- Ethereum’s netflow from exchanges increased by over 6%.

- ETH has remained below its resistance level.

Over the past month, Ethereum [ETH] has experienced a notable trend of outflows from exchanges. It indicated that investors were moving their holdings away from trading platforms.

Despite the reduction in exchange balances, the volume of ETH being staked has continued to grow. ETH has been endeavoring to stabilize its price amid these shifts in investor behavior and network participation.

Ethereum increase monthly outflow

AMBCrypto’s analysis of Ethereum’s transaction data revealed a significant net outflow from exchanges. The data showed that over 1 million ETH moved out of trading platforms in June.

This outflow, valued at approximately $3.8 billion, marked a considerable 6.4% month-over-month change. It indicated a substantial reduction in the amount of Ethereum held on exchanges.

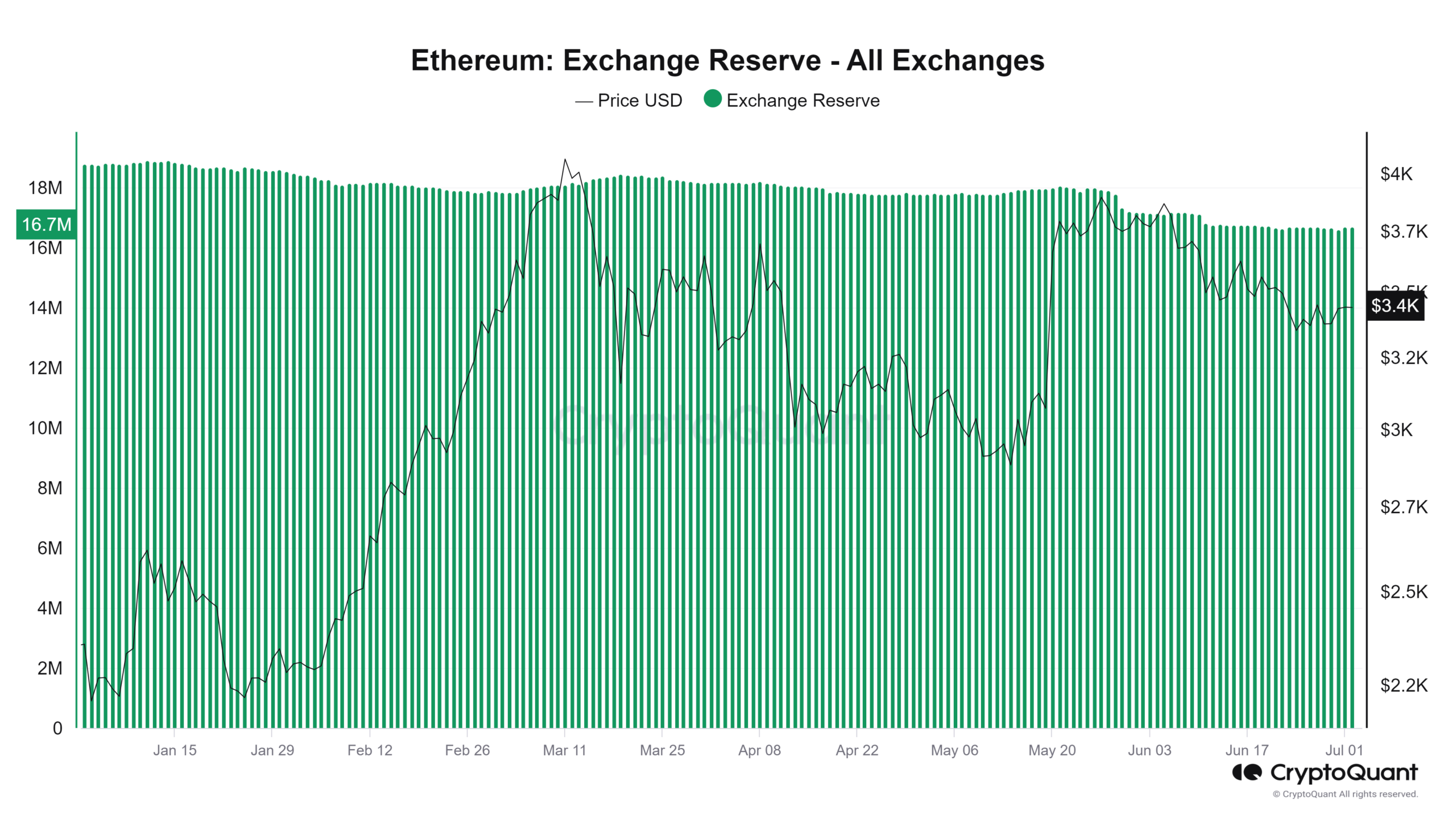

Further examination of the exchange reserve data from CryptoQuant highlighted the magnitude of this shift. At the beginning of June, the total ETH held in exchange reserves was over 17 million.

