- ONDO has a strongly bullish bias on the lower and higher timeframes.

- Another 15% move higher is possible, provided the bulls can convert a key resistance to support.

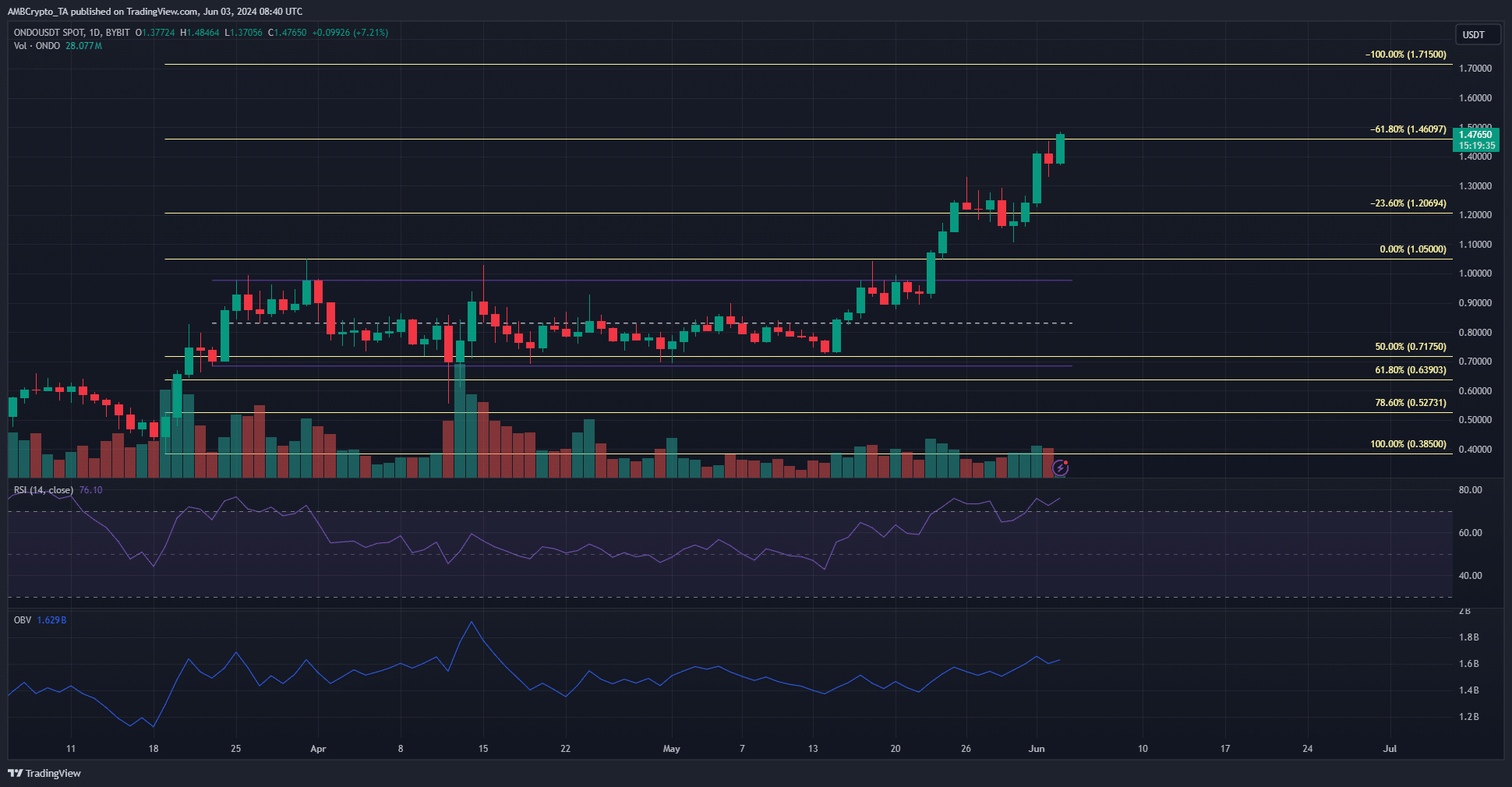

Ondo [ONDO] posted 56% gains since the 23rd of May and has broken out past a two-month-old range formation. The psychological $1 level was also flipped to support by the bulls.

Bitcoin’s [BTC] recent stasis did not affect ONDO negatively. Is this a sign of strength, or will ONDO retrace its gains? Technical analysis revealed some strong evidence for which outcome the altcoin would witness.

The Fibonacci extension levels presented the next bullish targets

The rally in mid-March was used to plot a set of Fibonacci retracement and extension levels (pale yellow). It showed that the range formation of the past two months found support at the 50% retracement level at $0.717.

