- Sellers have taken over Ethereum price direction, suggesting that price might fall below $3,000.

- The one-day Realized Cap dropped, indicating that the market might lose confidence if the trend persists.

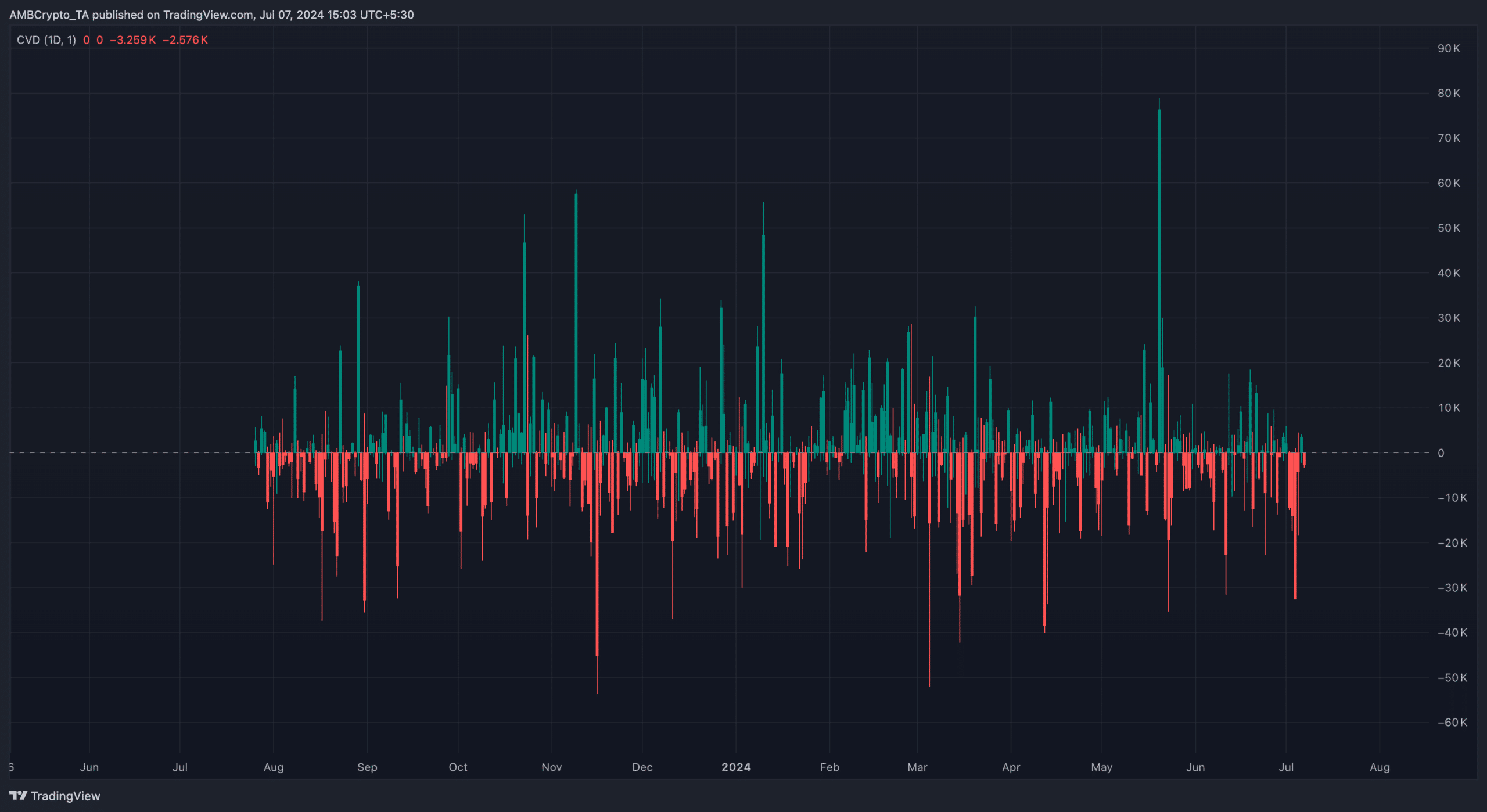

The price of Ethereum [ETH] risks falling below $3,000 for the second time in a few days. This was according to the data AMBCrypto obtained from the Cumulative Volume Delta (CVD).

