- ETH volume soars past $1 billion during the first 24 hours.

- The recent surge sparks investors optimism.

After long months of waiting, Ethereum [ETH] Exchange-traded funds (ETFs) went live on 23rd July. The crypto community has been eagerly awaiting the approval of ETH ETFs.

Since the approval of BTC ETFs early this year, the market has been buzzing with speculation about the approval of other ETFs.

ETH ETF hits past $1 billion

CBOE approved nine ETH ETFs last week, and the NYSE cleared them for trading. Within the first few hours of trading, volumes started at $110 million and reached $600 million shortly.

Since the trading started, ETH ETF trading volume has surged by over $1 billion by the close of business day. The record shocked the market by hitting over 23% of what BTC ETFs did on the first day of trading.

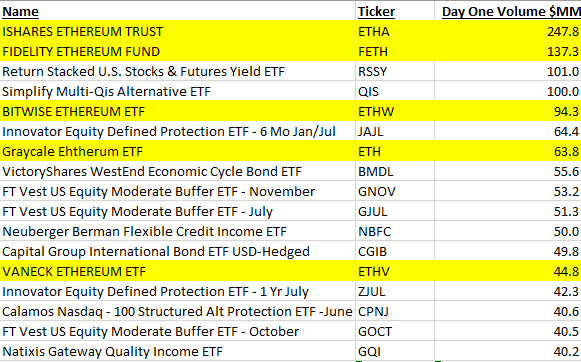

During these trading hours, Ishares ETH Trust (ETHA) did a 25% over the counterpart IBIT’s volume. For instance, ETHA recorded $694.5 million on the first trading day, while ETHE reached $248 million.

This shows that ETH exchange-traded funds are doing much better than BTC, and there is heightened excitement around Ethereum ETFs because of market affordability.

Notably, the surge has brought increased discussion within the community as analysts share different opinions. For Instance, Eric Balchunas shared his analysis on his X page comparing Ether’s ETF performance with BTC ETF’s months ago. He noted that,

“I was curious how the Eth ETFs would rank in Day One volume vs all 600 or so new launches in the past 12mo, but *excluding* the BTC ETFs and $ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot. And $CETH, which was lowest among the group, would still rank in the Top 10% vs a normal new launch. Just another way to illustrate how unusual all this is.”

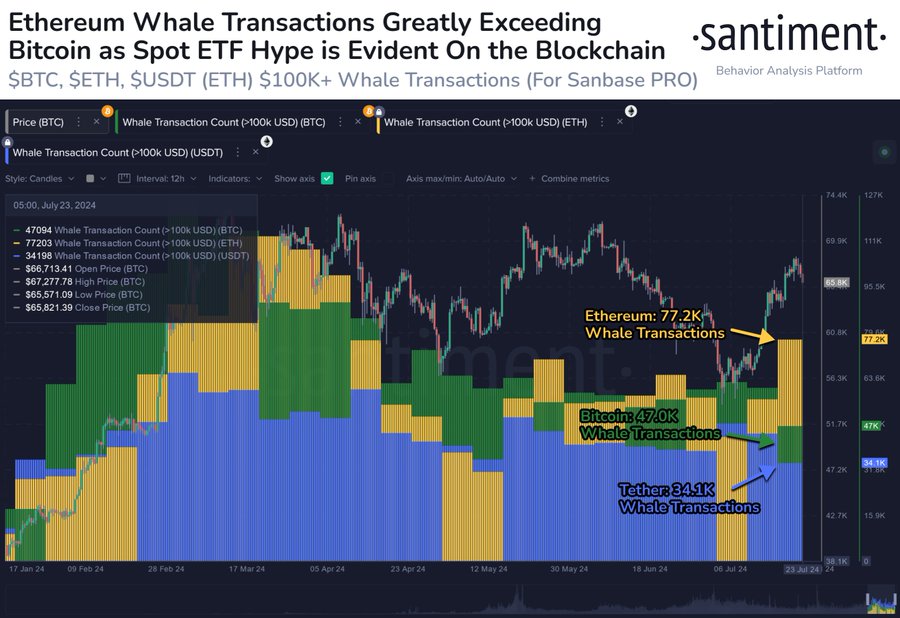

Increased whale activity

Notably, the approval of Ethereum ETFs has resulted in higher speculations with various stakeholders, especially ETH whales, taking action.

