- Altcoins show signs of recovery, with potential for significant gains.

- Analysts highlight strong market movements and positive technical patterns signaling a bullish trend.

The altcoin market is showing signs of reversing its recent bearish trend, having plunged from a peak of over $1.26 trillion in March to as low as $960 billion by 24th June.

With the advent of July, a significant rebound has been observed. Over the past several days, the altcoin market has experienced a nearly 3% surge, once again surpassing the $1 trillion mark, currently valued at $1.025 trillion.

This resurgence in the altcoin market is closely linked to a parallel recovery in Bitcoin [BTC]. BTC has seen approximately a 2.7% increase in the past week, with prices oscillating between $62k and $63k.

An analyst from Crypto Banter’s The Sniper Trading Show highlighted that Bitcoin’s trading at this range indicates a bullish push in the last 24 hours, exemplified by the formation of a “pin bar candle.”

Such a pattern often hints at a potential bullish reversal. During The Sniper Trading Show, the analyst emphasized how the bulls have driven the price upward at the weekly and monthly close. This signals strong upward momentum.

Altcoins potential to surge 40% this week

The analyst noted that altcoins, including prominent names like Solana [SOL], are demonstrating significant activity. Analyzing the Ethereum to Bitcoin chart, he pointed to a possible trend reversal and a resurgence in Ethereum’s value.

He remarked that many altcoins are showing potential on higher time frames. With robust RSI levels indicating a bullish divergence, these coins could soon outperform both Ethereum and Bitcoin.

Moreover, the overall sentiment in the cryptocurrency market appears to be shifting positively. The analyst highlighted the decreasing dominance of USDT as a signal that the market bottom might be forming, paving the way for substantial gains.

This sentiment is bolstered by strategic movements in coins like Cardano [ADA], RUNE, Injective [INJ], Chainlink [LINK], Fantom [FTM], Solana, and Polkadot [DOT], all of which are forming bullish patterns that could lead to significant price increases.

The analyst particularly predicts a robust performance for altcoins in the coming week, forecasting gains of 20-40%.

While optimistic about altcoins, he maintains a more reserved outlook for Bitcoin, suggesting a gradual increase in its price without anticipating an immediate surge to $70,000.

Observed bullish signs: Cardano as a case study

To assess potential bullish trends in altcoins, Cardano [ADA] serves as an illustrative case study. We will be looking at Cardano’s major metric for any notable sign of bullishness. It can perhaps give more credibility to the analyst’s prediction of a 40% rise for altcoins.

First of all, it is worth noting the asset’s market performance — ADA has exhibited a robust performance recently; it rose by 2.5% over the past day, continuing a week-long upward trend that has seen a total increase of over 5%. ADA was trading at $0.4064 at press time.

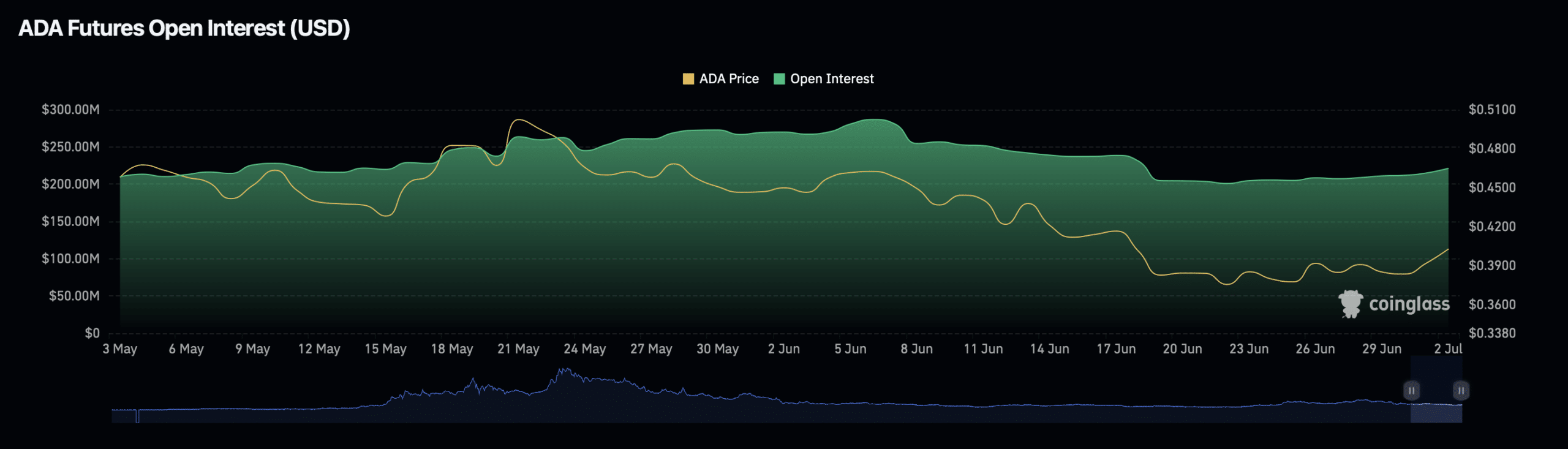

The asset’s open interest, a measure of the total number of outstanding derivative contracts like futures and options that have not been settled, reflects its rising price trend.

