- The founder of Curve DAO has been facing massive liquidations.

- CRV has dropped by over 23%.

Curve DAO [CRV] has come under heavy FUD (fear, uncertainty, and doubt) in the last 24 hours. This is due to the heavy borrowing position of the founder and the liquidation of most of those positions.

Curve DAO at risk

According to data from Arham Intelligence, CRV tokens worth $140 million were at risk of liquidation.

This happened because the platform’s founder, Michael Egorov, borrowed around $95.7 million in stablecoins against $141 million in CRV across five different protocols.

According to the data, $50 million of the borrowing was on a platform that charged around 120% APY. The high APY is because there is almost no crvUSD available for borrowing against CRV on the platform.

The risk here is that a drop in the value of CRV will cause these positions to be liquidated.

Now, there has been a recent drop in the price of CRV, and the resulting liquidations have put additional pressure on the price, exacerbating the downward trend.

CRV’s historic decline

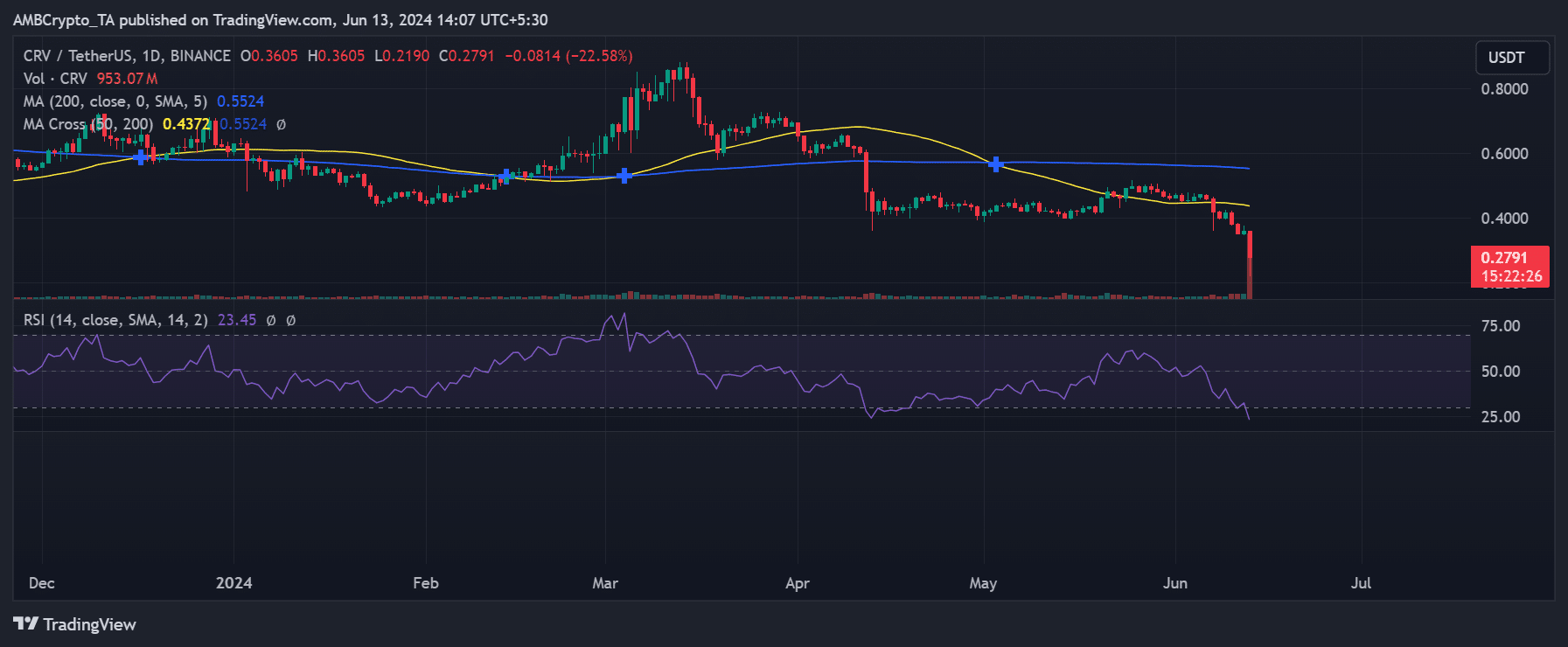

AMBCrypto’s analysis of CRV’s price trend on a daily time frame indicated that more liquidations are likely by the end of the day.

As of this writing, the price has dropped by over 23%, falling from around $0.36 to approximately $0.27.

CRV saw consecutive declines on the 10th and 11th of June, with a total decline of over 16%. The chart indicated that its price fell from around $0.41 to approximately $0.35 during those two days.

A 2.74% increase on the 11th of June briefly took its price to around $0.36, giving it a temporary breather and creating the appearance of a potential rebound.

Additionally, the chart showed that this recent drop was the highest single decline CRV had experienced in over a year.

Supply on Exchange hits ATH

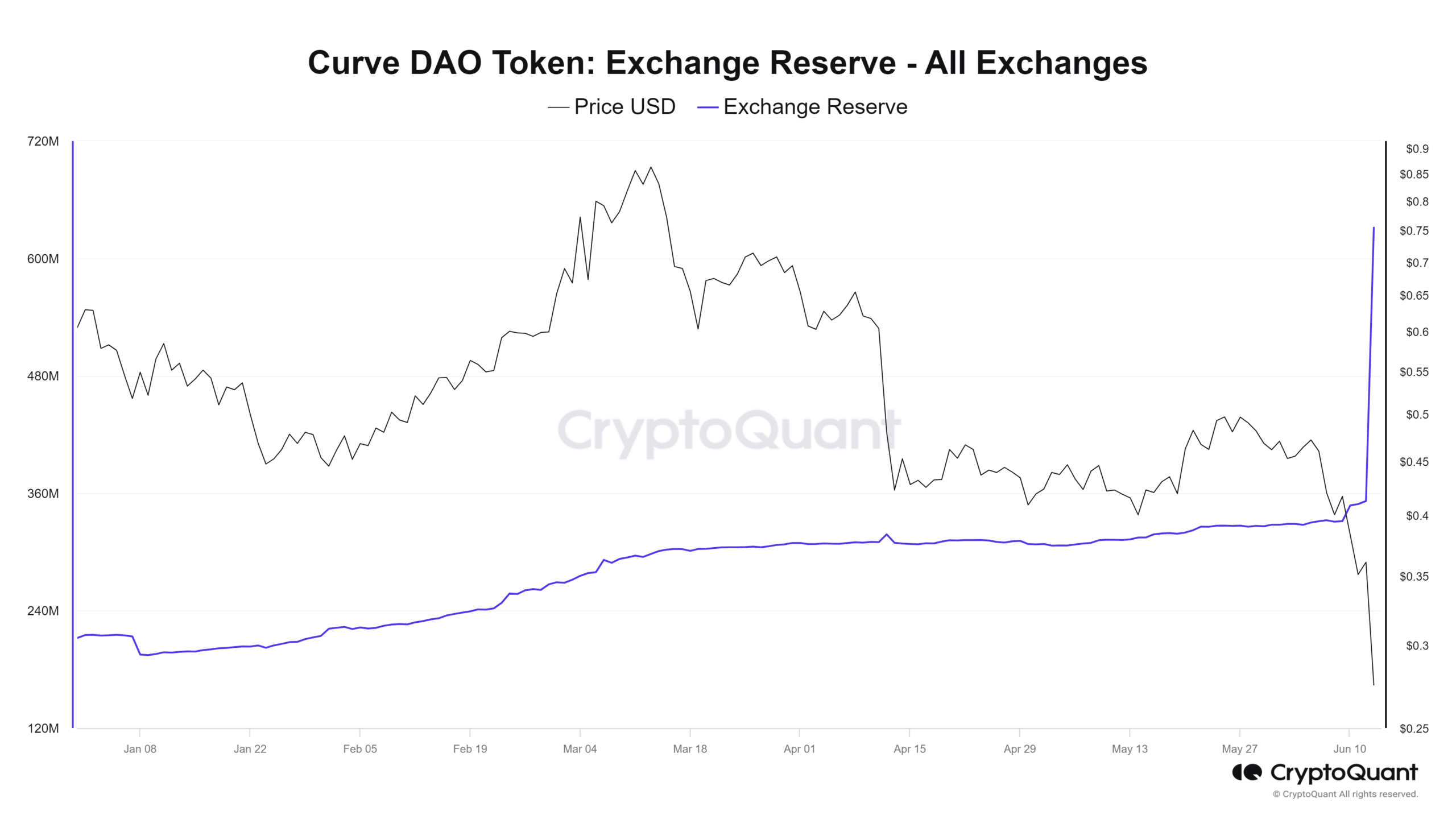

These recent developments have sparked panic among holders, leading to a substantial amount of Curve DAO (CRV) being sent to exchanges.

AMBCrypto’s analysis of its exchange reserve on CryptoQuant showed a significant spike in the last 24 hours.

The data indicated that the exchange reserves have increased significantly and are now over 627 million as of this writing.

Is your portfolio green? Check out the CRV Profit Calculator

Additionally, this was the highest level of CRV exchange reserves ever recorded, marking an all-time high.

This move indicated that most holders were disposing of their holdings, which could further drive the price down.

![Curve [CRV] plummets 23% in 24 hours amidst founder’s debt crisis Curve [CRV] plummets 23% in 24 hours amidst founder’s debt crisis](https://ambcrypto.com/wp-content/uploads/2024/06/Curve_DAO_declines_1-1-1000x600.webp)