GETTY IMAGES

GETTY IMAGESHarland and Wolff, the Belfast-based shipbuilder which built the Titanic, has formally entered administration for the second time in five years.

Last week the company’s board had warned that the move was inevitable.

The administration process is confined to the holding company, Harland & Wolff Group Holdings plc, with the operational companies which run the yards continuing to trade.

Its main yard is in Belfast with other operation at Appledore in England and Methil and Arnish in Scotland.

‘Reduce the headcount’

The company’s executive chairman, Russell Downs, is optimistic that a new owner or owners will be found for the yards.

Gavin Park and Matt Cowlishaw of Teneo Financial Advisory have been appointed as joint administrators.

The holding company currently has 66 employees.

In a statement Harland and Wolff said: “The Administrators will unfortunately be required to reduce the headcount upon appointment.

“A number of employees will be retained to provide certain required services to the operational companies under a transitional services agreement with the Administrators.”

The company has also restated that the administration process means that shareholders in Harland and Wolff will see the value of their investment wiped out.

Titanic builders

Vernon Lewis Gallery/Stocktrek Images/Getty

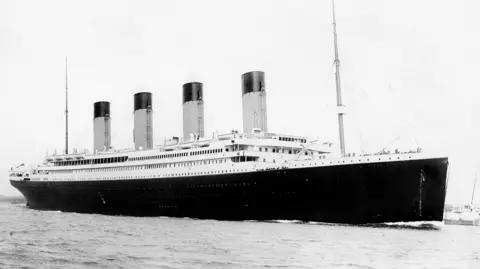

Vernon Lewis Gallery/Stocktrek Images/GettyFamous for building the Titanic, the Belfast shipyard was founded in 1861 by Yorkshireman Edward Harland and his German business partner, Gustav Wolff.

By the early 20th Century, Harland and Wolff dominated global shipbuilding and had become the most prolific builder of ocean liners in the world.

What happened to Harland and Wolff?

Harland and Wolff was bought out of administration in 2019.

Its then Norwegian owners had withdrawn support and the business fell into insolvency, having not built a ship in a generation.

The new owner, Infrastrata, was a small London-based energy firm which did not have significant experience in marine engineering.

Infrastrata later changed its name to Harland and Wolff and in 2022 won a major Royal Navy contract as part of a consortium led by Navantia, Spain’s state-owned shipbuilder.

However financial losses mounted as it scaled up its operations.

GETTY IMAGES

GETTY IMAGESThe 2021 accounts, which covered a 17-month period, showed a loss of more than £25m.

The audited annual accounts for 2022 showed turnover of £28m and a loss of about £70m with the auditor’s opinion of “material uncertainty” about the firm’s ability to continue as a going concern.

Unaudited accounts for 2023 saw a loss of £43m.

The company was increasingly reliant on high-interest borrowings from a specialist US lender, Riverstone.

It was also pinning its hopes on getting government loan guarantee that would allow refinancing with more conventional lenders.

In July the new government confirmed there would be no support as there was “a very substantial risk that taxpayer money would be lost”.

Russell Downs, a restructuring expert, was parachuted in to act as executive chairman and began a strategic review of the business along with advisors from Rothschild bank.