Car tax changes that were originally scheduled to be introduced today could have seen drivers pay five times their original bills if they weren’t scrapped earlier this year.

HM Revenue and Customs (HMRC) announced in February that it will begin charging double cab pick-up trucks as company cars from the start of July in a move designed to reform motoring taxation.

It said it was introducing these changes as a “pragmatic way” to resolve ongoing issues with the suitability and classification of double cab pick-up trucks.

These pick-up trucks, most of which have a payload of more than 1,000kg, are considered to be commercial vehicles, meaning businesses can reclaim tax on their vans and pick-up trucks.

Do you have a story you’d like to share? Get in touch by emailingmotoring@gbnews.uk

The new rules would have seen these vehicles defined as company cars, leaving them eligible to pay massive rates of Benefit-in-Kind (BiK) taxes.

Most pick-up trucks have large petrol and diesel engines which release higher levels of pollution, meaning they would be liable to pay some of the highest rates of BiK tax.

While electric vehicles currently pay just two per cent BiK tax, the most polluting vehicles – namely those which release more than 160g of CO2 per kilometre – have to pay a rate of 37 per cent.

One of the most popular pick-up trucks in the UK is the Wildtrak version of the diesel Ford Ranger, which would be required to pay the 37 per cent rate, in addition to a list price of £47,220 (including VAT).

Under the proposed rules from HMRC, a 20 per cent taxpayer in England could have to pay £291 per month, while a 40 per cent taxpayer would have to fork out £582 per month in company car tax.

However, drivers were able to breathe a sigh of relief around one week later when HMRC announced that it would be scrapping the proposed changes after speaking with the industry.

The car taxes were seen as overzealous, with some drivers and businesses potentially seeing their bills increase fivefold almost overnight.

Commenting on the decision to scrap the new rules, HMRC confirmed that the guidance had been withdrawn and that any arrangements to help businesses would also be scrapped.

It added that the rules would have had an impact on businesses and individuals which was not part of the Government’s aim to support these groups.

The withdrawal notice stated: “The Government will consult on the draft legislation to ensure that it achieves that outcome before introducing it in the next available Finance Bill.”

Nigel Huddleston, Financial Secretary to the Treasury, said: “We will change the law at the next available Finance Bill in order to avoid tax outcomes that could inadvertently harm farmers, van drivers and the UK’s economy.”

Despite the HMRC U-turn, Paul Hollick, chair of the Association of Fleet Professionals (AFP), said the move to suggest such terms was “embarrassing”.

LATEST DEVELOPMENTS:

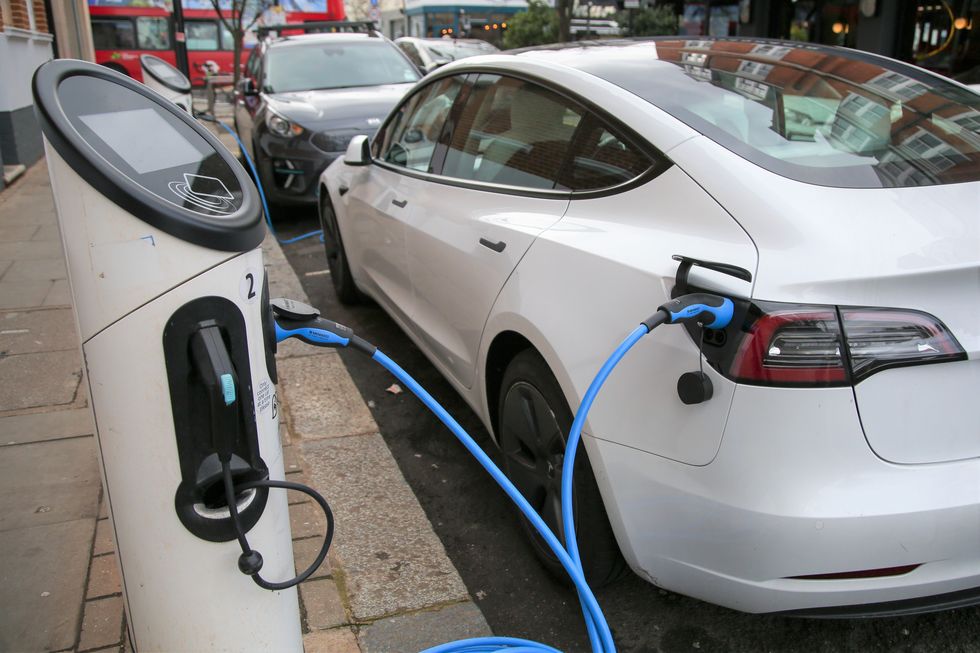

Electric vehicles attract the lowest rate of Benefit-in-Kind taxes

GETTY

He did warn that the issue may not be completely closed as lawmakers look to introduce the rules regardless, with the next Government having to deal with it.

The expert said: “The Government with the HMRC do want to try and change things… that will happen at some point in the next couple of years,” he told Fleet News at 10.