- Notcoin saw a slump in buying pressure on the lower timeframes.

- The momentum and trend continued to favor NOT bulls.

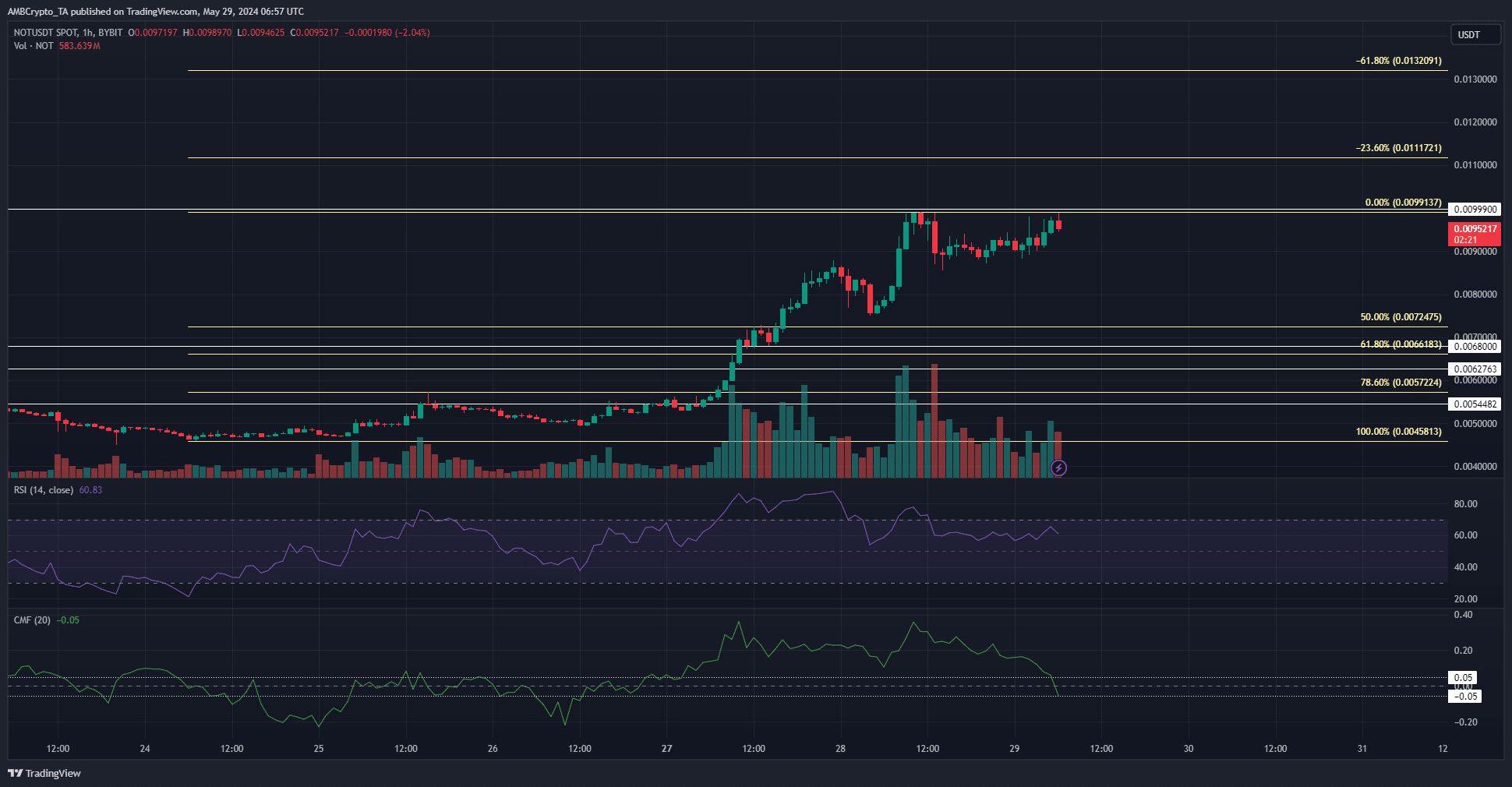

Notcoin [NOT] saw a 115% rally that began on the 24th of May and lasted till the 28th. Since then, it has faced stiff resistance at the $0.0099 level, just below the psychological round-number resistance at $0.01.

A recent AMBCrypto analysis highlighted the $0.0066 and $0.0068 levels as key resistances. The bulls smashed their way through these short-term resistances, outlining the strength of the bulls this week.

The past 24 hours saw the upward move fizzle slightly

The $0.0072-$0.0075 region acted as resistance earlier this week but was flipped to support in the past 24 hours.

