- FLOKI has a strong bullish market structure.

- The recent surge underlined bullish intent and demand backed the meme token’s bullish expectations.

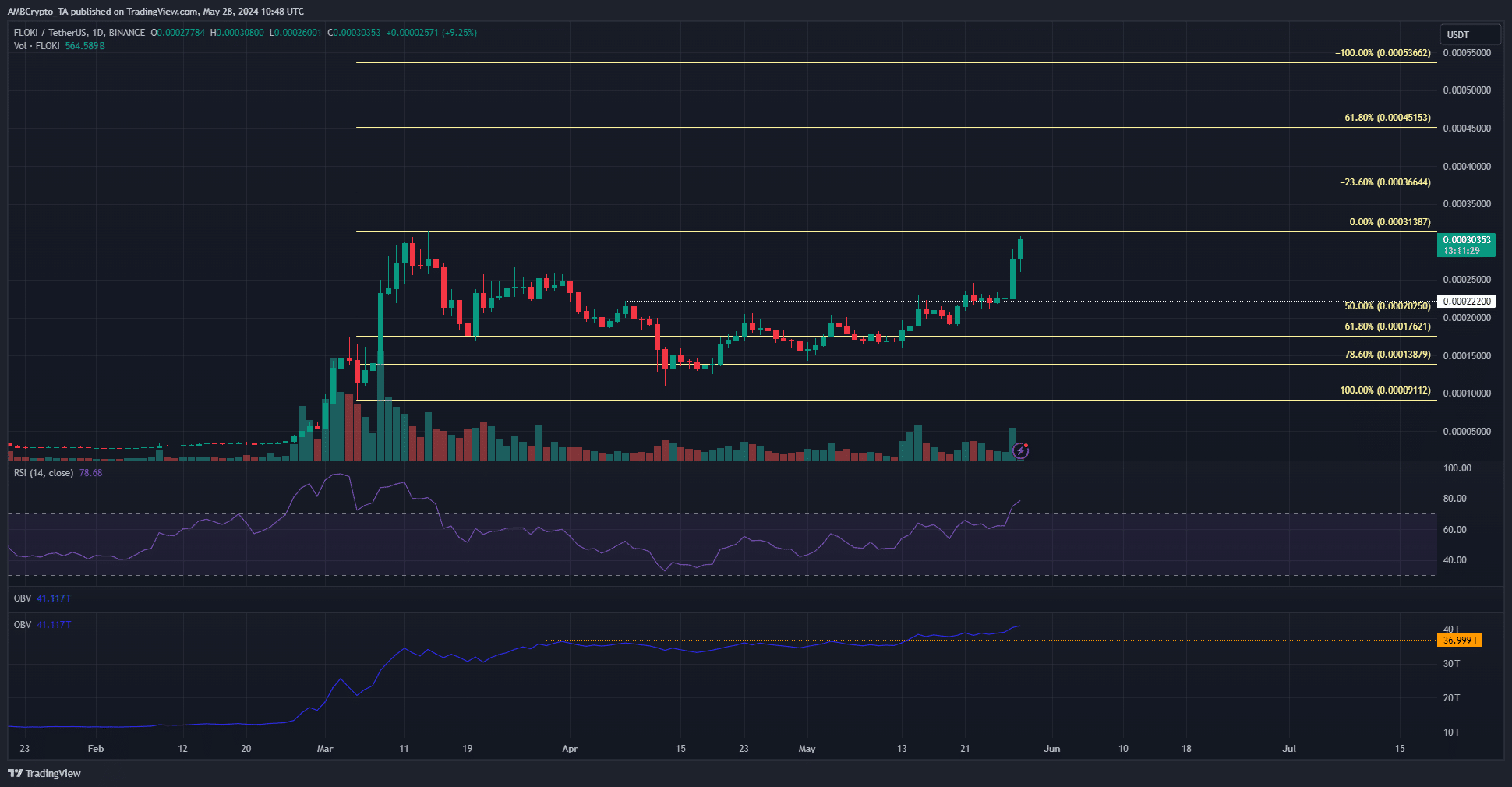

Floki Inu [FLOKI] was in the midst of a sharp upward move. It has gained 35% since Monday, the 27th of May, and was just 3% beneath the highs that rebuffed FLOKI bulls back in the first half of March.

The FLOKI price prediction was strongly bullish based on the technical indicators and the price action on the daily chart, calling for another 50% rally. News that whales were loading up on FLOKI added to the bullish expectations.

The bullish structure break saw FLOKI prices skyrocket

The $0.000222 level, marked in white, was one of the significant lower highs that the memecoin set during its retracement since mid-March. The 50% retracement level at $0.000202 was another short-term resistance level.

Over the past ten days, both levels were flipped to support. The OBV also broke out past a local resistance level marked in orange, reinforcing the idea of firm buying pressure.

