- ProShares filed an S-1 to launch an Ethereum ETF.

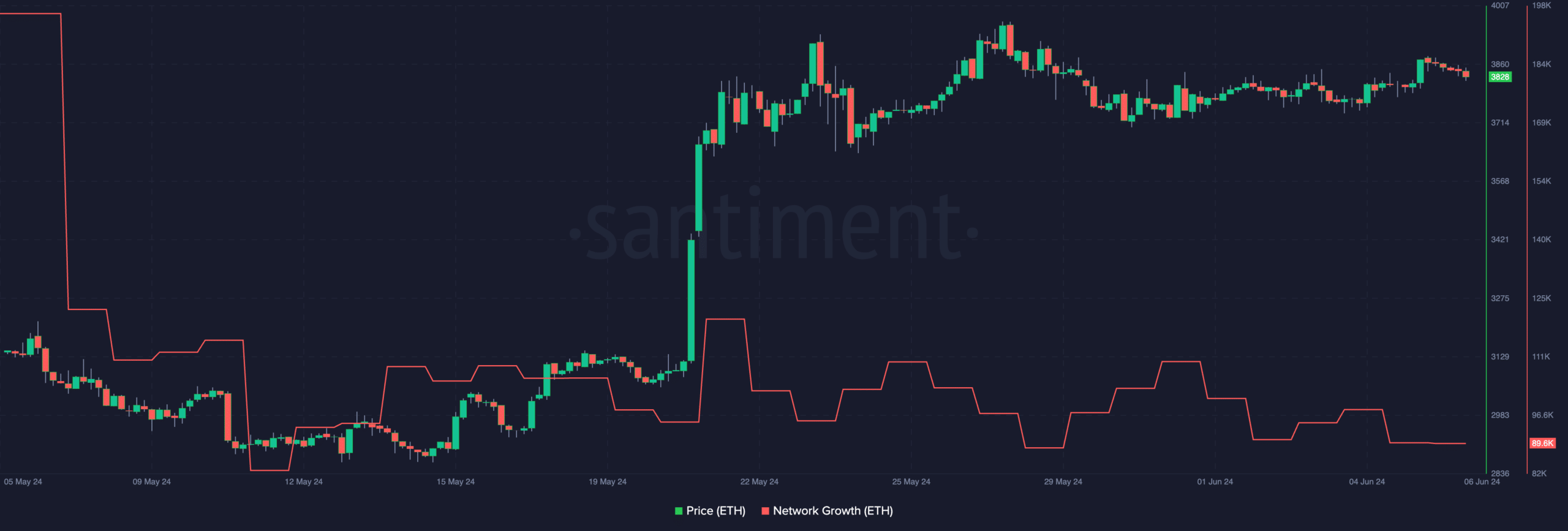

- ETH’s price continued to decline along with its network growth.

Over the past few days, Ethereum [ETH] fell victim to the larger bearish sentiment prevailing in the market and witnessed a correction.

It’s raining ETFs

However, financial institutions did not lose any enthusiasm and ETF applications continued to be submitted to the SEC.

ETF issuer ProShares took a significant step towards launching its spot Ethereum ETF by filing an S-1 registration statement.

According to the filing, Coinbase Credit will act as a critical partner by providing ProShares with a trade credit line.

This essentially allows ProShares to borrow Ethereum and cash for certain transactions that go beyond their immediate trading balance.

Meanwhile, Bank of New York Mellon (BNY Mellon) will take on the role of transfer agent. This means they’ll be responsible for processing both purchases and redemption orders for the ETF, essentially keeping track of who owns shares within the fund.

The filing also clarified some previously announced roles. For instance, BNY Mellon will also serve as administrator and cash custodian, while Coinbase Custody will handle the safekeeping of the Ethereum assets.

It’s important to note that the filing allowed for some flexibility in these roles.

While BNY Mellon’s administrator role is initially set for a two-year term with annual renewals, ProShares has the option to make changes after that period.

Similarly, the ETF can add or remove custodians for both Ethereum and cash, as well as switch prime execution agencies at any time. Interestingly, Coinbase also retains the right to step down from its role as cash custodian.

How is ETH doing?

Despite the enthusiasm showcased by ProShares, the price of ETH continued to decline. At press time, ETH dipped below the $3,500 mark and was trading at $3,497.81.

Even though the decline in price was significant, the overall trend for ETH looked mostly positive.

Read Ethereum (ETH) Price Prediction 2024-25

Since the 19th of May, the price of ETH moved upwards while exhibiting higher highs and higher lows, indicative of a bullish trend.

However, AMBCrypto’s analysis of Santiment’s data revealed that the network growth for ETH had declined along with the price, indicating that new addresses were losing interest in ETH.