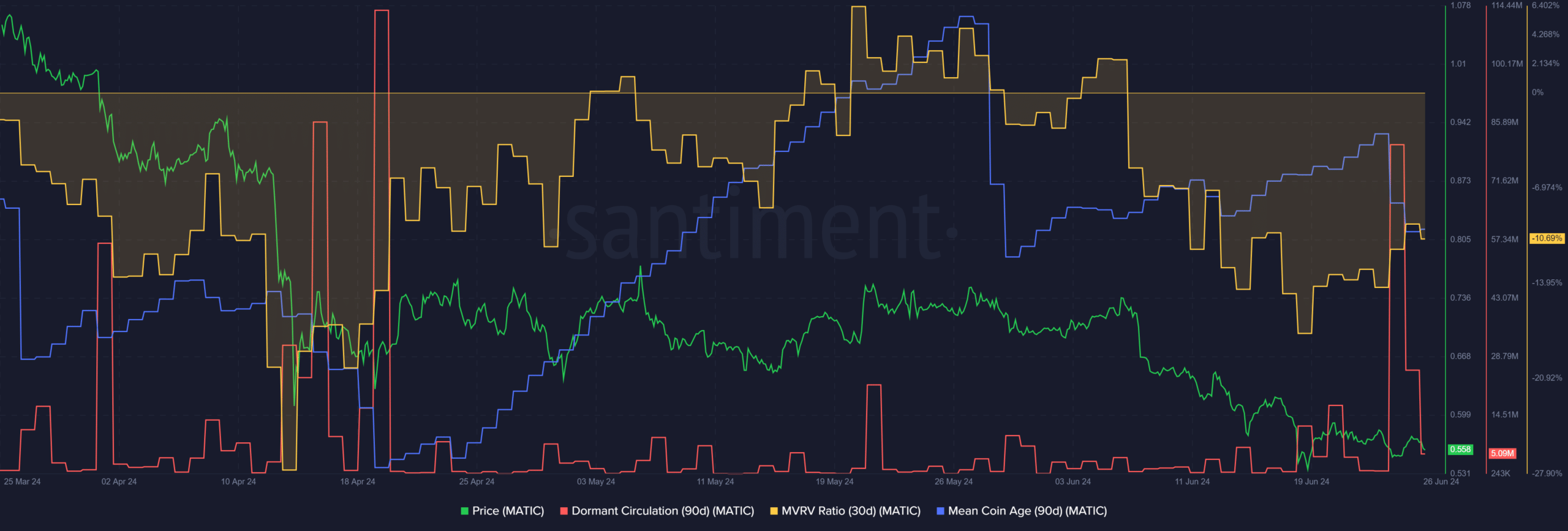

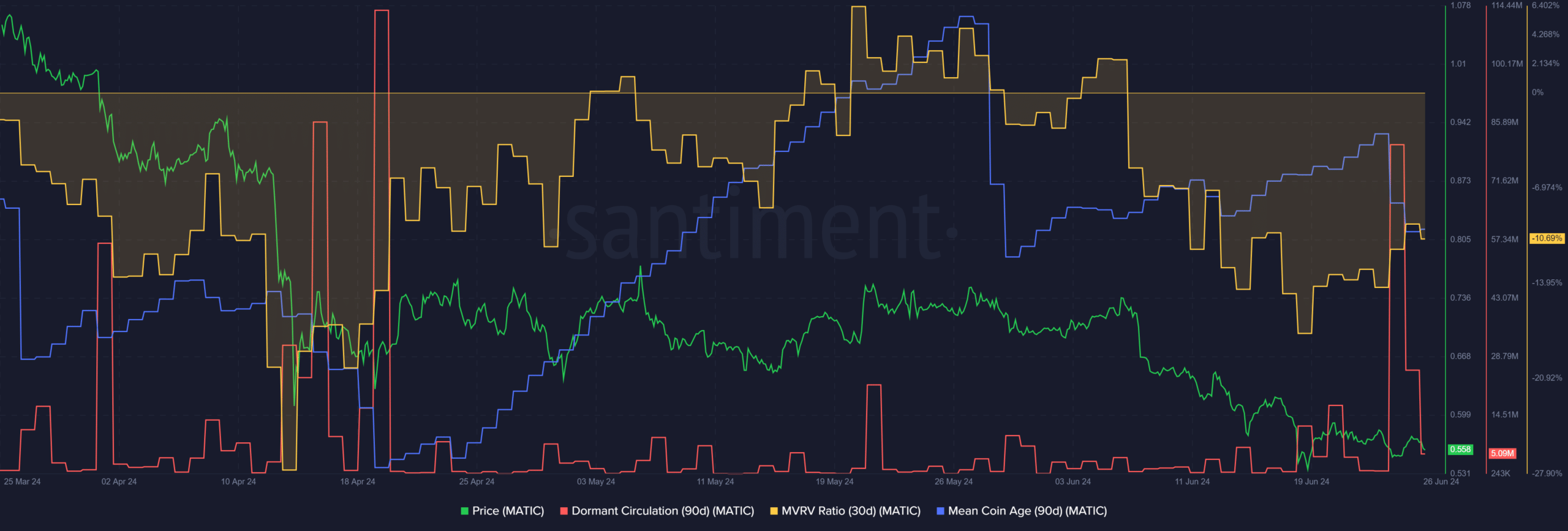

A spike in the dormant circulation hints at the next price move

Source: Santiment

On the 24th of June, the dormant circulation saw a large spike. A jump of a similar proportion was last seen in mid-April when prices tested the $0.6 support multiple times.

Read Polygon’s [MATIC] Price Prediction 2024-25

It signaled Polygon crypto buyer capitulation and a similar scenario was playing out again.

This could see prices plunge deeper. The MVRV ratio was deeply negative, showing that short-term buyers were at a loss. Any bounces will likely be sold for these traders to break even, making recovery harder.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.