- Bitcoin has held firmly above $60K since mid-July.

- Several positive catalysts are lined up. Will BTC climb higher?

After staying below $60K in the first half of July, Bitcoin [BTC] reclaimed the psychological level and previous range-low, partly induced by the Trump attack.

The mid-week recovery extended, posting over 8% gains but hit an obstacle near $65K. As of press time, the recovery cooled off and slid below $64K.

‘Trump trade’ to boost Bitcoin?

According to Charles Edwards, founder of crypto hedge fund Capriole Investment, BTC stalled near $65K because the price of NASDAQ dropped.

“Bitcoin is down because the NASDAQ is down. But the NASDAQ is down because of imminent easing and an AI earnings plateau. The latter has no impact on BTC, and the former is bullish BTC.”

NASDAQ is heavily focused on tech stocks. However, investors have been reportedly rotating out big tech stocks to small-cap stocks to capitalize on a likely Trump win. Market pundits called it “Trump trade.”

According to some market analysts, Trump’s pro-crypto stance could bolster the bullish scenario for BTC. For example, QCP Capital analysts viewed Trump’s VP pick, J.D. Vance, as a positive catalyst for BTC.

“Trump picking J.D. Vance as his Vice President provides another positive catalyst. Vance holds BTC, and we expect him to lobby for crypto-friendly regulations if Trump gets elected.”

The firm added that the upcoming launch of the Ethereum [ETH] ETF, expected to occur on the 23rd of July, was another bullish catalyst. On-chain metrics also corroborated the bullish outlook.

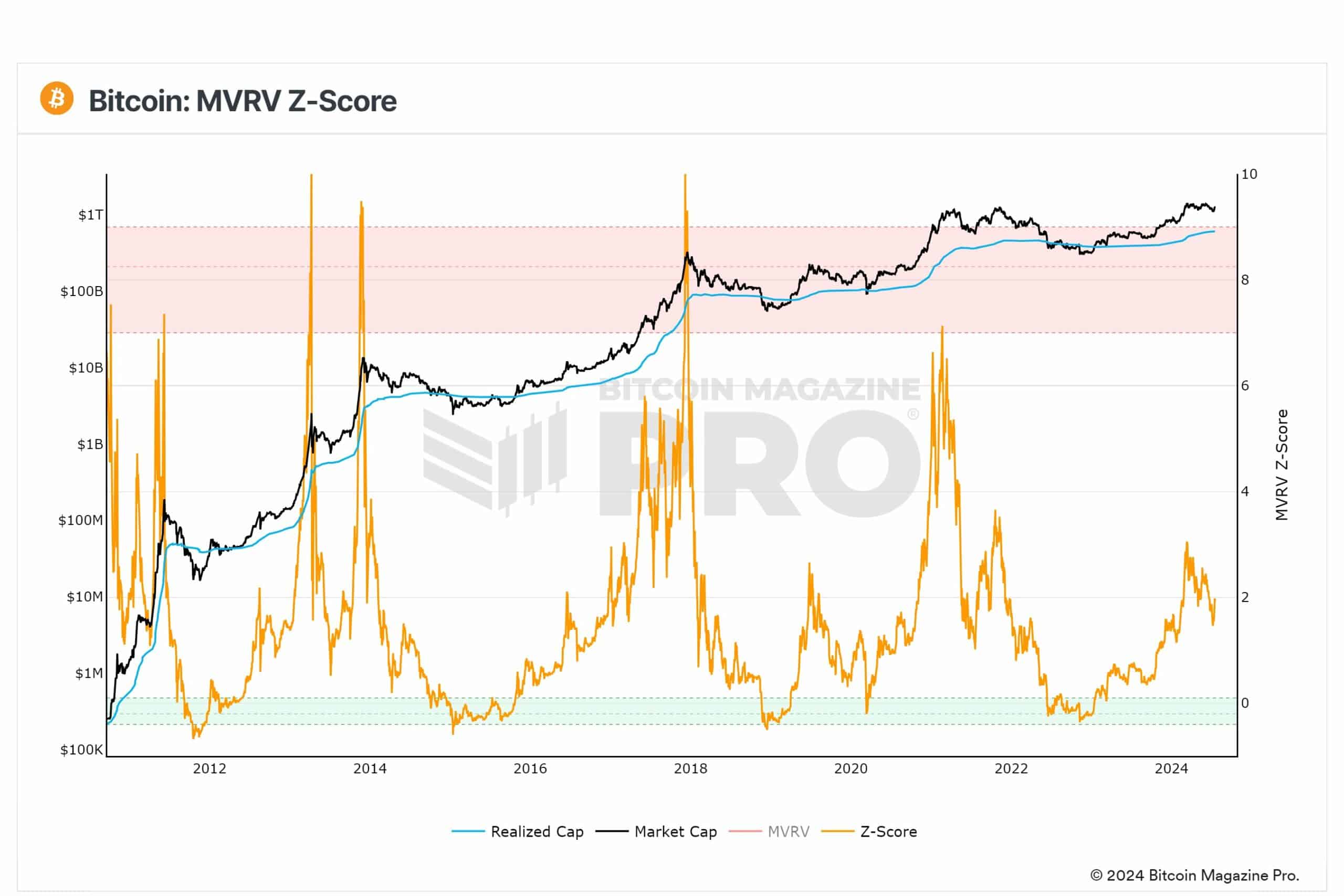

MVRV-Z score signal more upside potential

Philip Swift, founder of Look Into Bitcoin, which rebranded to Bitcoin Magazine Pro, noted that BTC bears were in disbelief as the MVRV-Z score recovered.

“MVRV Z-Score: Still so much more to come from this bull cycle. Z-score bouncing back up now to 2. Bears in disbelief.”

The MVRV (Market Value to Realized Value)-Z score is a BTC market cycle top and bottom indicator. It has accurately predicted past market tops (>7) and bottoms (0).

However, the metric was not overheated and didn’t signal a market top as of press time. That meant more headroom for BTC.

Also, crypto options worth $1.8 billion are set to expire on the 19th of July, per Deribit data. The max pain for both BTC and ETH for the looming options expiry stood at $62K and $3.15K, respectively.

It meant that an overall dip by BTC and ETH toward the max pains could be expected. However, a leg up couldn’t be overruled, given the likely launch of ETH ETF next week.