- PEPE pulled back to retest a significant support level before a potential price reversal

- Key metrics highlighted PEPE’s resilience and possible bullish trends in the future

PEPE grabbed investors’ attention over the last few days, especially as it traded close to a strong support level for a likely price reversal if its nascent bullish momentum steers a price surge. In fact, such a move could fuel a major rally on the charts.

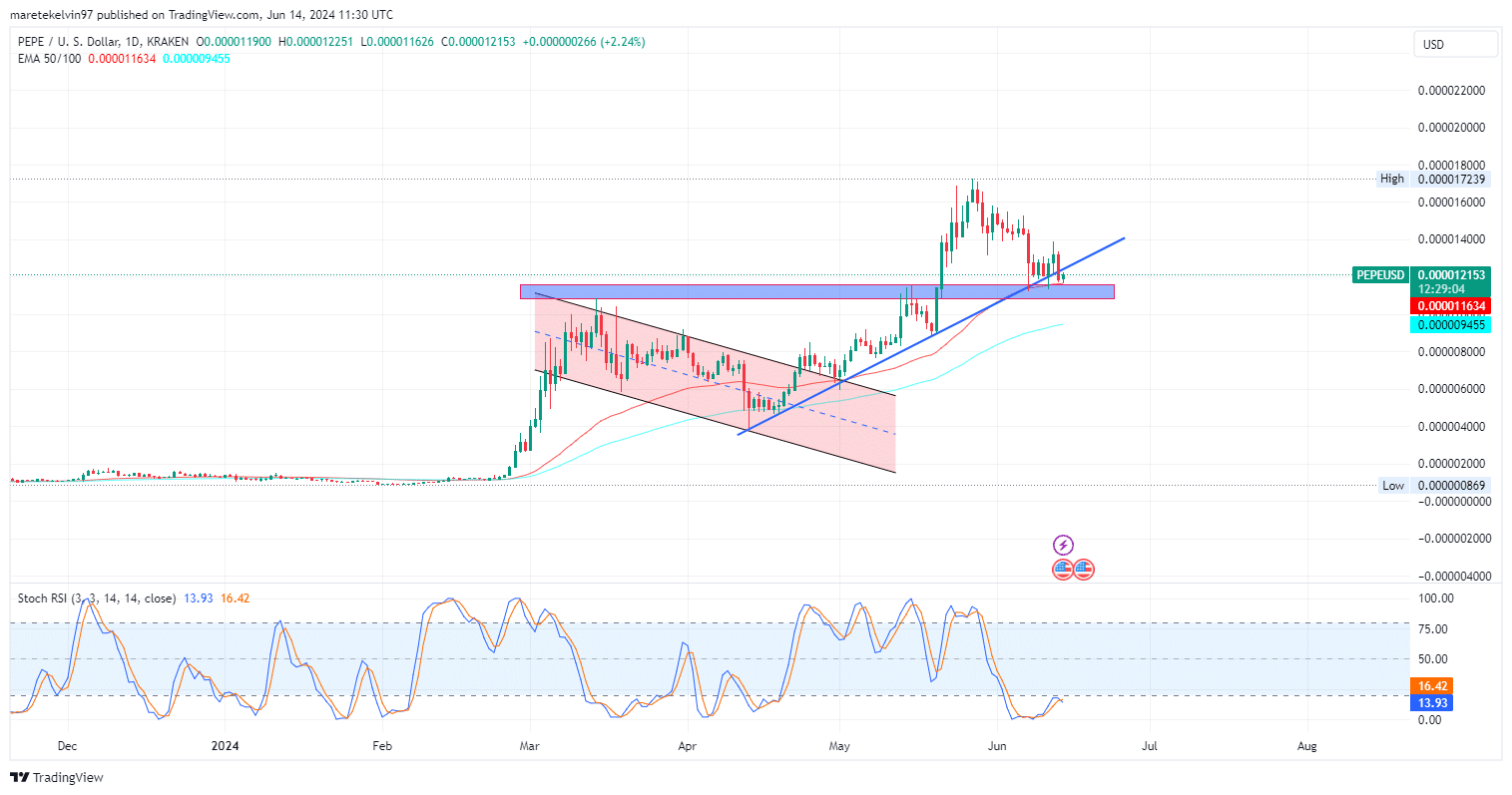

PEPE’s prices have recorded a 33.53% pullback since May 28 to retest a support level at $0.000015. PEPE has since consolidated around the support level for the past 6 days, with bullish momentum gradually building. The price action has respected an ascending trendline too.

