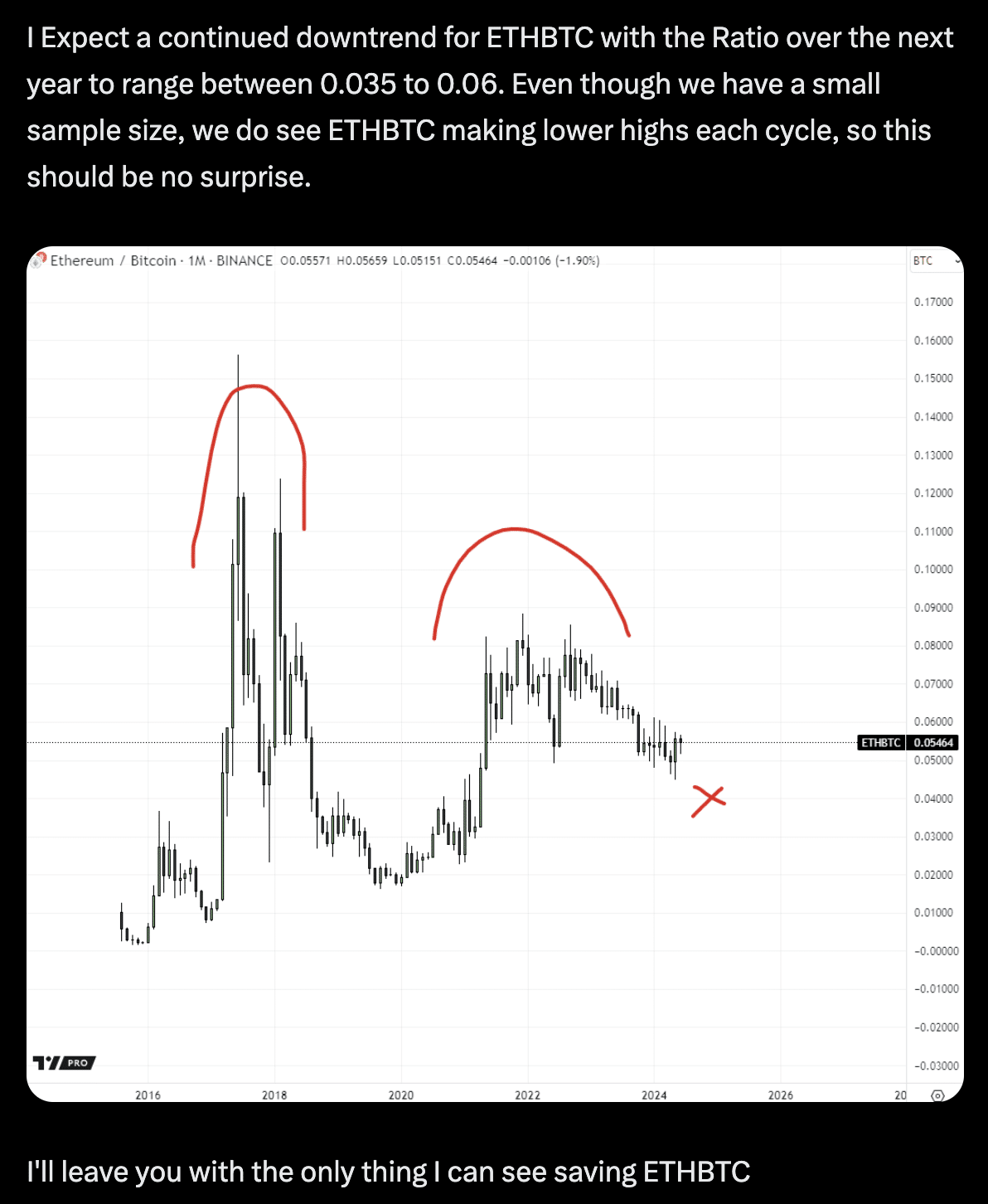

- Spot Ether ETFs may reduce Ethereum’s price to as low as $2,400.

- Institutional interest in Ethereum is less compared to Bitcoin, affecting ETF conversion rates.