After doing so, NOT prices surged higher to the $0.0099 level which had rebuffed the buyers on the listing day as well.

A short-term range was observed between $0.0088 and $0.0099. This could be the consolidation phase NOT bulls need before forcing another rally.

The buying pressure has weakened in the past 12 hours, as denoted by the CMF’s dive to stand at -0.05 at press time.

The RSI remained above neutral 50 and signaled bullish momentum.

The Fibonacci retracement levels showed $0.0072 and $0.0066 are important support levels, but it is unlikely that NOT would drop toward them in the coming weeks.

A rally toward the extension levels at $0.0112 and $0.0132 is more likely to occur but a Bitcoin [BTC] drop below $67k might affect the Notcoin uptrend adversely.

The sustained demand encouraging

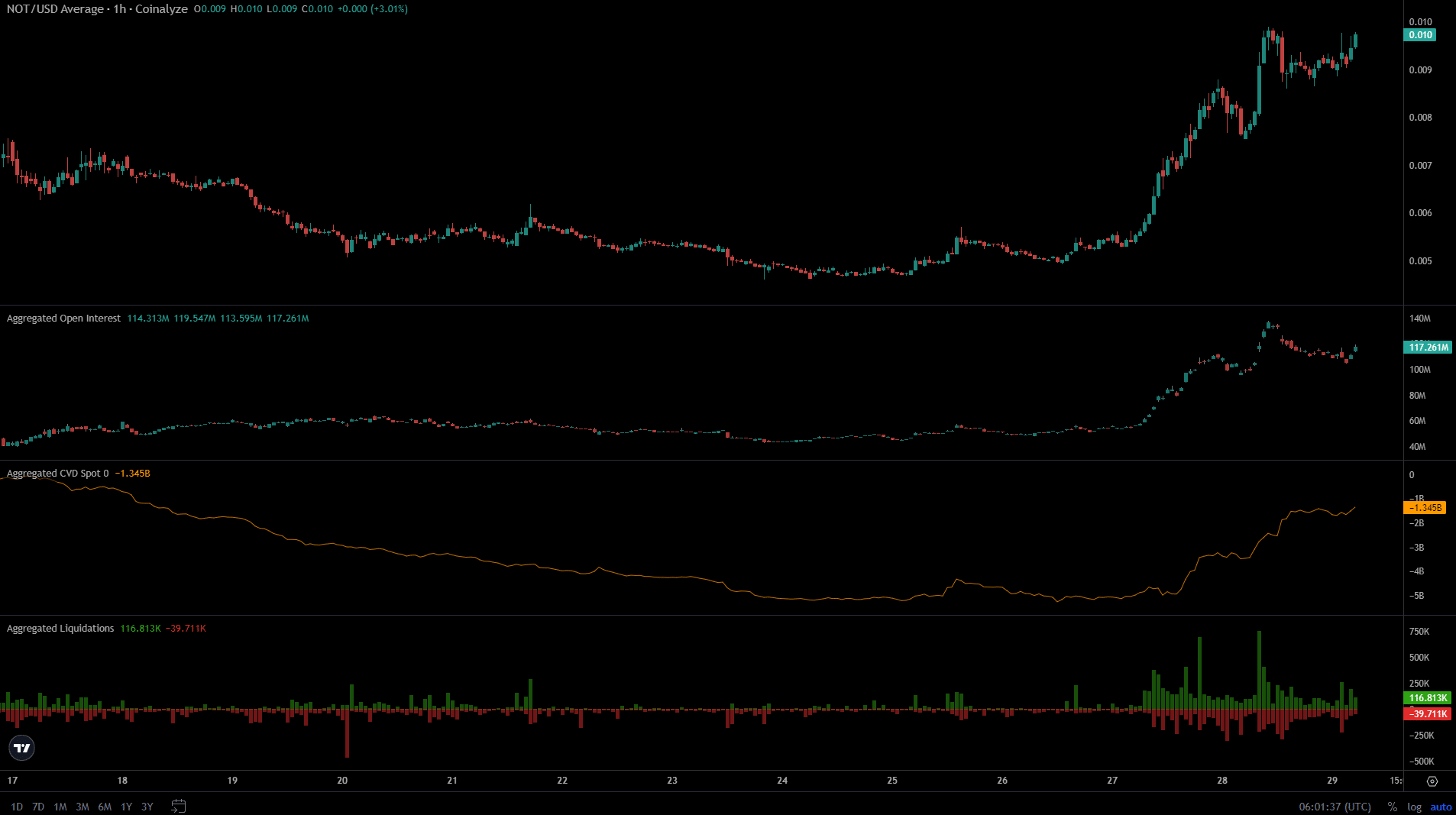

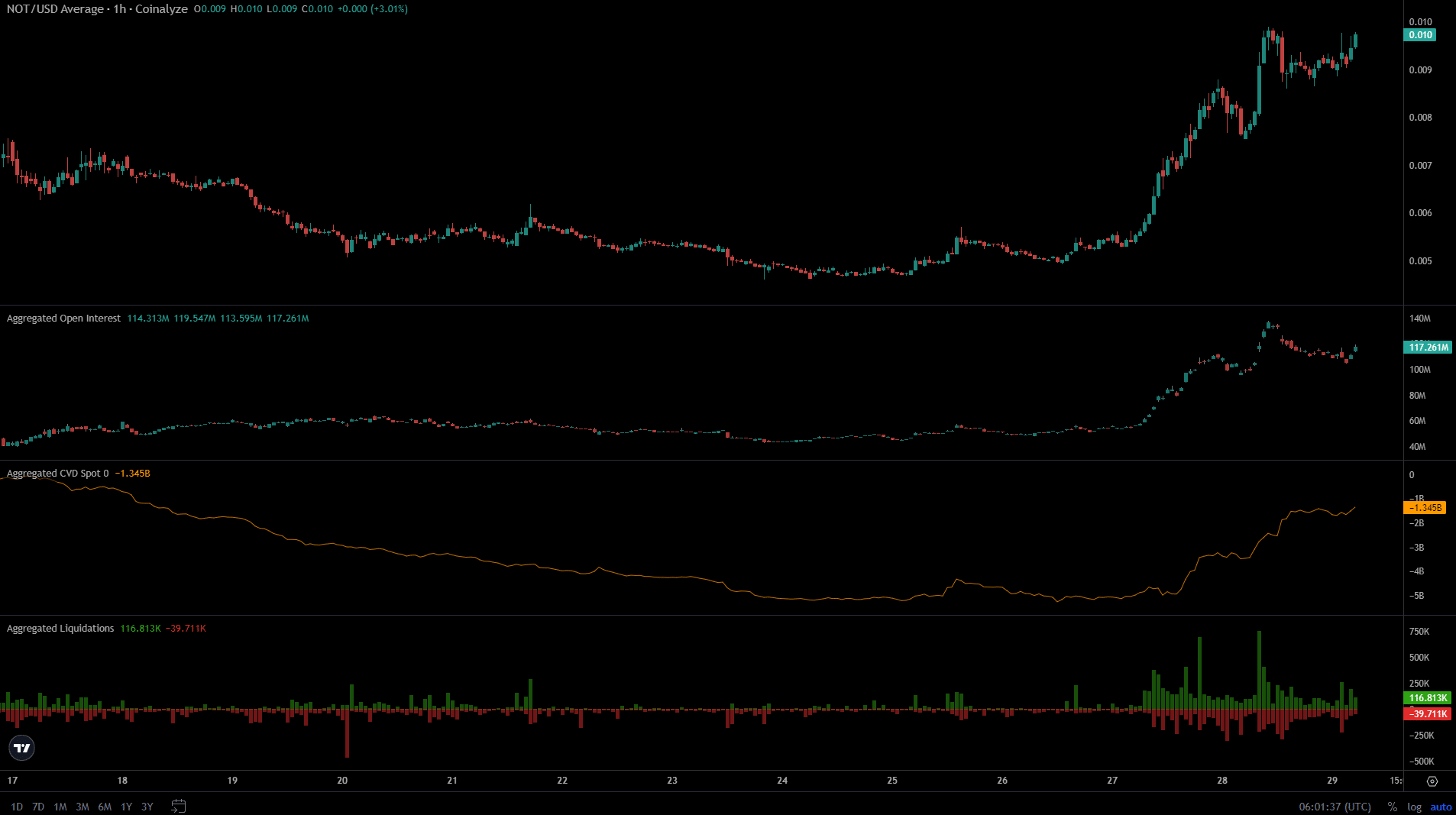

Source: Coinalyze

During the upward rally of the past two days, the short liquidations saw abnormally large spikes.

This showed many participants were betting against more gains and were subsequently liquidated. Their forced market buy orders took prices even higher.

The Open Interest was trending higher alongside the price, showing bullish sentiment behind the token.

Is your portfolio green? Check out the NOT Profit Calculator

The majority of the market were convinced that the rally might extend higher, which raised some concerns that a liquidity hunt might ensue.

The spot CVD also caught a strong move upward, which was encouraging. The recent rally was not a byproduct of the derivatives markets alone, and more gains were a possibility.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.