- Ethereum ETF approval is expected by September allowing issuers to prepare for trading.

- ETH price declined post-announcement but showed recovery.

After much anticipation regarding the approval of Ethereum [ETH] spot Exchange Traded Funds (ETFs), the SEC has finally provided a specific timeline.

Is SEC ready to approve the ETH ETF?

During a budget hearing on 13th June, SEC Chair Gary Gensler responded to U.S. Senator Bill Hagerty’s inquiry about the approval process for ether ETFs and indicated that the approvals are expected to take place this summer.

Providing further insights on the same, Gensler added,

“Individual issuers still are working through the registration process. It’s working smoothly.”

On the 23rd of May, the SEC approved 19b-4 filings from eight companies. However, for these issuers to start trading on US exchanges, they still needed their S-1 filings approved.

Shedding light on the same, Gensler explained in a recent interview with Reuters, that the approval process for spot Ethereum ETFs depends on how promptly issuers respond to the SEC’s feedback.

“These registrants are self-motivated to be responsive to the comments they get, but it’s really up to them how responsive they are.”

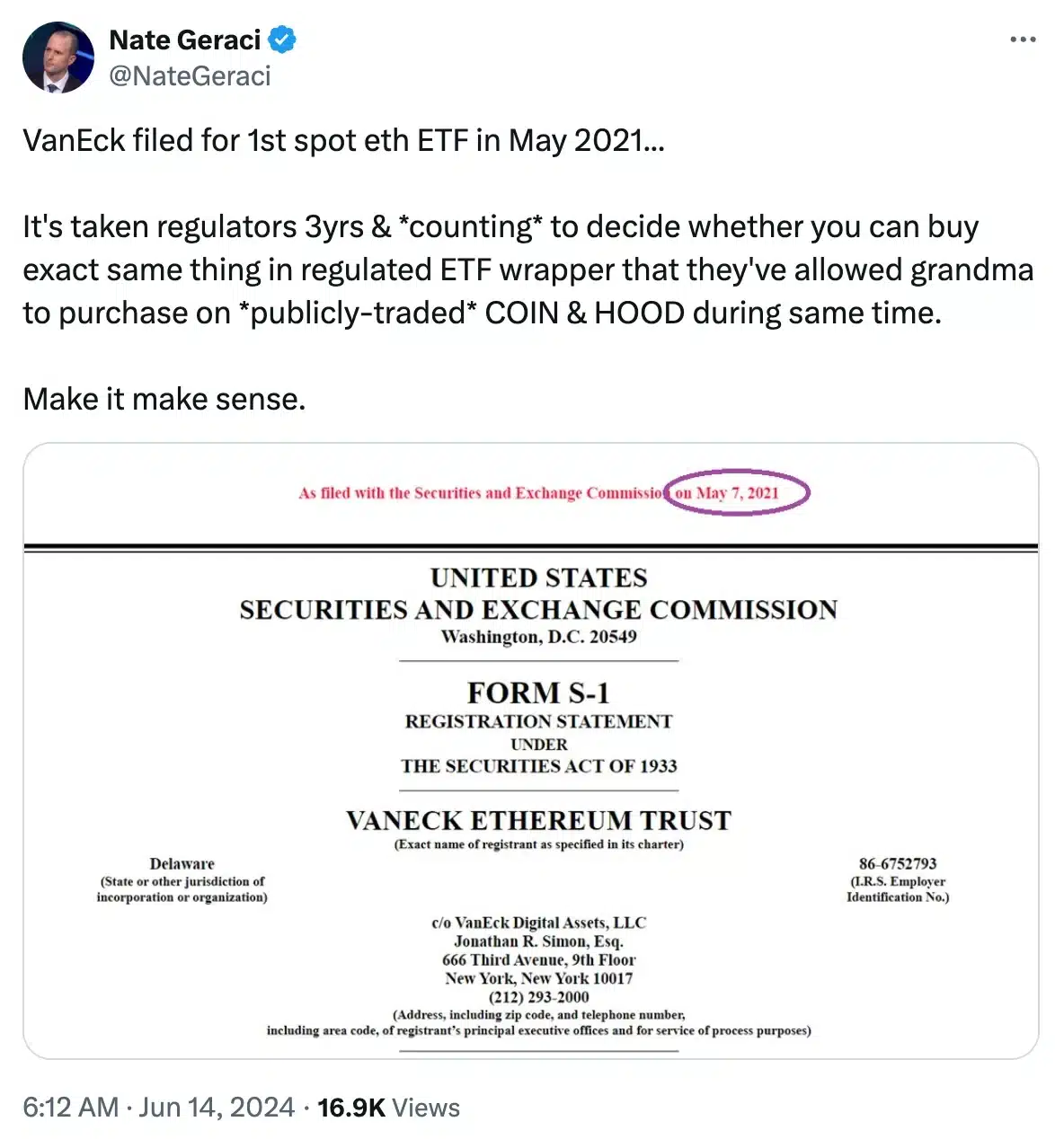

On the other hand, Nate Geraci, President of ETF Store, expressed his frustration over the prolonged approval process and said,

Despite such concerns, Gensler’s recent take suggests that the Ether ETFs are likely to be approved by September. The shift from the expected June timeline to September is likely intended to give issuers enough time to prepare for trading.

ETH’s market performance

However, following the announcement on 13th June, ETH, which was trading at $3,558 saw a decline to $3,464, marking its lowest point in June.

But, as of the latest update, ETH has shown signs of recovery, rising by 0.69% and was trading at at $3,517.

However, since these indicators did not demonstrate a strong bullish sentiment, ETH might once again fall victim to prevailing bearish trends.