The exponential moving averages (EMA 50/100) seemed to provide additional support as the EMA 50-day trend was above the EMA 100-day with PEPE trading above.

Additionally, the stochastic RSI pointed to a slightly overbought zone, suggesting a sustained uptrend after a brief consolidation. This confluence between the support levels and indicators makes PEPE a meme for investors to watch for long positions.

PEPE volume, open interest on USD exchanges flash bullish signals

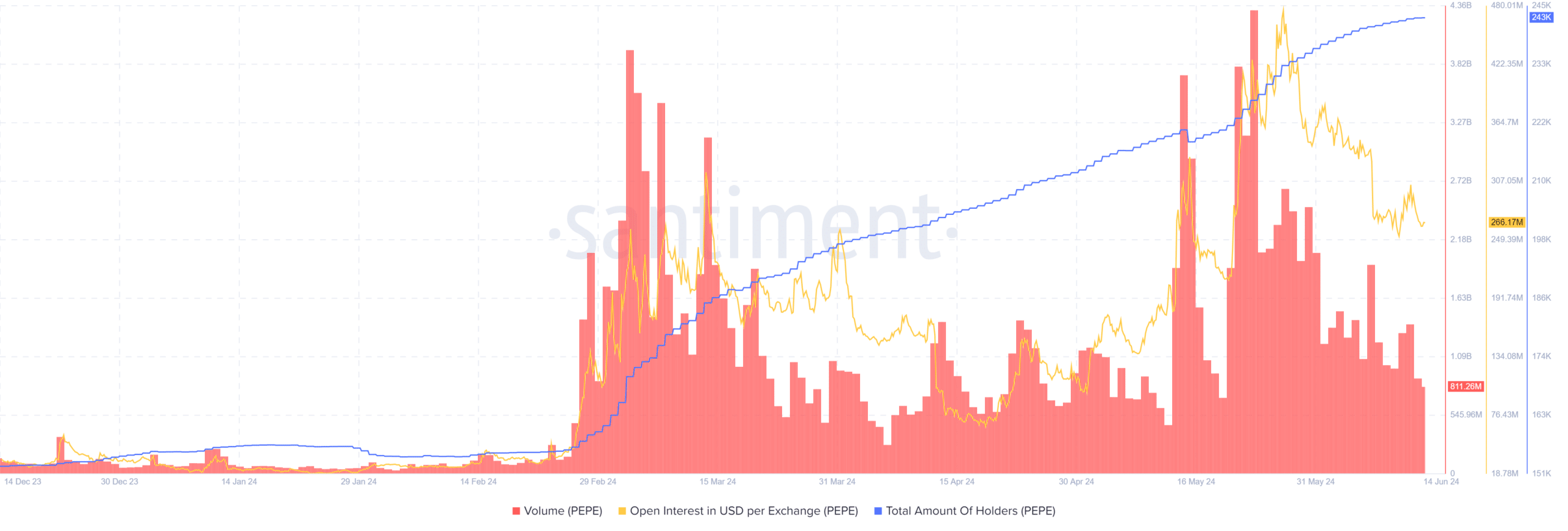

AMBCrypto further analysed volume, open interest on the USD exchange, and the total number of holders on Santiment. PEPE’s volume indicated several spikes correlating with an increasing open interest. This correlation highlighted greater PEPE trading activity and interest at this significant support level.

The total number of holders seemed to rise steadily too, reflecting widening investor confidence and the accumulation of PEPE tokens. With these market sentiments, the key support level can prove to be a stronghold for the market’s bulls.

What do liquidity dynamics have to add?

The aggregated order book liquidity delta indicated that buy orders are outweighing the sell orders around the key support level – A sign of buying interest building strongly. This liquidity imbalance also meant that buyers are arming themselves to defend the support level from any further bouts of depreciation. Hence, the bullish bias.

Is PEPE positioned for a reversal?

Technical indicators, ascending holder numbers, and positive liquidity all seemed to lend the market a bullish outlook. Investors should keep an eye on PEPE as it fluctuates around the support level with a potential price hike on the horizon.

However, if the price falls past the support level, a retest of $0.000009 will be imminent.