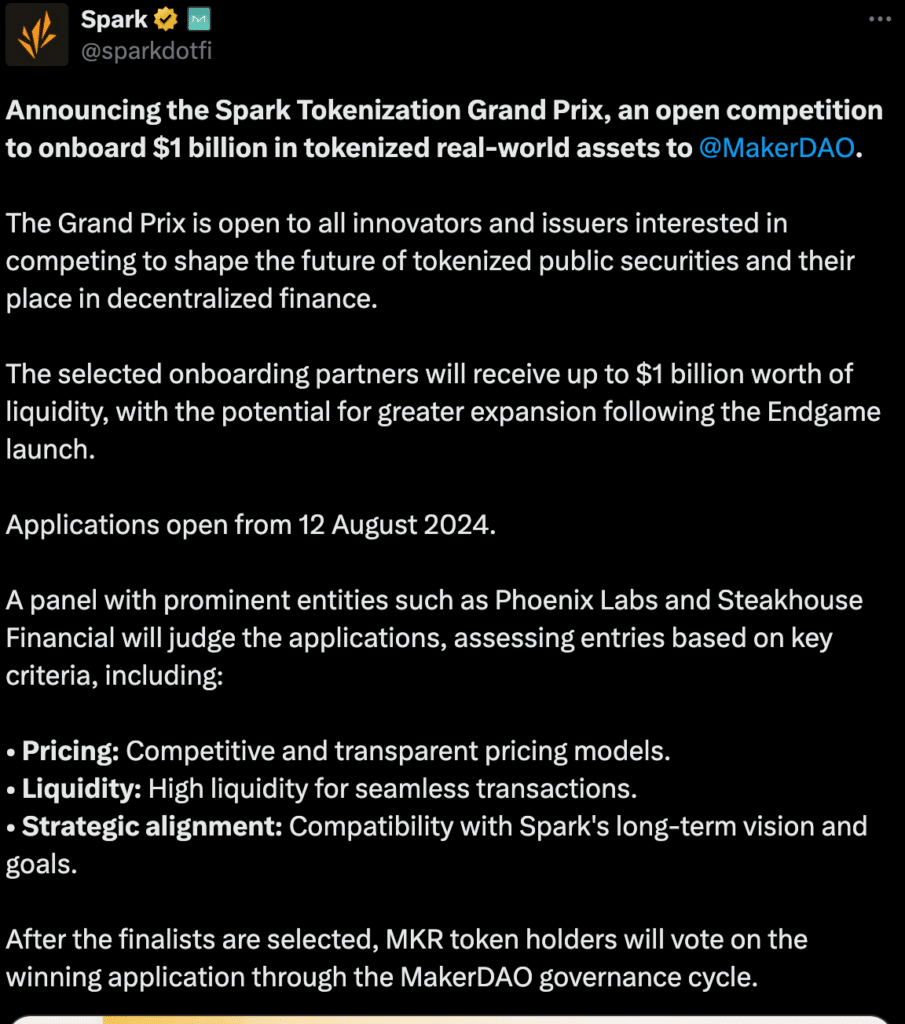

- MakerDAO announced an open competition to invest $1 billion in tokenized U.S Treasury offerings

- MKR’s price registered a significant uptick thanks to this announcement

MKR witnessed a significant uptick in price over the last 24 hours after a long period of negative price action. Its latest hike in value can be attributed to the protocol’s recent announcements made at ETHCC.

Making the right moves

A key catalyst for the price hike is MakerDAO’s unveiling of a $1 billion investment program focused on tokenized U.S. Treasury offerings. This move has attracted significant interest from industry giants, including BlackRock’s BUIDL, Superstate, and Ondo Finance, who have all expressed their keenness to participate.

By prioritizing the integration of Real-World Assets (RWAs) like U.S government bonds and bills, MakerDAO is addressing a critical challenge in the cryptocurrency space and solidifying its position as a DeFi pioneer. This initiative aligns with Founder Rune Christensen’s overarching Endgame Plan and represents a substantial restructuring of the protocol’s reserve strategy.

Ultimately, the goal is to fortify MakerDAO’s dominance within the DeFi ecosystem.