As Ethereum [ETH] trails Bitcoin in performance, its price has seen a 5.1% decrease over the past 24 hours, bringing it to a current valuation of $3,315.

This recent downturn in price reflects broader market trends and investor sentiment. Despite this fall, analysts foresee a further drop potentially driven by new financial products entering the market.

Andrew Kang of Mechanism Capital speculates that the introduction of spot Ethereum exchange-traded funds (ETFs) could push Ethereum’s price down to as low as $2,400.

ETH ETFs to drive down Ethereum’s price?

The rationale behind Kang’s prediction lies in the comparative lack of institutional interest in Ethereum as opposed to Bitcoin.

The founder of Mechanism Capital disclosed that the absence of strong incentives for converting spot ETH into ETFs, coupled with unimpressive network cash flows, presents a challenging outlook for Ethereum’s immediate future in the ETF market.

These factors may contribute to Ethereum’s struggle to maintain its market price in the face of evolving market structures and investor preferences.

Additionally, the potential influx of ETH into the ETF landscape is estimated to attract about 15% of the flows that Bitcoin ETFs have garnered, based on extrapolations from Bitcoin’s ETF performance.

Initial data indicates that spot Bitcoin ETFs attracted around $5 billion in new funds within six months of their launch.

Applying these figures to Ethereum, it is projected that Ethereum-based ETFs might see approximately $840 million in true inflows during a similar timeframe.

Concerning this, Kang expresses skepticism about the alignment between the crypto community’s expectations and traditional financial (tradfi) allocators’ preferences, indicating that the market may have already “priced in” the effects of the ETF launch.

Challenges in market perception

Furthermore, the conceptual pitch of Ethereum as a decentralized financial settlement layer and a base for Web3 applications carries potential. However, according to Kang, current data suggest that it may be a challenging sell.

Particularly, the reduction in network transaction fees due to decreased activity in decentralized finance and non-fungible tokens has shifted perspectives, possibly likening ETH to overvalued tech stocks in terms of financial metrics.

Additionally, according to Kang, the recent regulatory green light for Ethereum ETFs was somewhat unexpected, giving issuers limited time to craft and disseminate effective marketing strategies.

He added that the removal of staking options from the ETF proposals could further dissuade investors from converting their holdings, impacting the anticipated influx of capital into these funds.

Concluding the insight, Kang noted:

“Does that mean ETH will go to zero? Of course not, at some price it will be considered good value and when BTC goes up in the future, it will be dragged up with it to some extent. Before the ETF launch, I expect ETH to trade from $3,000 to $3,800. After the ETF launch my expectation is $2,400 to $3,000. However, If BTC moves to $100k in late Q4/Q1 2025, then that could drag ETH along to ATHs, but with ETHBTC lower. “

Are there bearish signs from ETH?

In light of Andrew Kang’s pessimistic view on Ethereum, it’s worth examining Ethereum’s fundamentals to validate these concerns.

