The takeover of Hargreaves Lansdown is today’s main City event after the investment platform backed a £5.4 billion private equity bid.

Investors also heard from FTSE 250-listed Bellway amid more signs of improving house market trends.

The week ended on a calmer note after Monday’s US recession fears and a big slide for the Nikkei 225.

FTSE 100 Live Friday

-

Hargreaves Lansdown backs £5.4bn bid

-

Bellway hails improved trends

-

Market volatility eases after Monday rout

UK economy may have boosted by the “Taylor Swift effect” in June, say City forecasters

12:36 , Simon Hunt

The elusive growth that the UK economy has struggled to generate may have been given a much needed boost by the first round of Taylor Swift concerts in June, official GDP figures are expected to show next week.

As the US singing superstar prepares to return to Britain for four more dates at Wembley Stadium on her record breaking Eras tour, official GDP data may reveal “Taylor made growth” in June when it is published by the Office for National Statistics (ONS) on Thursday, according to City analysts.

They say that spending on hotels, restaurant meals, and memorabilia by the hundreds of thousands of fans watching her concerts in Edinburgh, Cardiff, Liverpool and London – combined with England’s extended run in the Euro’s men’s football championship – will have helped keep the huge services sector stay in positive territory.

Clearbank enters Europe with new banking licence

11:08 , Simon Hunt

London-based ClearBank has today announced it has expanded into Europe, after securing a Credit Institution Licence from the European Central Bank, under the supervision of De Nederlandsche Bank.

Expansion to Europe marks the first step in ClearBank’s international growth plans, with the company now competing on a regional level.

“We’re thrilled to be open for business in Europe – and this marks the first milestone in our global expansion strategy. We will soon fulfil client demand for Euro clearing, as well as Sterling, with the US Dollar coming next,” said Charles McManus, CEO at ClearBank.

“ClearBank has succeeded in one of the most competitive fintech environments in the world, demonstrating the strength of our people, technology, and business model.”

FTSE 100 higher, Deliveroo progress continues after first profit

10:04 , Graeme Evans

The FTSE 100 index is ending a turbulent week back where it started as sentiment continues to improve after Monday’s stock market rout.

Stronger mining stocks helped London’s top flight put on 0.4% or 33.89 points at 8178,86, having been as low as 7923 on Monday afternoon.

Anglo American rose 2.5% or 58p to 2280p, while copper miner Antofagasta improved 37.5p to 1851.5p.

Glencore also lifted another 8.7p to 411.9p following this week’s decision to retain its coal operations, a move that should accelerate returns to shareholders.

Other blue-chip stocks with momentum included Ladbrokes owner Entain, which put on 19.8p to 569.8p following yesterday’s upgrade to full-year guidance.

Outside the top flight, Deliveroo continues to attract interest after yesterday’s first profit and £150 million shares buyback announcement.

Today’s rise of 4.8p to 145.7p means the value of the food delivery platform has jumped by a fifth in the past week. UBS today reiterated its Buy recommendation and upped its target price to 257p from 217p previously.

