- BTC could hit $350K in two months per Kiyosaki.

- However, the level is way too bold to be achieved statistically in 2024.

Industry titans and market analysts expect Bitcoin [BTC] to breach its current $60K – $71K price consolidation range before end-year. For Galaxy Digital’s Mike Novogratz, the end-2024 target was $100K if the $73K ATH was cleared.

Another crypto analyst, PlanB, saw $500K per BTC as a possible fete in the current market bull run.

However, Rober Kiyosaki, an entrepreneur and author of ‘Rich Dad, Poor Dad,’ has made a bold prediction – $350K per BTC in the next two months.

‘BITCOIN will be $350,000 by August 25, 2024, is not a lie. It’s a prediction. It’s speculation, it’s an opinion, but it’s not a lie.’

Kiyosaki added that the prediction was possible because of ‘the incompetence of our leaders, President Biden, Treasury Secretary Yellin and Fed Chair Powell.’

Is $350K per BTC too optimistic?

However, another renowned crypto analyst, Willy Woo, deemed Kiyosaki’s projection too bold to be achieved within such a short timeframe. The move to $350K per BTC would mean 5X in two months.

Maybe in 2025, Woo noted,

‘Statistically possible in 2025 if monetary debasement resumes. Next to no chance in 2024 outside of a bullish black swan.’

