Getty Images

Getty ImagesThe rising cost of public services and benefits has driven government borrowing to higher levels than expected in July, official figures show.

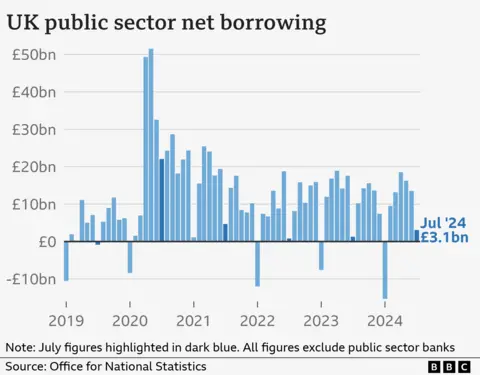

Borrowing, the difference between spending and tax income, hit £3.1bn last month, the highest level for July since 2021.

The increase was £1.1bn higher than what most economists had predicted, leading to speculation about what tax and spending decisions the chancellor will announce at the autumn Budget.

The Office for National Statistics (ONS) also revealed the UK’s national debt remained at its highest level since the early 1960s.

Jessica Barnaby, deputy director for public sector finances at the ONS, said income tax receipts had grown “strongly” and debt interest payments had fallen last month.

However, she added this was more than offset as “the cost of public services and benefits continued to increase”, leading to higher borrowing.

Figures showed spending on social benefits jumped higher due to recent inflation-linked increases.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the latest borrowing figures showed public spending was “already overshooting Budget forecasts”.

“Further revisions could easily change the picture, but Chancellor Rachel Reeves will likely have to raise taxes and borrow more in the medium term to cover spending more on public services,” he added.

Isabel Stockton, senior research economist at the Institute for Fiscal Studies, said Chancellor Rachel Reeves faced “tough choices” in her first Budget on 30 October.

Darren Jones, chief secretary to the Treasury, said the borrowing figures were “yet more proof of the dire inheritance left to us by the previous government”.

He said taxpayers’ money was being “wasted on debt interest payments rather than on our public services”.

A fierce row between Labour and the Conservatives has been rumbling over the current state of the public finances.

Chancellor Rachel Reeves has previously said the government will have to raise some taxes in October’s Budget, claiming the previous government left a £22bn “hole” in the public finances.

But the Conservatives have denied this and have instead accused Labour of misleading the public on tax rises.

Borrowing is usually lower in July compared to other months because the government has gathered a high number of self-assessed income taxes by that point in the year.

Higher government spending this year, though, means this is the fourth highest year-to-July borrowing since monthly records began in January 1993. The government spent £107.4bn in total this July, £3.5bn more than in the previous July.

The interest payable on central government debt in July was £7bn, which the ONS said was the second highest interest payable for that month since it started recording that data in 1997.