The RSI on the daily chart was at 78 and in the overbought zone. This does not signal an immediate pullback but served to outline the strength of the bulls during the recent move. More gains are expected in the coming days.

A dip to the $0.000275-$0.000284 region would offer a buying opportunity. The 61.8% and 100$ Fibonacci extension levels at $0.00045 and $0.00053 are the next take-profit targets.

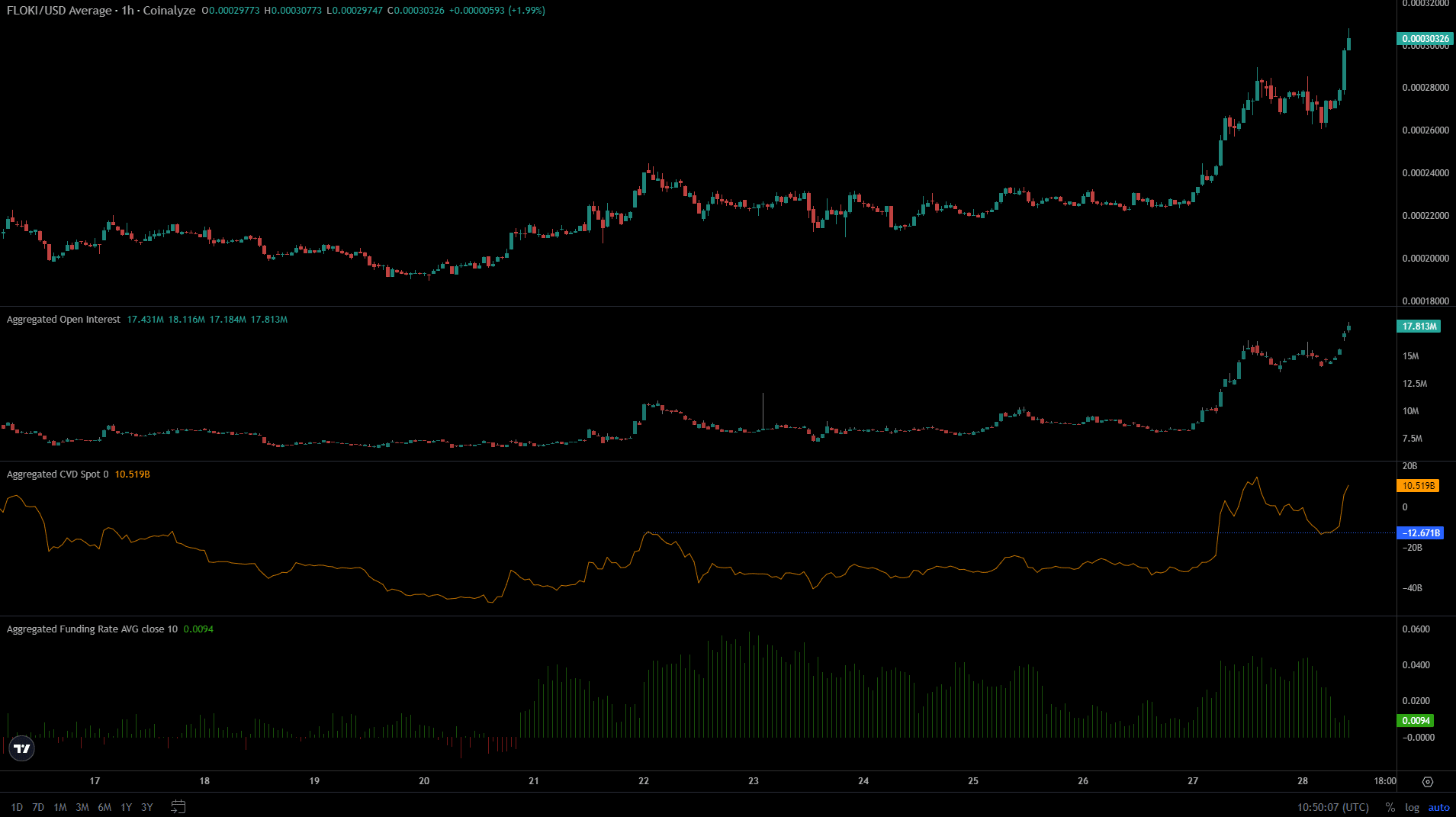

The bullish sentiment was present in both spot and futures markets

Source: Coinalyze

Like the OBV, the spot CVD also reclaimed a local resistance level as support and has surged higher in the past 24 hours. This was a strong sign of demand in the spot market.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The Open Interest also saw a frenzied uptrend in the past two days alongside the price.

The funding rate was also positive but slid lower in recent hours. This might be a sign that some futures traders believed the market is overextended and were no longer in long positions.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.