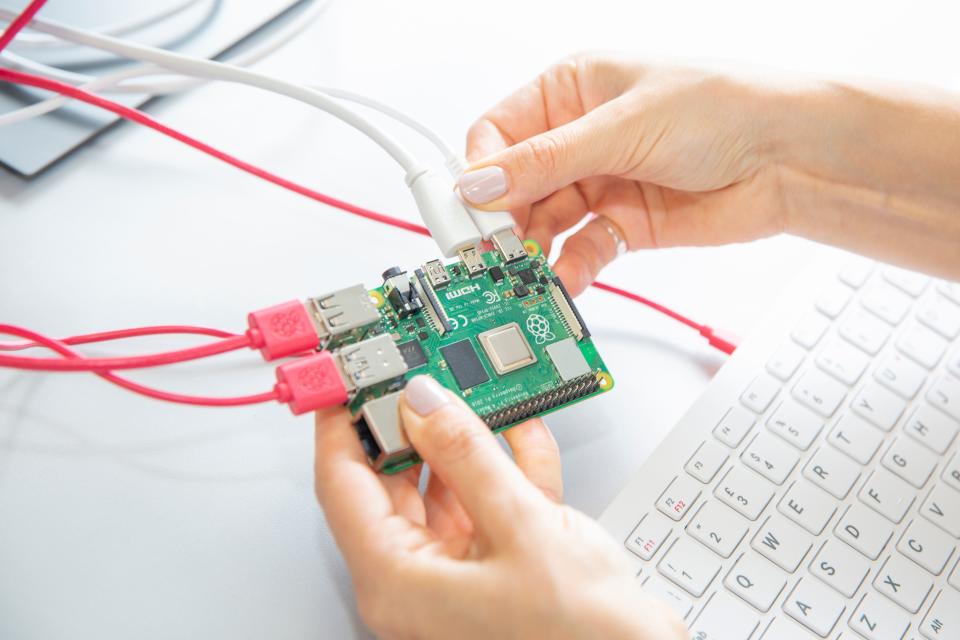

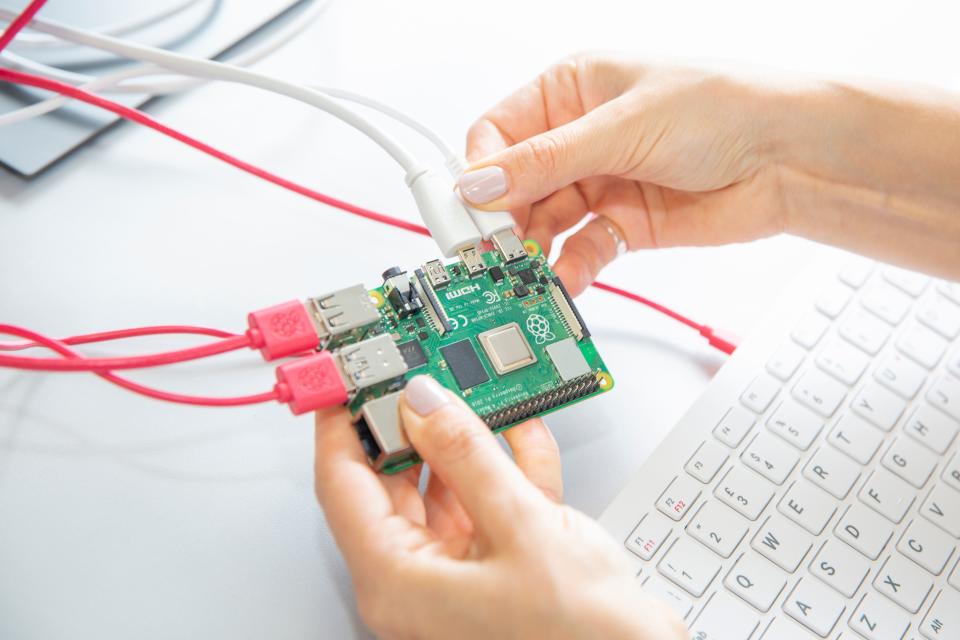

Raspberry Pi shares rise on new product launch

09:06 , Simon Hunt

Raspberry Pi has launched a new computer model as the Cambridge-based business further new growth opportunities.

The model, called the Pico 2, which comes with the company’s new RP2350 chip, offers “faster processors, more memory, upgraded interfacing capabilities, and new security features,” according to Raspberry Pi.

It is now available to pre-order for £4.80 and is set to remain in production until at least 2040.

“With a higher core clock speed, double the on-chip SRAM, double the on-board flash memory, more powerful Arm cores, optional RISC-V cores, new security features, and upgraded interfacing capabilities, Raspberry Pi Pico 2 delivers a significant performance and feature boost, while retaining hardware and software compatibility with earlier members of the Raspberry Pi Pico series.,” Raspberry Pi said.

Raspberry Pi shares rose 2.5% to 283p.

Vix fear index falls back after volatile start to week

08:54 , Graeme Evans

The VIX index, which is a gauge of investor uncertainty, is back near where it started the week after jumping 181% at one point in Monday’s market rout.

It peaked at 65.73, with the eventual 65% increase at Monday’s close above any movement seen during the global financial crisis.

The index closed last night at 23.79 after US recession fears eased on figures showing the largest drop in weekly initial jobless claims in nearly a year.

UBS Global Wealth Management said market volatility could remain elevated for some time, particularly as liquidity is typically thinner over the summer.

However, it said that much about the backdrop remains positive: “Although the US economy now looks to be growing at a rate slightly below trend, fears of a recession look premature.”