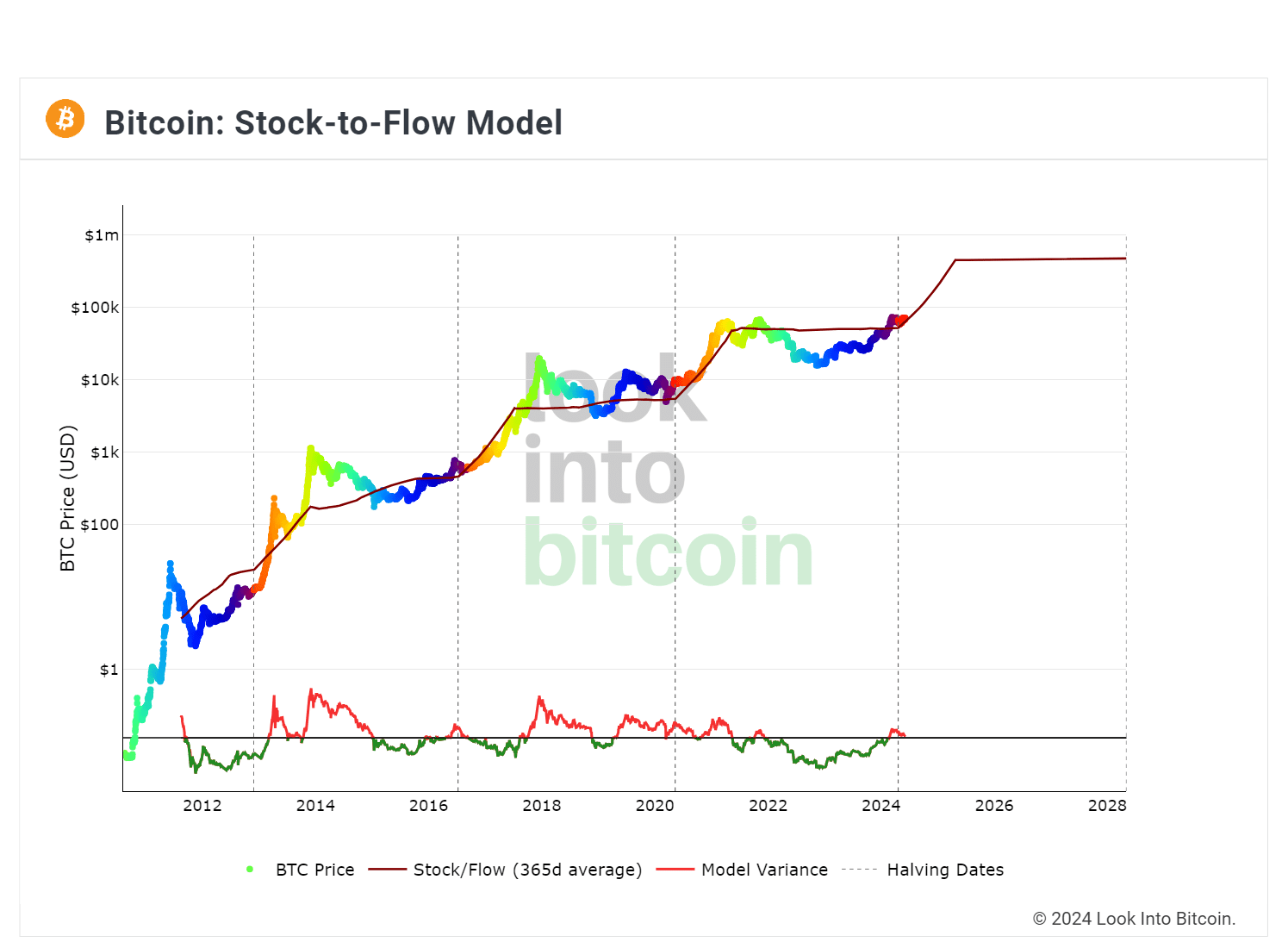

Interestingly, the Stock-to-Flow (S2F) model confirmed Woo’s argument and forecasted that $350K per BTC was only possible in March 2025.

The S2F model, based on BTC’s supply schedule, has fairly predicted BTC’s future price prospects in the past. Given that mined BTC reduce with time, BTC supply also declines and the S2F ratio value increases with time.

That’s why, according to the model, BTC’s value is expected to rise as supply reduces in the future. Based on the model, BTC could hit $80K – $85K in August 2024, as opposed to the $350K projected by Kiyosaki.

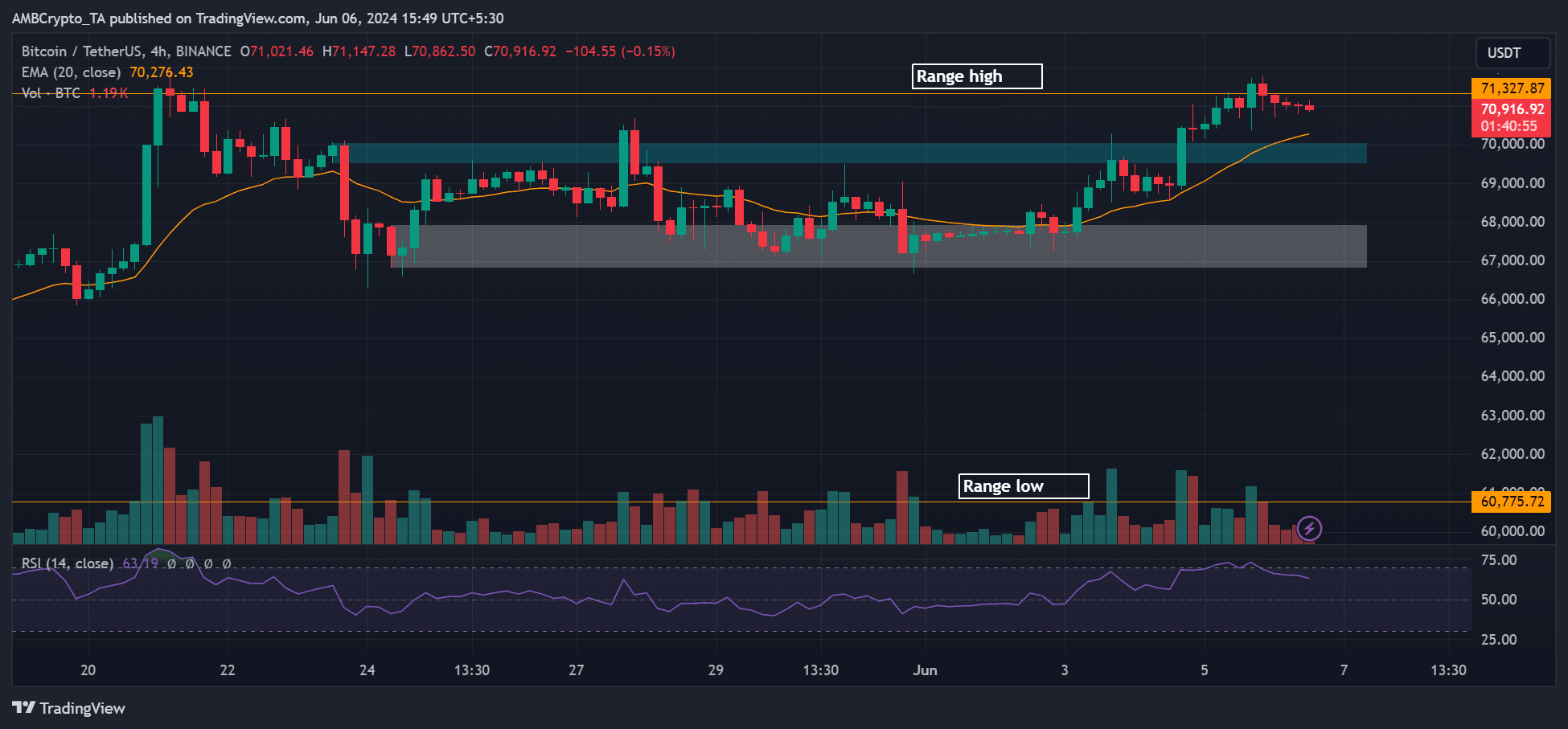

In the meantime, BTC could ease back to the short-term demand, which was a previous supply of around $70K, before going higher to the $72K mark.

