- PEPE’s Open Interest surged to a new high.

- The meme coin’s high MVRV ratio put it at risk of decline.

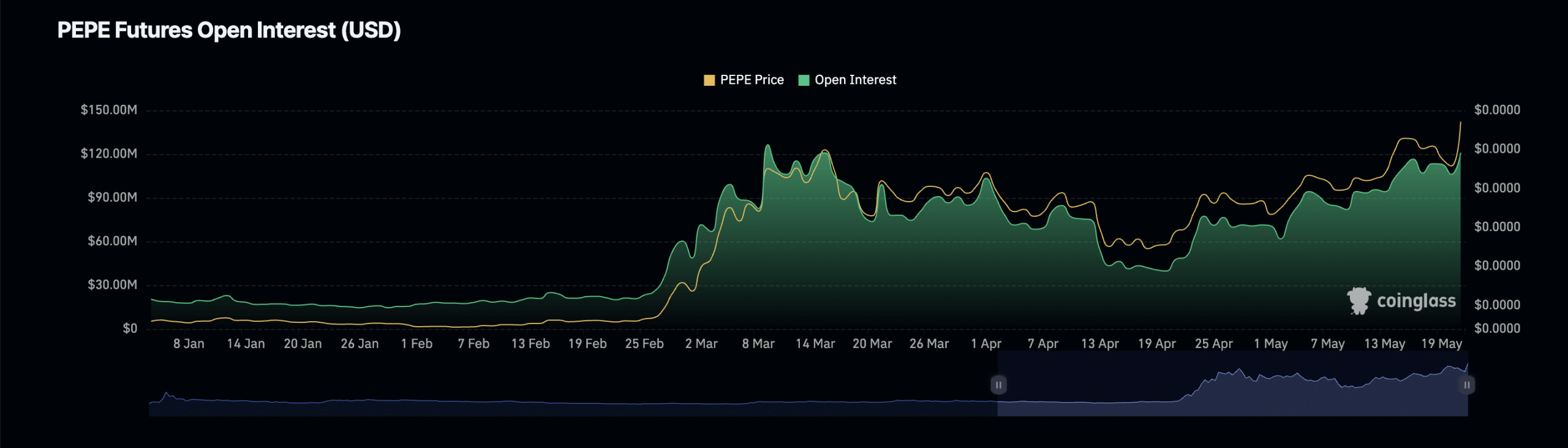

Pepe’s [PEPE] Futures Open Interest has rallied to a two-month-high amid the recent rally in the cryptocurrency market, according to Coinglass’ data.

At $121 million at press time, the meme coin’s Futures Open Interest surged by 14% in the past 24 hours.

PEPE Futures Open Interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled.

When it rises, it signals a spike in market activity or a positive change in sentiment among traders, suggesting that more market participants are opening new positions.

Assessing the token’s Funding Rates confirmed the current bullish trend. PEPE’s funding rate was positive at 0.0156% as of this writing.

Perpetual futures contracts use Funding Rates to ensure that the contract price stays close to the spot price.

When an asset’s futures funding rates return a positive value, it suggests a strong demand for long positions. It is a bullish signal and interpreted as a precursor to the asset’s continued price growth.