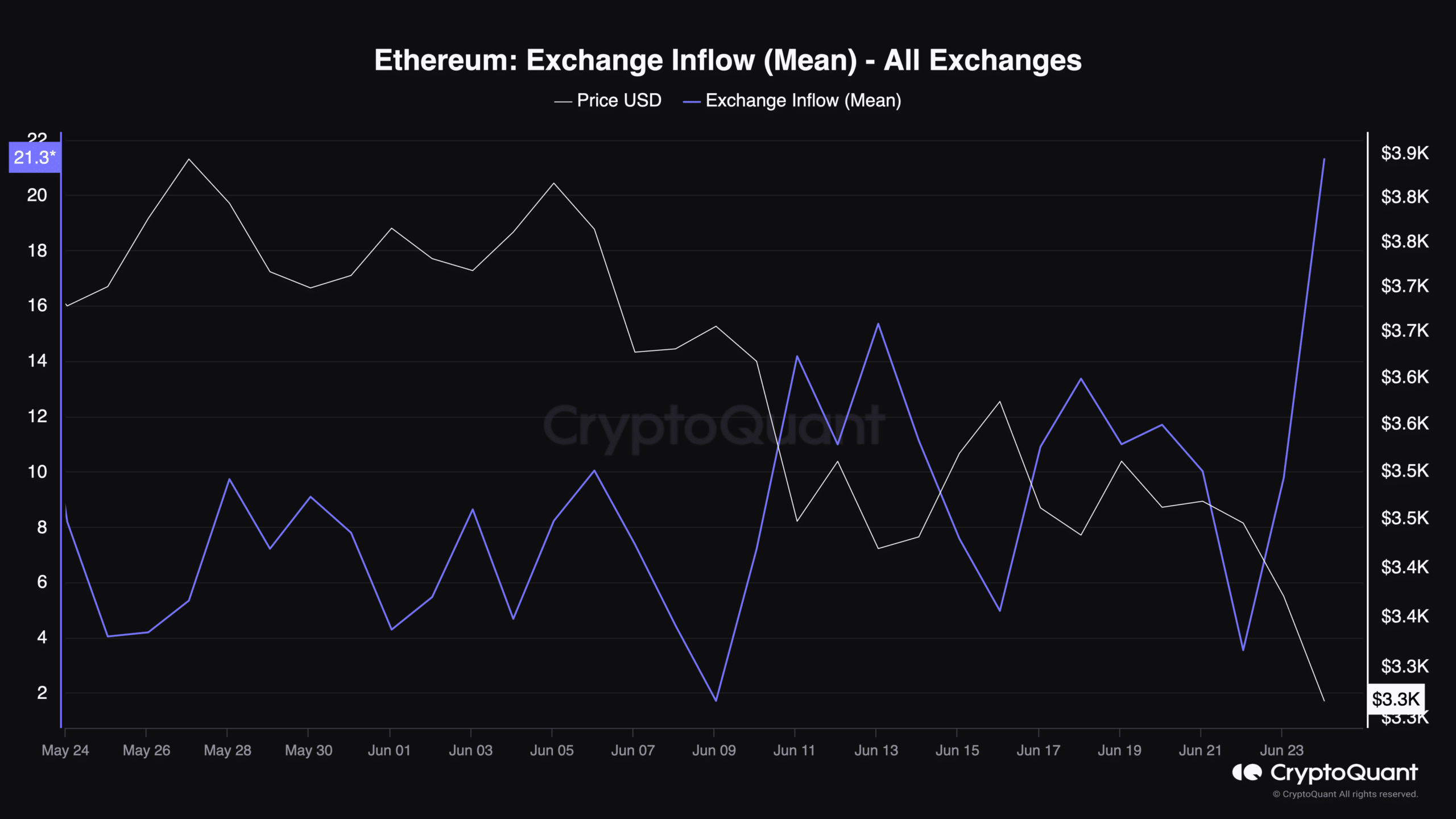

Data from CryptoQuant reveals a worrisome trend in one of Ethereum’s key metrics—there has been a notable increase in Ethereum deposits on exchanges, suggesting a potential rise in selling pressure.

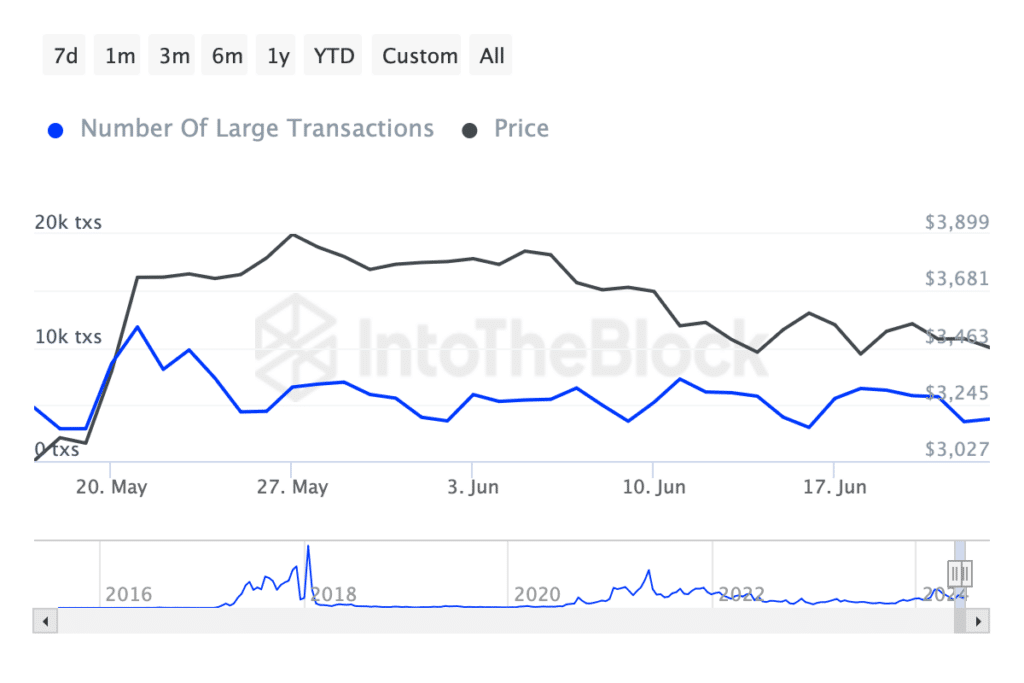

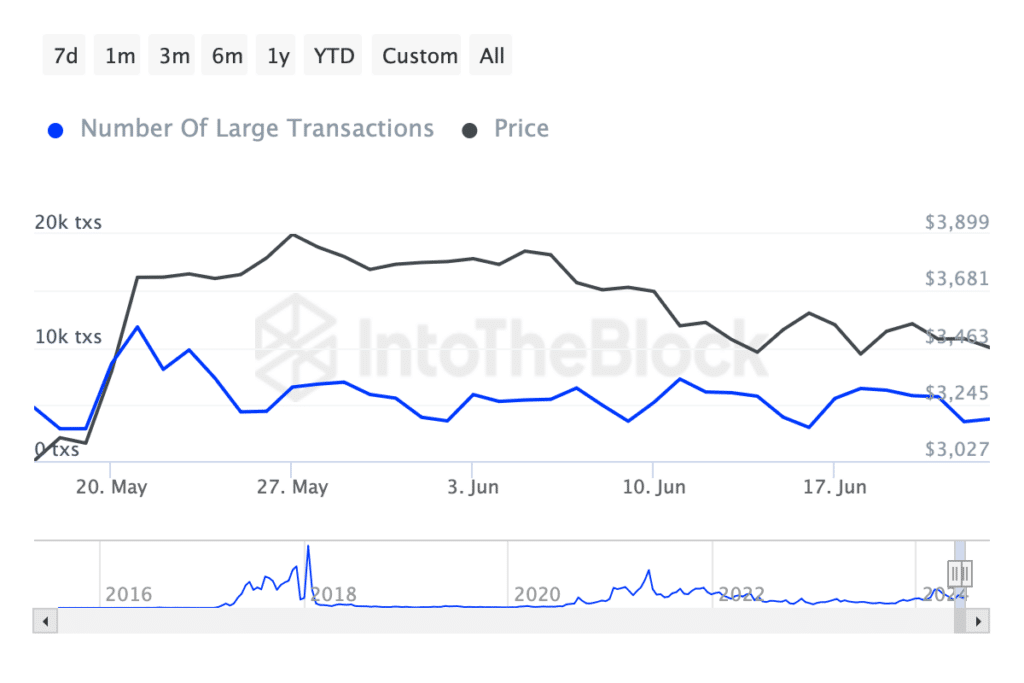

This indicator aligns with IntoTheBlock’s data, which shows a significant reduction in large ETH transactions (those exceeding $100,000).

Read Ethereum’s [ETH] Price Prediction 2024-2025

These transactions have decreased from over 10,000 late last month to under 4,000 as of today.

Source: IntoTheBlock

Despite these bearish signs, a recent report from AMBCrypto highlights an uptick in Ethereum’s daily active addresses, adding a layer of complexity to the market’s dynamics.