- SEC approved spot Ethereum ETFs – A sign of increasing crypto acceptance

- However, differences in BTC and ETH spot ETF approvals have raised a few questions

Crypto-adoption seems to be on the rise after the United States’ Securities and Exchange Commission (SEC) gave the green light to Ethereum [ETH] spot exchange-traded funds (ETFs).

This approval finally came through on 23 May, approximately five months after the SEC approved Bitcoin [BTC] spot ETFs on 11 January.

However, a closer look at the approval processes of these two cryptocurrencies reveals clear distinctions between them.

Contrary to the spot Bitcoin ETFs, which were approved by a vote from the SEC’s five-member committee, including Chair Gary Gensler, the spot Ether ETFs were approved by the SEC’s Trading and Markets Division.

This raises a crucial question – Why didn’t SEC Chair Gary Gensler vote on the ETH ETF? Does he still consider Ether a security rather than a commodity?

Was ETH ETF approval a political stunt?

James Seyffart, a research analyst at Bloomberg Intelligence, addressed this question when he implied that broader political implications and the SEC’s internal dynamics are the primary reasons behind this distinction. On 24 May, he tweeted,

Here, Seyffart is underlining that the approval was issued through delegated authority and though it’s a common practice, it leaves ambiguity about individual positions as there aren’t any public commissioner votes to see.

He further went on to add that even though the approval is final for now, SEC Commissioners like Crenshaw could still request a review.

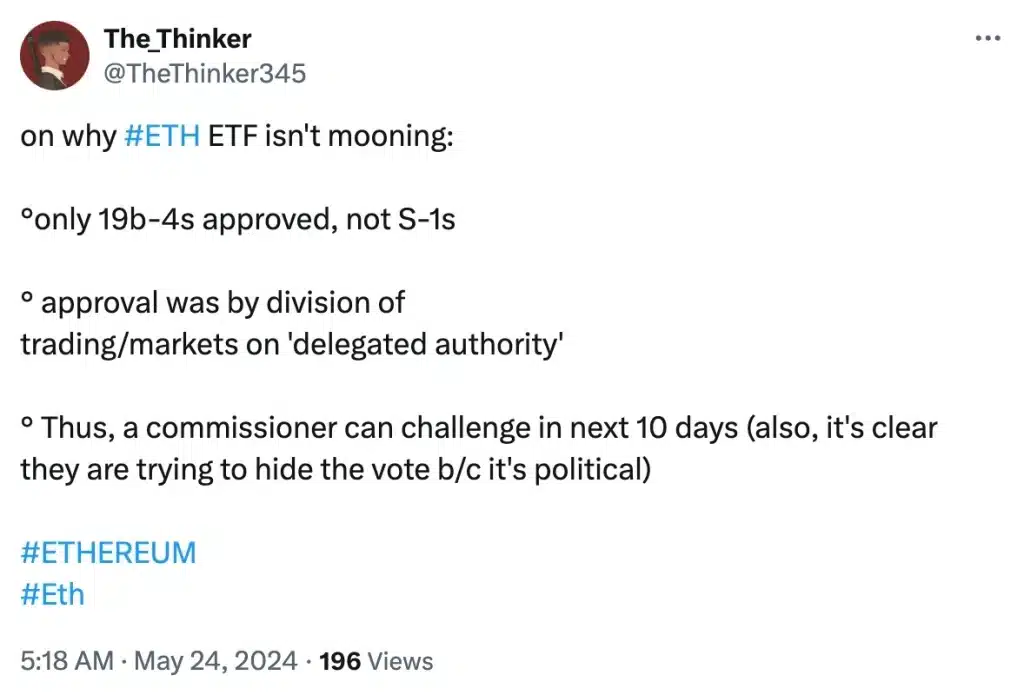

These differences didn’t go unnoticed among many in the crypto-community, especially in light of ETH’s indifference on the charts immediately after the approval. In fact, one commentator went on to say,

Bitcoin vs. Ethereum

The differences between the two ETFs were evident not only in the approval processes, but also in the subsequent price actions of both cryptos. Following the approval of the BTC ETF, Bitcoin’s price surged from just below $46,000 to around $47,500. Meanwhile, ETH saw an 11% hike, surpassing $2,500 for the first time in 20 months.

However, the market reaction was quite different after the approval of the ETH ETF. On 24 May, Bitcoin, along with various other altcoins including Ethereum, registered significant declines on the charts.

Gensler maintains his anti-crypto position

As expected, people are still speculating on the reasons behind Gensler’s voting approach during the BTC ETF approval, and his absence from the vote for the ETH ETF. His history of anti-crypto positions, however, implies that he favors neither Bitcoin nor Ethereum.

The same was evidenced by a recent remark he made,

“Crypto is a small piece of our overall markets. But, it’s an outsized piece of the scams and frauds and problems in the markets.”