The Australian stock market has experienced a slight downturn over the last week, falling by 1.4%, though it remains up by 6.5% over the past year with earnings expected to grow by 13% annually. In such a fluctuating environment, identifying stocks that are potentially undervalued can offer opportunities for investors looking for value in a growing market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

GTN (ASX:GTN) |

A$0.445 |

A$0.85 |

47.4% |

|

MaxiPARTS (ASX:MXI) |

A$2.04 |

A$3.94 |

48.2% |

|

ReadyTech Holdings (ASX:RDY) |

A$3.25 |

A$6.26 |

48% |

|

Australian Clinical Labs (ASX:ACL) |

A$2.48 |

A$4.73 |

47.5% |

|

Strike Energy (ASX:STX) |

A$0.225 |

A$0.45 |

50.3% |

|

IPH (ASX:IPH) |

A$6.25 |

A$12.00 |

47.9% |

|

Regal Partners (ASX:RPL) |

A$3.29 |

A$6.18 |

46.8% |

|

Core Lithium (ASX:CXO) |

A$0.085 |

A$0.17 |

49.5% |

|

Millennium Services Group (ASX:MIL) |

A$1.145 |

A$2.24 |

48.9% |

|

SiteMinder (ASX:SDR) |

A$5.20 |

A$10.02 |

48.1% |

Let’s review some notable picks from our screened stocks

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.54 billion.

Operations: The company’s revenue is primarily derived from its leisure and corporate travel services, generating A$1.28 billion and A$1.06 billion respectively.

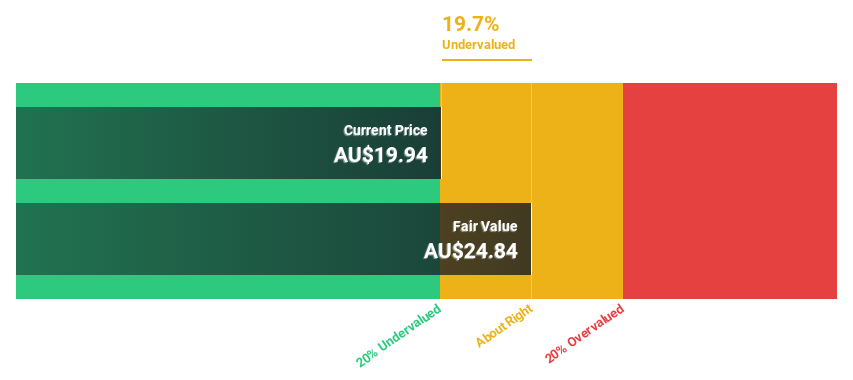

Estimated Discount To Fair Value: 19.7%

Flight Centre Travel Group (FLT), priced at A$20.63, is trading below our estimated fair value of A$25.62, indicating a potential undervaluation. Recently profitable, FLT’s earnings are expected to increase by 18.8% annually, outpacing the Australian market forecast of 13%. Despite this growth, its revenue increase of 9.7% annually exceeds the market’s 5.2%, but does not reach high growth thresholds. With a projected high return on equity of 21.8% in three years, FLT combines solid profitability prospects with moderate undervaluation based on cash flows.

Overview: HMC Capital Limited, operating in Australia, manages real estate-focused funds with a market capitalization of approximately A$2.63 billion.

Operations: The firm oversees funds concentrated on real estate, generating revenues of approximately A$80.29 million.

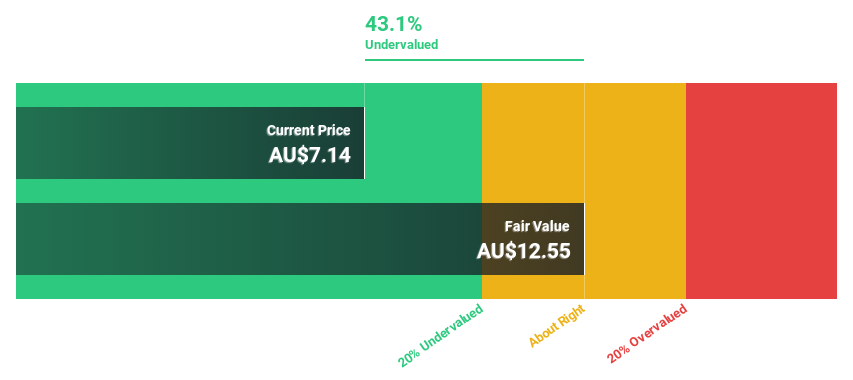

Estimated Discount To Fair Value: 43.1%

HMC Capital, with a current price of A$7.14, appears undervalued against a fair value estimate of A$12.55, reflecting a significant discount. The company’s revenue growth is robust at 20.1% annually, outperforming the Australian market’s 5.2%. Despite recent shareholder dilution from multiple equity offerings totaling A$188.30 million, HMC’s earnings are poised to grow by 16.9% per year, surpassing the market average of 13%. However, its forecasted return on equity in three years is relatively low at 10.5%.

Overview: Judo Capital Holdings Limited, operating in Australia, offers a range of banking products and services tailored to small and medium-sized businesses, with a market capitalization of approximately A$1.38 billion.

Operations: The company generates revenue primarily through its banking segment, totaling A$328.70 million.

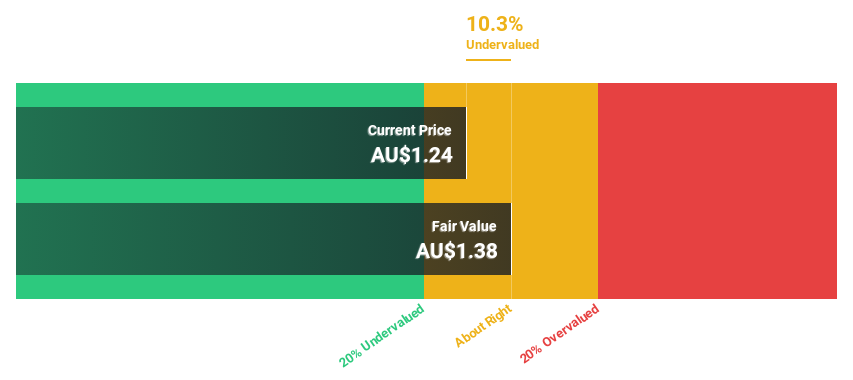

Estimated Discount To Fair Value: 10.3%

Judo Capital Holdings, priced at A$1.24, trades below its calculated fair value of A$1.38. While its revenue growth is projected at 16.6% annually, outpacing the Australian market’s average of 5.2%, its earnings are expected to increase by 26.32% per year, also above the national trend of 13%. Recently added to the S&P/ASX 200 Index, Judo shows potential despite a modest forecasted return on equity of 10.1% in three years and a valuation that is not significantly undervalued based on discounted cash flows.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FLT ASX:HMC and ASX:JDO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com