PEPE holders book profit

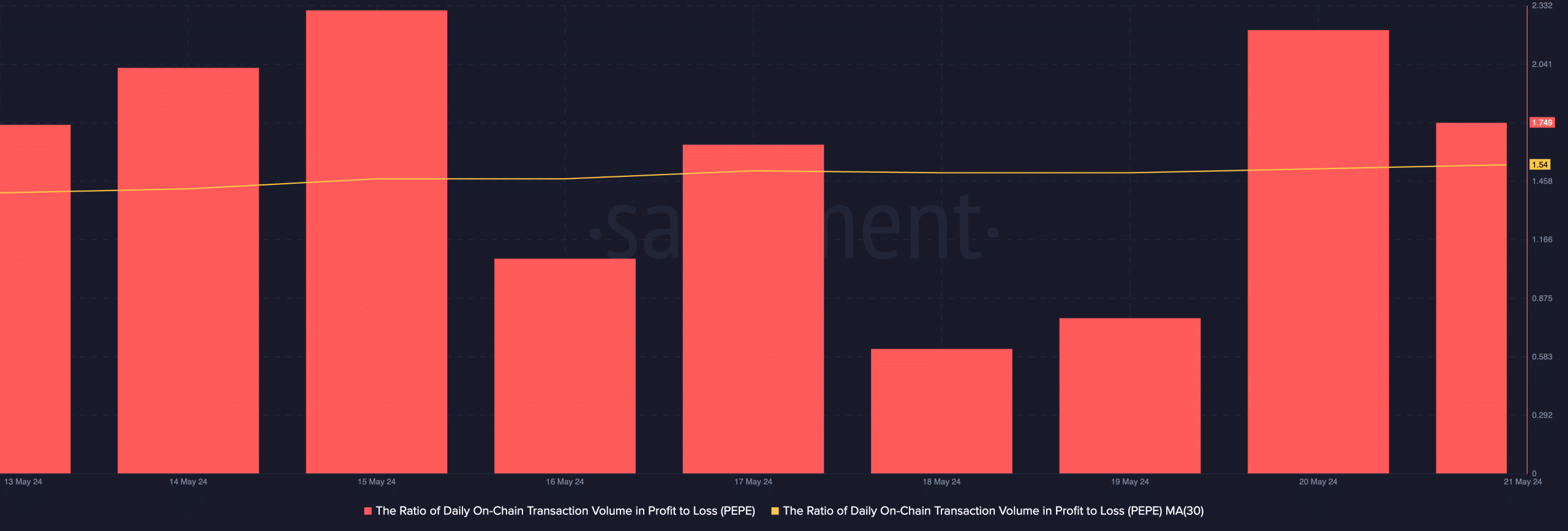

AMBCrypto assessed how profitable PEPE transactions have been recently and found that its traders have mostly logged gains on their investments.

A look at the daily ratio of PEPE’s transaction volume in profit to loss (using a 30-day moving average) showed its value at 1.54, according to Santiment’s data.

This revealed that for every PEPE transaction that has ended in a loss in the last month, 1.54 transactions have turned a profit.

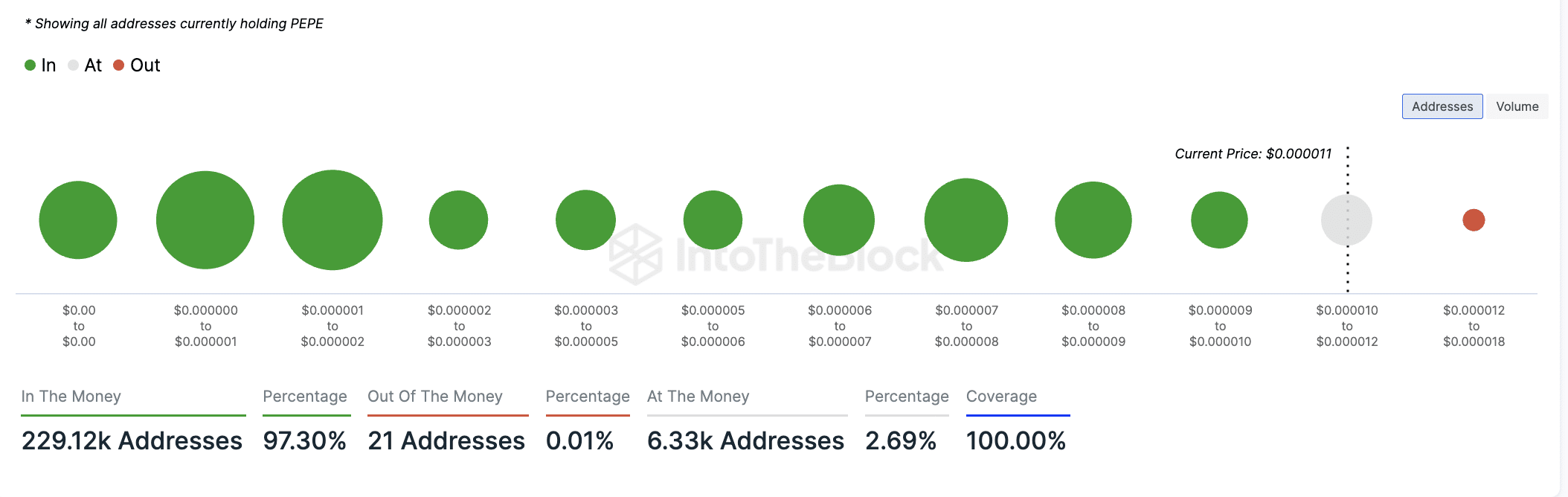

According to IntoTheBlock, at press time, 229,120 wallet addresses, which make up 97.30% of all PEPE holders, were “in the money.” An address is “in the money” when it holds its coins at a profit.