In the past two weeks, ONDO has flipped the 23.6% extension level at $1.2 to support and was trying to force its way above the 61.8% extension at $1.46. The 100% extension level at $1.71 is the next target.

The RSI on the 1-day chart was at 76 to signal strong bullish momentum. A divergence has not formed on this timeframe and signaled continued bullish momentum. The OBV was climbing at a more sedate pace.

Like the rest of the market, the trading volume was weak, but the price action was bullish.

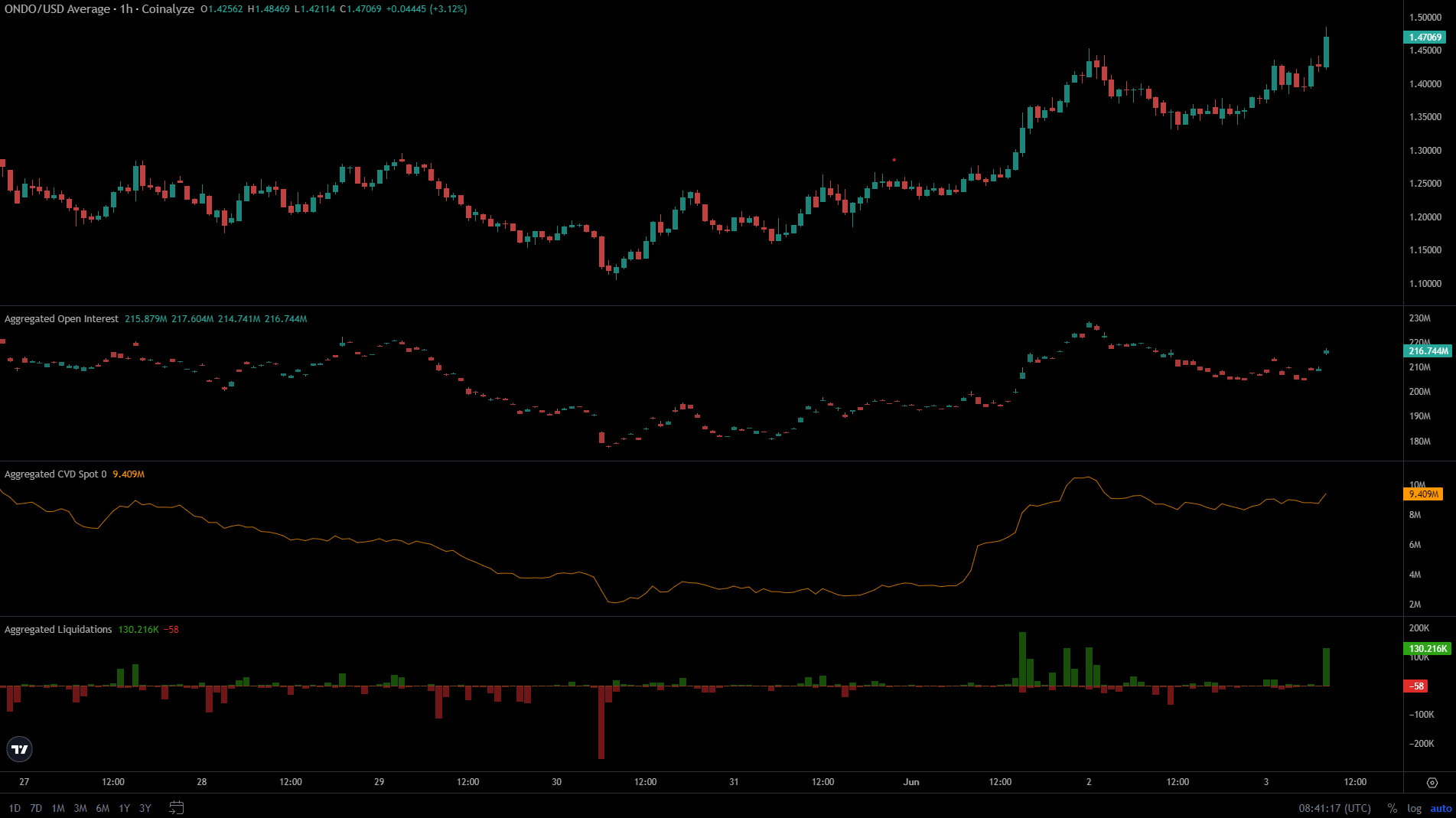

The spot demand and speculative interest were encouraging

Source: Coinalyze

Coinalyze data showed that the Open Interest waxed and waned alongside ONDO’s price action. This meant that the traders were bullish and willing to enter long positions as prices climbed higher.

Read Ondo’s [ONDO] Price Prediction 2024-25

The spot CVD also maintained its uptrend, although it has slowed down over the past two days.

The short liquidations due to the recent price surge added to the market buys. Overall, buying pressure was present in the lower timeframes.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.