- Injective’s latest update could have big implications for the protocol and INJ’s price

- At the time of writing, the altcoin’s price action was stagnant though

The Injective protocol is in the news today after it announced the roll-out of its first exchange traded product (ETP) dubbed AINJ. This ETP will be issued by 21Shares. This is a development that could be the start of a major trend, one that provides blockchain and crypto exposure to investors in traditional finance.

According to the official announcement, the development marks an important milestone for Injective in its plan for integration with traditional financial markets. In fact, the blog revealed that the new ETP will make it possible for traditional investors to benefit from staking rewards.

Impact on Injective protocol

A potentially significant benefit for Injective is that the AINJ ETP provides an avenue that major institutions can use to invest in the protocol in a transparent and regulated manner.

It could thus present an opportunity to secure institutional liquidity from traditional investment markets. If that happens, Injective will be on the fastlane for more utility.

Will Injective ETP launch affect INJ’s price action?

An influx in institutional liquidity into the Injective protocol through the AINJ ETP has the potential to improve utility and hence, demand for INJ. Such an outcome would drive up the price of the token, and potentially encourage more long-term HODLing. An outcome that would lead to positive price action in the long term.

However, a look at INJ’s price action revealed that the announcement may not have had a significant impact on its price. It was valued at $26.85, at the time of writing, after encountering some resistance within the same price range. This is a sign of a slowdown in demand, one compared to what we saw following its recent recovery from its monthly lows.

While INJ’s short term performance may not indicate any noteworthy impact from the AINJ ETP, its effect might be felt in the long-term.

As for the short-term scenario, we evaluated INJ’s transaction and address activity to establish the state of the network.

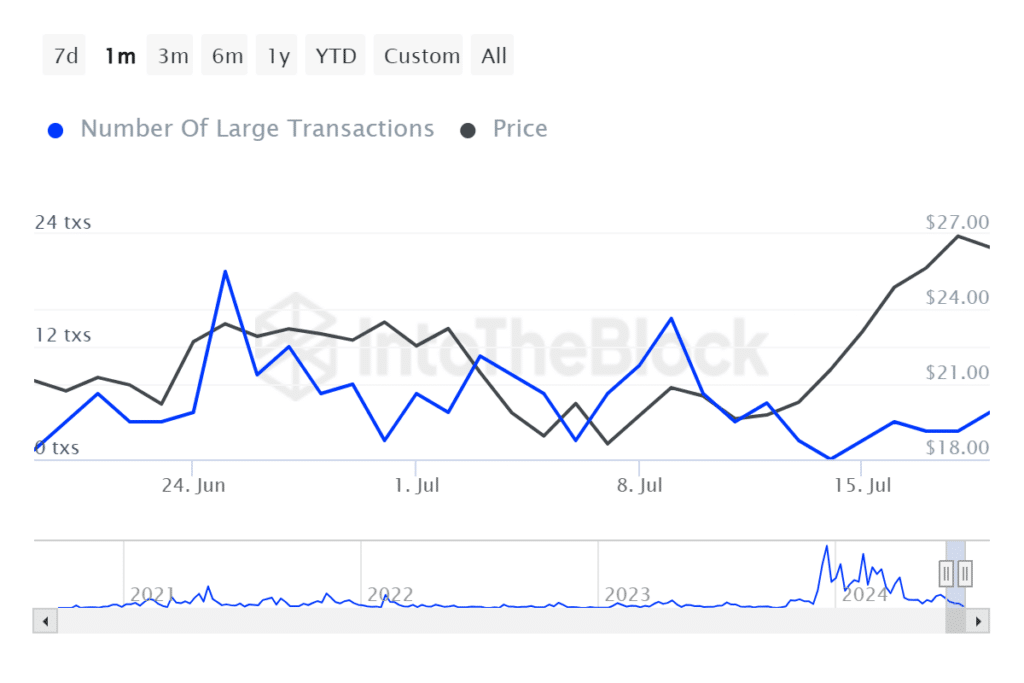

Large transactions valued above $100,000 have registered a slight uptick since 14 July. Alas, the number of transactions remained limited – A sign of low activity.

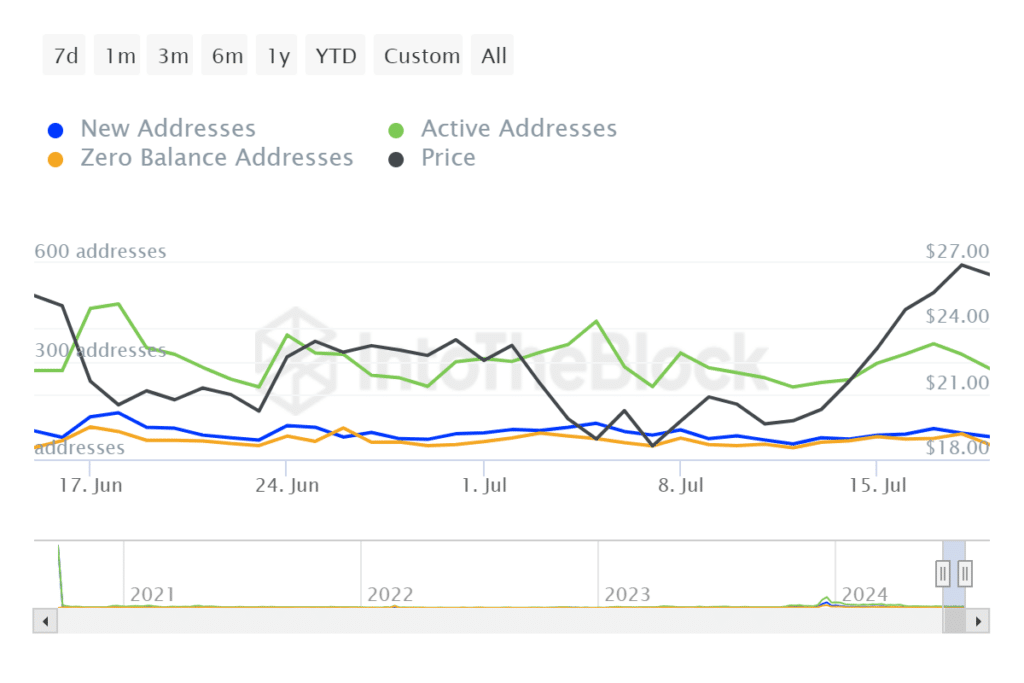

We also observed that over the same weekly period, the number of active addresses and new addresses went up slightly.

Nevertheless, the numbers remained within modest levels and even slowed down over the last 2 days.

Simply put, a look at the aforementioned on-chain metrics revealed that INJ’s demand is now recovering, albeit gradually. That may be the reason why INJ’s upside will be limited in the short term.