According to Santiment, ETH ETFs have caused increased whale activity since CBOE announced the start of the trading date. Through their official X (formerly Twitter) page, Santiment noted the whale activity, noting that,

” Whale activity is clearly being impacted by the release of Ethereum’s 9 new spot ETFs. Since July 17th, the amount of ETH transfers exceeding $100K in value is +64% higher than the amount of BTC transfers, and +126% than the amount of USDT (on ETH) transfers.”

The increased whale activity suggests investors are confident about the altcoin’s direction. Therefore, whales believe ETH ETFs will drive prices up, thus increasing profitability. This shows trust in the direction and potential prospects for the crypto.

Impacts on price charts

As of this writing, ETH was trading at $3449 after a 0.06% decline in the past 24 hours. Equally, its prices have declined by 1.10% on weekly charts.

Despite having a positive trading volume, ETH has declined by 12% from pre-approval. ETH trading volume surged by 30% pre-approval, but declined to 18.57% after approval.

This suggests that Ether ETFs approval has not positively impacted price charts.

However, the overall market sentiment remains positive as MACD shows a higher buying pressure. The MACD shows that the short-term moving average is above the long-term, suggesting a positive market sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

Equally, a positive AO further confirms this, indicating that the short-term period is trending higher than the long-term period.

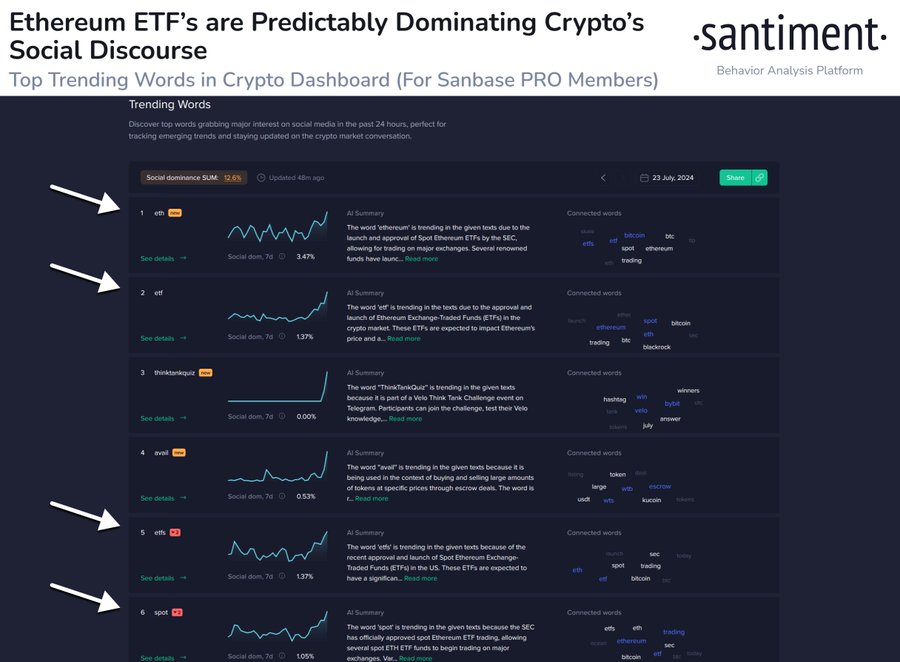

According to Santiment, the traction for ETH spot ETFs are off the charts over the ETFs launch. Through their X page, Santiment shared that,

“The social volume toward any keywords related to ‘Ethereum’, ‘Spot’, or ‘ETF’ are off the charts on a historic day. In the past 24 hours, the ETH/BTC is +3.4%, and traders are anticipating the bullish momentum for crypto’s #2 market cap asset is just getting started.”