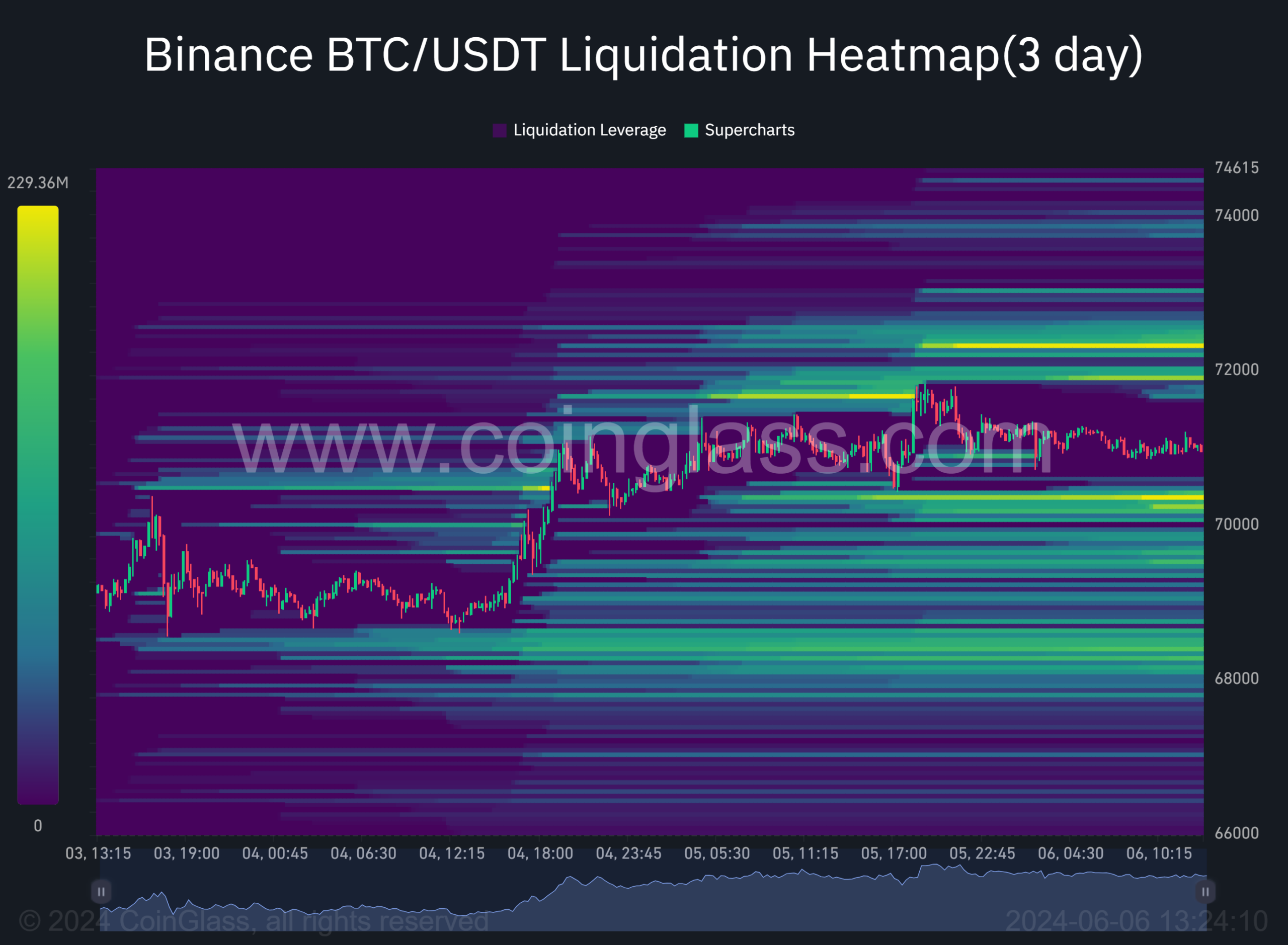

The Coinglass liquidity data supported the scenario, showing key magnetic levels for price action at $70K and $72.3K, as shown by the orange levels.