- Bitcoin’s failure to break $60,000 twice in two days pushed the index to its lowest since 2023

- Historical data showed that BTC could rally by 28% in a month or two

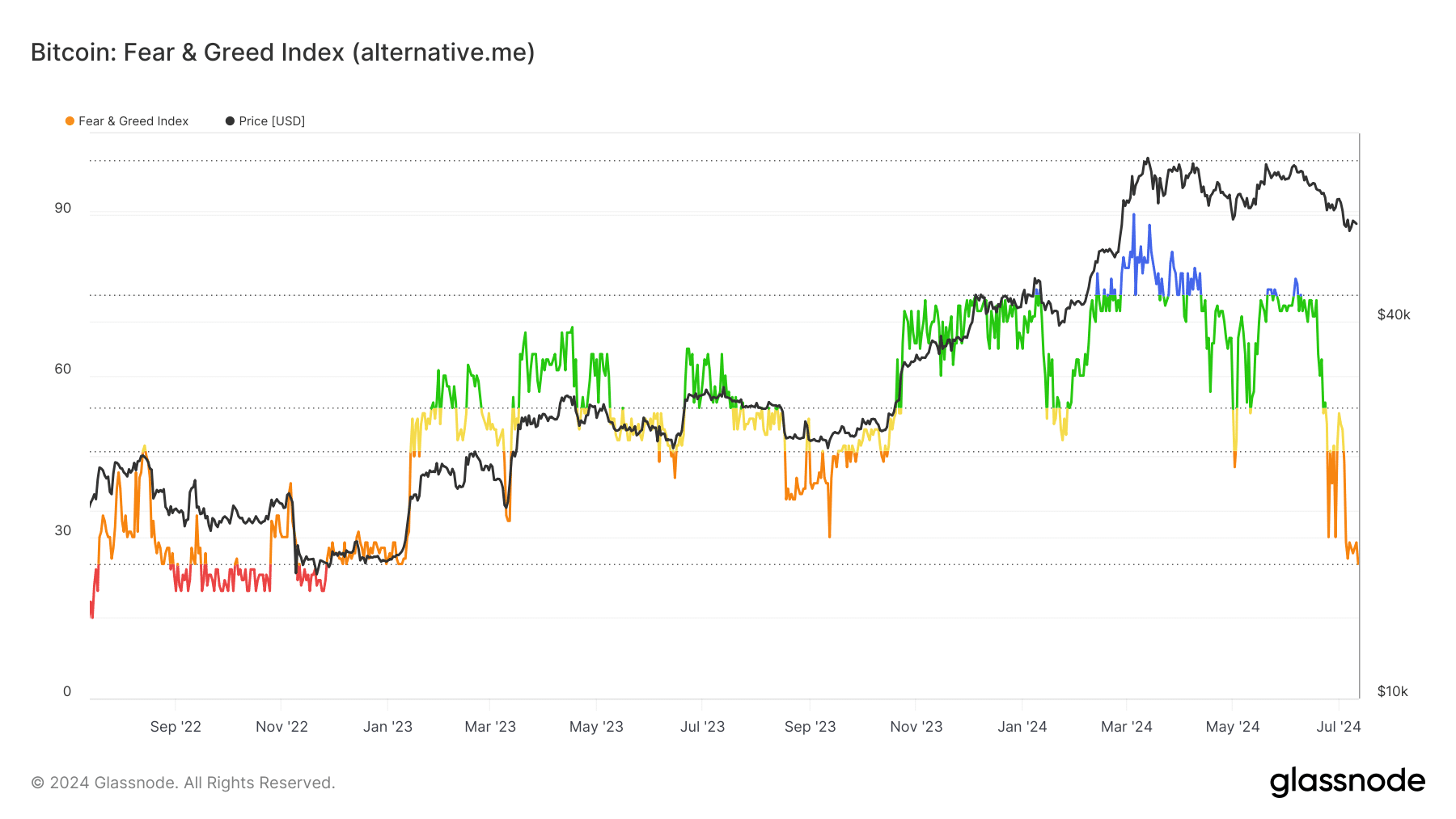

In a surprising turn of events, the Crypto Fear and Greed Index moved to the extreme fear level. At press time, the index’s reading measuring the sentiment around Bitcoin [BTC] and other cryptos was 25.

Behavior in the market is mostly emotional due to high volatility. Sometimes, market participants get greedy and do not want to miss out on price jumps. Other times, corrections force fear into the market.