On the daily chart ETH/USD, the spot CVD had dropped to the negative region. The CVD tracks the difference between the buying and selling volume of a cryptocurrency over some time.

Buyers struggle to sustain the pressure

When the value is positive, more holders are buying than those selling. Sustaining this means that the price of the cryptocurrency might increase in the short-term. However, when it is negative, it means that sellers are dominant.

In a situation like this, it becomes difficult for prices to increase. At press time, the price of the altcoin was $3,012. Before that, ETH had attempted to flip $3,100, but bears rejected the move.

However, apart from the CVD, other metric revealed that it could take some time before the cryptocurrency fully recovers.

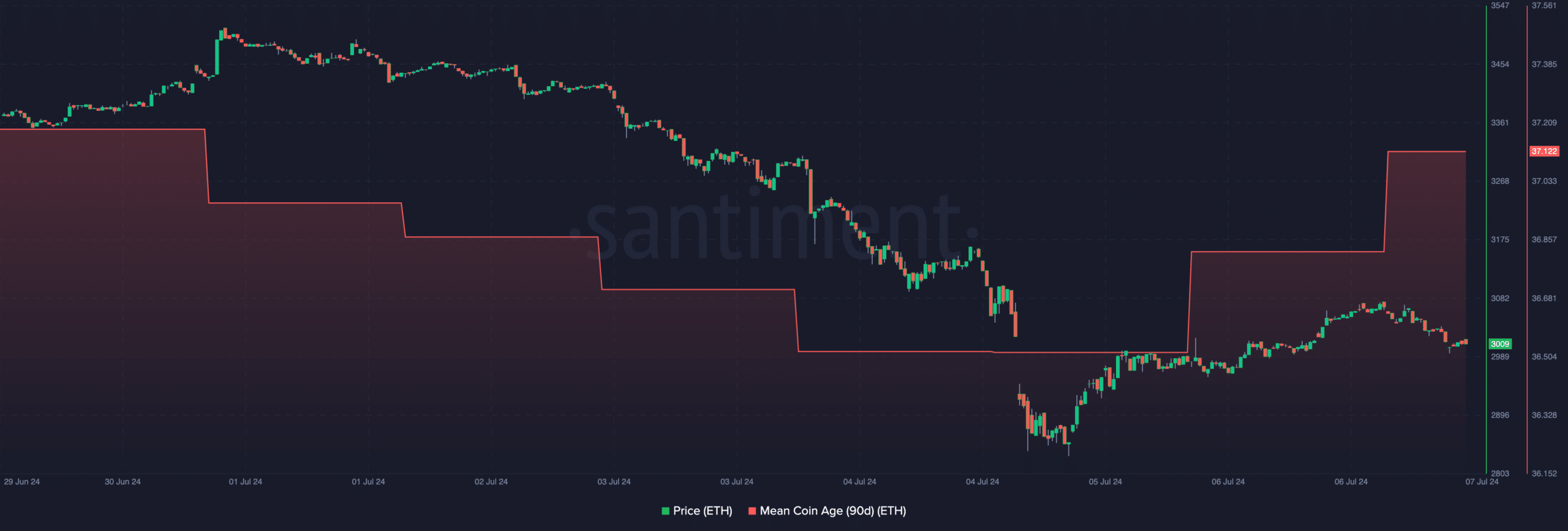

One of such datasets is the Mean Coin Age (MCA). The MCA is the average age of coins on a blockchain. When it increases, it means that old coins are moving back into circulation, thereby, increasing the potential of a sell-off.