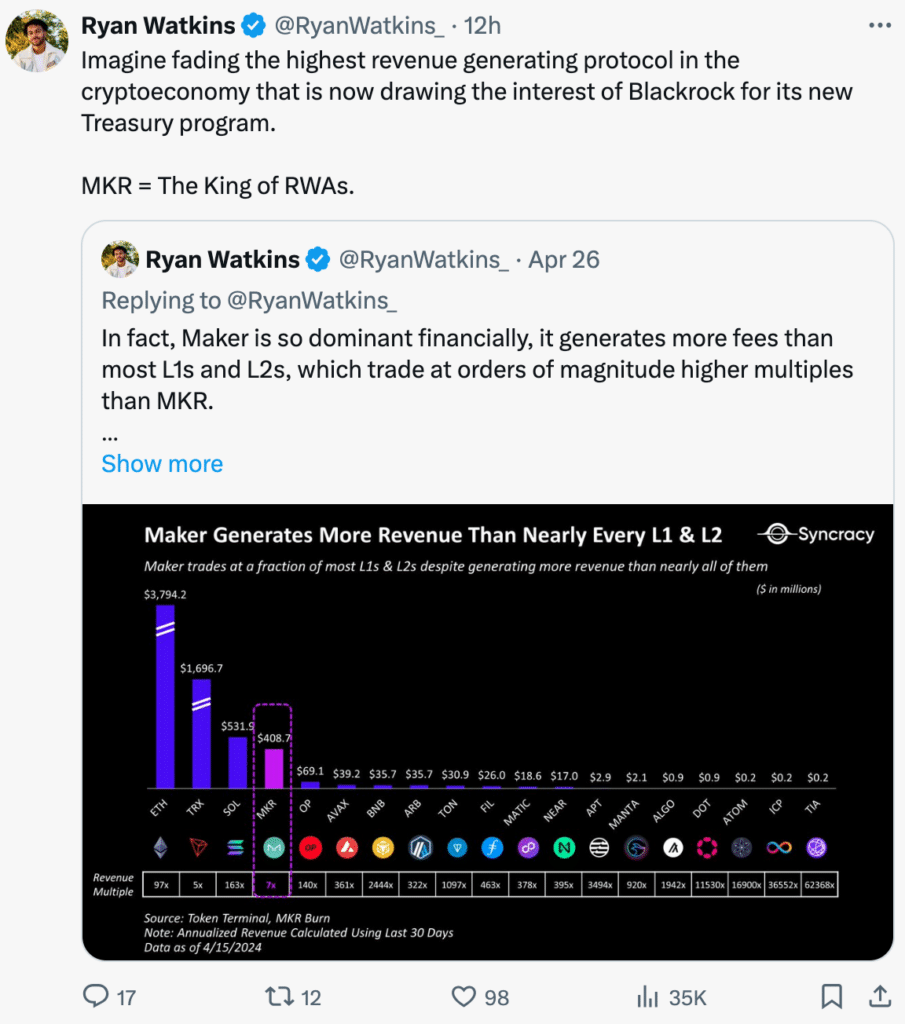

Beyond the institutional interest sparked by MakerDAO, another key driver of the protocol’s growth is its exceptional revenue-generating capacity.

Consider this – Ryan Watkins, Co-founder of Syncrancy Capital, highlighted MakerDAO’s financial dominance, noting that it surpasses most Layer-1 and Layer-2 networks in terms of fee generation. This, despite those networks commanding significantly higher valuations.

