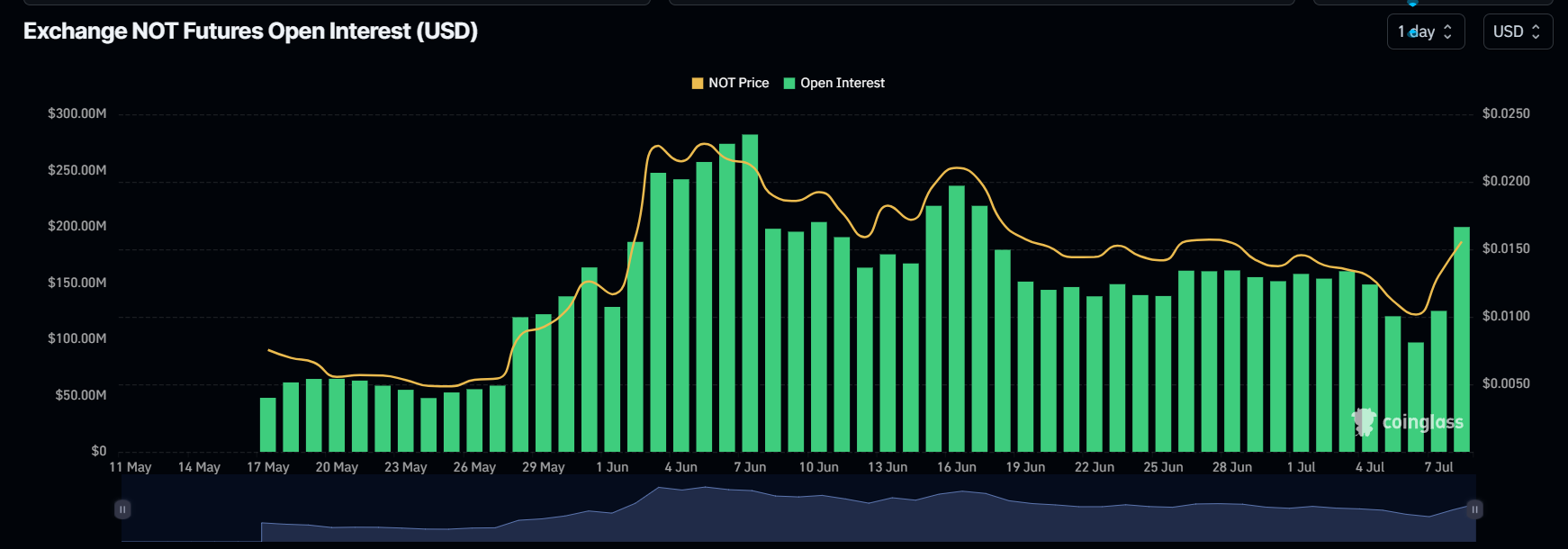

- Notcoin token surged more than 55% in just 24 hours, with a 118% spike in open interest.

- According to technical analysis, NOT could surge 35% more if it shows a strong daily candle closing above $0.017.

After a massive downturn across the cryptocurrency market in the past few days, the overall market now appears to be recovering.

Amid this ongoing recovery, the recently listed Telegram-linked Notcoin [NOT] has gained massive attention from investors and traders following the record 55% price surge, rising from $0.010 to $0.016 in just 24 hours.

Reasons behind the NOT price surge

The potential reason behind this massive price surge could be the continuous development and notable user engagement on the platform.

Besides this major update in recent days, the community also announced that Notcoin Explore is about to become a public platform for Web 3 projects worldwide.

Additionally, Notcoin recently announced that they burned a massive $3 million worth of NOT tokens and plans to distribute $4.2 million of tokens as an incentive to Gold and Platinum users of Notcoin.

These updates and continuous user support for Notcoin could be the reasons behind the massive 55% price surge.

Notcoin technical analysis and key levels

According to expert technical analysis, NOT was looking bullish, and was near a strong resistance level of $0.016. Since 19th June, NOT has attempted multiple times to breach this $0.016 level, but failed.

However, the recent massive surge may cause it to breach this resistance level.

If NOT token on a daily time frame gives a strong candle closing above $0.017, then in the coming days we may see a massive price surge of 35% of even more.

Additionally, the 24-hour open interest for the NOT token reflects strong trader and investor interest and confidence, as it has surged by more than 118%.

Will NOT sustain this recent gain?

However, there is another concern about whether NOT tokens will sustain this massive price surge. The answer is very clear, if user engagement and continuous development remain consistent, there is a high chance that the price will be sustained.

According to an on-chain analytic firm CoinGlass, in this challenging situation, short sellers have liquidated a massive $4.72 million short position in the last 24 hours.

In the same period, bulls have liquidated nearly $2.23 million of long positions. This higher short liquidity position signals that bulls are officially back in Notcoin (NOT).

Realistic or not, here’s NOT’s market cap in BTC’s terms

As of this writing, NOT was trading near $0.016, and in the last 24 hours, it experienced a huge 55% price surge. The trading volume in the same period has also surged more than 330%, flashing notable traders’ and investors’ participation in NOT token.

If we look at the performance of NOT over a longer period, in the last seven days, despite continuous ups and downs in the market, the token was up by 11%.