Getty Images

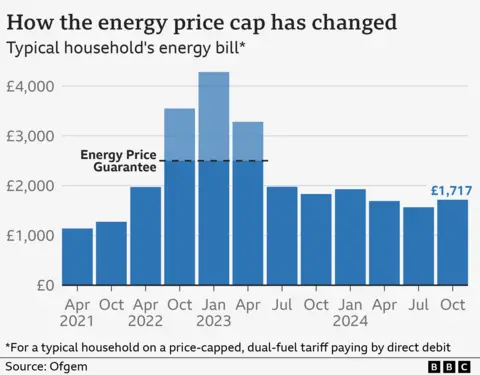

Getty ImagesA typical household’s annual energy bill will rise by £149 in October under the new price cap.

People using an average amount of gas and electricity will pay £1,717 a year, a 10% rise compared with now.

The cap, set by the energy regulator Ofgem, affects the price paid for each unit of gas and electricity used in 27 million homes in England, Wales and Scotland.

Although prices are still lower than last winter, the rise in bills comes as some support for bills has been withdrawn, and the new government has announced it will halt winter fuel payments for 10 million pensioners in England and Wales.

Energy prices have fallen twice this year – in April and July – but will head back up in the run-up to winter, by about £12 a month for a typical user.

To calculate the effect on what households will pay this autumn, billpayers can add 10% to their current annual bill.

The rise in the price cap is the result of higher prices on the international energy market, Ofgem said, owing to increasing geopolitical tensions and extreme weather driving competition and demand for gas, which determines the price of wholesale electricity.

Bills will remain about £117 a year cheaper for a typical household than in October last year, but analysts say another rise in prices is likely in January.

Standing charges are rising by one penny a day for gas and also for electricity, but the regulator is considering reforming the system.

How your bill will change in October

In specific terms:

- Gas prices will be capped at 6.24p per kilowatt hour (kWh), and electricity at 24.5p per kWh – up from 5.48p and 22.36p respectively now. A typical household uses 2,700 kWh of electricity a year, and 11,500 kWh of gas

- Households on prepayment meters will pay slightly less than those on direct debit, with a typical bill of £1,669

- Those who pay their bills every three months by cash or cheque will pay more, with a typical bill of £1,829

- Standing charges – a fixed daily charge covering the costs of connecting to a supply – will go up to 61p a day for electricity and 32p a day for gas, compared with 60p and 31p respectively now, although they vary by region

Prices are much lower than their peak, but they remain well above pre-Covid pandemic levels, and financial support from the government has either been wound down or is being cut.

The final cost-of-living payment was made to eight million people on means-tested benefits in February, and the new government has announced it will stop winter fuel payments for 10 million pensioners in England and Wales. The payment is a devolved matter in Scotland and Northern Ireland.

That will hit Billy and Sylvia Cunningham, a couple aged in their 70s from Warrington.

“We did get the help last year, but we still felt the cold, we still had to wrap in blankets and watch the smart meter shooting up,” said Mrs Cunningham.

Her husband has Parkinson’s and struggles when he gets cold. “It’s hard work sometimes,” he said. “If your fingers are freezing, you can’t do nothing.”

The couple are just £100 above the threshold to qualify for pension credit, a state pension top-up, and so will also miss out on the winter fuel payment worth another £200. One unexpected bill, they said, could push them into an overdraft as higher prices had already eroded their savings buffer.

Some households are already in debt to their supplier and now face increased prices in the run up to winter.

Ofgem chief executive Jonathan Brearley said prices would be “volatile” in the long-term and so building a low-carbon, homegrown energy system was a sensible policy.

Energy Secretary Ed Miliband said the increase in prices would be “deeply worrying” for families.

“We will also do everything in our power to protect billpayers, including by reforming the regulator to make it a strong consumer champion, working to make standing charges fairer, and a proper warm homes plan to save families money,” he said.

Standing charges overhaul

Although the price cap is changed every three months, it is illustrated by Ofgem in terms of an annual bill for a household using a typical amount of gas and electricity.

People in larger properties will tend to pay more overall due to higher energy usage, while those in smaller properties likely use less so pay less.

As well as announcing the new price cap, Ofgem also outlined options to change the standing charge billing system.

Standing charges are the fixed daily fees paid for being connected to the system, but they are unaffected by how much people use.

The short-term options presented by the regulator include a potential plan to move between £20 and £100 from the standing charge to the price paid for every unit of energy used, giving customers the opportunity to save money by lowering their usage.

But many vulnerable people do not have the opportunity to do so, as they might need to keep the heating on, or use electricity to run medical equipment.

Mr Brearley said there was “no silver bullet” when it came to altering standing charges.

Greg Jackson, the boss of supplier Octopus Energy said it was “crazy” that standing charges were so high and varied by region.

How some pensioners can claim support

An estimated 880,000 low-income pensioner households eligible for pension credit currently fail to claim it.

The government says it is worth an average of £3,900 a year and claiming it can qualify people for other financial support such as winter fuel payments.

You can check your eligibility for pension credit via the government’s online calculator.

Information is also available on how to make a claim. There is also a phone line available on weekdays – 0800 99 1234.

Guide to benefits, when you qualify and what to do if something goes wrong, are provided by the independent MoneyHelper website, backed by government.

Benefits calculators are also run by Policy in Practice, and charities Entitledto, and Turn2us.