The focus of investors now shifts to economic releases next week, including the US inflation reading for July and retail sales.

UBS added: “Markets will be hoping for evidence of a soft landing – with inflation gradually falling toward the Federal Reserve’s 2% target and consumer spending moderating without pointing to an economic contraction.”

FTSE 100 higher on mining strength, Bellway up 2% after update

08:30 , Graeme Evans

Stronger commodity stocks have boosted the FTSE 100 index, with the top flight up by 0.3% or 25.64 points to 8170.61.

Anglo American led the sector after shares rose 2.5% or 54.5p to 2276.5p, while Rio Tinto improved 68.5p to 4999p..

Glencore also lifted 6.9p to 410.1p following this week’s decision to retain its coal operations, a move that should accelerate returns to shareholders.

Hargreaves Lansdown rose 2% or 25.5p to 1103p after its board backed a private equity-led takeover that values shares at 1110p before the payment of a 30p dividend.

The FTSE 250 index lifted 0.4% or 80.79 points to 20,589.37, with Bellway up 2% or 64p to 2722p after it reported improving trends in its trading update.

Bellway hails improvements in housing market, including ‘affordability’

07:55 , Michael Hunter

Bellway became the latest major developer to back government plans to build more homes, saying today that there were signs of improvement in the market, including over affordability.

The FTSE 250 company said it completed 7,654 homes in the year to the end of July, down from 10,945 a year ago, but ahead of expectations.

The average selling price slipped to £308,000 , down from £310,306, but also above forecasts.

Housing revenue fell to £2.35 billion, down from £3.4 billion.

Jason Honeyman, chief executive, said:

“The improving trading backdrop, combined with the strength of our outlet opening programme, has generated healthy growth in the year-end order book.

“As a result, we are in a strong position to return to growth in financial year 2025, as previously guided. “

He added:

“ We are encouraged by the new Government’s plans to increase the supply of new homes across the country and welcome its plans to reform the planning system.”

Oil price back near $80 a barrel

07:43 , Graeme Evans

Oil prices are set for their first weekly rise in over a month, with Brent Crude this morning at just above $79 a barrel.

This compares with $74.38 a barrel at the start of this week.

Yesterday’s 1% increase came as the demand outlook received a boost from US figures showing weekly jobless claims below forecasts.

Middle East tensions have also lifted the price in recent days, having fallen back from the $87 a barrel of a month ago.

Hargreaves Lansdown backs £5.4 billion private equity bid that will take the fund manager off the stock exchange

07:23 , Michael Hunter

Hargreaves Lansdown backed the £5.4 billion bid for the FTSE 100 fund manager today from a private equity consortium, a deal that will end its time as a listed company.

The Bristol-based finance firm has been listed in London since 2007. It said today that the final offer valued its shares at 1140p in cash and would include a 30p per share dividend for the financial year which ended on 30 June.

Compared to the Hargreaves Lansdown share price before the approach was first made in April, the price is at a premium of over 54%.

The consortium is made up of CVC, Nordic Capital and ADIA.

Hargreaves Lansdown is named after its founders – Peter Hargreaves and Stephen Lansdown – who set it up as an investment tip sheet. It now runs a state-of-the-art trading platform from which clients can run their own portfolios and pensions.

Peter Hargreaves still owns 20% of the firm, which has £155 billion in assets under management. Stephen Lansdown owns around 6%.

US stocks rally at end of turbulent week, FTSE 100 seen higher

07:03 , Graeme Evans

Leading Wall Street benchmarks closed sharply higher last night after weekly jobless claims figures eased concerns about the US economy.

The Dow Jones Industrial Average rose 1.8%, the S&P 500 index by 2.3% and the tech-focused Nasdaq Composite by 2.9%.

Stocks on the front foot included Nvidia, which put back 6% after recent heavy losses, and Google parent company Alphabet with a gain of 2%.

The FTSE 100 benefited from the US bounce during yesterday’s session, reversing an initial 1% decline to close 0.3% or 21.91 points lower at 8144.97.

The top flight is forecast to add 11 points at 8156 as market conditions begin to steady after Monday’s heavy selling caused by US recession fears.

Recap: Yesterday’s top stories

06:58 , Simon Hunt

Good morning from the Standard City desk.

Here’s a summary of our top headlines from yesterday: