- WIF has led the memecoin chart in gains in the last seven days.

- In the last 24 hours, it was facing selling pressure.

In recent weeks, the cryptocurrency market has witnessed a notable surge in the popularity of animal-themed memecoins, particularly those themed around dogs and cats.

Leading the gains in this playful, yet speculative segment of the market, is dogwifhat [WIF], which has outperformed other memecoins over the last seven days.

dogwifhat leaps

According to the latest data from CoinMarketCap, dogwifhat experienced a notable increase of over 20% in the last seven days.

This surge has positioned it fourth among memecoins in terms of market capitalization. As of this writing, its market capitalization was over $2.2 billion.

Despite its strong weekly performance, dogwifhat has shown some instability in the past 24 hours, oscillating between gains and losses. As of this writing, a slight decline of less than 1% was noted.

Volume in the last 24 hours

Despite these short-term fluctuations, dogwifhat had a significant 24-hour trading volume, which reached over $412 million, underscoring its popularity and active trading community.

The volume was second only to Pepe [PEPE], which has a slightly higher volume of over $449 million.

If dogwifhat continued to experience more gains than losses for the remainder of the week, it could close as one of the top gainers.

WIF sees more gains

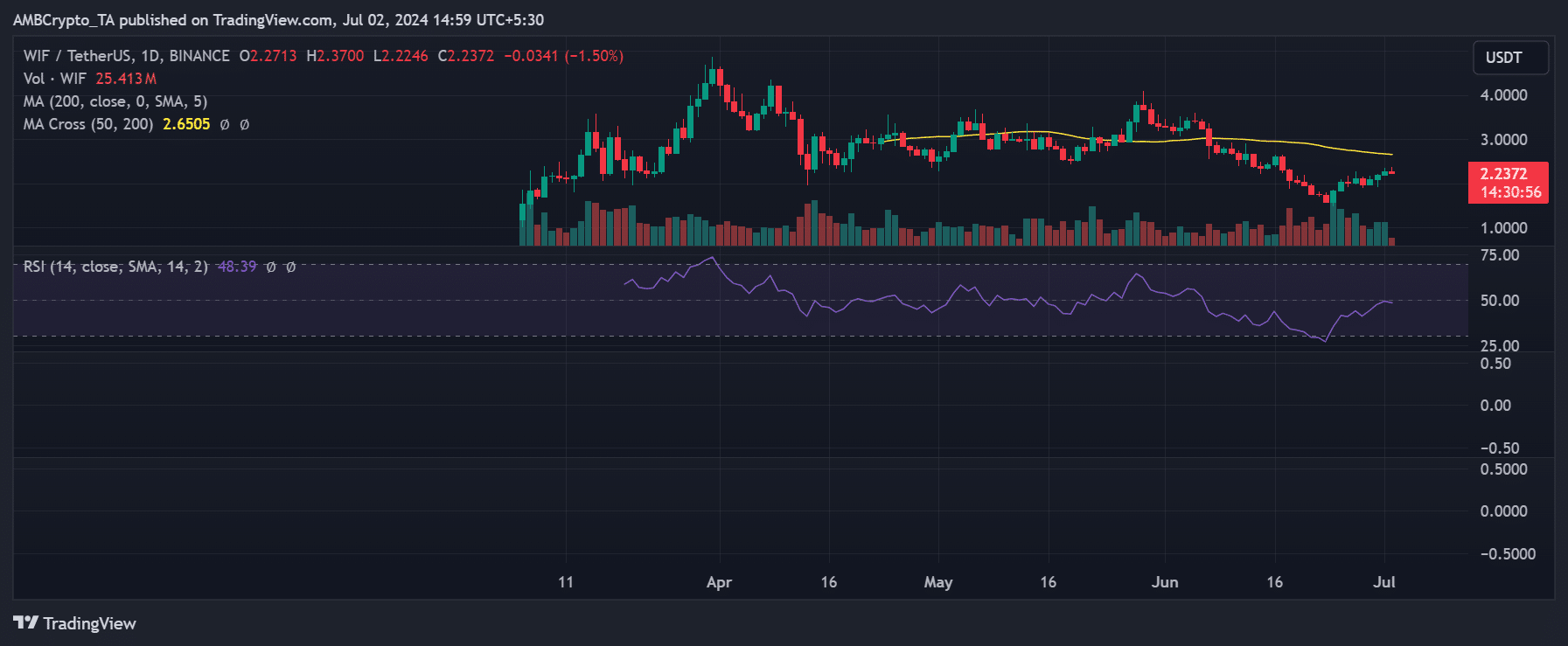

AMBCrypto’s analysis of dogwifhat on a daily time frame chart, as reported by AMBCrypto, highlighted a pattern of more gains than losses in recent days.

The memecoin closed trading on the 1st of June with an encouraging increase of over 3%, with its price reaching around $2.27.

This rise marked the second consecutive day of gains for dogwifhat, suggesting a positive short-term trend in its trading activity.

Is your portfolio green? Check out the WIF Profit Calculator

Despite a subsequent decline of over 1%, dogwifhat has managed to sustain a trading price around the $2.2 range, indicating some level of price stability despite the pullback.

Further insights from its Relative Strength Index (RSI) analysis showed that the RSI was just below the neutral line of 50. This positioning suggested that WIF was currently in a bear trend, albeit weakening.