The Crypto Fear and Greed Index ranges from 0 to 100. Using data from social media, trends in the market, and project dominance, values close to 100 indicate extreme greed. On the other hand, readings close to zero indicate fear.

At 25, the index represented its lowest level since September 2023. Back then, Bitcoin was valued at around $25,131 on the charts. By October of the same year though, the price had risen to $32,960.

Like it was the other time, the drop in the index could be linked to BTC. This, because of how the price has performed within the last 48 hours.

According to AMBCrypto’s market analysis, Bitcoin attempted to rise above $60,000 on 10 July. Alas, it failed. Again, the crypto approached the key region on the 11th, but was rejected.

As a result of this, sentiment in the market changed, with participants showing a glimpse of distrust in the coin’s short-term potential. However, if we go by the Crypto Fear and Greed Index’s impact on price in 2023, Bitcoin could jump in one to two months.

Furthermore, if the pattern rhymes, BTC could see a 28% hike within the aforementioned period. At press time, Bitcoin’s price was $56,948. If the price rises by 28% between August and September, it could trade at $72,893.

Despite the historical analysis and bullish potential, BTC holders need to be wary though.

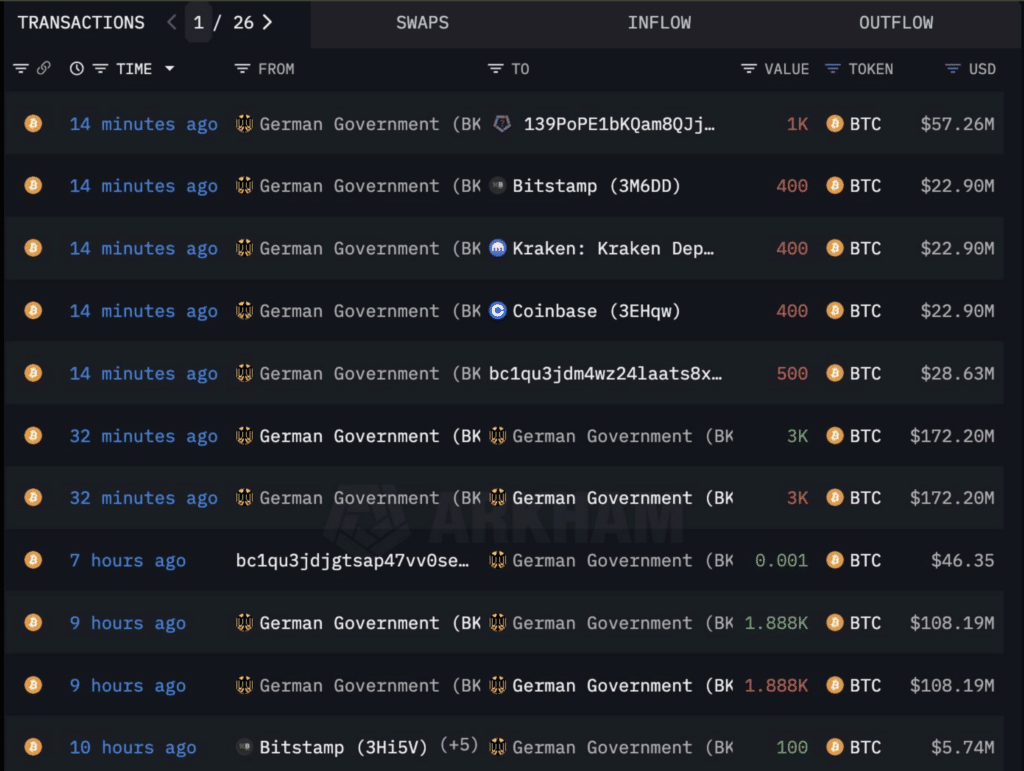

This, because of the actions taken by the German government. Over the last few weeks, the country has been distributing billions of Bitcoin. This was also one of the reasons the Crypto Fear and Greed Index hit extreme fear levels. In fact, on 12 July, the government sold another round worth $154.60 million.

Should this continue into the next month, BTC could find it challenging to reach the predicted level above. However, if the selling stops, Bitcoin might attempt revisiting $70,000 in a few weeks from now.

Read Bitcoin [BTC] Price Prediction 2024-2025

That being said, according to analyst Michaël van de Poppe, Bitcoin is doing well to absorb the sell pressure. In his post on X, he noted,

“It’s incredible that this sell pressure has been absorbed and that Bitcoin’s price is around $60K.”