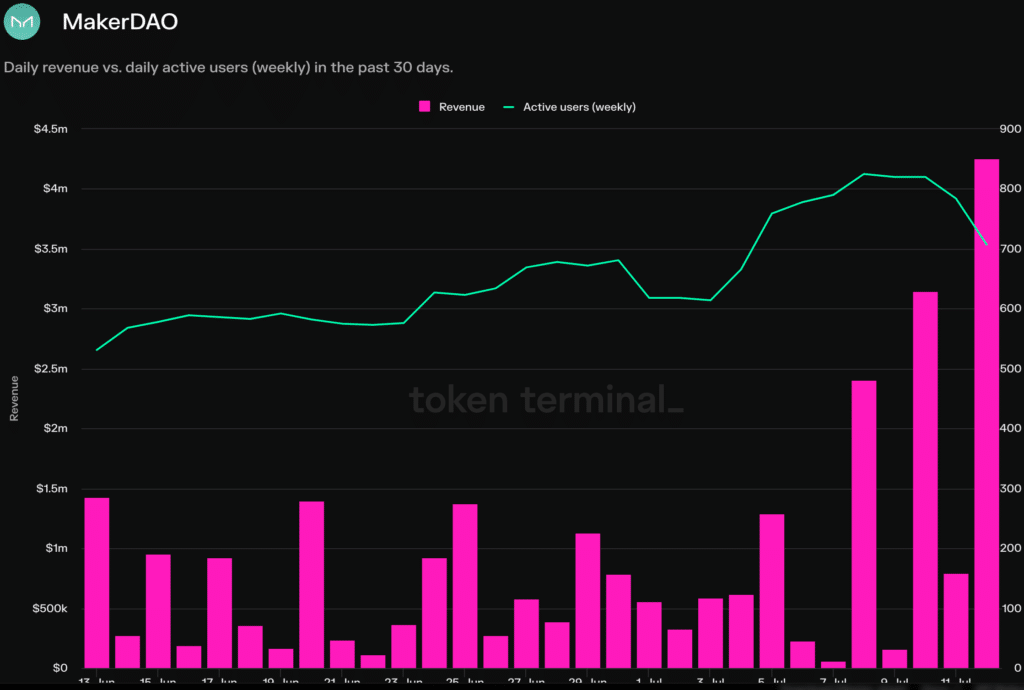

Here, it’s worth highlighting that AMBCrypto’s analysis of Token Terminal’s data revealed that the daily active addresses surged by 39.8% over the past month. Additionally, the revenue generated by MakerDAO also grew by 25% over the aforementioned period.

MKR sees green

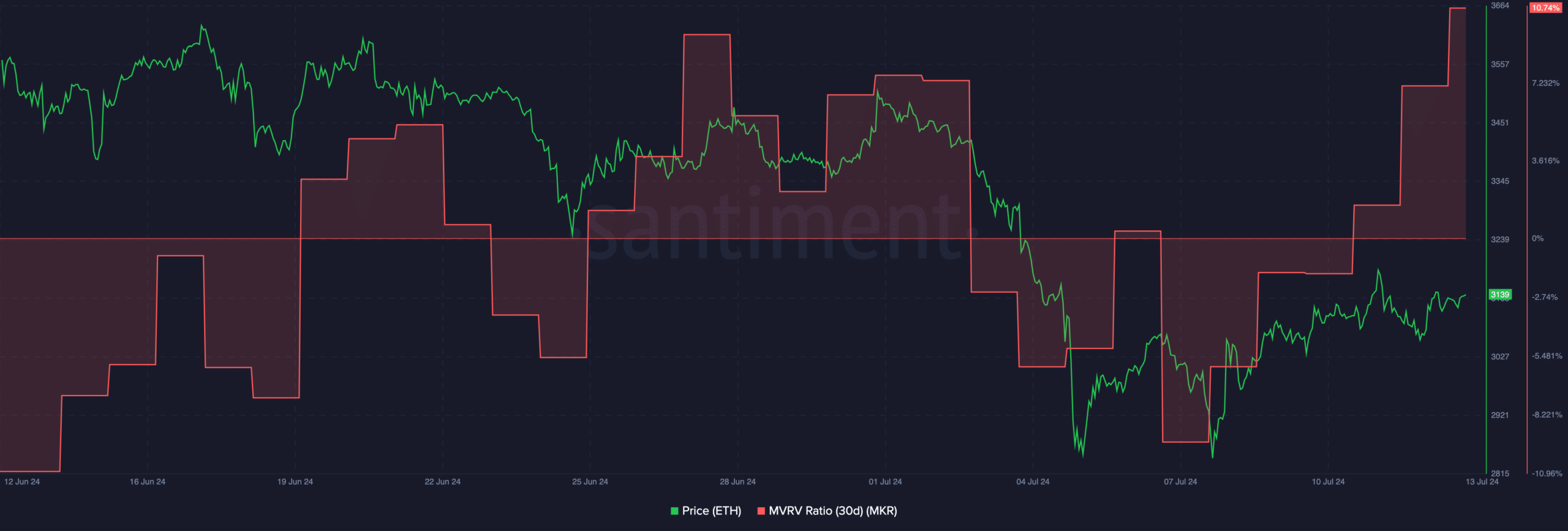

At press time, MKR was trading at $2,651.82, with its price up by 10.9% over the last 24 hours. Along with the surge in price, the altcoin’s MVRV ratio also registered a massive uptick, indicating high profitability amongst users.

Usually, a high MVRV ratio means that some holders are bound to indulge in profit-taking, causing a correction in its price.

Realistic or not, here’s MKR’s market cap in BTC’s terms

However, due to the fact that the MKR token gives voting rights to its holder, it could be safe to assume that some buyers are not looking to profit but to have a say in which direction MakerDAO goes.

This could mean that some holders may choose not to sell and the selling pressure may not be as profound, compared to other tokens with high MVRV ratios.