Conversely, only 6,330 addresses, which make up 3% of all PEPE holders, were held at a loss. These addresses bought the meme coin when it traded above $0.000012.

As of this writing, PEPE exchanged hands at $0.000011, according to CoinMarketCap’s data.

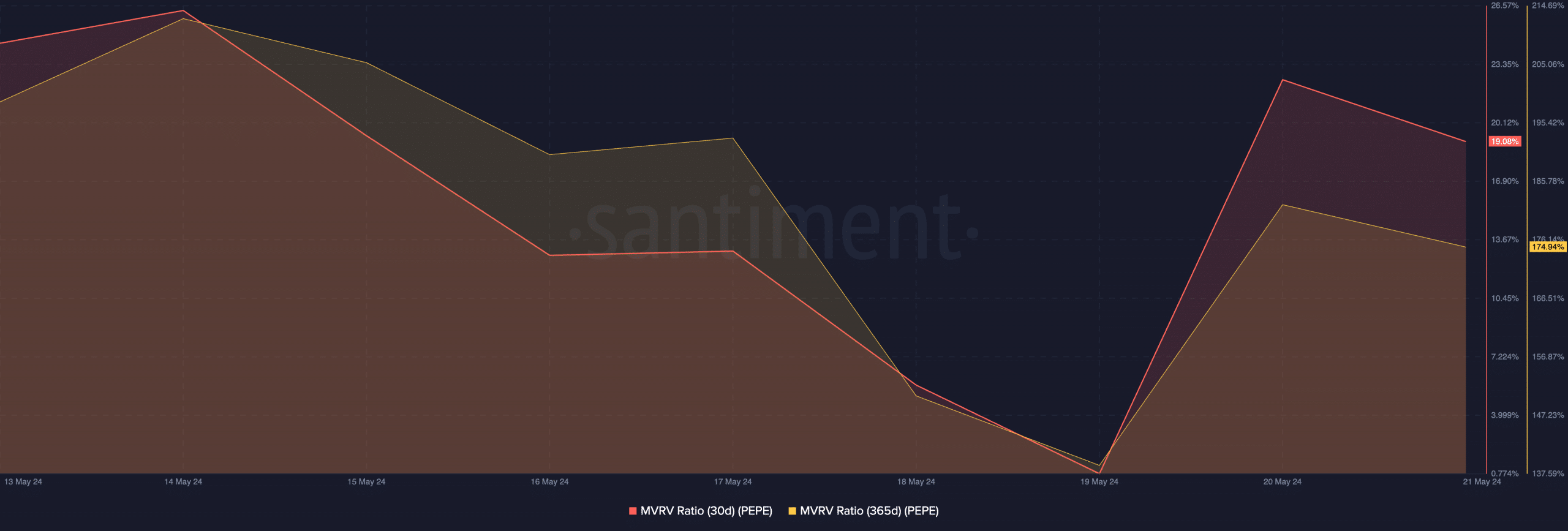

Despite the token’s double-digit rally in the past 24 hours, investors should exercise caution. Per its Market Value to Realised Value (MVRV) ratio, PEPE was overvalued at press time.

This metric tracks the ratio between PEPE’s current market price and the average price of each of its acquired tokens.

When it returns a value above one, it suggests that an asset’s market value is significantly higher than the price at which most investors acquired their holdings. When this happens, the asset is overvalued.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

PEPE’s MVRV ratios assessed on 30-day and 365-day moving averages were 19.08% and 174.94%, respectively.

Historically, high MVRV levels have sometimes been followed by periods of profit-taking, where investors who bought at lower prices sell their holdings.