But a decrease in the coin age implies that holders are refraining from selling. Instead, they are opting to keep their assets in non-custodial wallets.

More old coins, more problem

As of this writing, ETH’s 90-day MCA had moved from 36.50 to 37.12. This increase implies a rise in trading activity involving the cryptocurrency.

Since the price fell from the value on the 6th of July, it implies that most of the exchange ended in a sale.

If this continues, the price of ETH could slip below $3,000. Also, if buying pressure fails to match up with the increase, the price might drop to $2,881 like it did on the 5th.

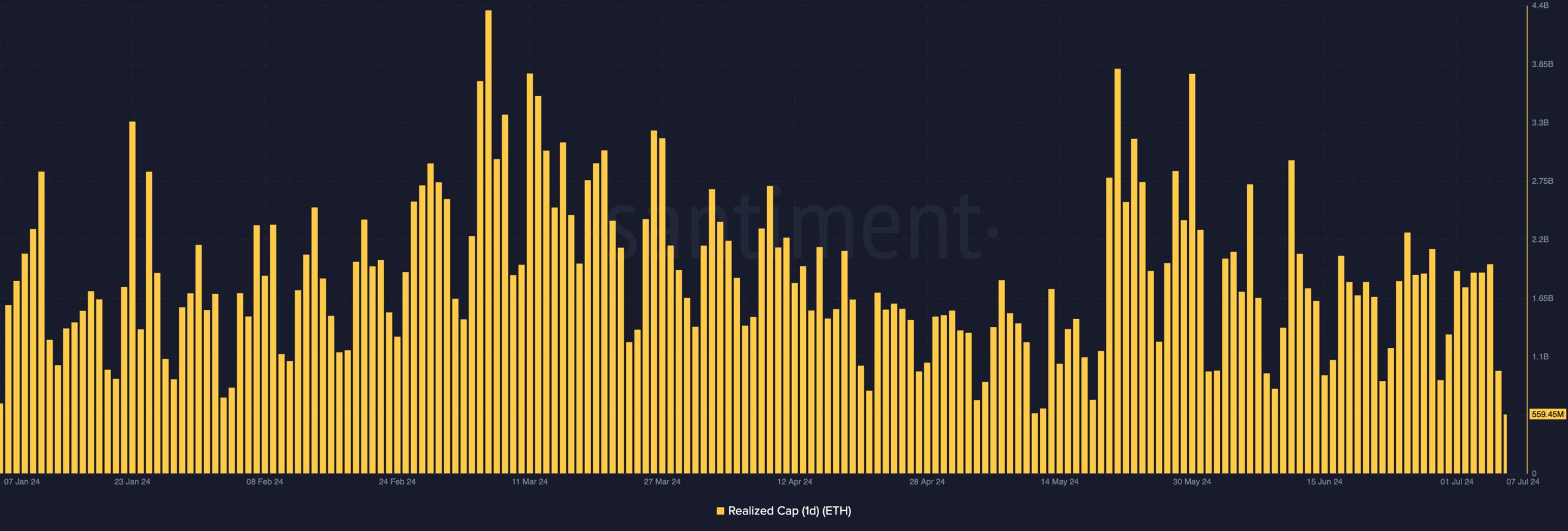

In addition to the above, the Realized Cap aligned with the forecast. Realized Cap represents that the value of each coin when it last moved compared to its trading value.

As a measure of the collective cost basis, the one-day Realized Cap dropped to $559.45 million. This decrease implies that ETH had plunged some holders into unrealized losses.

If this persists, the broader market might lose confidence in Ethereum, possibly prompting low demand for the cryptocurrency. Should this be the case, the price might fall as stated earlier.

Is your portfolio green? Check the Ethereum Profit Calculator

Interestingly, this decrease also presents a buying opportunity as long as ETH remains in a bull market.

However, the fruits of this change might not reflect in a few days or weeks. But in the long term, ETH’s price looks likely to jump.