- Bitcoin dropped 3.89% amid Mt. Gox repayments and the German government’s sell-off.

- 75.48% of BTC holders were “in the money,” indicating potential bullish sentiment.

The crypto market saw yet another challenging day as the global market cap dropped to $2.04 trillion, marking a 3.33% decrease in the past 24 hours.

Bitcoin takes a hit!

Bitcoin [BTC], in particular, has garnered significant attention due to a steep decline over the past week, fueled by rumors surrounding the Mt. Gox repayment process.

In fact, on the 5th of July, as Mt. Gox commenced repayments, BTC fell to its lowest level since February.

Compounding the issue, the German government also chose this moment to sell off their Bitcoin holdings, amplifying fear, uncertainty, and doubt (FUD) within the community.

Remarking on the same, Devchart, Co-Founder ChartAlerts noted,

“The awkward moment where you want to refill on this dump but you also realize that Mt Gox and the German govt have $10 billion worth of #BTC ready to go on the market in the near future.”

As of the latest update, BTC was trading at $55,459.62, reflecting a 3.89% decline over the past 24 hours.

This downward trend was further confirmed by the Relative Strength Index (RSI), which has dipped well below the neutral level and was nearing the oversold zone at press time.

Historically, oversold and overbought conditions have often signaled a potential pullback. Therefore, there remains hope that BTC might recover once the Mt. Gox repayment process concludes.