According to Coinglass, ADA’s open interest has risen by 3% in just one day, now valued at $223.28 million.

This surge aligns with an approximate 1% increase in open interest volume, now standing at $257.59 million, indicating a growing commitment from traders.

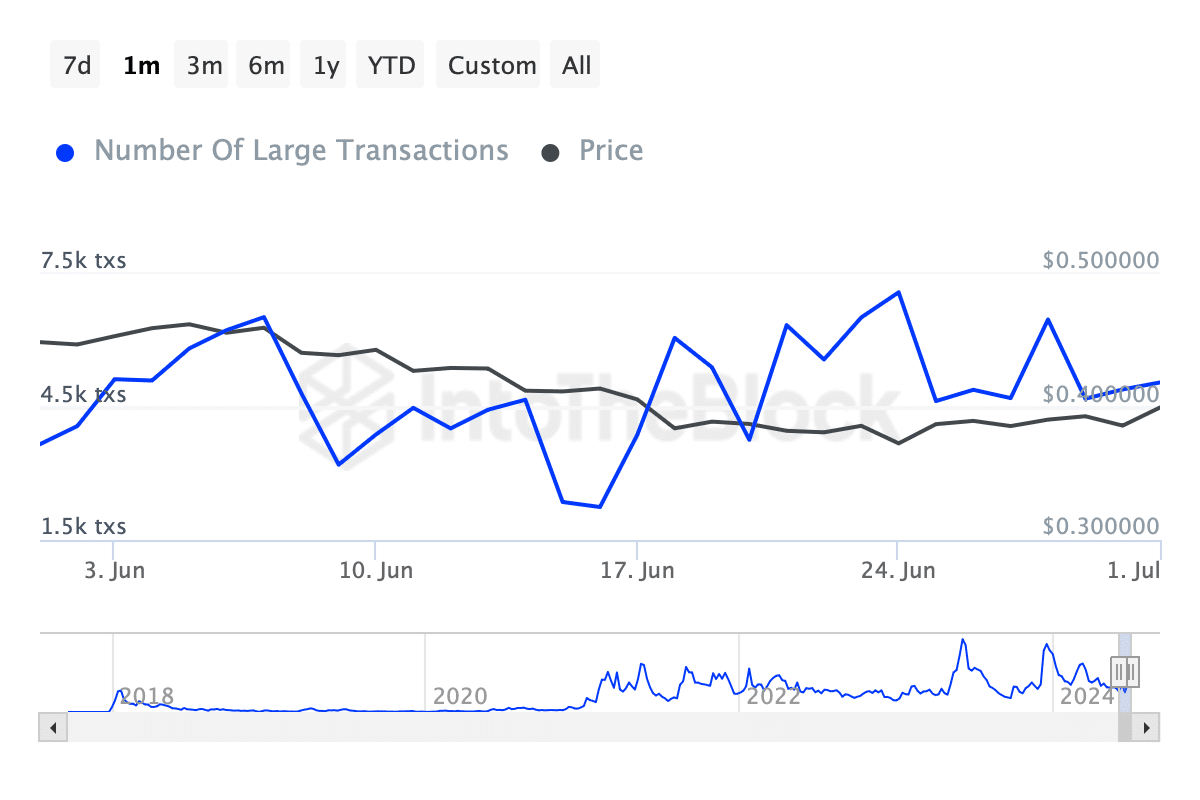

Moreover, whale activity in ADA has also seen a significant uptick. Data from IntoTheBlock reveals a sharp increase in large transactions (over $100,000), climbing from less than 4,000 transactions last month to over 5,000 transactions today.

This rise in high-value transactions is an indicator of growing interest from major investors, potentially influencing ADA’s price positively.

Is your portfolio green? Check out the Cardano Profit Calculator

These robust metrics in ADA’s trading activity hint that both Cardano and the broader altcoin market may be gearing up for a bullish surge, as anticipated by the analyst on Crypto Banter.

This optimistic scenario was further supported by an earlier AMBCrypto report, suggesting that the recent negative sentiment around ADA could be a precursor to a significant price rebound.