- Notcoin’s price rallied, volume hits $4.54 billion, only behind BTC, ETH, and USDT.

- The price could drop to $0.015 as indicators showed that the token was overbought.

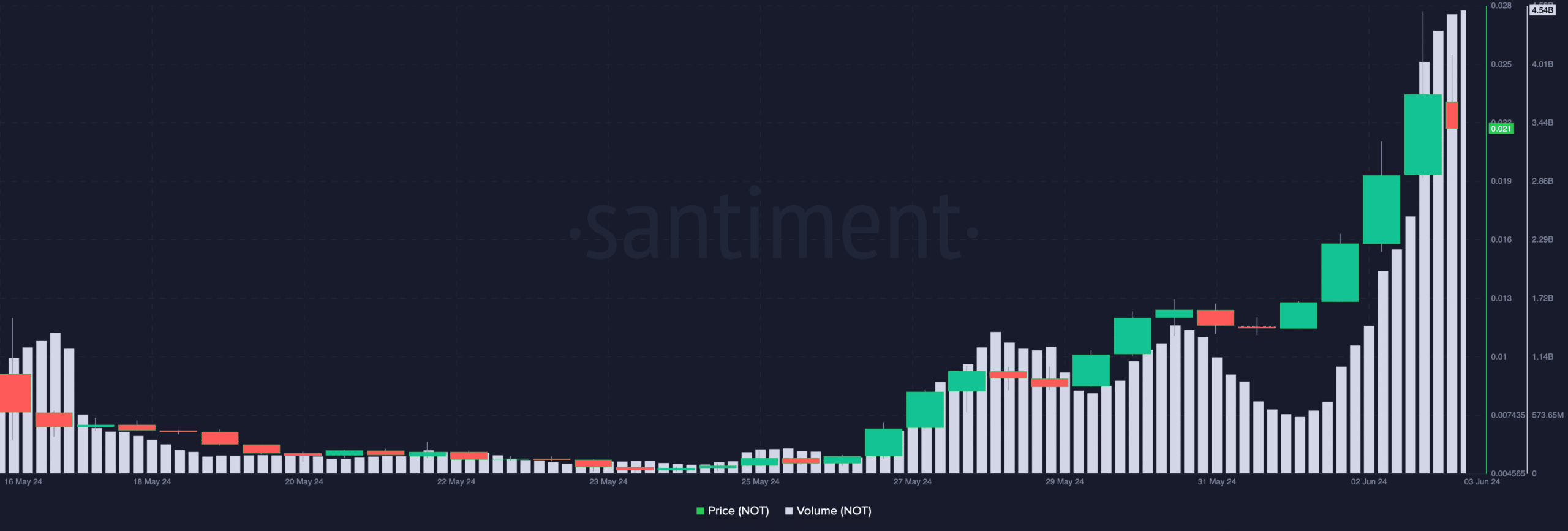

The 24-hour volume of Notcoin [NOT], fueled by the tremendous price increase, was more than that of Solana [SOL] and BNB. As of this writing, NOT’s volume was $.4.54 billion, according to Santiment.

The price, on the other hand, was $0.021. This value was at a 287% hike in the last seven days. However, the price mentioned was a decline as Notcoin had initially hit $0.028 on the 2nd of June.

During the same period, BNB’s volume was $1.75 billion while Solana recorded $1.72 billion in trading volume. The metric is an indicator of interest. Therefore, the surge meant a lot of capital was deployed in the token’s favor.

Back-to-back jumps

For those unfamiliar, Notcoin launched about a month ago. And previously, AMBCrypto had reported how its launch was marred by selling pressure.

However, another article explained what led to the price surge and the jump into the top 100 per market cap. In the mentioned piece, we had predicted that NOT would hit $0.01.

Interestingly, it did not take long for the project to do that. Moreso, Notcoin is now part of the top 60 in terms of market cap, rising above Bonk [BONK].

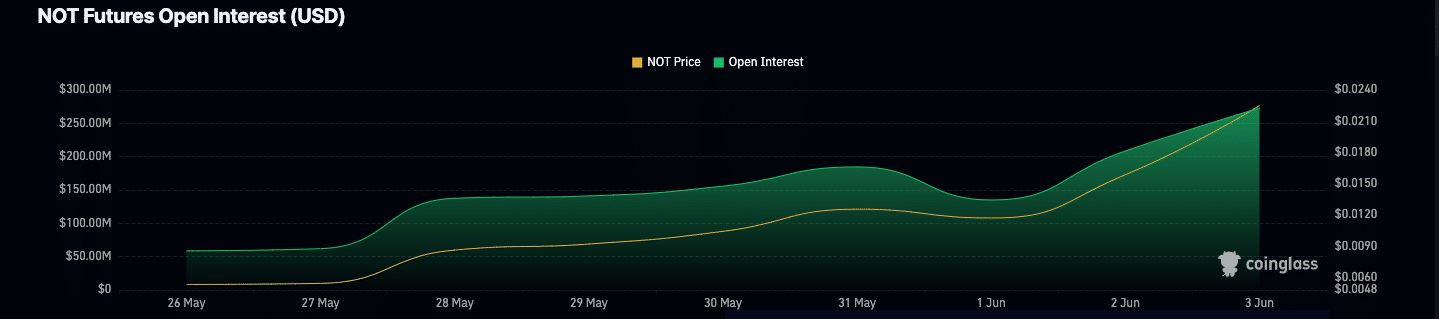

Apart from that, the Open Interest (OI) around the token surged over the weekend. According to Coinglass, Notcoin’s OI was as high as $273.02 million.

When the OI decreases, it means that money is exiting the market as more contracts get closed. However, an increase in the metric is a sign of the presence of new liquidity.

For the price, the rising OI was one of the reasons NOT was able to sustain its uptrend. This is because increasing Open Interest can serve as a strength for the direction a token is moving.

However, traders, as well as NOT holders might need to be careful.

NOT becomes overbought, hurts traders’ positions

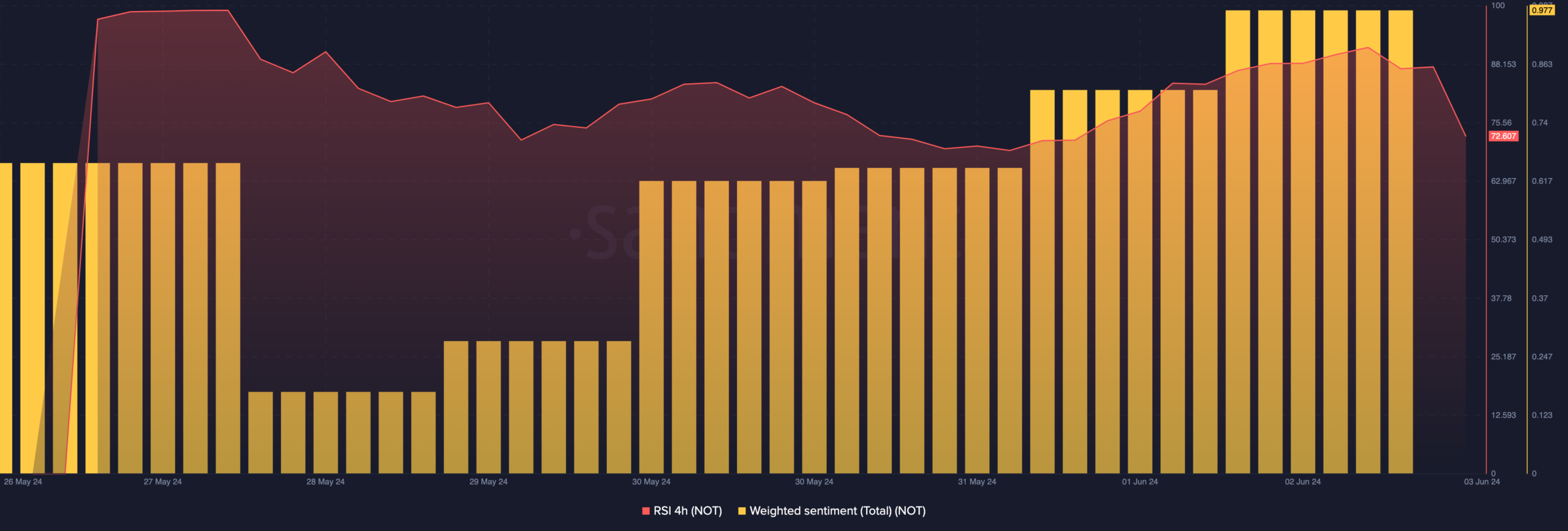

For instance, the Relative Strength Index (RSI) on the 4-hour timeframe was 72.60. The RSI measures momentum. A reading below 30 indicates that an asset is oversold.

But a reading over 70 indicates that the cryptocurrency is overbought, and that was the situation with Notcoin. Considering this position, NOT’s price could fall.

If the potential decline continues, the price of NOT could drop to $0.015. However, a resurgence in buying pressure could push the price back in the upward direction.

Beyond that, the Weighted Sentiment was a lot higher than normal, suggesting that many market participants were bullish on NOT. However, this metric seemed to have reached an extreme level. As such, it could validate the bearish prediction above.

Meanwhile, interesting things were happening with Notcoin in the derivatives market.

Realistic or not, here’s NOT’s market cap in SOL terms

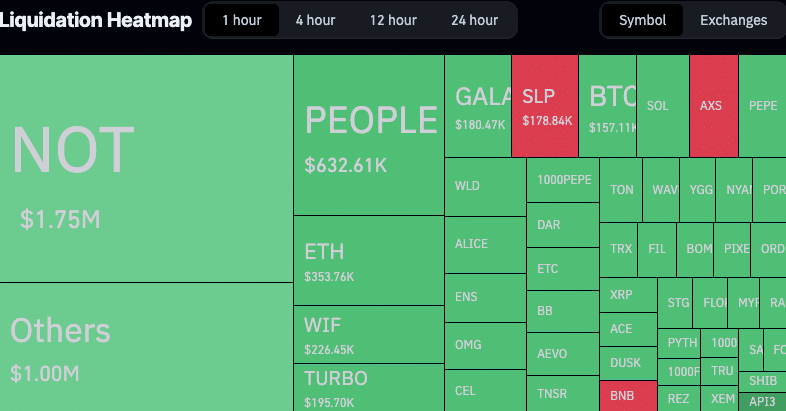

According to Coinglass, NOT was only behind Bitcoin [BTC] in terms of 24-hour liquidation.

For that period, shorts were the most affected by the $23.48 million liquidation. However, that has changed within the last hour as the decline in NOT’s price has forced longs to record a large part of the $1.75 million wipeout.