Impact on Bitcoin Cash can’t be overlooked

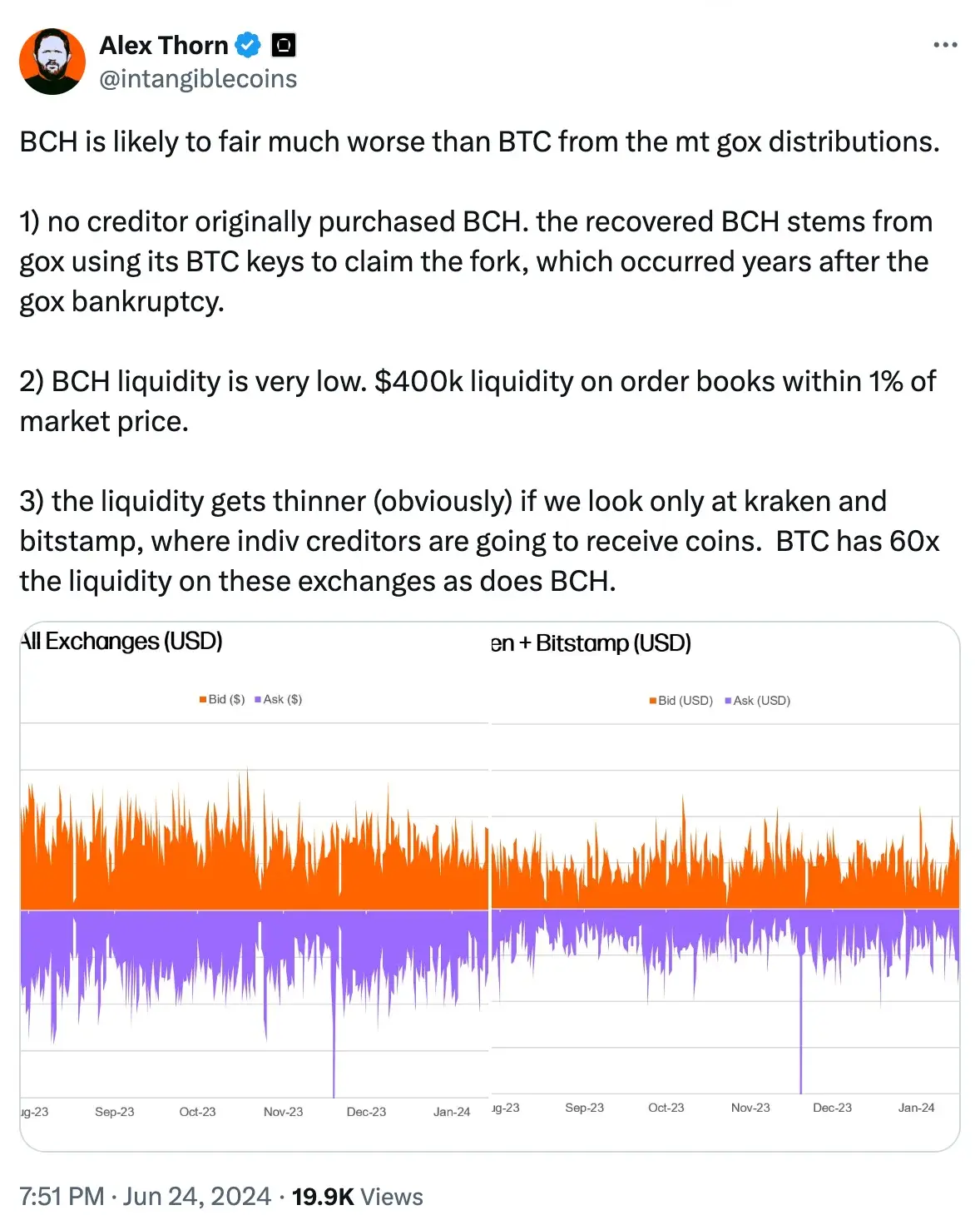

Bitcoin Cash [BCH] was also down by 6.79%, changing hands at $311.35 at press time.

The difference in the decline suggests that BCH suffered a significantly greater loss compared to BTC. This was earlier highlighted by Alex Thorn, Head of Firmwide Research at Galaxy Digital, when he noted,

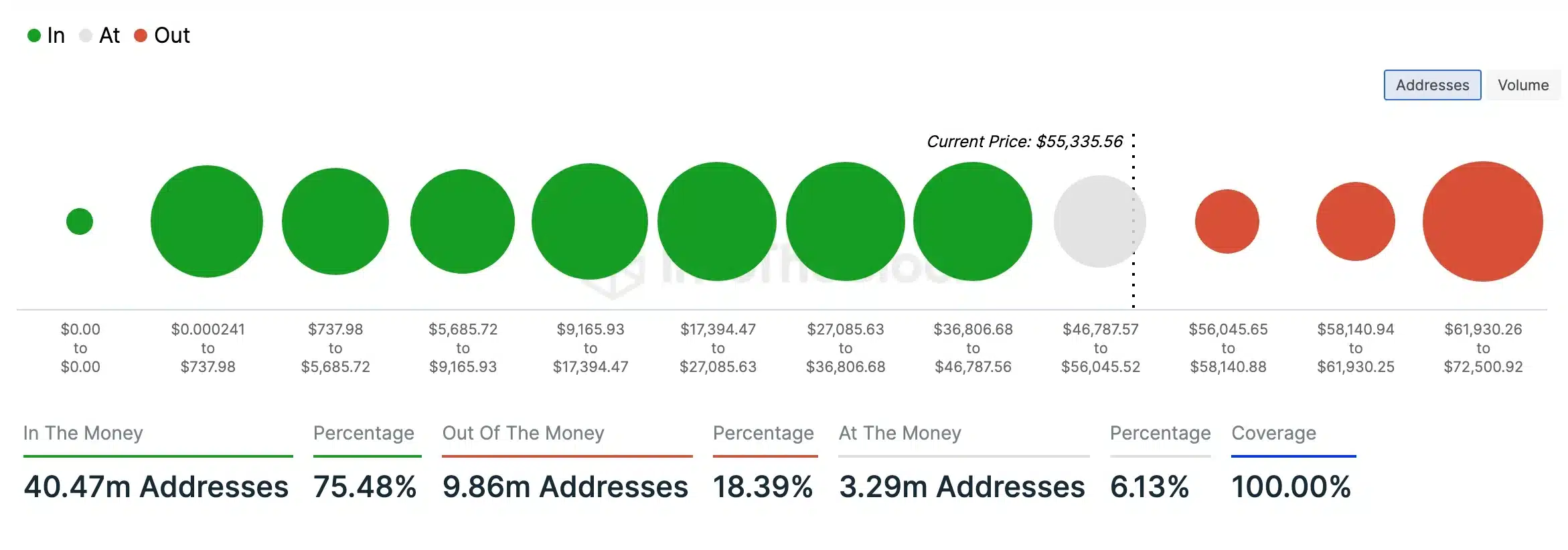

However, AMBCrypto’s analysis of IntoTheBlock data revealed that a significant majority (75.48%) of BTC holders held tokens valued higher than their purchase price at press time, indicating that they were “in the money.”

In contrast, a smaller segment (18.39%) held BTC tokens that are worth less than their purchase price, placing them “out of the money.” This suggested a bullish sentiment or potential upcoming price surge for Bitcoin.

CEX HTX summed it up well when they noted,