By the end of the month, this figure had decreased to around 16 million ETH. As of this writing, the reserve was around 16.6 million ETH.

This decline in exchange reserves typically suggests a couple of strategic movements by investors.

It is either an increase in long-term holding, as investors withdraw ETH to secure wallets, or a move to engage more actively in the Ethereum staking process.

This is especially true with the ongoing development towards Ethereum 2.0. Both scenarios imply a bullish sentiment among holders.

Total Ethereum staked increases

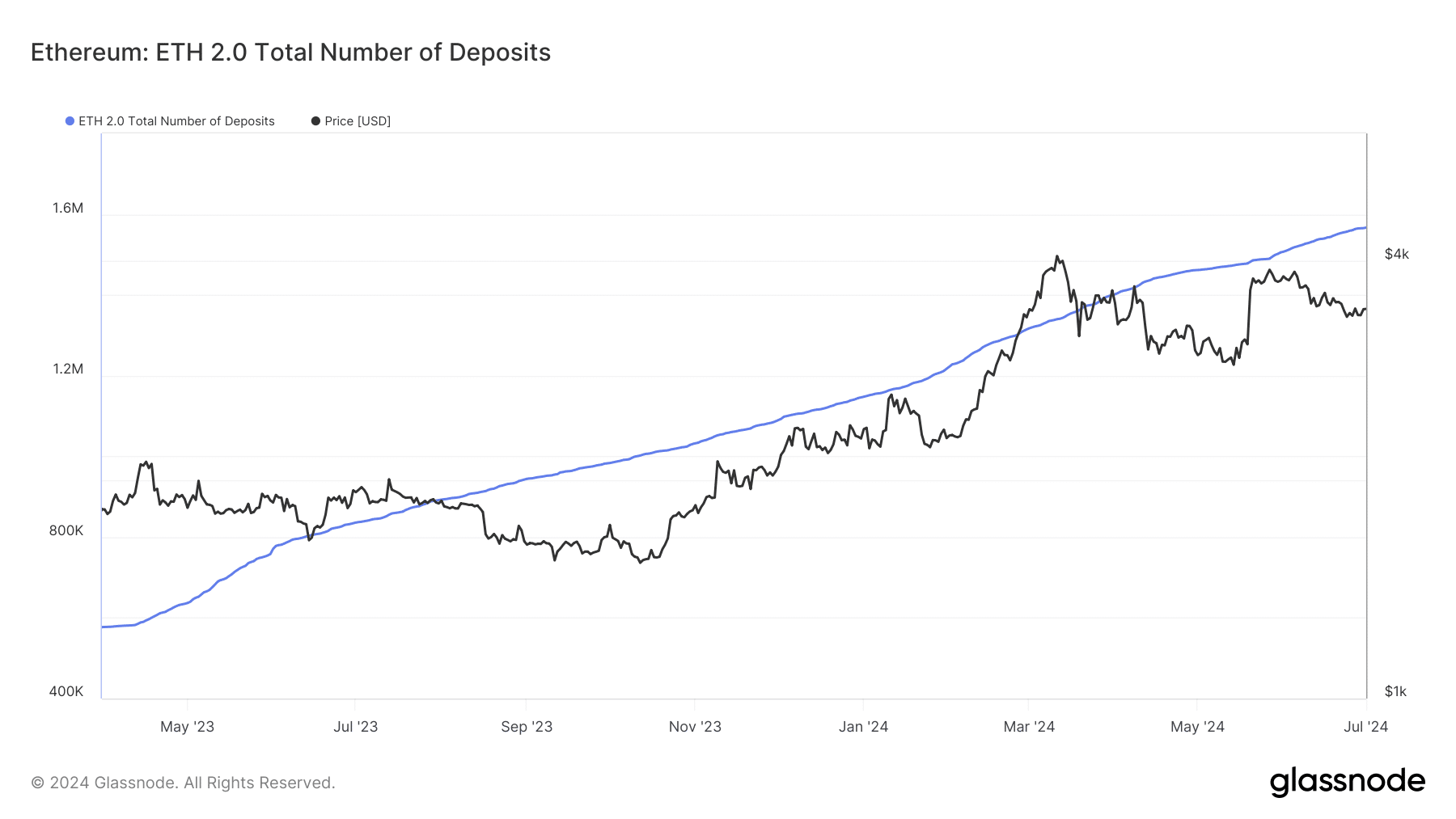

The analysis of Ethereum’s staking activity offers insightful trends into the behavior of its holders, particularly with the decreasing balances on exchanges.

According to data from Glassnode, there has been a consistent increase in the total number of deposits. This indicated that more holders were opting to stake their ETH.

This activity is significant as it suggests a shift from trading or holding Ethereum on exchanges to securing it in staking contracts. According to the latest data, the number of deposits has surpassed 1.5 million.

Further reinforcing this trend, data from Dune Analytics revealed that over 33.2 million ETH have been staked. This substantial volume of staked ETH accounts for almost 28% of the total ETH supply.

Overall, the increased staking activity and the corresponding decline in exchange-held ETH underscore a strategic shift among holders toward long-term investment.

ETH finding resistance

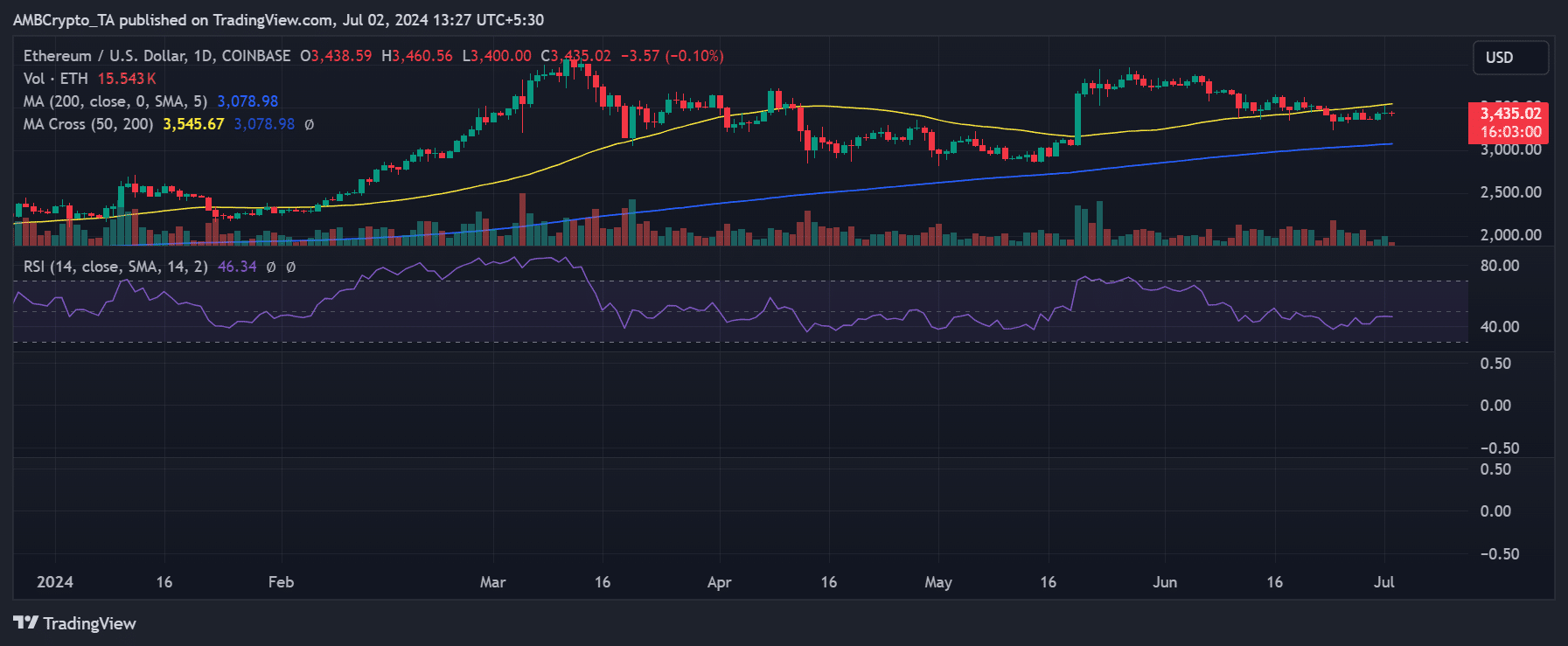

AMBCrypto’s analysis of Ethereum on a daily time frame chart indicated a shift in its market dynamics, with the price recently falling below its short moving average (yellow line).

This moving average, which previously acted as a support, is now functioning as a resistance level due to the recent price decline.

This reversal from support to resistance is a common technical pattern that suggests a change in market sentiment, where the price level that once bolstered buying interest now poses a barrier to upward movements.

Read Ethereum’s [ETH] Price Prediction 2024-25

As of this writing, Ethereum was trading at around $3,430, experiencing a slight decline of less than 1%.

The immediate resistance defined by the short moving average is currently positioned in the range of $3,500 to $3,600.